- Home

- »

- Plastics, Polymers & Resins

- »

-

Water Soluble Packaging Market Size, Industry Report, 2030GVR Report cover

![Water Soluble Packaging Market Size, Share & Trends Report]()

Water Soluble Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report by Material (Polymers, Fibers, Surfactants), By Product (Bags, Pouches), By Solubility Type, By End-use (Household Products, Agriculture, Medical, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-077-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Soluble Packaging Market Summary

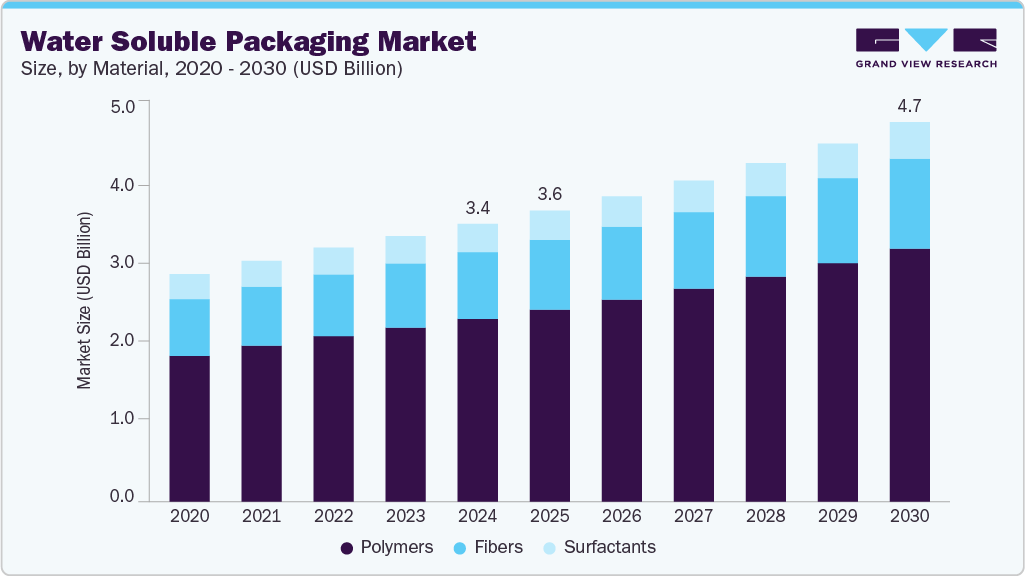

The global water soluble packaging market size was estimated at USD 3.44 billion in 2024 and is projected to reach USD 4.70 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. Soluble packaging is designed to dissolve in water, making it a sustainable alternative to traditional packaging materials such as plastic, glass, and metal.

Key Market Trends & Insights

- North America accounted for the largest market share of over 32.3% in 2024 in the water-soluble packaging market.

- The U.S. market is the largest contributor to the North American region in 2024.

- By material, the polymer segment dominated the market in 2024 and accounted for 65.8% of the revenue share.

- By product, the bags segment accounted for the largest market share in 2024.

- By solubility, the demand for hot water solubility accounted for a higher market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.44 Billion

- 2030 Projected Market Size: USD 4.70 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growth of the water-soluble packaging market is attributed to rising environmental concerns and a shift in consumer demand for sustainable packaging solutions. This packaging is convenient to use for consumers, easily dissolvable, and contributes minimally to environmental pollution. The U.S. federal government has implemented several regulations on plastic packaging, which is creating growth opportunities for water soluble packaging industry. For instance, the U.S. Environmental Protection Agency (EPA) has established regulations for the disposal of plastic waste, and the Food and Drug Administration (FDA) has established regulations regarding the use of plastics in consumer goods which further fuels the market growth for water-soluble packaging solutions.The U.S. market houses a significant number of water soluble packaging manufacturers such as MonoSol (a Kuraray Division), U.S. Non Wovens, Mondi, and Smart Solve Industries, which supports the water soluble packaging demand in the country. Growing awareness regarding the benefits offered by water soluble packaging solutions is driving their adoption by end-users in the U.S. For instance, Saie, a health and beauty brand, uses water soluble packaging for its products.

Stringent government regulations on plastic ban have also positively impacted the water-soluble packaging industry growth. For instance, the draft European Union regulation published by the UK government has set a target to achieve zero avoidable plastic waste by 2042. This initiative by the government has further led to increased demand for sustainable packaging solutions such as water-soluble packaging.

