Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Application (Municipal, Industrial), By Process By Equipment (Primary Treatment, Secondary Treatment Tertiary Treatment), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-317-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

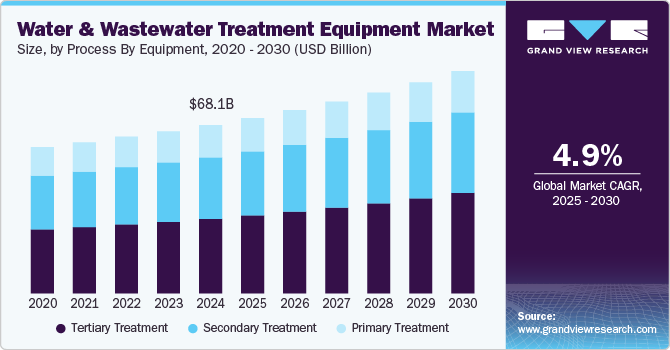

The global water and wastewater treatment equipment market size was estimated at USD 68.12 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. The market growth is driven by factors such as population growth, urbanization, industrialization, and stricter environmental regulations. Rising awareness of environmental pollution, stringent management regulations, and a growing demand for sustainable and efficient wastewater treatment solutions are expected to contribute to the expansion of the water and wastewater treatment equipment industry. The market is further set to grow due to increasing industrialization, population growth, and stricter government regulations on wastewater discharge.

Companies in the water and wastewater treatment equipment industry are forming partnerships with end-users to promote new technologies. Increased investment in research and development to improve technology efficiency is also expected to drive market growth. Small and medium-sized businesses are adopting new water and wastewater treatment technologies, creating opportunities for growth. For instance, in December 2022, LTIMindtree Limited, a consulting and information technology services company, announced a partnership with Yorkshire Water, a water treatment utility and water supply company, to transform its business operations across the latter’s asset management, wastewater, and water segments.

Many opportunities in the water and wastewater treatment equipment market due to technological advancements and the introduction of innovative treatment solutions provide huge potential for market players to implement such solutions to gain a competitive advantage. The market is witnessing growth in the adoption of membrane filtration and ultraviolet disinfection technologies because of their high efficacy in treating water and wastewater.

Market Concentration & Characteristics

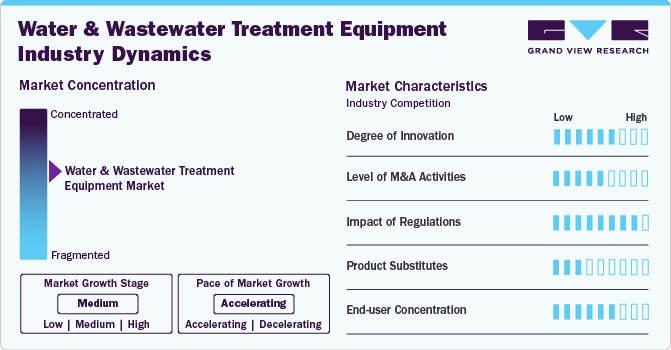

The market for water and wastewater treatment equipment is characterized by moderate industry concentration, with a mix of established players and emerging companies. Leading global players typically dominate the market, offering a wide range of products and solutions to address different needs across industrial, municipal, and commercial sectors. These key companies have strong research and development capabilities, allowing them to innovate and provide advanced, efficient treatment technologies. Despite the market dominance of these major players, there is still room for smaller players and regional companies to grow, especially in developing regions where there is increasing demand for water treatment solutions.

The market features a variety of equipment types, ranging from basic filtration units to complex systems like membrane filtration, reverse osmosis, activated sludge treatment, and biological treatment systems. Each type of technology caters to different customer needs, such as water purification, wastewater treatment, or reuse of treated water. The market's diverse range of solutions is driven by the increasing complexity of water pollution and wastewater disposal issues, which require tailored treatment methods to ensure compliance with stringent environmental regulations and standards.

