- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Waterborne Coating Additives Market Size Report, 2030GVR Report cover

![Waterborne Coating Additives Market Size, Share & Trends Report]()

Waterborne Coating Additives Market Size, Share & Trends Analysis Report By Product (Wetting & Dispersion Agents, Defoaming, Rheology Modifiers, Flow Additives), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-624-0

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Waterborne Coating Additives Market Trends

The global waterborne coating additives market size was valued at USD 3.80 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030.Growing infrastructural spending in the industrial and residential sectors, particularly in South East Asia and the Middle East & Africa regions, is expected to drive product demand in the architectural and industrial wood segments. Additionally, volatile organic compound (VOC) emissions in the construction and manufacturing industry have steered revisions in regulatory standards.

Recent advances in waterborne technology can be attributed to stringent regulatory restrictions and consumer expectations. Construction and manufacturing industries in mature economies in North America and Europe have witnessed growing consumer preference towards eco-friendly products. Regulatory bodies in Europe have made several revisions to industry standards to incorporate low VOC levels as a mandatory requirement for the paints and coatings industry.

Stringent REACH and EPA regulations regarding VOC and toxic content in solvent-based additives have led to the commercialization of water-soluble alternatives with improved performance. Associative thickeners such as HEUR, HMPE, HASE, and HMHEC have gained significant share in recent years owing to improved stability and longevity as compared to conventional modifiers, including bentonite and pyrogenic silica. Additives play a significant role as the major component of waterborne coatings. They chemically enhance the formulation to provide stability and color retention for the long term. This is expected to positively drive industry growth in the coming years.

Despite moderate overall growth in the EU, the aftermarket for the construction and automotive industries is expected to remain a key driver sustaining economic growth in this region. Demand for high-quality coatings in home interior and automotive components can be attributed to growing consumer awareness about social lifestyle trends. Moreover, growing marine activities in the North Sea and the Mediterranean are expected to steer demand for durable and protective coatings in regions such as the U.K. and Norway.

The rising demand for wetting and dispersion additives to prevent reflocculation of the dispersed particles in coatings is expected to drive demand. These additives have three primary functions – wetting, dispersion, and stabilization of waterborne coatings. The rheology modifiers segment is anticipated to witness substantial demand in the region during the forecast period. Rheology modifiers lower surface tension and improve film quality, color acceptance, and wet abrasion resistance. These modifiers improve rheological properties such as in-can stability, brushability, film building, and sagging.

Application Insights

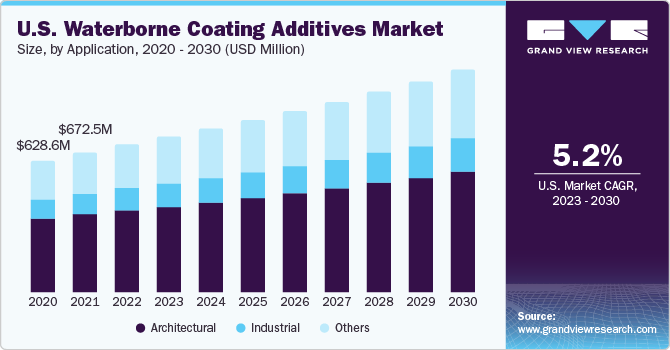

The architectural segment accounted for the largest revenue share of 57.0% in 2022. The escalating emphasis on quality standards in architecture is a significant factor propelling the demand for waterborne coating additives. Architectural coatings are needed to exhibit exceptional tensile strength, weather resistance, UV protection, and color retention. Waterborne coating additives are specifically designed to augment these properties and elevate the overall coating performance. The demand for durable and aesthetically pleasing architectural coatings further contributes to the momentum of the market.

The industrial segment is expected to expand at a steady CAGR of 6.5% during the forecast period. Factors such as stringent regulations on volatile organic compound (VOC) emissions, the increasing demand for environment-friendly coatings, the need for improved performance and durability of these coatings, and growing industrialization are driving the growth of the market for waterborne coating additives in the industrial sector.

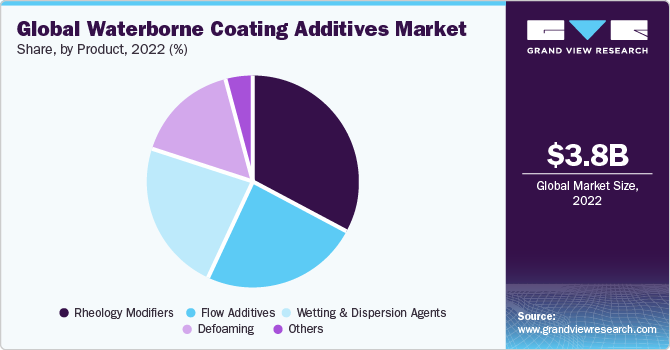

Product Insights

Based on the product, the market has been mainly segmented into wetting and dispersion agents, defoaming, rheology modifiers, and flow additives, among other products. The rheology modifiers segment accounted for the largest revenue share of 43.2% in 2022. Additionally, growing demand for wetting and dispersion additives to prevent reflocculation of the dispersed particles in coatings is expected to drive market demand over the forecast period.