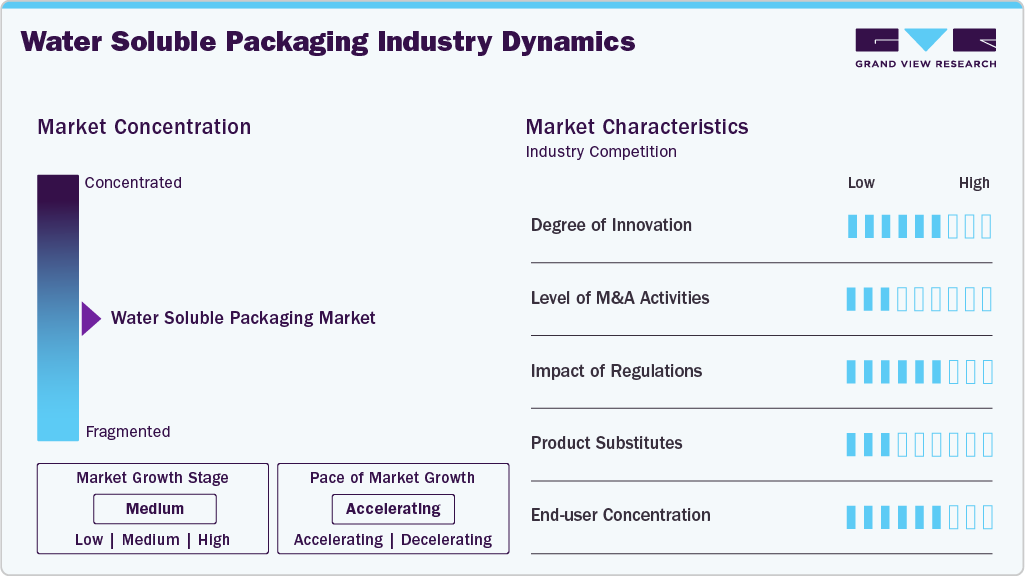

Market Concentration & Characteristics

The water-soluble packaging market is moderately concentrated, with several companies contributing to the overall market share and product innovation. The market is also characterized by several small-scale start-ups, which encourage further innovation in product development. The market is experiencing a moderate growth rate. However, it is expected to gain higher growth rates over the next few decades.

The water soluble packaging market has been witnessing growing innovation, especially in the incorporation of sustainable materials such as polymers, surfactants, and fibers derived from natural sources. Brands are developing packaging that is highly soluble and offers extra-strength catering to varied applications, including retail, medical, and chemical industries. Water soluble packaging improvements also reflect ongoing innovations and consistent investments in their R&D.

Environmental regulations significantly influence water-soluble packaging solutions and the responsible sourcing of materials. Governments across North America and European countries have implemented recycled-content mandates and single-use plastic restrictions. These laws are pushing brands toward water soluble and compostable alternatives. Compliance has become a key driver of R&D and product positioning. Regulatory impact is high and continues to shape future market offerings.

Water soluble packaging manufacturers are actively expanding product lines to address the issues of waste generated from traditional packaging. Eco-friendly alternatives, including compostable and water-soluble packaging, are gaining traction. Companies are also offering customized packaging solutions for various end-use sectors. Product expansion is healthy and driven by environmental and consumer demands.

Companies from different verticals are incorporating water-soluble packaging as a part of their environmental efforts. Brands including Procter & Gamble, Unilever, and Reckitt Benckiser Group are using water soluble pods for their homecare products including detergents, shampoos, bath soaps and gels, among others. Companies are also making strategic alliances to develop and customize packaging for their products.

Material Insights

Based on materials, water-soluble packaging is segmented into polymer, surfactants and fibers. Among these, the polymer segment dominated the market in 2024 and accounted for 65.8% of the revenue share. Polyvinyl alcohol is popularly used as a water-soluble packaging material due to its strong film-forming properties and excellent water solubility. These polymers are compatible with a wider range of product ingredients, including aggressive chemicals, enzymes, and other active ingredients having applications in household, medical, agriculture, and personal care sectors.

The fiber segment is expected to advance at a substantial CAGR of 5.2% during the forecast period. Natural fiber materials are derived from plant sources including wood pulp, while, synthetic fibres are derived from grains such as corn and wheat, which are further used in the production of fiber-based water-soluble packaging solutions. For instance, water soluble paper is an example of fiber-based packing product that helps in lowering the environmental impact compared to conventional plastic packaging solutions. Such products helps in driving the demand for fiber-based water soluble packaging market.