A notable characteristic of this industry is its reliance on technological advancements. The increasing demand for more sustainable and efficient treatment processes has spurred the development of cutting-edge technologies such as membrane bioreactors, UV disinfection, and advanced filtration systems. These innovations are being driven by the need to improve water quality, reduce the environmental impact of wastewater disposal, and meet regulatory requirements. As a result, companies in the market are continuously investing in research and development to stay competitive and meet the evolving needs of the market.

The water and wastewater treatment equipment market is heavily influenced by government regulations and environmental policies. Stringent regulations regarding wastewater discharge and water quality standards drive the demand for advanced treatment technologies. Governments across the globe are implementing regulations that encourage the adoption of eco-friendly and efficient solutions, further driving market growth. As urbanization and industrialization continue to increase, the demand for effective water and wastewater treatment solutions is expected to rise, making this sector essential for sustainable development and environmental protection.

Drivers, Opportunities & Restraints

The water and wastewater treatment equipment market is primarily driven by increasing industrialization, population growth, and stringent environmental regulations. As urbanization accelerates, the demand for clean water and efficient wastewater management solutions intensifies, particularly in rapidly growing cities. Governments are imposing stricter regulations on wastewater discharge and water quality, which is pushing industries and municipalities to adopt advanced treatment technologies. Additionally, growing environmental awareness and the need for sustainable water use further fuel the market's expansion.

A key restraint for the market is the high initial investment and operational costs associated with advanced treatment technologies. Many small and medium-sized enterprises (SMEs), as well as municipalities in developing regions, face challenges in affording the installation and maintenance of sophisticated equipment. Additionally, the complexity of these systems can require specialized labor for operation and upkeep, adding to overall costs. These financial barriers may limit widespread adoption, particularly in cost-sensitive markets.

There are significant opportunities in the market driven by technological advancements and the rising demand for sustainable water solutions. Emerging technologies such as membrane filtration, nanotechnology, and AI-based water treatment systems offer potential for improving efficiency and reducing costs. The growing trend of water reuse and recycling also opens new market avenues, particularly in water-scarce regions where demand for innovative wastewater treatment solutions is high. Furthermore, the global push for sustainability and stricter environmental policies presents a long-term opportunity for companies offering eco-friendly and energy-efficient water treatment solutions.

Application Insights

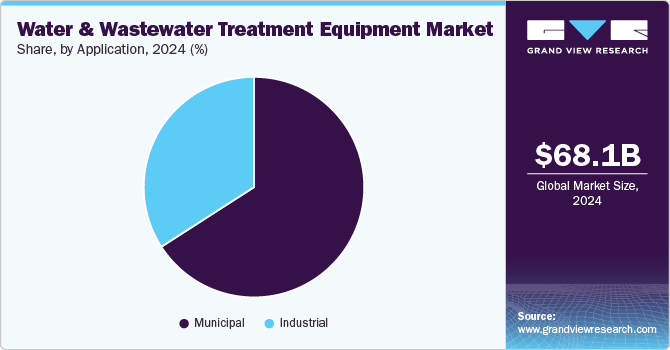

The municipal application segment accounted for a revenue share of 65.9% in 2024. In the municipal sector, water and wastewater treatment equipment plays a crucial role in providing clean drinking water and ensuring proper wastewater management for urban populations. Municipalities rely on these systems to meet regulatory standards for water quality and wastewater discharge, safeguarding public health and the environment. With increasing urbanization and population growth, municipalities are adopting advanced treatment technologies such as membrane filtration, UV disinfection, and biological treatment to address water scarcity, reduce pollution, and promote water reuse. Additionally, aging infrastructure in many cities presents opportunities for upgrading and modernizing municipal treatment systems to enhance efficiency and sustainability.

