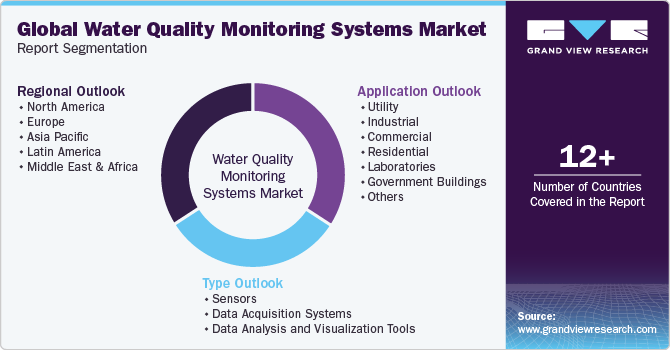

Water Quality Monitoring Systems Market Size, Share & Trends Analysis Report By Type (Sensors, Data Acquisition Systems, Data Analysis & Visualization Tools), By Application (Industrial, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-322-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

The global water quality monitoring systems market size was estimated at USD 5.67 billion in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. Advancements in technology, increased environmental awareness, stricter regulations, climate change, urbanization, and industrialization have all heightened the need for comprehensive water quality monitoring. Improved sensors and remote sensing technologies have upgraded the accuracy and efficiency of monitoring efforts. Simultaneously, the impacts of climate change and increased pollution from urban and industrial activities necessitate continuous and stringent assessments to protect water resources and ensure their sustainable use.

Governments worldwide enforce stricter regulations and standards to protect water resources and public health, which is accelerating the demand for comprehensive water monitoring solutions to monitor and maintain water quality strictly. These regulations mandate regular assessment of various parameters such as pH, dissolved oxygen, turbidity, heavy metals, and microbial contaminants in water bodies. For instance, the World Health Organization (WHO) develops international guidelines on water quality to safeguard public health. Its Guidelines for Drinking-Water Quality (GDWQ) serve as a foundation for setting national regulations and standards globally.

The rising public awareness about environmental issues and the critical importance of clean water further fuels the demand within the water quality monitoring systems industry, compelling industries and governments worldwide to invest more heavily in sustainable water management practices and technologies. Industries, agriculture, and municipalities not only need to comply with regulations but also aim to demonstrate their commitment to sustainable water management practices. This has led to the widespread adoption of advanced water quality monitoring technologies to ensure compliance and maintain public trust.

Type Insights

The sensors segment led the market in 2024, accounting for over 80.0% share of the global revenue. The growth of the segment can be attributed to advances in sensing technology that enable more precise measurements and widen the application portfolio. For instance, multi-parameter sensors allow for simultaneous measurement of various water quality parameters, enhancing efficiency and cost-effectiveness. Similarly, IoT-enabled sensors facilitate integration with smart systems to enable real-time monitoring and data transmission and subsequently improve water management through immediate response and predictive maintenance. As such, the latest sensors are increasingly being deployed in agricultural applications for irrigation monitoring. Municipalities are also adopting advanced sensors for large-scale water system management.

The data acquisition systems segment is predicted to experience significant growth in the coming years. This growth can be attributed to the vital role data analysis and visualization tools play in enabling data-driven decision-making in water quality management. By processing large datasets from multiple sensors and sources, these tools can translate complex data into easily understandable visualizations, such as charts, graphs, and maps, and deliver deeper insights into water quality management. At the same time, integration with IoT platforms and sensor networks can help ensure the timeliness and accuracy of analysis. Advanced analytical capabilities, including predictive modeling and statistical analysis, can aid in proactive decision-making and a deeper understanding of water quality dynamics.

Application Insights

The utility segment accounted for the largest revenue share in 2024. Utilities play a critical role in ensuring compliance with stringent water quality regulations and managing aging infrastructure by adopting advanced monitoring systems. These systems detect contaminants, optimize treatment processes, and provide real-time data to manage water distribution networks effectively, preventing waterborne diseases. For instance, under the Clean Water Act, state, tribal, and federal agencies monitor various water bodies, such as lakes, rivers, and streams, to assess their condition. Local governments, nongovernmental organizations, and volunteers also contribute to these efforts, generating valuable data that helps identify pollution issues and prioritize control measures.

