- Home

- »

- Pharmaceuticals

- »

-

Washington Legal Cannabis Market, Industry Report, 2030GVR Report cover

![Washington Legal Cannabis Market Size, Share & Trends Report]()

Washington Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Hemp, Marijuana), By Derivatives (CBD, THC), By Cultivation, By End-use (Industrial Use, Medical Use), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

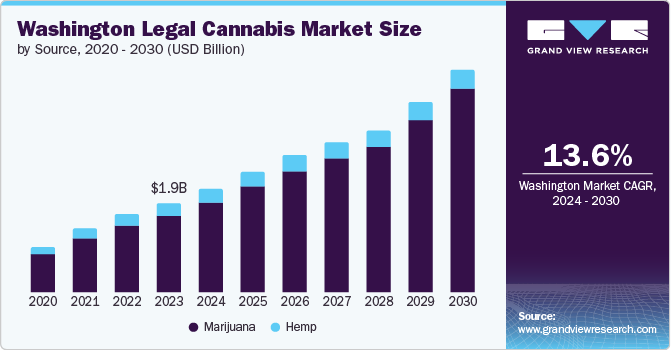

The Washington legal cannabis market size was estimated at USD 1.86 billion in 2023 and is expected to grow at a CAGR of 13.6% from 2024 to 2030. The growing demand for effective pain management therapies and the rising burden of chronic pain are boosting the market growth. Moreover, rising awareness and legalization of cannabis consumption are expected to accelerate the demand for cannabis in Washington over the forecast period. For instance, in December 2012, Washington legalized the sale, purchase, and use of cannabis for individuals aged 21 and over for recreational purposes.

Cannabis is effective in alleviating chronic pain and nausea associated with chemotherapy treatments. Moreover, the ongoing increase in the acceptance and legalization of medical cannabis products has led to market growth. For instance, the Food and Drug Administration (FDA) has approved the use of cannabis-derived drug products, such as Epidiolex, for treating seizures and chemotherapy-induced side effects.

Moreover, Washington lawmakers are making another run at legalizing homegrown marijuana. In January 2024, a House Committee advanced legislation permitting a person 21 years or older to legally grow up to four plants with a maximum of 10 per household. House Bill 2194, approved by the House Regulated Substances and Gaming Committee, modified the national legislation with growing limits of six cannabis plants for an individual and 15 per household with multiple adult residents.

Furthermore, growing acceptance and positive attitude of consumers towards the consumption of cannabis and cannabinoid (CBD)-based products resulted in increased penetration of cannabis. For instance, according to the Washington State Department of Health, in 2021, around 58% of adults surveyed in Washington expressed they had used cannabis at least once in their lifetime.

The rising number of companies entering the local markets to serve the increasing demand for cannabis, the launch of new products, and favorable government initiatives support the market growth. For instance, in September 2023, Jones Soda Co., a Seattle-based company, declared its crossover cannabis brand Mary Jones, now available at Washington state dispensaries.

The adoption of cannabis is anticipated to increase further with the growing number of medical and adult-use patients & customers. Furthermore, with the legalization of marijuana for adult use, a shift is anticipated in patient preference for marijuana from medical to recreational purposes due to low cost and easy access to marijuana after legalization in the state. Through these legalizations, the government can focus on gaining substantial revenue from taxes levied on cannabis products. For instance, in the fiscal year 2023, Washington state collected USD 468.5 million in legal marijuana income and license fees. The state imposed a 37% excise tax on the sale of recreational marijuana.

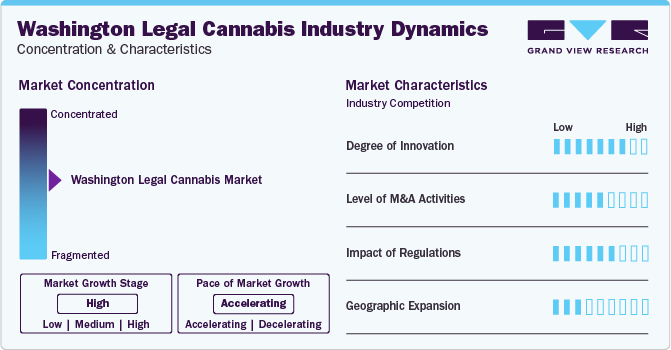

Market Concentration & Characteristics

The Washington legal cannabis market is characterized by a high degree of innovation owing to the growing demand for cannabis-infused products and increasing awareness among people regarding the medicinal benefits of cannabis, growing R&D activities on the use of cannabis and its medicinal properties. For instance, in May 2022 the Washington State University Center for Cannabis Policy, Research, and Outreach and The University of Washington Center for Cannabis Research implemented a Cannabis Research Framework (CRF). This initiative was targeted in uniting the industry experts studying cannabis to draw analysis on the research report provided to the Washington State Legislature.