In industrial applications, water and wastewater treatment equipment is essential for managing the large volumes of water used in various processes such as manufacturing, cooling, and cleaning. Industries such as pharmaceuticals, food and beverage, textiles, and chemicals require tailored treatment systems to ensure that their wastewater meets environmental standards before being discharged or reused. Advanced treatment technologies, including reverse osmosis, ion exchange, and chemical precipitation, help remove contaminants from industrial wastewater, reducing environmental impact and ensuring compliance with regulations. With industries facing increasing pressure to reduce their water footprint and adopt more sustainable practices, the demand for efficient and cost-effective treatment solutions continues to grow.

Process By Equipment Insights

The tertiary treatment segment dominated the market with a revenue share of 44.3% in 2024. Tertiary treatment is the final stage in water and wastewater treatment, aimed at polishing the treated water to meet stringent quality standards before discharge or reuse. This stage often involves advanced filtration, chemical treatment, or disinfection methods, such as UV treatment or membrane filtration, to remove remaining contaminants like pathogens, heavy metals, or nutrients that were not removed during earlier stages. Tertiary treatment is increasingly important as regulations on water quality become more stringent, and the demand for water reuse, especially in industrial and municipal sectors, continues to rise. It helps ensure that water is safe for various purposes, including irrigation, industrial processes, or even potable reuse.

The secondary treatment is the biological phase of water and wastewater treatment, where the focus is on removing dissolved organic matter and suspended solids through microbial action. In this stage, activated sludge processes or trickling filters are commonly used, where microorganisms break down organic pollutants in the wastewater. Secondary treatment is a crucial step for reducing biochemical oxygen demand (BOD) and suspended solids, helping to ensure that the water meets basic quality standards for discharge into natural bodies of water. This treatment stage is essential for municipal and industrial wastewater management, as it plays a major role in reducing the environmental impact of wastewater before further refinement in tertiary treatment.

Regional Insights

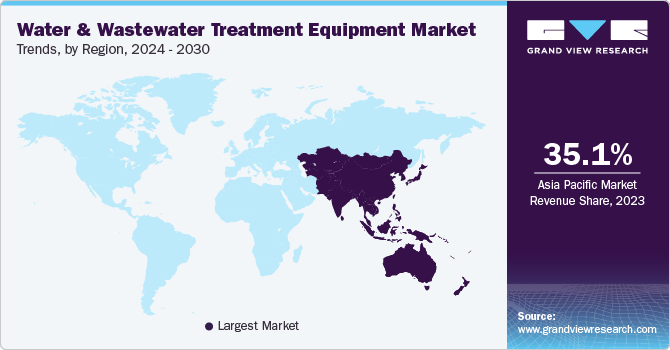

Asia Pacific water and wastewater treatment equipment market dominated the market and accounted for 35.6% of the global share in 2024. The region is witnessing rapid growth due to rapid industrialization, urbanization, and population growth. Countries like China, India, and Japan are heavily investing in water treatment infrastructure to meet the growing demand for clean water and address the challenges posed by water pollution. Stricter government regulations and increased awareness of water scarcity and environmental impact are driving the adoption of advanced treatment technologies such as membrane filtration, reverse osmosis, and biological treatment.

China water and wastewater treatment equipment market held 37.5% share in the Asia Pacific market. In China, the market is expanding rapidly as the country deals with severe water pollution, population growth, and increasing industrial demands. The Chinese government has implemented stringent regulations to improve water quality and manage wastewater effectively, which is driving the demand for advanced treatment technologies.

The water and wastewater treatment equipment market in the India is expected to grow at a CAGR of 5.9% from 2025 to 2030. India's market for water and wastewater treatment equipment is experiencing significant growth due to urbanization, industrialization, and increasing concerns about water pollution and availability.

North America Water And Wastewater Treatment Equipment Market Trends

The water and wastewater treatment equipment industry in North America is experiencing significant growth driven by the increasing emphasis on sustainability, regulatory compliance, and aging infrastructure. The U.S. and Canada are investing heavily in upgrading and replacing outdated water treatment systems to meet stringent water quality standards and improve resilience against climate change.