The residential segment is anticipated to grow at the fastest CAGR during the forecast period due to increasing consumer awareness about water contamination and the need for safe drinking water. As concerns about water quality rise, homeowners are seeking solutions to monitor and purify their water supplies. The integration of IoT technologies into residential water monitoring systems enhances their appeal by providing real-time data and alerts, allowing homeowners to take proactive measures to ensure water safety. In addition, advancements in affordable and user-friendly monitoring devices make these systems more accessible to a wider range of consumers.

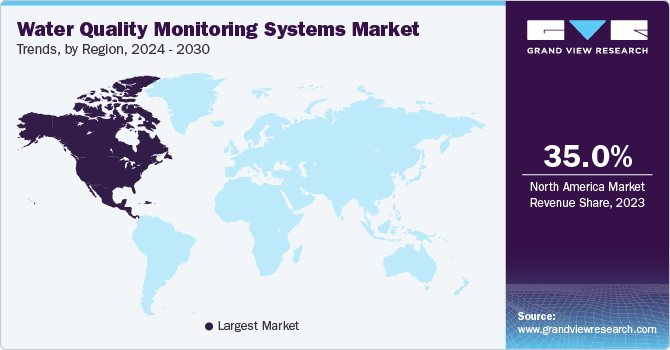

Regional Insights

North America water quality monitoring systems market held the dominant revenue share of over 36.0% in 2024. The North America water quality monitoring systems industry is experiencing significant growth due to stringent regulatory frameworks and the increasing awareness of the importance of water conservation and public health. Government bodies and environmental agencies have implemented rigorous water quality and pollution control standards, necessitating advanced monitoring solutions. The rise in industrial activities, combined with improper waste disposal practices and agricultural runoff, has increased water pollution, further highlighting the need for continuous and effective monitoring.

U.S. Water Quality Monitoring Systems Market Trends

The U.S. water quality monitoring systems market held a dominant revenue share in 2024. Water pollution is a significant concern in the U.S., prompting officials in various states and cities to take measures to ensure the safety of the water supply. These efforts, coupled with technological advancements in water quality testing equipment and systems, have driven the adoption of such technologies. Consequently, the water quality monitoring systems industry is anticipated to experience growth in the coming years. Moreover, the presence of major market players, such as Danaher Corporation, Xylem, and Teledyne Technologies Incorporated, also supports market growth.

Europe Water Quality Monitoring Systems Market Trends

Europe water quality monitoring systems market is expected to witness significant growth over the forecast period. Europe's high per capita income, substantial government funding for environmental services, and water quality monitoring research investments drive market growth. Many European governments have enacted laws ensuring water bodies meet standards for public consumption. Moreover, the increasing public awareness about water pollution, boosted by awareness campaigns, contributes to the region's market expansion. For instance, a new four-year European research project, IBAIA, aims to develop in situ sensors for real-time water quality monitoring. The project, supported by USD 5.1 million from the EU's Horizon Europe Framework Programme, focuses on creating four sensor modules using photonics and electrochemical technologies. These sensors help detect salinity, microplastics, nutrient salts, organic chemicals, and heavy metals.

Asia Pacific Water Quality Monitoring Systems Market Trends

Asia Pacific water quality monitoring systems industry is anticipated to register a CAGR of 9.2% during the forecast period. The region's rapid industrialization, urbanization, and population growth have resulted in a heightened awareness of the importance of maintaining clean water sources. Governments across the Asia Pacific have implemented stringent regulations to safeguard water quality and public health, thereby driving the demand for advanced monitoring systems. Increasing investments in water infrastructure and environmental conservation have also propelled growth within the water quality monitoring systems industry.

China water quality monitoring systems market dominated the region in 2024 due to its large-scale initiatives aimed at tackling water pollution and improving resource management. The country's rapid industrialization and urbanization have led to significant environmental challenges, including water pollution, which necessitates the use of advanced monitoring systems. China's government has implemented strict regulations on water quality, driving the adoption of sophisticated monitoring technologies across industries. In addition, China's focus on smart city development and environmental sustainability has created a favorable environment for the growth of water quality monitoring systems.

