- Home

- »

- Renewable Energy

- »

-

ABC Market Size Report, 2030GVR Report cover

![Wave and Tidal Energy Market Size, Share & Trends Report]()

Wave and Tidal Energy Market Size, Share & Trends Analysis Report By Type (Wave Energy, Tidal Energy), By Technology (Tidal Stream Generator, Oscillating Water Columns), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-096-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Report Overview

The global wave and tidal energy market size was valued at USD 970.0 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 32.9% from 2024 to 2030. The global shift towards clean and sustainable energy sources, favorable government policies and incentives to promote the development and adoption of renewable solutions, and significant advancements in wave and tidal energy technologies have contributed to market growth.

The demand for sustainable energy alternatives is steadily rising across the world. For instance, the International Energy Agency (IEA) has predicted that strong economic growth and continued electrification in underserved areas would drive the fastest pace of electricity demand in 2024 and 2025. Additionally, economies worldwide are undertaking strategic initiatives to reduce their dependence on conventional energy sources, which has led to promising growth prospects for the wave and tidal energy industry.

Excess and uncontrolled use of fossil fuels across both developed and emerging economies has resulted in pollution, global warming, and greenhouse gas (GHG) emissions, posing a significant threat to both the environment and human life. As countries seek to reduce their reliance on fossil fuels and mitigate climate change, renewable energy is becoming an increasingly attractive option, boosting development in this industry. Government policies and regulations, such as tax credits and feed-in tariffs, are incentivizing investments in marine energy technologies. Wave and tidal energy, as sources of clean and predictable power, are well positioned to address the changing energy generation landscape by ensuring energy diversification and grid resilience.

Advancements in technologies are improving the efficiency of turbines and reducing costs associated with power generation, making wave and tidal energy more competitive with conventional energy sources. Moreover, the vast untapped resources of ocean energy, estimated to be capable of meeting a substantial proportion of global electricity demand, present a significant growth opportunity in the coming years. As the industry continues to mature, economies of scale and reduced costs are expected to drive further growth, making wave and tidal energy an increasingly important contributor to the global energy mix.

Type Insights

Wave energy dominated the market with a revenue share of 73.8% in 2023. This higher share can be attributedto the extensive availability of the required resources worldwide, with coastlines offering consistent and predictable wave patterns, making it an attractive option for energy generation. Additionally, wave energy technologies have demonstrated a higher energy generation capacity compared to tidal energy, resulting in more electricity generated per unit of installed capacity. Moreover, significant research and development investments in this segment have led to improved efficiency and reduced costs associated with wave energy generation, driving segment growth.

The tidal energy segment is expected to register the fastest CAGR over the forecast period. By leveraging consistent and cyclical ocean tides, tidal energy has emerged as a promising renewable energy source, particularly in regions with high tidal ranges. The development of more efficient and cost-effective technologies, such as tidal stream generators and barrages, has improved the viability of tidal energy projects. Additionally, governments have implemented supportive policies and incentives that are driving substantial investments in the tidal energy infrastructure. The establishment of large-scale tidal energy projects, such as the MeyGen tidal array in Scotland, has demonstrated this segment's potential for commercial-scale deployment.

Technology Insights

Tidal stream generator (TSG) technology held the largest market share in 2023. This is owing to its technological maturity, efficiency, and adaptability across various tidal environments. TSGs harness the kinetic energy of ocean tides using submerged turbines and have higher capacity factors and reliability, compared to other tidal energy technologies. The ability of tidal stream generators to operate in both ebb and flood tides, as well as in various water depths, has positioned them as a viable option for developers and investors of large-scale projects. Moreover, the successful deployment of commercial-scale TSG projects in recent years has validated the technology's performance and scalability. Furthermore, significant research and development investments have led to improved turbine designs, materials used, and installation techniques, which have reduced energy generation costs and increased efficiency.

