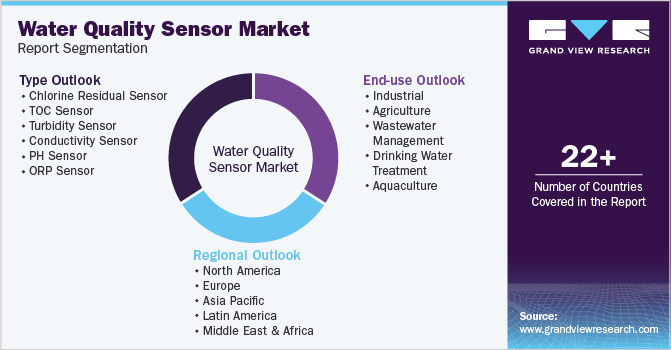

Water Quality Sensor Market Size, Share & Trends Analysis Report By Type (Chlorine Residual Sensor, Turbidity Sensor), By End-use (Industrial, Wastewater Management), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-414-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Water Quality Sensor Market Size & Trends

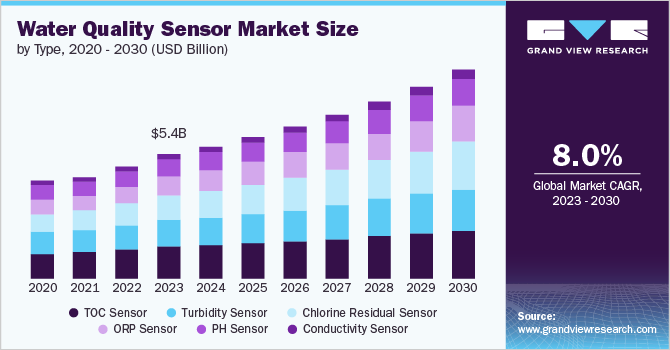

The global water quality sensor market size was estimated at USD 5.42 billion in 2023 and is projected to grow at a CAGR of 8.0% from 2024 to 2030. The market is witnessing robust growth, primarily fueled by increasing global awareness about environmental conservation and the critical importance of water quality monitoring for both human health and ecosystem sustainability. Factors such as stricter government regulations regarding water pollution control, advancements in sensor technologies, and the rising demand from industries such as wastewater treatment, pharmaceuticals, and food and beverage are also contributing significantly to market expansion.

This surge in demand for water quality sensors signifies a collective move towards more sustainable water resource management practices, reflecting an overarching trend towards environmental stewardship and the implementation of smart, technology-driven solutions to address global water quality challenges.

Water quality sensors play a crucial role in monitoring the conditions of various water bodies, ensuring that the water remains safe for drinking, recreational activities, and habitat for aquatic life. These sensors measure parameters such as temperature, pH levels, dissolved oxygen, turbidity, and the presence of harmful chemicals or pathogens. Employing advanced technologies, water quality sensors provide real-time data, enabling immediate responses to pollution incidents and helping in the effective management of water resources. This not only aids in preventing health hazards but also supports the sustainability of ecosystems by maintaining the balance and cleanliness of water environments.

Drivers, Opportunities & Restraints

The demand for water quality sensors is primarily driven by the increasing global emphasis on water conservation and the need to monitor and control water pollution. Growing awareness regarding the health impacts of contaminated water and stringent government regulations regarding water quality standards have also significantly contributed. The expansion of industries that require large volumes of water for their processes, such as pharmaceuticals, food and beverages, and chemicals, necessitates the deployment of water quality monitoring systems to ensure compliance with environmental regulations.

The integration of IoT with water quality monitoring systems offers the potential for real-time data collection and analysis, enabling more efficient water management practices. This technological leap opens doors for the development of new, more sensitive, and accurate sensors. Moreover, the increasing investment in wastewater treatment and reuse in water-scarce regions provides a substantial market opportunity. There is also a growing trend towards the development of portable and user-friendly water quality testing kits for individual and community use, presenting an opportunity for expansion into new customer segments.

High costs associated with the development and deployment of advanced sensors can be a significant barrier, especially in low-income countries. The complexity of water quality monitoring systems and the need for skilled personnel for operation and maintenance further add to the challenges.

Type Insights

“The demand for chlorine residual sensor segment is expected to grow at a CAGR of 10.0% from 2024 to 2030 in terms of revenue”

The TOC sensor segment led the market and accounted for 25.6% of the global revenue share in 2023. TOC sensors are pivotal in assessing the organic matter in water, serving crucial roles in environmental monitoring, wastewater treatment, and ensuring the safety of drinking water. The demand is further propelled by technological advancements that have enhanced sensor accuracy, reliability, and cost-effectiveness, making them accessible for both industrial and municipal applications.

