Warehousing Market Size, Share & Trends Analysis Report By Warehouse Type (General Warehousing, Specialized Warehousing), By End-use (Retail, Food & Beverages), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-338-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Warehousing Market Size & Trends

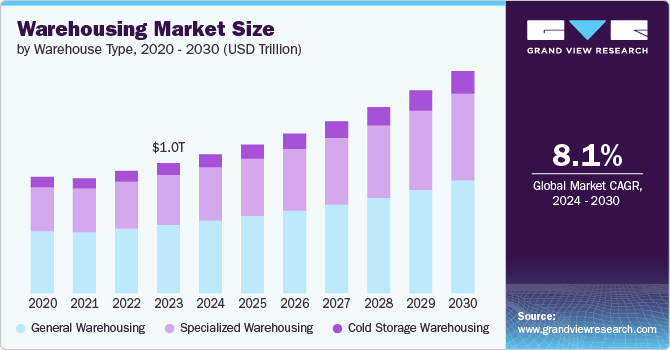

The global warehousing market size was estimated at USD 1.01 trillion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. Various factors, including e-commerce expansion and increasing globalization & supply chain complexity, drive the growth of the market. Moreover, technological advancements in the sector offer significant growth opportunities for the market. Warehousing is a critical component of supply chain management, ensuring that inventory is managed efficiently and is readily available to meet demand. Inventory management, storage, and order fulfillment are some of the key aspects of warehousing.

Warehousing provides essential benefits that enhance operational efficiency, reduce costs, improve customer satisfaction, and support overall business growth. By optimizing storage, inventory management, and distribution processes, warehousing plays a vital role in the modern supply chain. The growing environmental concerns are prompting warehouse operators to adopt green practices. Modern warehouses often incorporate energy-efficient technologies and practices, reducing environmental impact. Moreover, implementing recycling and waste management practices within warehouses promotes sustainability.

E-commerce is driving the growth of the warehousing market by increasing the demand for storage space and accelerating the need for rapid order fulfillment. According to the U.S. Department of Commerce of the International Trade Administration (ITA), global Business-to-Business (B2B) e-commerce will reach a market value of over USD 36 trillion by 2026. E-commerce businesses need to maintain higher inventory levels to ensure product availability and meet rapid order fulfillment demands. This necessitates larger storage spaces. Moreover, consumers expect quick delivery times, sometimes within the same day. Warehouses close to urban centers are essential to meet these expectations.

Innovations in Warehouse Management Systems (WMS), automation, robotics, and the Internet of Things (IoT) have enhanced efficiency and operational capabilities in warehousing. These technologies enable better inventory management, faster order processing, and improved accuracy. Companies are introducing solutions for automated warehouses. For instance, in March 2024, LG Business Solutions USA, a division of South Korea-based LG Electronics, announced the launch of the LG CLOi CarryBot, a family of autonomous mobile robots designed to enhance warehouse efficiency by intelligently navigating complex floor plans and transporting payloads. These robots feature advanced technology, including an AMR platform, intuitive fleet management, and integration with warehouse systems. They offer reliable, on-time movements and reduce physical strain on workers, thus improving productivity and operational efficiency.

Warehouse Type Insights

The general warehousing segment dominated the target market with a share of 52.0% in 2023. The segment's growth can be attributed to the ability of general warehouses to accommodate a wide variety of goods. They are used across various industries and support the storage and distribution of products, materials, and equipment. These warehouses are used to store goods that do not require specific temperatures for storage, such as apparel and other non-perishable products. Consumer goods, such as electronics, furniture, and apparel, are witnessing rapid growth in online sales. According to the U.S. Department of Commerce of the International Trade Administration (ITA), consumer electronics, furniture, and fashion are among the top Business-to-Consumer (B2C) e-commerce categories. This is driving the growth of the general warehouses segment.