On the other hand, Oscillating Water Columns (OWC) technology is anticipated to register the fastest growth from 2024 to 2030. This is attributed to its innovative design, versatility, and growing adoption in various marine environments. OWCs harness the energy of ocean waves using a column of water that oscillates, driving a turbine, and possess significant potential for efficient and reliable energy generation. OWCs can be deployed in a wide range of water depths and coastal configurations, making them suitable for leveraging wave energy resources. The successful deployment of commercial wave energy projects using OWC technology, such as the Mutriku Wave Power Plant in the Bay of Biscay, Spain, has validated its performance and scalability, leading to increased adoption of the OWC technology.

Regional Insights

Europe dominated the global market with a revenue share of 38.9% in 2023. The region has played a pioneering role in wave and tidal energy development, with countries such as the UK, Germany, and Italy investing heavily in research and development, pilot projects, and commercial-scale deployments. Strong regulatory support, including generous feed-in tariffs, tax credits, and grant funding, have incentivized investment in marine energy technologies. Additionally, the European Union’s target to achieve 40GW of installed ocean energy capacity by 2050 has encouraged regional economies to increasingly adopt such energy generation solutions in the coming years.

UK Wave and Tidal Energy Market Trends

The UK held the largest revenue share in the European market for wave and tidal energy in 2023. This is owing to the presence of extensive coastlines and islands in this region, which offer substantial oceanic resources, making it an ideal location for deploying wave and tidal energy technologies. The UK’s ambitious renewable energy targets and commitment to reducing carbon emissions have further driven demand for wave and tidal energy.

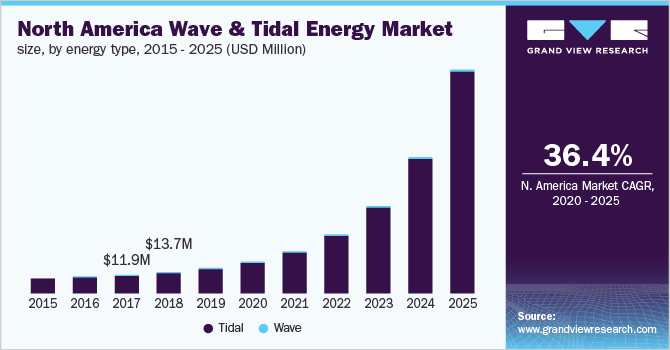

North America Wave and Tidal Energy Market Trends

North America held a substantial share of the global market in 2023. This is owing to its well-established renewable energy industry, presence of favorable policy frameworks, and availability of an extensive coastline with abundant wave and tidal resources. The U.S. and Canada have led developments in this sector, with numerous pilot projects and commercial-scale deployments, particularly in the Pacific Northwest and Atlantic Canada. Additionally, the region's advanced research and development infrastructure, including institutions such as the National Renewable Energy Laboratory (NREL) under the U.S. Department of Energy and the Canadian Renewable Energy Association (CanREA), has driven innovations and reduced costs associated with renewable energy generation.

U.S. Wave and Tidal Energy Market Trends

The U.S. accounted for a notable share of the regional market in 2023. This is attributed to the presence of a vast coastline around the country. A study by the U.S. Energy Information Administration suggests that the potential energy that could be harnessed from waves along the U.S. coastline each year could be as high as 2.64 trillion kilowatt-hours. This amount of energy is equivalent to around 63% of the overall electricity generated by utility-scale power plants in the country in 2023. Growing demand for renewable energy, increasing state and provincial renewable portfolio standards, and declining technology costs have also contributed to the economy’s notable share in the wave and tidal energy sector.

Asia Pacific Wave and Tidal Energy Market Trends

Asia Pacific is expected to register the fastest CAGR during the forecast period. This is attributed to the rapidly growing demand for renewable energy in this region, increasing investments in marine energy technologies, and favorable government policies. Regional countries, such as China, India, and Japan, have set ambitious renewable energy targets, driving the adoption of wave and tidal energy technologies to reduce dependence on fossil fuels and mitigate climate change. Moreover, strong regulatory support in the region has incentivized investments in marine energy technologies and tidal energy projects. Additionally, the presence of a significant coastline and island nations has boosted the potential of energy generation using wave and tidal resources, making it an attractive region to deploy marine energy technologies.