The market for chlorine residual sensors is experiencing significant growth due to the critical role these sensors play in water treatment and distribution systems. Chlorine residual sensors are essential for monitoring and controlling the levels of chlorine in water, ensuring it remains safe for consumption while preventing over or under-chlorination. This need spans across municipal water treatment plants, swimming pools, and various industrial water treatment applications.

End-use Insights

“The demand form wastewater management end use segment is expected to grow at a significant CAGR of 8.7 % from 2024 to 2030 in terms of revenue”

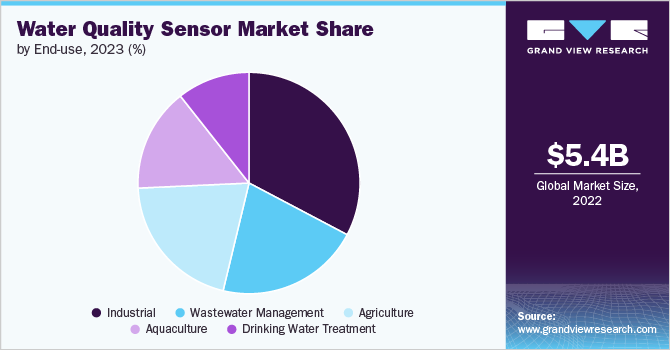

Industrial end-use segment accounted for 32.7% of the global water quality sensor market revenue share in 2023. This segment is witnessing substantial growth, fueled by the pressing need for maintaining stringent water quality standards in various industrial processes. Industries such as pharmaceuticals, chemicals, food and beverage, and semiconductors, where water purity is critical, are increasingly investing in advanced water quality sensors. These sensors are essential for monitoring numerous parameters, including pH levels, dissolved oxygen, turbidity, and specific contaminants, ensuring the water used in processes meets the required standards and regulations.

The wastewater management end-use segment is experiencing significant expansion, driven by the global emphasis on environmental sustainability and the need for effective wastewater treatment solutions. As urbanization and industrial activities surge, so does the volume of wastewater generated, necessitating advanced sensor technologies for monitoring and treating this water before discharge or reuse. Water quality sensors play a crucial role in this process, offering precise and continuous monitoring of various contaminants and parameters such as chemical oxygen demand (COD), biological oxygen demand (BOD), pH, and temperature.

Regional Insights

“China to witness fastest market growth at 9.1% CAGR from 2024 to 2030”

The Asia Pacific region holds a significant share of the global market, primarily due to rapid industrialization, urbanization, and the growing awareness of environmental concerns in densely populated countries such as China and India. This region's vast agricultural activities, coupled with its formidable manufacturing and industrial sectors, generate substantial demand for water quality monitoring to prevent pollution and ensure the safety of water resources. Which will drive the demand for water quality sensors over the forecast period.

The water quality sensor market in China is estimated to grow at a significant CAGR of 9.1% from 2024 to 2030. China's water quality sensor market is experiencing substantial growth, underscored by the country's intensive efforts to tackle water pollution and enhance water resource management. The Chinese government has introduced stringent water quality standards and regulations to protect its water bodies, driving the demand for advanced water quality sensors across various sectors. These sensors are crucial for real-time monitoring and assessment of water quality, aiding in the detection and control of pollutants in diverse applications ranging from municipal wastewater treatment to industrial effluent management.

North America Water Quality Sensor Market Trends

The North America water quality sensor market is significantly driven by stringent regulatory standards, growing environmental concerns, and the need for efficient water management across various sectors. Industries such as oil and gas, pharmaceuticals, food and beverage, and agriculture, along with municipal water treatment facilities, are major contributors to the demand for these sensors. Their need for precise and real-time data to ensure compliance with water quality standards and to optimize water usage efficiently supports the market's expansion in North America.

Europe Water Quality Sensor Market Trends

The water quality sensor market in Europe is experiencing steady growth, largely driven by the region's stringent environmental regulations, high awareness regarding water conservation, and advanced technological landscape. Countries across Europe are increasingly investing in smart water management systems that incorporate advanced sensors for monitoring parameters such as pH, dissolved oxygen, turbidity, and various contaminants. This surge in demand is further supported by the growing need for efficient wastewater treatment processes, and the maintenance of high-quality standards for drinking water.