The cold storage warehousing segment is expected to register the fastest CAGR over the forecast period. The segment's growth can be attributed to the growing demand for perishable food products, such as fruits, vegetables, and dairy products, which is driving the demand for cold storage warehouses. Moreover, the need to comply with stringent food safety regulations is driving the need for cold storage warehouses. Companies operating cold storage facilities are expanding their presence. For instance, in April 2024, Americold Logistics, Inc. announced the start of construction on a USD 127 million refrigerated storage facility in Missouri, U.S., which is projected to create nearly 190 jobs. This facility will boost cold storage capabilities and support the region's only single-line rail service for refrigerated shippers between Mexico and the U.S. Midwest.

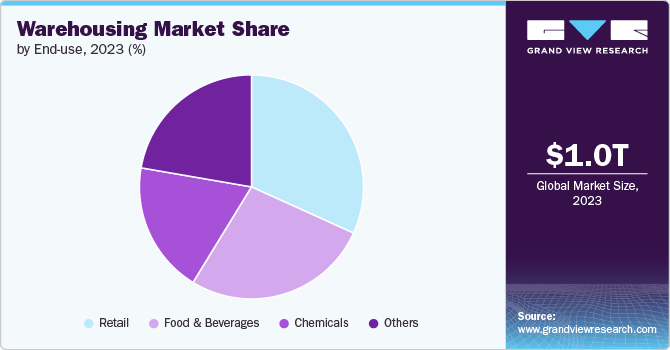

End-use Insights

The retail segment held the largest market share of 31.0% in 2023. The segment’s growth is attributed to the growing adoption of omni-channel retailing and growing consumer expectations for fast delivery. Retailers are increasingly adopting omnichannel strategies, which integrate online and offline sales channels. This approach requires robust warehousing solutions to manage inventory across multiple platforms and ensure seamless customer experiences. The share of online retail sales in overall retail sales is witnessing growth worldwide. According to the Office of National Statistics (ONS) of the UK, the percentage of internet sales in total retail sales in the UK has grown from 17.9% in December 2017 to 27.9% in December 2023.

The food & beverages segment is expected to register the fastest CAGR over the forecast period. The growth of the food & beverages segment is driven by an increasing demand for a diverse range of food and beverage products, driven by population growth, rising incomes, and changing dietary preferences. This necessitates more warehousing space to store these products. Moreover, the need to maintain the quality of perishable food products is driving the demand for temperature-controlled cold storage warehouses.

Regional Insights

North America dominated the market with a market share of 31.0% in 2023. The growth of the market in the region is driven by various key factors, such as the adoption of advanced technologies in warehouses in the region and the developed technological and logistics infrastructure. According to the Government of Canada, in 2023, over 262,000 businesses were operating in the transportation and warehousing sector in Canada.

U.S. Warehousing Market Trends

The market in the U.S. is projected to grow at a CAGR of 6.7% from 2024 to 2030. The growth of the market in the country can be attributed to the growing number of warehouses in the country to meet the growing demand. According to WarehousingAndFulfillment.com, a division of insightQuote.com, the number of warehouses in the country has grown from about 14,600 in 2007 to around 22,000 in 2023. Changes in consumer buying habits, like the preference for fast deliveries, influence the demand for strategically located warehouses.

Europe Warehousing Market Trends

The market in Europe is projected to grow at a CAGR of 7.7% from 2024 to 2030. The market’s growth is driven by government initiatives to boost the supply chain resiliency. Moreover, the expansion of retail chains, supermarkets, and wholesale distributors has increased the need for warehousing space to support their operations and ensure a steady supply of products. For instance, in July 2023, Claire’s (CBI Distributing Corp.), a U.S.-based retailer, announced plans to open 50 stores in the European Union (EU).

Asia Pacific Warehousing Market Trends

Asia Pacific is expected to witness the fastest CAGR of 9.3% from 2024 to 2030. The target market’s growth in the region can be attributed to the e-commerce boom in the region. The rapid expansion of e-commerce in the Asia Pacific region has significantly increased the demand for warehousing space. Moreover, rapid urbanization and population growth in countries like China, India, and Southeast Asian nations have led to increased demand for warehousing facilities to support retail, e-commerce, and industrial activities. According to The World Bank Group, the percentage of urban population in South Asia has grown from 31% in 2010 to 36% in 2023.

