- Home

- »

- Specialty Polymers

- »

-

Waterproofing Chemicals Market Size & Share Report, 2030GVR Report cover

![Waterproofing Chemicals Market Size, Share & Trends Report]()

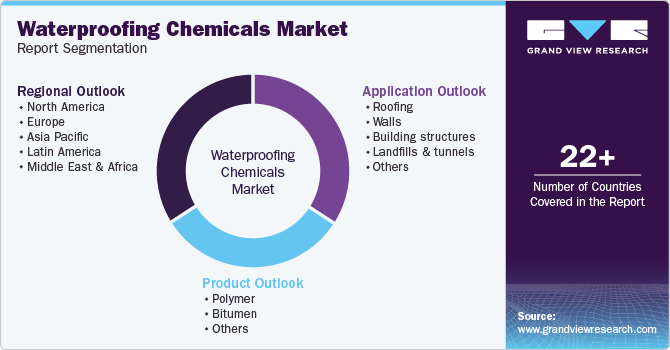

Waterproofing Chemicals Market Size, Share & Trends Analysis Report By Product (Polymers, Bitumen), By Application (Roofing, Walls, Building Structures), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-395-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Waterproofing Chemicals Market Trends

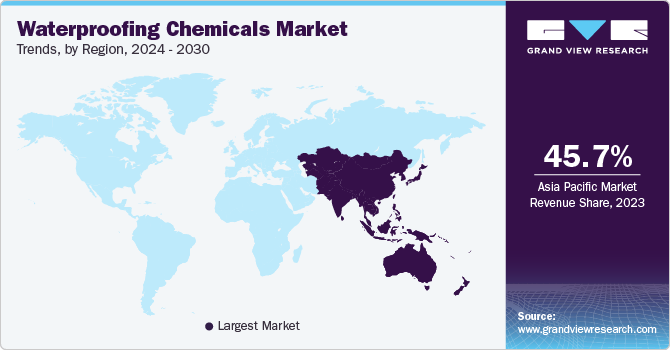

The global waterproofing chemicals market size was valued at USD 6.80 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The worldwide rise in building and construction activities and increasing awareness regarding the importance of waterproofing for the longevity of building structures has fueled the demand for waterproofing solutions across global economies. Substantial market growth has been observed in the Asia Pacific region owing to rapid construction activities taking place in economies such as China, India, Indonesia, and South Korea over the past three decades. Moreover, growing pace of urbanization and construction of commercial buildings and other infrastructure in rapidly developing economies of the Middle East and Africa regions present promising growth prospects for this market.

The onset of climate change has led to the prevalence of more frequent and severe weather patterns, such as heavy rainfall, flooding, and storms. These weather events are primarily responsible for the corrosion of the internal structure of buildings, making them vulnerable to damage. Waterproofing chemicals aid in retaining the strength of these structures by resisting water seepage, leading to their high demand in construction projects. Furthermore, stringent building construction guidelines and environmental regulations mandating waterproofing measures drive market expansion. Minimum waterproofing requirements have been established for residential construction activities that address foundation waterproofing, waterproofing of the roof and exterior walls, and basement waterproofing. Such measures aid in the development of resilient building structures.

In recent years, there have been continuous innovations in the development of waterproofing materials and their application techniques, expanding the market's potential and addressing specific application requirements. For instance, industries and academia are collaborating on various platforms to find innovative solutions for the protection of monuments and buildings from external damages such as water leakage. Additionally, multinational companies are investing in building manufacturing and commercial facilities in high-potential markets in the Asia Pacific and Middle East regions. These factors are expected to propel the demand for waterproofing chemicals in untapped markets.

Product Insights

Bitumen-based waterproofing accounted for the highest revenue share of 54.3% in the market in 2023. Bitumen is a petroleum-derived product characterized by relatively low production costs compared to other waterproofing materials. This economic advantage has made it an appealing option, particularly in price-sensitive markets. Bitumen has a long history of application in waterproofing as it offers high efficacy in protecting structures such as roofs, tunnels, below-ground structures, and foundations from water ingress. This reliability has led to sustained demand for the use of bitumen-based products in residential and commercial construction activities. Moreover, depending on the loading time and temperature, the product displays either elastic or viscous behavior, making it a highly versatile option.