The Washington legal cannabis is characterized by a medium level of merger and acquisition (M&A). M&A activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth. For instance, in April 2023, Charlotte's Web, a U.S.-based cannabis company formed a joint venture with AJNA BioSciences PBC, a botanical drug development company, and British American Tobacco PLC. The joint venture is aimed to obtain FDA approval for full spectrum hemp extract botanical drug.

The cannabis industry in Washington is thriving owing to a structured regulatory framework for the cultivation, consumption, and sale of cannabis. The Washington State Liquor and Cannabis Board (LCB) regulates all cannabis-related licensing, and the Washington State Department of Health regulates medical cannabis.

Many companies are adopting this strategy to strengthen their business and expand their product portfolio. For instance, in October 2022, Canopy Growth Corporation, a Canadian cannabis firm, announced that it was merging its U.S. assets into a newly established holding company to expedite its penetration into the market. The firm announced the formation of Canopy USA to reduce expenses and seize opportunities in the U.S. market, which is expected to exceed USD 50 billion by 2026.

Source Insights

By source, the marijuana segment dominated the market with the highest revenue share of 87.03% in 2023 and is anticipated to witness the fastest CAGR growth over the forecast period. The segment is expected to increase due to rising awareness about its therapeutic applications, such as pain management, appetite enhancement, and eye pressure reduction, further changing consumer behavior toward recreational marijuana and a rise in educational programs regarding its medical use. For instance, in July 2023, Gonzaga University partnered with Green Flower, a cannabis education center, to start 6-month online programs in both Cannabis Compliance and Risk Management and Cannabis Healthcare & Medicine.

The hemp segment held a significant revenue share in 2023. Due to the legalization of hemp and the growing awareness of the levels of CBD present in it, there has been a rise in demand for hemp extracts across various industries, such as foods & beverages, personal care, cosmetics, pharmaceuticals, nutraceuticals, textiles, and non-textiles. For instance, in February 2022, PepsiCo, a food and beverage company, introduced a beverage infused with hemp seed under its Rockstar Energy brand.

Derivatives Insights

CBD dominated the market with the largest revenue share of 64.69% in 2023. CBD is usually used for addressing pain management or analgesia, anxiety problems, mental problems, and sleep disorders. These problems are quite common, and the utilization of products or supplements infused with CBD has been increased to resolve these issues. Furthermore, many similar studies have provided supportive evidence for the benefits of health conditions. For instance, in December 2022, President Biden signed a bill (Cannabis Research Bill) known as the Medical Marijuana and Cannabidiol Research Expansion Act, H.R. 8454, which cleared the way for cannabis research activities.

The others segment held a considerable market share in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This segment includes components of the cannabis plant, such as flavonoids, terpenes, and other minor cannabinoids (CBG, CBN, THCV). Various advantages offered by these minor cannabinoids and terpenes in treating various medical conditions and introducing new products are propelling the market growth. For instance, in December 2023, Rare Cannabinoid Company, a Cannabis company, launched THC + THCV Uplift Gummies. They combine Delta-9-THC with the energizing, appetite-controlling effects of THCV.

