- Home

- »

- Beauty & Personal Care

- »

-

Waterproof Makeup Market Size And Share Report, 2030GVR Report cover

![Waterproof Makeup Market Size, Share & Trends Report]()

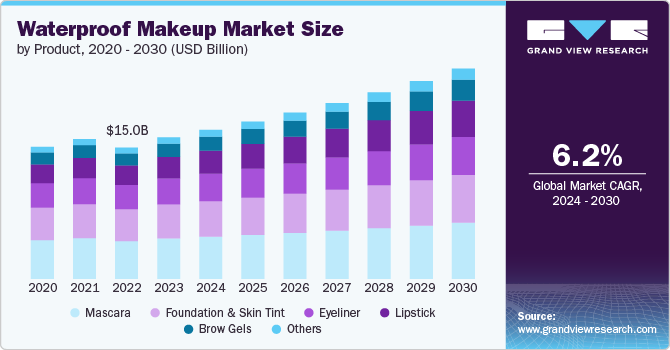

Waterproof Makeup Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mascara, Foundation & Skin Tint, Eyeliner, Lipstick, Brow Gel), By Form, By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-391-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Waterproof Makeup Market Size & Trends

The global waterproof makeup market size was estimated at USD 15.85 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. The popularity of waterproof makeup has surged in recent years, largely due to its durability and long-lasting quality. Modern consumers, particularly those with active lifestyles, prioritize products that offer high performance under various conditions, including humidity, sweat, and exposure to water. This demand is particularly strong among athletes, performers, and individuals living in regions with high humidity.

Additionally, the rise of social media and beauty influencers showcasing the effectiveness of waterproof makeup has significantly contributed to its popularity. Platforms like Instagram, TikTok, and YouTube are replete with tutorials and reviews that highlight the benefits of these products, further driving consumer interest and adoption.

Several key trends have emerged in the waterproof makeup market since 2022. One prominent trend is the shift towards multi-functional products. Consumers are increasingly looking for makeup that not only offers waterproof benefits but also includes skincare ingredients. For example, foundations and concealers with added SPF protection and hydrating properties are gaining traction. Brands like Estée Lauder and L'Oréal have capitalized on this trend by introducing products that combine makeup and skincare benefits, meeting the dual needs of consumers.

Another significant trend is the emphasis on natural and clean beauty. As consumers become more conscious of the ingredients used in their cosmetics, there has been a growing demand for waterproof makeup formulated with natural and non-toxic ingredients. Brands such as Tarte and RMS Beauty have responded by launching waterproof products that are free from parabens, sulfates, and other harmful chemicals. This trend aligns with the broader movement towards clean beauty, reflecting consumers' desire for products that are both effective and safe for their skin and the environment.

Innovation plays a crucial role in the waterproof makeup market, with brands investing heavily in research and development to enhance product performance. One notable advancement is the use of film-forming agents that create a flexible, breathable barrier on the skin, ensuring long-lasting wear without clogging pores. Companies like Chanel and Palladio Beauty Group LLC have leveraged such technologies to develop waterproof mascaras and eyeliners that withstand smudging and fading throughout the day.

Furthermore, the integration of advanced polymers and silicones in waterproof formulations has improved the texture and application of these products. This innovation ensures that waterproof makeup feels lightweight and comfortable on the skin, addressing previous concerns about heaviness and difficulty in removal. For instance, e.l.f. Cosmetics's waterproof foundations and concealers utilize cutting-edge formulations to provide a seamless, natural finish while maintaining exceptional durability.

Several initiatives have been launched by leading brands to strengthen their presence in the waterproof makeup market. One significant initiative is the expansion of product lines to cater to diverse skin tones and types. Fenty Beauty, for instance, has introduced an inclusive range of waterproof foundations and concealers available in a wide array of shades, ensuring that all consumers can find products that match their skin tones. Additionally, brands are focusing on sustainability and eco-friendly practices in response to growing environmental concerns. Packaging innovations, such as recyclable and refillable containers, are becoming more prevalent. Companies like Kjaer Weis and Ilia Beauty are at the forefront of this movement, offering sustainable packaging solutions without compromising the quality and performance of their waterproof products.