Product Insights

Based on products, the water-soluble packaging market is segmented into bags, pouches, and pods & capsules. Among these, the bags segment accounted for the largest market share in 2024 and is expected to maintain its dominance during the forecast period. This is due to its extensive adoption in the medical packaging sector, especially for infected laundry bags and disposable consumables. The convenience and easy application of water-soluble bags make them a preferred choice for both manufacturers and consumers. For instance, a study in April 2024 revealed that over 92% of hospital laundry staff have been in contact with contaminated linen, underscoring the significant infection risks in healthcare settings. To mitigate this, many hospitals have adopted water-soluble laundry bags, which can be placed directly into washing machines, reducing direct handling of soiled linens and enhancing infection control measures. Additionally, increasing regulatory emphasis on hospital hygiene standards is driving the procurement of safer and more sustainable packaging solutions. As a result, demand for water-soluble medical bags is expected to continue rising, particularly across hospitals, nursing homes, and emergency care facilities.

The pouches segment is anticipated to grow at a considerable CAGR over the forecast period. The water-soluble pouches are commonly used for single-dose packaging of items such as laundry detergents, agricultural chemicals, industrial cleaning agents, and personal care products including bath additives. Designed to completely dissolve in water without leaving waste, they offer a sustainable and user-friendly alternative to conventional plastic packaging. Increasing demand for biodegradable, pre-measured packaging across industries such as home care, agriculture, and personal care is expected to fuel continued growth of this segment over the coming years.

Solubility Insights

The demand for hot water solubility accounted for a higher market share in 2024. The ability to dissolve the packaging quickly and easily in hot water temperatures ranging typically between 60°C to 80°C eliminates the need for measuring, handling, and disposing of traditional packaging materials. This is a major factor driving the demand for this segment.

Cold-water soluble packaging offers greater energy efficiency by dissolving quickly at temperatures below 20°C, eliminating the need for hot or warm water. Growing environmental awareness and the push for eco-friendly packaging solutions are driving increased demand for water-soluble packaging, which in turn is expected to encourage the market for cold-water soluble options. For instance, in 2021, Emballator introduced rigid containers made from PVOH that dissolve in cold water. These containers can be tailored to meet specific customer needs, providing an innovative and sustainable alternative for packaging dry products while helping reduce plastic waste.

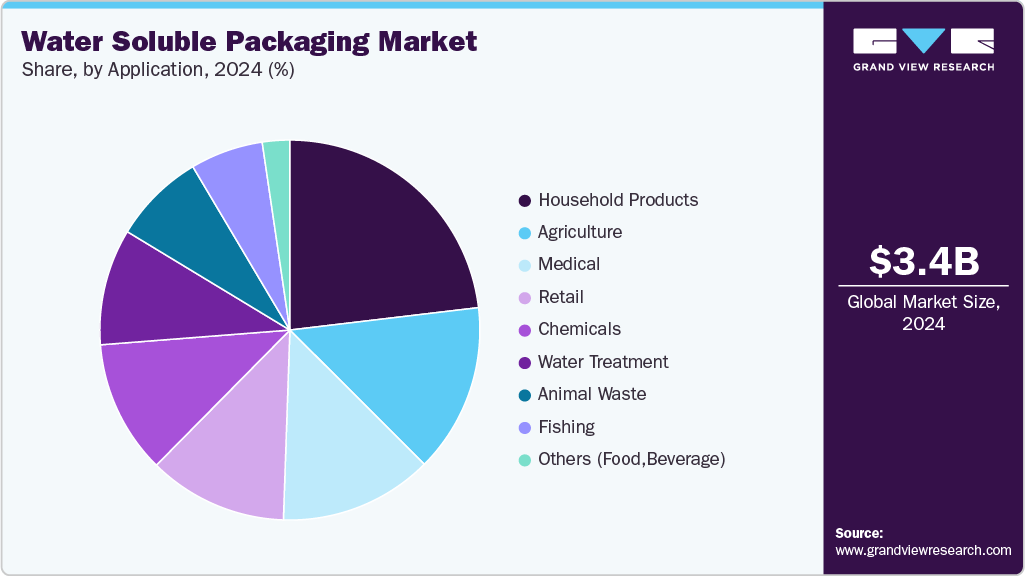

End-use Insights

The demand from the household products segment accounted for the largest market share in 2024, owing to the wide application of water-soluble packaging in laundry detergent pods and other household cleaning products, such as drain cleaner pods, glass cleaner pods, and toilet blocks. Many companies started to provide household products in such water soluble packaging. For instance, Unimasses Group, a global household cleaning products manufacturer, offers a wide range of laundry detergent in Water-soluble packaging. Such packaging provides a convenient and efficient way of dispensing cleaning products without the need for measuring or handling bulky containers. Such innovations in household product packaging are fuelling the demand for this segment.