Key Warehousing Company Insights

Some of the key companies operating in the market include Deutsche Post AG, GEODIS, A.P. Moller - Maersk, and FedEx, among others.

-

A.P. Moller - Maersk is a Danish integrated shipping and logistics company. The company operates in three business segments, namely, Ocean, Terminals, and Logistics & Services. It offers end-to-end warehousing and distribution services. With its extensive global presence and network, the company offers facilities prepared to manage the supply chain needs, whether at the starting point or the final destination. The company has a presence in 130 countries and has a workforce of more than 110,000 employees.

Lineage, Inc. and NewCold are some of the emerging companies in the target market.

- Lineage, Inc. offers comprehensive warehousing and logistics services across diverse industries. Its facilities specialize in temperature-controlled storage and accommodate a wide range of food commodities, such as beef, pork, poultry, fruits, vegetables, bakery products, ice cream, seafood, and more.

Key Warehousing Companies:

The following are the leading companies in the warehousing market. These companies collectively hold the largest market share and dictate industry trends.

- Deutsche Post AG

- BrightKey, Inc.

- GEODIS

- NIPPON EXPRESS HOLDINGS, INC.

- FedEx

- RXO Inc.

- XPO, Inc.

- Ryder System, Inc.

- Mitsubishi Logistics Corporation

- C.H. Robinson Worldwide, Inc.

- Americold Logistics, Inc.

- Lineage, Inc.

- Kuehne+Nagel

- A.P. Moller - Maersk

- NewCold

Recent Developments

-

In June 2024, A.P. Moller - Maersk unveiled a low-greenhouse gas emission warehouse at Taulov Dry Port in Fredericia, Denmark. This facility marks the company’s forefront initiative in low-emission warehousing, establishing new global standards in line with its ambition to achieve net-zero CO2 emissions company-wide by 2040. It strengthens its logistics capabilities in the Nordics, enhancing the handling of cargo across sea, road, and air networks.

-

In May 2024, Lineage, Inc. expanded its facility in Lębork, Pomorskie, Northern Poland, increasing pallet space capacity by about 30% to over 40,000 pallet spaces. This expansion supports Lineage, Inc.'s commitment to meeting growing demands in Central and Eastern Europe (CEE) following the establishment of a new regional headquarters in Warsaw in November 2023.

Warehousing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.08 trillion |

|

Revenue forecast in 2030 |

USD 1.73 trillion |

|

Growth Rate |

CAGR of 8.1% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Warehouse type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Deutsche Post AG; BrightKey, Inc.; GEODIS; NIPPON EXPRESS HOLDINGS, INC.; FedEx; RXO Inc.; XPO Inc.; Ryder System, Inc.; Mitsubishi Logistics Corporation; C.H. Robinson Worldwide, Inc.; Americold Logistics, Inc.; Lineage, Inc.; Kuehne+Nagel; A.P. Moller - Maersk; NewCold |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehousing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global warehousing market report based on warehouse type, end-use, and region:

-

Warehouse Type Outlook (Revenue, USD Million; 2017 - 2030)

-

General Warehousing

-

Specialized Warehousing

-

Cold Storage Warehousing

-

-

End-use Outlook (Revenue, USD Million; 2017 - 2030)

-

Retail

-

Food & Beverages

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global warehousing market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 1.73 trillion by 2030.

b. North America dominated the warehousing market with a share of over 31.0% in 2023. This is attributable to the developed logistics and technological infrastructure and the presence of numerous market players in the region.

b. The global warehousing market size was estimated at USD 1.01 trillion in 2023 and is expected to reach USD 1.08 trillion in 2024.

b. Some key players operating in the warehousing market include Deutsche Post AG, BrightKey, Inc., GEODIS, NIPPON EXPRESS HOLDINGS, INC., FedEx, RXO Inc., XPO, Inc., Ryder System, Inc., Mitsubishi Logistics Corporation, C.H. Robinson Worldwide, Inc., Americold Logistics, Inc., Lineage, Inc., Kuehne+Nagel, A.P. Moller - Maersk, and NewCold.

b. Key factors driving market growth include the expansion of the e-commerce sector and the adoption of automation in warehouses.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."