These additives have three primary functions, including wetting, dispersion, and stabilization of the waterborne coatings. Major wetting and dispersion additives include polyacrylate salts, fatty acid and fatty alcohol derivatives, acrylic copolymers, maleic anhydride copolymers, and alkylphenol ethoxylates. Rising product demand in architectural, wood, and furniture coatings segments is anticipated to drive the market during the forecast period.

The rising demand for waterborne coatings in the European region, owing to the steadily expanding construction industry, is anticipated to drive market expansion over the projection period. Germany’s regulatory body, which includes Technische Anleitung (TA) Luft, coupled with the U.K.’s Environmental Protection Act, provides the guideline for lowering VOC content in paints and coatings. This factor is expected to increase the demand for waterborne coatings by replacing solvent-borne coatings used in construction activities.

The wetting & dispersion agents segment is expected to expand at the fastest CAGR of 7.0% during the forecast period. The market segment is witnessing substantial expansion due to growing consumer awareness and the utilization of these products. The escalating demand for high-performance additives such as wetting and dispersion agents is being driven by the thriving end-use industries in emerging markets. The need for coatings is on the rise due to rapid industrialization, urbanization, and infrastructural development in countries such as China, India, Brazil, and Mexico. This surge is amplifying the market demand for wetting and dispersion agents.

The defoaming segment is expected to grow at a moderate rate during the forecast period. Major causes of foam formation in waterborne coatings include mechanical introduction of air by mixing or application processes, air displacement during wetting or dispersion and generation of gas by chemical reactions, and rapid drying causing bubbles. Defoamers are used to prevent foam formation during processing and destroy the existing foam. Rising waterborne coatings demand, particularly in Europe, is anticipated to drive the additives market over the next seven years.

Regional Insights

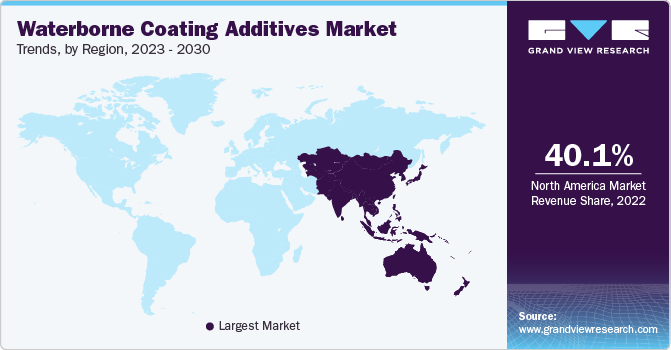

The Asia Pacific region dominated the market and accounted for a revenue share of 40.1% in 2022; moreover, it is expected to advance at the fastest CAGR of 6.7% through 2030. Owing to the expanding building and construction sectors in the region, coupled with the evolving lifestyle of the population, the utilization of waterborne coating additives has witnessed strong growth. Additionally, increasing per capita disposable income allows individuals to allocate more resources to housing, thereby driving up the demand for waterborne coating additives.

Stringent government regulations to lower VOC content in paints & coatings are expected to raise the demand for waterborne coatings in North America. Moreover, the increasing automobile demand, coupled with the rapid development of new industries being set up, is expected to propel the North American waterborne coatings market during the assessment years. Factors such as rising employment rates and consumer confidence are expected to drive waterborne coatings demand in this region. The emergence of green building norms is another factor expected to drive market demand in North America.

Europe held a significant market share in 2022. A large production base of waterborne coatings, along with the early commercialization of finished products in economies such as the U.K., Germany, France, and Italy, have led to the steady market demand. Stringent REACH and government regulations regarding VOC and toxic content in conventional synthetic coatings have created demand for waterborne coatings. These products have penetrated around 90% of the architectural segment in the mature markets of North America and Europe, as a drop-in substitute to petroleum-derived solvent borne coatings.

Key Companies & Market Share Insights

The global market for waterborne coating additives is highly fragmented in nature. The strong presence of local manufacturers, particularly in China and India, has facilitated in minimizing procurement costs as compared to the imported brands from Europe and the U.S. This has facilitated industry participants to invest in R&D initiatives for new product development strategies to enhance their market presence globally.