The consumption of water soluble packaging in the agriculture industry is expected to grow at the fastest during the forecast period of 2025 to 2030. Water soluble packaging solutions are used in packaging fertilizers and pesticides, which helps to reduce waste and minimize its environmental impact. Furthermore, water-soluble packaging is widely used in hospitals, healthcare centres, and nursing homes, in the form of laundry bags. These water-soluble laundry bags are used to wash the contaminated and infected laundry of patients without the risk of infection, as these bags are dissolvable in water when they are put together in a washing machine along with laundry.

In the retail sector, water-soluble packaging is used in garment bags, grocery bags, and other consumer goods packaging. The personal care industry is adopting this packaging solution to eliminate plastic packaging usage due to stringent government regulations on plastic ban and plastic waste management For instance, the Government of Canada introduced the Single-Use Plastics Prohibition Regulations, which came into effect in December 2022. These regulations aim to eliminate specific categories of single-use plastic items such as checkout bags, cutlery, stirring sticks, and food service ware by regulating their manufacture, import, and sale. This measure is part of Canada’s broader strategy to achieve zero plastic waste by 2030. Such proactive government initiatives are encouraging industries to adopt sustainable alternatives including water-soluble packaging.

The chemical industry is expected to expand at a significant rate during the forecast period, on account of the fast-growing trend of fabric dyeing. Dye pods have gained popularity among the younger generation due to their convenience and ease of use. These pods are simply dropped in water along with the fabric and they dissolve and release the color into the water, eliminating the packaging waste.

Regional Insights

North America accounted for the largest market share of over 32.3% in 2024 in the water-soluble packaging market. This is owing to the increasing demand for environmental-friendly packaging solutions from various regional end-user industries including household products, healthcare, and food & beverages. In addition, the stringent government regulations and the rising awareness among consumers about the negative environmental impact of traditional packaging materials are driving the demand for such packaging solutions in North America.

U.S. Water Soluble Packaging Market Trends

The U.S. market is the largest contributor to the North American region in 2024. This growth is primarily driven by rising demand from the household sector for cleaning pods and capsules, particularly for laundry and dishwashers. These products offer convenience and safety, with formulations designed to minimize skin contact with harmful chemicals. Additionally, the increasing adoption of dishwashers and washing machines has bolstered the market for water-soluble detergents and dishwasher pods.

Beyond household use, the expanding U.S. healthcare sector is also fueling demand. For instance, in 2023, National Health Expenditure (NHE) grew by 7.5% to $4.9 trillion, accounting for 17.6% of the country’s GDP, with spending reaching $14,570 per person. Medicare spending rose by 8.1% to $1,029.8 billion (21% of total NHE), while Medicaid spending increased by 7.9% to $871.7 billion (18% of total NHE). This substantial growth in healthcare spending drives the demand for hygienic, sustainable packaging solutions-such as water-soluble laundry bags used in hospitals and care facilities to safely handle contaminated materials without direct contact. As a result, the healthcare sector is a significant contributor to the rising demand for water-soluble packaging in the U.S.

Europe Water Soluble Packaging Market Trends

Europe accounted for a significant market share in 2024 due to the increased product demand from the household segment and stringent government regulation pertaining to environmental protection. The trend of independent living in the region has led to hectic and busy schedules of consumers, giving rise to an increased demand for products that are convenient and easy to use. Consumer buying such products has a positive impact on the water-soluble packaging market due to the growing demand for cleaning pods. Moreover, stringent government regulations on plastic bans and a growing emphasis on sustainable packaging is driving the market demand for these solutions in the region. For instance, in December 2024, the European Council approved the Packaging and Packaging Waste Regulation, which mandates that all packaging must be recyclable or reusable by 2030. This regulation is pushing industries to adopt innovative, eco-friendly materials such as water-soluble films, further accelerating market growth.

Asia Pacific Water Soluble Packaging Market Trends

Asia Pacific is poised to expand at the fastest CAGR of 6.4% through 2030 in the market for water-soluble packaging, owing to the rising demand for sustainable packaging solutions in the region. Countries such as China, India, South Korea, and Japan are major contributors to the market growth, owing to the high demand for laundry detergents and personal care products. Moreover, the ban on plastic packaging in various countries is fueling regional market growth.