India is expected to substantially contribute to the Asia Pacific market for wave and tidal energy in the coming years. Growing pace of economic activities, increasing energy demand, and commitment to sustainable development have driven growth in the wave and tidal energy market. India has a coastline of over 7,500 kilometers, with the Standing Committee on Energy submitting a report in August 2021 stating that the theoretical tidal & wave energy potential stands at 12.5 GW and 41.3 GW. As the global pressure to deploy renewable energy solutions rises, promising growth is anticipated for the wave and tidal energy market in this country.

Key Companies & Market Share Insights

Some key companies involved in the wave and tidal energy market include ORPC, Orbital Marine Power, and AW Energy, among others.

-

Orbital Marine Power is a Scotland-based renewable energy solutions company. The company's flagship product, the O2, is an innovative, floating tidal energy converter that leverages the power of ocean tides to generate electricity. O2 comes with a patented design that allows it to rotate with the tidal currents, maximizing energy capture while minimizing environmental impact. With a capacity of 2MW, the O2 is one of the most powerful tidal energy solutions in the world. In October 2023, Orbital and its project partners were selected by the European Commission for its EURO-TIDES project as part of its Horizon Europe Programme. The project aims to deliver 9.6 MW of tidal energy.

-

ORPC, Inc. (Ocean Renewable Power Company) is a U.S.-based river and tidal energy solutions company with subsidiaries in Ireland, Canada, and Chile. The company is known for its RivGen power generation solution, which generates electricity from free-flowing currents of rivers and tides. In October 2023, ORPC partnered with Shell Technology’s Marine Renewable Program to supply two of its Modular RivGen systems that were demonstrated at a Shell site on the Lower Mississippi River in 2024, demonstrating the technology's potential in a real-world setting.

Key Wave and Tidal Energy Companies:

The following are the leading companies in the wave and tidal energy market. These companies collectively hold the largest market share and dictate industry trends.

- Ocean Power Technologies, Inc.

- SAE Renewables

- Carnegie Clean Energy

- ORPC, Inc.

- Yam Pro Energy

- AW Energy

- Aquanet Power

- ANDRITZ

- Orbital Marine Power

- BIOPOWER SYSTEMS PTY LTD

Recent Developments

- In May 2024, Orbital Marine Power announced its partnership with Global Energy Group, wherein the latter would oversee the manufacturing and assembly of floating tidal turbines. These turbines would be a part of Orbital’s Orkney projects, with their manufacturing expected to begin at Global Energy Group’s Scotland facility in 2024. The projects are a continuation of Orbital’s O2 tidal turbine that started operating in 2021 and offset around 2 kilotons of CO2 annually.

- In March 2024, AW Energy announced the completion of the WaveFarm project, backed by the European Maritime and Fisheries Fund (EMFF). This project involves the deployment of the company’s ‘WaveRoller’ submerged wave energy converter for energy generation, building upon the rising demand for wave energy as a viable renewable power source.

Wave and Tidal Energy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,182.1 million

Revenue Forecast in 2030

USD 6,503.0 million

Growth Rate

CAGR of 32.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in MW, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Italy, Spain, China, Japan, Australia, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Ocean Power Technologies, Inc.; SAE Renewables; Carnegie Clean Energy; ORPC, Inc.; Yam Pro Energy; AW Energy; Aquanet Power; ANDRITZ; Orbital Marine Power; BIOPOWER SYSTEMS PTY LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wave and Tidal Energy Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wave and tidal energy market report based on type, technology, and region.

-

Type Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Wave Energy

-

Tidal Energy

-

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Tidal Stream Generator

-

Oscillating Water Columns

-

Barrage

-

Others

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."