Key Water Quality Monitoring Systems Company Insights

Some key companies in the water quality monitoring systems market are General Electric Company, Danaher Corporation, and Xylem. These companies focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/technology development. For instance, in January 2024, ABB acquired Real Tech Inc., a Canadian company specializing in innovative optical sensor technology for real-time water quality monitoring and testing. This acquisition aims to enhance ABB's portfolio in the water segment, leveraging Real Tech Inc.’s optical sensors and AI-powered analytics to improve water management. The move aligns with ABB’s strategy to advance smart water management solutions and expand its environmental technology offerings globally.

Key Water Quality Monitoring Systems Companies:

The following are the leading companies in the water quality monitoring systems market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Danaher Corporation

- Xylem

- Agilent Technologies, Inc.

- Teledyne Technologies Incorporated

- HORIBA, Ltd.

- Emerson Electric Co.

- Siemens

- Evoqua Water Technologies LLC

- Pentair

Recent Developments

-

In February 2024, the Odisha Government's Housing & Urban Development Department (Odisha, India) launched the first state-level Water Quality Assurance Cell (WQAC) to improve urban water supply standards. The initiative focused on ensuring rigorous water quality surveillance and monitoring from intake to consumer taps, with technical support from the public technical university, IIT Madras. The initiative aims to maintain high water quality standards across urban areas in the state of Odisha, supplementing existing infrastructure, including state and regional water testing laboratories and the Drink from Tap Mission.

-

In January 2024, Badger Meter, Inc. acquired select remote water monitoring software and hardware from Trimble Inc., an American software, hardware, and services technology company. These include the Trimble Unity Remote Monitoring software and the Telog brand of Remote Telemetry Units (RTUs). This acquisition aims to enhance Badger Meter's smart water management offerings by providing real-time monitoring solutions for water, wastewater, stormwater, and environmental applications. The integration of these technologies is expected to improve data collection, asset performance, and risk management for the company's customers.

-

In December 2023, Siemens acquired Bunt Planet S.L., a technology-based company, to enhance its AI portfolio in the water sector. Siemens has increasingly focused on integrating AI and digital technologies into various industries, including water management. This acquisition highlights the company’s commitment to further advancements in AI technologies tailored for water-related applications.

Water Quality Monitoring Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.03 billion |

|

Revenue forecast in 2030 |

USD 8.55 billion |

|

Growth rate |

CAGR of 7.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; South Africa; KSA |

|

Key companies profiled |

General Electric Company; Danaher Corporation; Xylem; Agilent Technologies, Inc.; Teledyne Technologies Incorporated; HORIBA, Ltd.; Emerson Electric Co.; Siemens; Evoqua Water Technologies LLC; Pentair |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Water Quality Monitoring Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global water quality monitoring systems market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sensors

-

pH

-

Dissolved Oxygen Sensors

-

Temperature Sensors

-

Turbidity Sensors

-

Total Organic Carbon (TOC) Analyzer

-

Conductivity Sensors

-

Others

-

-

Data Acquisition Systems

-

Data Analysis and Visualization Tools

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Utility

-

Industrial

-

Commercial

-

Residential

-

Laboratories

-

Government Buildings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global water quality monitoring systems market size was estimated at USD 5.67 billion in 2024 and is expected to reach USD 6.03 billion in 2025.

b. The global water quality monitoring systems market is expected to grow at a compound annual growth rate of 7.2 % from 2025 to 2030 to reach USD 8.55 billion by 2030.

b. North America dominated the water quality monitoring systems market with a share of 36.0% in 2024. The North America water quality monitoring systems market is experiencing significant growth, driven by stringent regulatory frameworks and the increasing awareness of the importance of water conservation and public health.

b. Some key players operating in the water quality monitoring systems market include General Electric Company, Danaher Corporation, Xylem, Agilent Technologies, Inc., Teledyne Technologies Incorporated, HORIBA, Ltd., Emerson Electric Co., Siemens, Evoqua Water Technologies LLC, Pentair

b. Key factors that are driving the water quality monitoring systems market growth include stringent environmental regulations, and rapid industrial growth and urbanization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."