China accounted for the largest market share in 2024 in the Asia Pacific region. This is attributed to the rapidly growing end-user industries and increased consumer awareness about sustainable packaging solutions. The Chinese government has been implementing certain regulations to reduce plastic packaging usage in the country, which is positively impacting the demand for sustainable packaging solutions. For instance, China's National Development and Reform Commission (NDRC), in collaboration with the Ministry of Ecology and Environment, has outlined a comprehensive plan to reduce single-use plastic consumption by 2025. This initiative is part of the 14th Five-Year Plan (2021-2025) aimed at controlling plastic pollution.

Key Water Soluble Packaging Company Insights

Key players in the Water Soluble Packaging Market include Kuraray, Lithey Inc., Mondi Group, SEKISUI CHEMICAL CO., LTD., Mitsubishi Chemical Corporation, Soltec Development, Soluble Technology Limited, Aquapak Polymers Ltd., Rovi Packaging, S.A., INVISIBLE COMPANY, AICELLO CORPORATION, Medanos Claros HK Limited, Cortec Corporation, Acedag Ltd, Changzhou Haoteng Environmental Protection New Material Technology Co., Ltd., Green Master Packaging, Guangdong Proudly New Material Technology Corp., Solupak, EOS Plast Srl, and Solubag.

-

Kuraray Co., Ltd. is a global leader in water-soluble films under the brand "Eval and Poval", known for their high-quality polyvinyl alcohol (PVA) materials used in packaging detergents, agrochemicals, and pharmaceuticals. The company focuses on innovation and sustainability in polymer science.

-

SEKISUI CHEMICAL CO., LTD. manufactures water-soluble and biodegradable films used in a variety of household and industrial applications. The company is recognized for its environmental stewardship and consistent R&D in advanced functional materials.

Key Water Soluble Packaging Companies:

The following are the leading companies in the water soluble packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Kuraray

- Lithey Inc.

- Mondi Group

- SEKISUI CHEMICAL CO., LTD.

- Mitsubishi Chemical Corporation

- Soltec Development

- Soluble Technology Limited

- Aquapak Polymers Ltd.

- Rovi Packaging, S.A.

- INVISIBLE COMPANY

- AICELLO CORPORATION

- Medanos Claros HK Limited

- Cortec Corporation

- Acedag Ltd

- Changzhou Haoteng Environmental Protection New Material Technology Co., Ltd.

- Green Master Packaging

- Guangdong Proudly New Material Technology Corp.

- Solupak

- EOS Plast Srl

- Solubag

Recent Developments

-

In October 2024, Solubag secured Series A funding worth USD 4.5 million led by Exit Ventures, with participation from Between the Coasts Ventures, Landon Ainge, and others. This investment was made with an aim to accelerate the development and commercialization of Solubag's patented water-soluble materials designed to replace single-use plastics.

-

In October 2024, British packaging firm Mondi plc announced the €634 million acquisition of Schumacher Packaging’s assets in Germany, Benelux, and the UK.

Water Soluble Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.60 billion

Revenue Forecast in 2030

USD 4.70 billion

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030.

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, solubility, end use, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea, Australia, Southeast Asia, Brazil; Chile; Saudi Arabia; UAE; South Africa

Key companies profiled

Kuraray; Lithey Inc.; Mondi Group; SEKISUI CHEMICAL CO., LTD.; Mitsubishi Chemical Corporation; Soltec Development; Soluble Technology Limited; Aquapak Polymers Ltd.; Rovi Packaging, S.A.; INVISIBLE COMPANY; AICELLO CORPORATION; Medanos Claros HK Limited; Cortec Corporation; Acedag Ltd; Changzhou Haoteng Environmental Protection New Material Technology Co., Ltd.; Green Master Packaging; Guangdong Proudly New Material Technology Corp.; Solupak; EOS Plast Srl; Solubag

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Soluble Packaging Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global water soluble packaging Market report based on based on material, product, solubility type, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymers

-

Surfactants

-

Fibers

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags

-

Pouches

-

Pods & Capsules

-

-

Solubility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Water

-

Hot Water

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household Products

-

Agriculture

-

Medical

-

Retail

-

Chemicals

-

Water Treatment

-

Animal Waste

-

Fishing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.