U.S. Water And Wastewater Treatment Equipment Market

The water and wastewater treatment equipment industry in the U.S. is expected to grow at a CAGR of 3.2% from 2025 to 2030. In the U.S., the market is growing due to rising concerns about water quality, pollution, and infrastructure challenges. The country is focusing on modernizing aging water systems, especially in urban areas. The adoption of technologies like membrane filtration, reverse osmosis, and UV disinfection is on the rise to ensure safe drinking water and treat wastewater efficiently.

The water and wastewater treatment equipment market in Canada is expected to grow at a CAGR of 3.8% from 2025 to 2030. Canada's market is expanding as the country faces increasing pressure to manage its water resources sustainably. With its vast natural resources, Canada is focusing on ensuring the protection of freshwater ecosystems while addressing wastewater treatment needs in both urban and remote communities.

Europe Water And Wastewater Treatment Equipment Market Trends

Europe’s water and wastewater treatment equipment industry is being driven by stringent environmental regulations, the push for sustainability, and the growing need for efficient water management solutions. The EU’s commitment to reducing water pollution and improving water quality has led to increased investments in wastewater treatment infrastructure and the adoption of advanced technologies.

The Germany water and wastewater treatment equipment market held 17.4% share in Europe. Germany's market is one of the most advanced in Europe, driven by the country’s strong regulatory framework and commitment to sustainability. The German market is focusing on improving water quality and wastewater treatment processes, particularly in industrial applications and municipalities. Germany's emphasis on reducing pollutants and advancing technologies, such as membrane filtration and energy-efficient treatment systems, is boosting the adoption of innovative water treatment solutions.

The water and wastewater treatment equipment market in France is expanding, fueled by stringent environmental regulations, particularly those related to nutrient removal and the treatment of wastewater from agriculture and industry, are encouraging the adoption of advanced treatment technologies. The market is also being influenced by the country’s commitment to achieving net-zero carbon emissions, leading to an increased demand for energy-efficient water treatment solutions.

Middle East & Africa Water And Wastewater Treatment Equipment Market Trends

The Middle East and Africa region is experiencing growth in the water and wastewater treatment equipment industry due to water scarcity, rapid urbanization, and industrialization. Countries like Saudi Arabia, the UAE, and South Africa are investing heavily in water treatment technologies to address the lack of freshwater resources and improve wastewater management. In the Middle East, desalination technologies are particularly important, with Saudi Arabia and the UAE leading the way in large-scale desalination plants.

The Saudi Arabia water and wastewater treatment equipment market is growing rapidly due to the country’s limited natural freshwater resources and a strong focus on desalination and wastewater recycling. The government is investing heavily in infrastructure projects to expand water treatment capacity, particularly in urban areas and industrial zones. Desalination is a key focus, with Saudi Arabia being one of the world leaders in this technology.

Latin America Water And Wastewater Treatment Equipment Market Trends

The water and wastewater treatment equipment industry in Latin America is expanding as the region faces challenges related to water pollution, scarcity, and rapid urban growth. Countries like Brazil, Mexico, and Argentina are investing in infrastructure improvements to ensure better water quality and wastewater management. In Brazil, the demand for treatment equipment is particularly high due to the need for sustainable solutions in both urban and rural areas. Government initiatives, such as the National Sanitation Plan in Brazil, are driving investments in water treatment infrastructure, while the growing focus on water reuse and wastewater recycling is contributing to market growth across the region.

The Brazil water and wastewater treatment equipment market is growing as the country faces significant water management challenges, including pollution and regional disparities in water availability. The Brazilian government is investing in modernizing and expanding water treatment infrastructure to ensure universal access to clean water and improve wastewater management. The growing emphasis on environmental protection, particularly in the Amazon rainforest, is driving the demand for eco-friendly and efficient treatment solutions.

Key Water And Wastewater Treatment Equipment Company Insights

Some of the key players operating in the market include Xylem Inc.; Pentair plc; and Ecolab Inc.