Collaborations and partnerships have also been a key strategy for brands looking to expand their reach and appeal. Notable collaborations, such as the partnership between Shiseido and Aaliyah Haughton Estate, have resulted in the launch of limited-edition waterproof makeup collections that generate significant buzz and consumer interest. These collaborations often leverage the popularity of celebrities and influencers to enhance brand visibility and attract new customers. Marketing campaigns and educational content that demonstrate the effectiveness and versatility of waterproof products are essential in driving consumer awareness and adoption. For example, tutorials that show how to create long-lasting makeup looks for various occasions, such as weddings, beach outings, and gym sessions, are highly effective in showcasing the value of waterproof makeup.

Brands are also leveraging digital platforms to engage with consumers and provide personalized recommendations. Virtual try-on tools, augmented reality (AR) experiences, and interactive social media campaigns allow consumers to explore waterproof makeup products and find the best matches for their needs. This personalized approach enhances the shopping experience and builds consumer confidence in the efficacy of the products.

Product Insights

The waterproof mascara accounted for a share of 28% in the year 2023. The demand is mainly driven by the trend of long-lasting and smudge-proof eye makeup, especially appealing to those with active lifestyles or those in humid climates. Innovations such as tubing mascaras, which wrap each lash in water-resistant polymers, are gaining popularity. Brands like Chanel's Lash Sensational Waterproof Mascara illustrate this trend.

The waterproof lipstick is projected to grow at a CAGR of 8.3% over the forecast period of 2024 to 2030. The demand for waterproof lipsticks is fueled by the desire for vibrant, long-lasting colors that can withstand eating and drinking. Liquid matte lipsticks, like those from brands such as Stila’s Stay All Day Liquid Lipstick, exemplify the trend toward non-transferable, durable lip color that remains intact throughout the day.

Form Insights

The liquid waterproof makeup accounted for a share of around 42% in 2023. Waterproof liquid foundations and concealers are popular for their ability to provide flawless, long-lasting coverage. The trend towards multi-functional products that combine coverage with skincare benefits, such as SPF and hydration, is evident in products like Estée Lauder's Double Wear Stay-in-Place Makeup.

The gels waterproof makeup is projected to grow at a CAGR of 6.7% from 2024 to 2030. Waterproof gel-based products, particularly eyeliners and brow gels, are preferred for their precision and durability. The trend towards natural-looking, well-defined brows and eyes drive this segment, with products like Anastasia Beverly Hills' Dipbrow Pomade leading the market.

End Use Insights

The women segment accounted for a share of around 61% in 2023. The women's waterproof makeup segment is extensive, driven by the need for durable and versatile products that withstand various conditions. Trends include the integration of skincare benefits and eco-friendly packaging, as seen in Tarte's Rainforest of the Sea collection.

The men's segment is estimated to grow at a CAGR of 6.9% from 2024 to 2030. Men's waterproof makeup is an emerging segment, driven by the growing acceptance of makeup among men for purposes such as concealing blemishes and evening skin tone. Products like War Paint for Men's waterproof concealer highlight this trend, addressing the demand for subtle, durable makeup solutions for men.

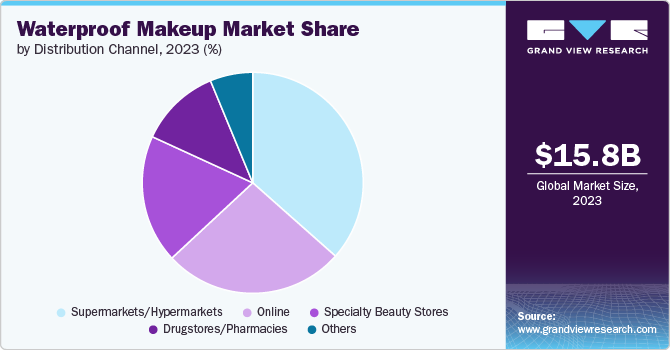

Distribution Channel Insights

The supermarkets/hypermarkets segment accounted for a revenue share of around 36% in 2023. Sales of waterproof makeup through supermarkets and hypermarkets are driven by the convenience and accessibility these channels offer. Trends show an increase in dedicated beauty aisles and the inclusion of premium and budget-friendly options, making it easier for consumers to purchase waterproof makeup during regular shopping trips.

The online segment is projected to grow at a CAGR of 7.3% from 2024 to 2030. The online sales channel is expanding rapidly due to the convenience of home shopping, detailed product descriptions, and customer reviews. The rise of virtual try-on tools and personalized recommendations further enhance the online shopping experience, as seen with brands like Sephora and Ulta offering extensive waterproof makeup collections online.