On the other hand, polymers-based waterproofing is expected to register the fastest CAGR over the forecast period. This is owing to the superior performance and versatility of application of polymer-based waterproofing solutions. For instance, polymers offer exceptional waterproofing properties such as flexibility, durability, and resistance to extreme weather conditions. These attributes make them highly effective in protecting structures from water leakage and subsequent damage. Moreover, continuous research and development efforts have led to the creation of innovative polymer-based formulations with enhanced performance characteristics and environmental sustainability. These factors, along with the high reliability of polymer-based products, are expected to propel their demand in the coming years.

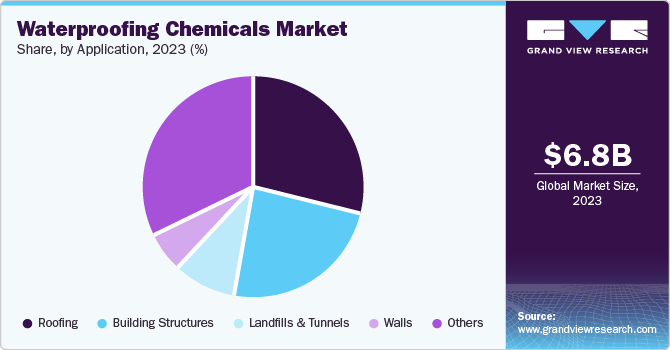

Application Insights

Roofing applications of waterproofing chemicals accounted for the highest market share in 2023. Rooftops in building structures are continuously exposed to multiple environmental factors, such as precipitation, ultraviolet radiation, and temperature fluctuations. These factors affect the structural integrity of roofs and lead to the formation of cracks, requiring robust waterproofing solutions. Effective waterproofing is paramount for preserving the underlying roofing structure from water seepage, which can lead to significant damage and costly repairs. Moreover, frequent maintenance cycles being conducted for existing roofs of buildings also require significant quantities of waterproofing chemicals, leading to segment dominance.

Meanwhile, the building structures segment is expected to register tahe fastest growth rate from 2024 to 2030. A surge in residential, commercial, and infrastructure development projects worldwide has led to increased utilization of waterproofing solutions to safeguard building integrity. Rapid urbanization and expanding populations have led to a heightened demand for resilient building structures, thereby driving the adoption of waterproofing chemicals. Furthermore, a growing emphasis on building maintenance and refurbishment is anticipated to propel a steady demand for waterproofing chemicals in the coming years from this application area.

Regional Insights

Asia Pacific led the waterproofing chemicals market with a revenue share of 45.7% in 2023. The region has witnessed rapid economic growth and urbanization, particularly in countries such as India, China, Singapore, and Indonesia, leading to a surge in construction activities. This has propelled demand for robust waterproofing solutions to protect buildings and infrastructure from water damage. Moreover, the region's position as a manufacturing hub for various chemicals and construction materials has contributed to the cost-competitiveness of waterproofing products, accounting for its leading share.

India Waterproofing Chemicals Market Trends

India accounted for a substantial share of the regional market in 2023. According to government records, the construction industry was among the highest recipients of foreign direct investment (FDI) of USD 33.91 billion from 2000 to 2024. Increasing economic activities and rapid migration of the population from rural to urban areas have led to a surge in the construction of residential and commercial buildings. These factors have propelled the demand for all types of building materials, including waterproofing chemicals.

Europe Waterproofing Chemicals Market Trends

Europe held a substantial market share in 2023. The need to restore and maintain aging infrastructure, such as bridges, tunnels, and dams, has created opportunities for waterproofing solutions to extend asset life and ensure structural integrity. Furthermore, the region is home to various historical monuments that require proper maintenance at frequent intervals, providing another avenue for market expansion. Additionally, new construction activities in urban centers have led to an increased demand for waterproofing materials in Europe.