Key Waterborne Coating Additives Companies:

- AkzoNobel N.V.

- Evonik

- BASF SE

- BYK

- Harmony Additive Pvt. Ltd.

- Dow

- Belami Fine Chemicals Pvt. Ltd.

- Allnex GMBH

- Huber Engineered Materials

- Falcon Technologies

- Shah Patil and Co.

- Arxada

- KaMin LLC

- The Lubrizol Corporation

Recent Developments

-

In June 2023, AkzoNobel N.V. obtained approval to provide its water-based refinishing products to Porsche China, currently one of the largest markets for the luxury auto brand. To cater to Porsche China's comprehensive refinishing needs, the company will offer its complete water-based Sikkens range, encompassing basecoats, clearcoats, and primer

-

In April 2023, AkzoNobel N.V. announced its intention to acquire Sherwin-Williams company’s Chinese Decorative Paints division. According to the company, this prospective acquisition aligns well with their strategic growth ambitions in China's Tier 3 to Tier 5 geographical regions

-

In June 2023, Evonik announced the inclusion of a new, radically cross-linkable defoaming slip additive to their TEGO Rad line of custom-designed silicone acrylates. The innovative TEGO Rad 2550 comprises a transparent liquid with low viscosity, that substantially reduces both dynamic and static surface tension in typical LED and UV-cured formulations

-

In March 2023, BASF SE began the production of Sovermol, its very first bio-based polyol, in Karnataka, India. This product meets the rapidly expanding need for environment-friendly goods in the Asia Pacific region. It has applications in windmills, flooring, New Energy Vehicles (NEV), and protective industrial coatings

-

In January 2023, BYK successfully expanded its production facility in Shanghai. This is the company’s second site in China. The phase II project (SCIP II) covers an area of 1.16 hectares and is built for a 4,750-ton capacity per year. It has a wide and comprehensive product line, comprising defoamers, surface additives, and others, which will now be available to the company's clients

Waterborne Coating Additives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.03 billion

Revenue forecast in 2030

USD 6.09 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in kilo tons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AkzoNobel N.V.; Evonik; BASF SE; BYK; Harmony Additive Pvt. Ltd.; Dow; Belami Fine Chemicals Pvt. Ltd.; Allnex GMBH; Huber Engineered Materials; Falcon Technologies; Shah Patil and Co.; Arxada; KaMin LLC; The Lubrizol Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterborne Coating Additives Market Report Segmentation

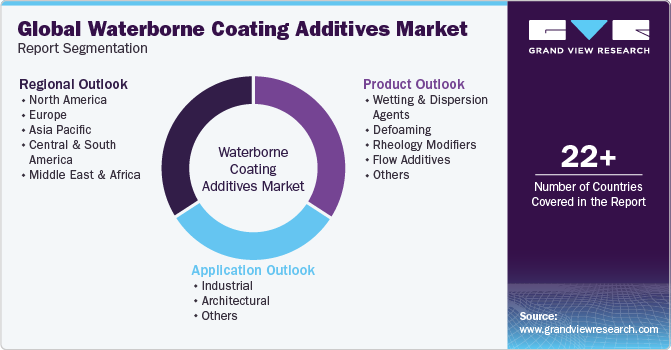

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global waterborne coating additives market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Wetting & Dispersion Agents

-

Defoaming

-

Rheology Modifiers

-

Hydroxyethyl Cellulose (HEC)

-

Hydrophobically Modified Hydroxyethyl Cellulose (HMHEC)

-

Ethyl hydroxyethyl Cellulose (EHEC)

-

Hydrophobically Modified Polyacetal Polyether (HMPAPE)

-

Hydrophobically Modified Ethoxylated Urethane (HEUR)

-

-

Flow Additives

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Architectural

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global waterborne coating additives market size was valued at USD 3.80 billion in 2022 and is expected to reach USD 4.03 billion in 2023.

b. The global waterborne coating additives market is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030 to reach USD 6.09 billion by 2030.

b. The Asia Pacific region dominated the market and accounted for a revenue share of 40.1% in 2022; moreover, it is expected to advance at the fastest CAGR of 6.7% through 2030.

b. Some key players operating in the waterborne coating additives market include Byk, Harmony Additive, Dow Coating Belami Fine Chemical, Allnex, Huber Engineered Materials, Falcon Technologies, Shah Patil and Co., Troy Corp, KaMin LLC, Lubrizol Advanced Materials, and Taminco.

b. Key factors that are driving the market growth include growing infrastructure spending in industrial and residential sectors, particularly in South East Asia and the Middle East & Africa.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."