Regional Insights

North America Waterproof Makeup Market Trends

The waterproof makeup market in North America held 24% of the global revenue in 2023. In North America, the market is influenced by the high adoption rate of innovative beauty products and a strong presence of leading cosmetic brands. The region sees a significant demand for waterproof makeup during summer and in coastal areas, with products like Palladio Beauty Group LLC's All Nighter Setting Spray being particularly popular.

U.S. Waterproof Makeup Market Trends

The waterproof makeup market in the U.S. accounted for a share of around 81% in the year 2023. The U.S. market for waterproof makeup is characterized by a high level of product innovation and marketing efforts targeting diverse consumer groups. Social media influencers and beauty vloggers play a significant role in driving trends, with waterproof products like Fenty Beauty’s Pro Filt'r Soft Matte Longwear Foundation gaining widespread popularity.

Asia Pacific Waterproof Makeup Market Trends

Asia Pacific is expected to grow at a CAGR of 5.8% from 2024 to 2030. The Asia Pacific region exhibits strong growth due to the influence of K-beauty and J-beauty trends. Consumers in countries like South Korea and Japan prioritize products that offer long-lasting performance and natural aesthetics. Brands such as Shiseido are popular for their high-quality waterproof makeup products.

Europe Waterproof Makeup Market Trends

Europe is projected to grow at a CAGR of 5.6% from 2024 to 2030. In Europe, the waterproof makeup market growth is driven by a combination of consumer demand for high-performance products and a growing preference for clean beauty. The region sees a strong trend towards environmentally friendly and sustainably packaged waterproof makeup, with brands like Kjaer Weis leading the charge in eco-friendly waterproof solutions.

Key Waterproof Makeup Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Waterproof Makeup Companies:

The following are the leading companies in the waterproof makeup market. These companies collectively hold the largest market share and dictate industry trends.

- Estee Lauder

- L’Oréal Paris

- Procter & Gamble

- Shiseido

- Revlon

- Coty Inc.

- Chanel

- LVMH

- Palladio Beauty Group LLC

- e.l.f. Cosmetics

Recent Developments

-

In June 2024, L’Oréal Paris introduced its newest product, the Voluminous Panorama Waterproof Mascara, in Malaysia. This mascara is engineered to provide clump-free, smudge-proof wear that lasts up to 24 hours. It is available for purchase on L’Oréal Paris’s store, Lazada, Shopee, and at Watsons and Guardian outlets throughout Malaysia.

-

In May 2024, Fenty Beauty introduced a new waterproof foundation, the Soft’Lit Naturally Luminous Longwear Foundation. This product is designed to withstand heat and humidity, offering a sweat-and-transfer-resistant formula. It provides a radiant finish, catering to those seeking a luminous, long-lasting look even in steamy weather conditions.

Waterproof Makeup Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.74 billion

Revenue forecast in 2030

USD 24.06 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Estee Lauder; L’Oréal Paris; Procter & Gamble; Shiseido; Revlon; Coty Inc.; Chanel; LVMH; Palladio Beauty Group LLC; e.l.f. Cosmetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterproof Makeup Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the waterproof makeup market report based on product, form, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mascara

-

Foundation and Skin Tint

-

Eyeliner

-

Lipstick

-

Brow Gels

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Gels

-

Powder

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Beauty Stores

-

Drugstores/Pharmacies

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global waterproof makeup market was estimated at USD 15.85 billion in 2023 and is expected to reach USD 16.74 billion in 2024.

b. The global waterproof makeup market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 24.06 billion by 2030.

b. Asia Pacific dominated the waterproof makeup market with a share of around 39% in 2023. The influence of Korean and Japanese beauty trends, which emphasize flawless and long-lasting makeup, is significantly boosting the adoption of waterproof products in the region.

b. Some of the key players operating in the waterproof makeup market include Estee Lauder; L’Oréal Paris; Procter & Gamble; MAC Cosmetics; Revlon; Coty Inc.; Maybelline; MAC Cosmetics; Urban Decay; Lancôme

b. Key factors that are driving the waterproof makeup market growth include consumers increasingly preferring makeup that can withstand various environmental conditions like heat, humidity, and water exposure, continuous advancements in waterproof makeup formulations, and integration of skincare benefits such as SPF protection and hydration are attracting a broad consumer base.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.