The UK accounted for a notable share of the European market in 2023. Stringent residential and commercial building construction laws in the country have compelled builders to incorporate waterproofing solutions in construction activities. Additionally, the UK experiences consistent rainfall activity throughout the year. These unexpected precipitation conditions require a robust waterproofing solution, leading to demand for innovative waterproofing chemicals in the country.

North America Waterproofing Chemicals Market Trends

North America held a significant share of the global market in 2023. A well-established and sprawling construction sector in the region has created a strong demand for waterproofing solutions to protect buildings and infrastructure from water damage. Furthermore, continuous investments in research and development activities by waterproofing solution companies have resulted in the development of advanced waterproofing technologies and products, solidifying the region's position as a prominent market.

The U.S. is the biggest economy in North America. The presence of prominent manufacturers such as Bostik, DuPont, andCarlisle Companies Inc. provides a competitive advantage and drives market growth in the economy. Moreover, a longstanding awareness regarding the importance of waterproofing for extending the life of structures, along with the presence of various historically significant buildings that require timely maintenance, has led to the widespread adoption of these products in the country.

Key Waterproofing Chemicals Company Insights

Some key companies involved in the waterproofing chemicals market include Pidilite Industries Ltd., BASF SE, and Sika AG, among others.

-

Pidilite Industries Ltd. is an Indian construction material, waterproofing solutions, and adhesives manufacturing company. The company has multiple brands, such as Fevicol, M-Seal, Dr.Fixit, Roff, and Araldite. Dr.Fixit offers a wide array of waterproofing solutions, such as Pidicrete URP, Raincoat WPC, and LW+, among others. The company has established three R&D facilities in India to develop advanced solutions to water leakage problems. Its extensive and distinct product offering for roof waterproofing, bathroom waterproofing, and internal & external waterproofing caters to the requirements of a diverse consumer base.

-

BASF SE is a German manufacturer of chemicals, plastics, performance chemicals, catalysts, coatings, and several other chemicals required by industries. BASF provides acrylic latex polymers and supplementary components for creating commercial waterproofing membranes in the waterproofing segment. These materials enhance the membranes' water resistance, breathability, strength, elasticity, flexibility, crack resistance, and adherence to underlying surfaces.

Key Waterproofing Chemicals Companies:

The following are the leading companies in the waterproofing chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Pidilite Industries Ltd.

- MAPEI S.p.A.

- BASF SE

- Sika AG

- Dow

- Carlisle Companies Inc.

- DuPont

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- Bostik

- Wacker Chemie AG

Recent Developments

-

In February 2024, MAPEI S.p.A. announced that it had acquired the Saudi Arabian waterproofing solutions company Bitumat. The acquisition forms a part of the company’s long-term plan to strengthen its presence in the Middle East. Bitumat has a main factory located in the 2nd Industrial City of Dammam, along with a manufacturing facility in Bahrain. Its waterproofing products have been extensively used in building projects in the Middle East & Africa region.

-

In April 2023, Sika AG announced its collaboration with the University of Cádiz (UCA) for cooperation in developing innovative technologies for preserving concrete structures against damage from oil and water ingress. The surface modifying technology has been developed by the UCA Nanomaterials research team specifically for reinforced concrete. The recent co-operation deal aims to further expand and develop this technology’s functionality.

Waterproofing Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.22 billion

Revenue Forecast in 2030

USD 10.72 billion

Growth Rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, volume in kilotons, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Belgium, Russia, China, Japan, South Korea, India, Southeast Asia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Pidilite Industries Ltd.; MAPEI S.p.A.; BASF SE; Sika AG; Dow; Carlisle Companies Inc.; DuPont; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Bostik; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterproofing Chemicals Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the waterproofing chemicals market report based on product, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Polymer

-

PVC

-

TPO

-

EPDM

-

Others

-

-

Bitumen

-

SBS

-

APP

-

Others

-

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Roofing

-

Walls

-

Building structures

-

Landfills & tunnels

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."