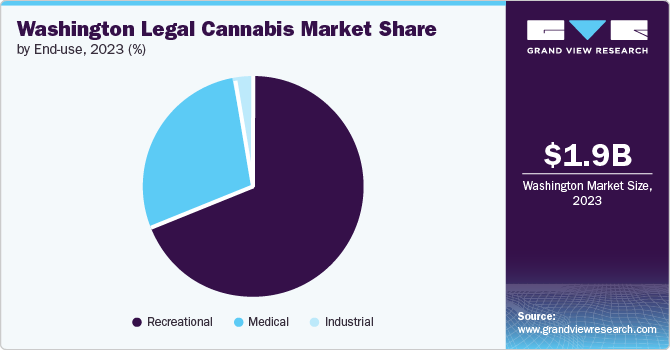

End-use Insights

The recreational use segment dominated the market in 2023 with a revenue share of 68.57% and is expected to grow at the fastest CAGR over the forecast period. This segment mainly includes using cannabis for smoking and consuming it in the form of foods & beverages. The rise in the launch of new cannabis-based food products and the legalization of cannabis for recreational purposes boost the segment growth. For instance, in February 2024, The Cannabist Company Holdings Inc., a U.S.-based manufacturer and retailer of cannabis products, introduced a dual-action cannabis gummy product under its Hedy brand. The launch includes two flavor combinations such as blueberry lemonade and pomegranate melon.

The medical use segment is anticipated to grow significantly over the forecast period. The application of cannabis for medical use is increasing as the demand for cannabis and cannabis-based products is increasing. However, government authorities strictly regulate medical cannabis distribution, and therefore, suppliers must maintain the required quality of products. In addition, the medical application of cannabis has witnessed major growth as the number of scientific studies supporting its benefits in the treatment of various diseases has increased.

Key Washington Legal Cannabis Company Insights

The growing demand for cannabis-infused cosmetics and food items is anticipated to propel the entry of new companies into the market, fueled by rising acceptance and awareness of cannabis for medical purposes. Key market players engage in strategic alliances such as mergers & acquisitions, collaborations, partnerships, and product launches with other industry participants to expand their market presence.

Key Washington Legal Cannabis Companies:

- NORTHWEST CANNABIS SOLUTIONS

- The Hollingsworth Cannabis Company, LLC

- Alkaloid Cannabis Company

- Herbs House

- Nirvana Cannabis

- Edgemont Group (Leafwerx)

- OLYMPIA WEED COMPANY

- Canna West Seattle

- Grow Op Farms (Phat Panda)

- Forbidden Farms, LLC

Recent Developments

-

In April 2023, Charlotte's Web, a U.S.-based company, formed a joint venture with AJNA BioSciences PBC, a botanical drug development company, and British American Tobacco PLC. The joint venture aimed to obtain FDA approval for full spectrum hemp extract botanical drug.

-

In March 2023, CV Sciences, Inc. introduced its new offering, +PlusCBD Daily Balance THC-Free Softgels and Gummies. The product is an on-the-go supplement for daily use that provides CBD wellness benefits.

Washington Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.16 billion

Revenue forecast in 2030

USD 4.64 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, end-use, cultivation

State scope

Washington

Key companies profiled

NORTHWEST CANNABIS SOLUTIONS; The Hollingsworth Cannabis Company, LLC; Alkaloid Cannabis Company; Herbs House, Nirvana Cannabis; Edgemont Group (Leafwerx); OLYMPIA WEED COMPANY; Canna West Seattle; Grow Op Farms (Phat Panda); Forbidden Farms, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Washington Legal Cannabis Market Report Segmentation

This report forecasts revenue growth and provides at country level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Washington legal cannabis market report based on source, derivatives, cultivation and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp CBD

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post-traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s

-

Diabetes

-

Parkinson's

-

Glaucoma

-

Others

-

-

Recreational Use

-

Frequently Asked Questions About This Report

b. The Washington legal cannabis market size was valued at USD 1.31 billion in 2023 and is expected to reach USD 1.49 billion in 2024.

b. The Washington legal cannabis market is expected to grow at a compound annual growth rate of 14.4% over the forecast period from 2024 to 2030 to reach USD 3.34 billion in 2030.

b. The CBD segment dominated the market with the largest revenue share of 64.7% in 2023. CBD is usually used for addressing pain management or analgesia, anxiety problems, mental problems, and sleep disorders.

b. Some of the key players in the market are NORTHWEST CANNABIS SOLUTIONS, The Hollingsworth Cannabis Company, LLC, Alkaloid Cannabis Company, Herbs House, Nirvana Cannabis, Edgemont Group (Leafwerx), OLYMPIA WEED COMPANY, Canna West Seattle, Grow Op Farms (Phat Panda), Forbidden Farms, LLC

b. The market for marijuana in Washington is expected to increase due to rising awareness about its therapeutic applications, such as pain management, appetite enhancement, and eye pressure reduction, further changing consumer behavior toward recreational marijuana

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."