-

Xylem, Inc was established in 2011 and is headquartered in Washington, U.S. Xylem, Inc. is a leading global water technology company, engaged in the manufacture, designing and service of products that primarily cater to water sector as well as electric and gas sector. Water infrastructure business segment focuses on applications related to the transport and treatment of water. The primary customers of this segment belong to utility and industrial end-use markets. Major products in this segment include disinfection, filtration, and mobile dewatering equipment, biological treatment equipment and water & wastewater pumps. Primary brands in water infrastructure segment including Flygt, Goodwin, Wedeco, Leopold, and Sanitair.

-

Pentair plc. operates through three business segments, namely Aquatic systems, Filtration solutions, and Flow Technologies. Aquatic systems business segment focused on manufacturing residential and commercial pool equipment and accessories including filters, pumps, heaters, light, automatic cleaners, and automatic controls. Pentair, Sta-Rite, and Kreepy Krauly are the key brands under this segment.

Key Water And Wastewater Treatment Equipment Companies:

The following are the leading companies in the water and wastewater treatment equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Xylem, Inc.

- Pentair plc.

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Ecolab Inc.

- DuPont

- Calgon Carbon Corporation

- Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

- Veolia Group

- Ecologix Environmental Systems, LLC

- Evonik Industries AG

- Parkson Corporation

- Lenntech B.V.

- Samco Technologies, Inc.

- Koch Membrane Systems, Inc

- General Electric

- Ovivo

View a comprehensive list of companies in the Water And Wastewater Treatment Equipment Market

Recent Developments

-

In April 2024, Thermax has launched a state-of-the-art manufacturing facility in Pune, focused on producing advanced water and wastewater treatment solutions. This milestone highlights Thermax’s dedication to resource conservation and long-term sustainability. Covering two acres, the facility reflects the company’s commitment to engineering excellence, driven by innovation, quality, and customer-centricity. Additionally, the facility will showcase Thermax’s latest technologies, such as softener and filter vessels, tubular membrane modules, and capacitive deionization solutions.

-

In May 2023, Xylem Inc. acquired Evoqua. Evoqua provides water treatment solutions for various end-use industries, such as food and beverage, power generation, life sciences, and microelectronics. With this initiative, the company will expand its presence in the European and North American markets.

Water And Wastewater Treatment Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 71.01 billion |

|

Revenue forecast in 2030 |

USD 90.02 billion |

|

Growth rate |

CAGR of 4.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, process by equipment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Norway; Finland; China; India; Japan; Australia; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Egypt |

|

Key companies profiled |

Xylem, Inc.; Pentair plc.; Evoqua Water Technologies LLC; Aquatech International LLC; Ecolab Inc.; DuPont; Calgon Carbon Corporation; Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION); Veolia Group; Ecologix Environmental Systems, LLC; Evonik Industries AG; Parkson Corporation; Lenntech B.V.; Samco Technologies, Inc.; Koch Membrane Systems, Inc; General Electric; Ovivo |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Water And Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global water and wastewater treatment equipment market report based on application, process by equipment, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Process by Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary treatment

-

Primary Clarifier

-

Sludge Removal

-

Grit Removal

-

Pre-Treatment

-

Others

-

-

Secondary treatment

-

Activated Sludge

-

Sludge Treatment

-

Others

-

-

Tertiary treatment

-

Tertiary Clarifier

-

Filters

-

Chlorination Systems

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global water and wastewater treatment equipment market size was estimated at USD 68.12 billion in 2024 and is expected to reach USD 71.01 billion in 2025.

b. The water and wastewater treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 and reach USD 90.02 billion by 2030.

b. Asia Pacific dominated the Water and wastewater treatment equipment market with a revenue share of 35.6% in 2024. The region has a large population that requires access to clean and safe water, which has led to a high demand for water treatment equipment.

b. Some of the key players operating in the water and wastewater treatment equipment market include Veolia Group, Ecolab Inc., Evoqua Water Technologies LLC, Pentair plc, Toshiba Water Solutions Private Limited, Xylem, Inc.

b. The key factors that are driving the water and wastewater treatment equipment market include the growing population, increasing water scarcity, rising industrialization, and government regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."