Key Water Quality Sensor Company Insights

Some of the key players operating in the market include Xylem Inc., Thermo Fisher Scientific Inc., and ABB Ltd. among others.

-

Xylem Inc. is committed to solving critical water and infrastructure challenges through innovation. The company wide range of products and services, including water pumps, treatment systems, and analytics solutions. Xylem offers an array of water quality sensors designed to address diverse needs across various sectors, including municipal, industrial, and environmental monitoring. The company plays a pivotal role in addressing the full cycle of water from collection, distribution, and usage, to the return of water back into the environment, focusing on the areas of water productivity, quality, and resilience.

-

Thermo Fisher Scientific Inc. specializes in manufacturing and distributing analytical instruments, equipment, reagents, consumables, software, and services tailored for research, manufacturing, analysis, discovery, and diagnostics. The company serves a broad spectrum of sectors, such as pharmaceuticals and biotechnology, academia and government, healthcare, and environmental industries.

Atlas Scientific LLC, TriOS Mess- und Datentechnik GmbH, and Eksoy Ltd., are some emerging market players.

-

Atlas Scientific LLC is engaged in the development of high-quality sensors and equipment designed for precision monitoring of pH, dissolved oxygen (DO), oxidation-reduction potential (ORP), electrical conductivity (EC), and various other water quality parameters. Atlas Scientific focuses on delivering innovative solutions that cater to both hobbyists and professional scientists, setting industry standards with its easy-to-integrate sensors and robust software interfaces.

Key Water Quality Sensor Companies:

The following are the leading companies in the water quality sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Hach Company (Danaher Corporation)

- Xylem Inc.

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Endress+Hauser Group

- Atlas Scientific LLC

- TriOS Mess- und Datentechnik GmbH

- OTT Hydromet (Hach Company)

- Libelium Comunicaciones Distribuidas S.L.

- Eksoy Ltd.

- SUEZ Water Technologies & Solutions

- Thames Water Utilities Limited

Recent Developments

-

In January 2024, ABB Ltd. announced its strategic acquisition of Real Tech Inc., a pioneering firm specializing in real-time water quality monitoring technology. This acquisition marks a significant expansion of ABB's portfolio into the burgeoning water quality management sector.

-

In February 2021, Yokogawa Electric Corporation announced the expansion of its water quality monitoring portfolio with the introduction of two innovative chlorine sensor units, FC800D and RC800D, which a reagent-type residual chlorine sensor unit tailored for precise.

Water Quality Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.74 billion |

|

Revenue forecast in 2030 |

USD 9.10 billion |

|

Growth Rate |

CAGR of 8.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Thermo Fisher Scientific Inc.; Hach Company (Danaher Corporation; Xylem Inc.; Honeywell International Inc.; ABB Ltd.; Siemens AG; Endress+Hauser Group; Atlas Scientific LLC; TriOS Mess- und Datentechnik GmbH; OTT Hydromet (Hach Company); Libelium Comunicaciones Distribuidas S.L.; Eksoy Ltd.; SUEZ Water Technologies & Solutions; Thames Water Utilities Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Water Quality Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and analyzes the industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global water quality sensor market based on the type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chlorine Residual Sensor

-

TOC Sensor

-

Turbidity Sensor

-

Conductivity Sensor

-

PH Sensor

-

ORP Sensor

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Agriculture

-

Wastewater Management

-

Drinking Water Treatment

-

Aquaculture

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the water quality sensor market with a revenue share of 46.5% in 2023. The Asia Pacific region holds a significant share in the global water quality sensor market, primarily due to rapid industrialization, urbanization, and the growing awareness of environmental concerns in densely populated countries such as China and India.

b. Some of the key players operating in the water quality sensor market include Thermo Fisher Scientific Inc., Hach Company (Danaher Corporation, Xylem Inc., Honeywell International Inc., ABB Ltd., Siemens AG, Endress+Hauser Group, Atlas Scientific LLC, TriOS Mess- und Datentechnik GmbH, OTT Hydromet (Hach Company), Libelium Comunicaciones Distribuidas S.L., Eksoy Ltd., SUEZ Water Technologies & Solutions, Thames Water Utilities Limited.

b. The water quality sensor market is witnessing robust growth, primarily fueled by the increasing global emphasis on water conservation and the need to monitor and control water pollution. Growing awareness regarding the health impacts of contaminated water and stringent government regulations regarding water quality standards have also significantly contributed.

b. The global water quality sensor market size was estimated at USD 5.42 billion in 2023 and is expected to reach USD 5.74 billion in 2024.

b. The global water quality sensor market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 9.10 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."