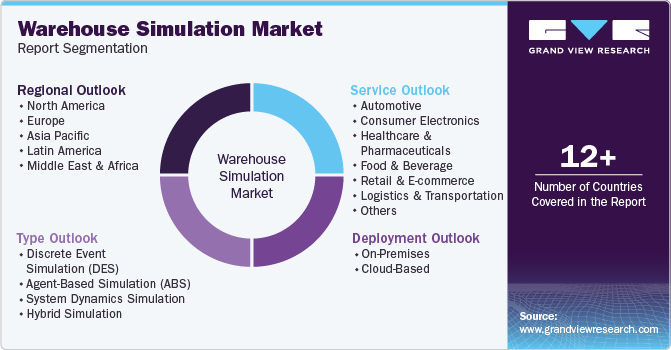

Warehouse Simulation Market Size, Share & Trends Analysis Report By Type, By Industry Vertical (Automotive, Consumer Electronics, Others), By Deployment (On-Premises, Cloud-Based), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-462-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Warehouse Simulation Market Size & Trends

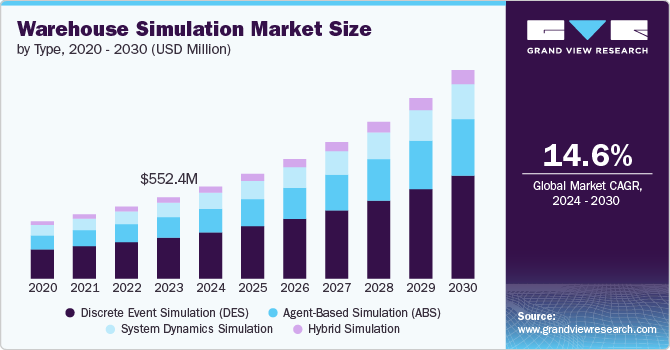

The global warehouse simulation market was valued at USD 552.4 million in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. Warehouse simulation refers to the use of computer models to replicate and analyze the operations within a warehouse environment. This involves simulating various components, including inventory movement, storage systems, labor allocation, equipment utilization, and order picking processes. The primary objective is to identify bottlenecks, evaluate potential improvements, and test new strategies in a risk-free, virtual setting before implementing them in the real world.

These simulations can range from simple 2D representations to highly complex 3D models that provide a comprehensive view of the warehouse operations.

The market for warehouse simulation software encompasses a variety of solutions, from standalone simulation tools to integrated systems that work alongside warehouse management systems (WMS) and enterprise resource planning (ERP) software. Key stakeholders in this market include software vendors, logistics companies, warehouse operators, and end user industries such as retail, manufacturing, and e-commerce, all of whom leverage these tools to enhance their warehousing and distribution capabilities.

The growing adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) in warehouse simulation software is a notable trend propelling market growth. These technologies allow for more accurate predictive analytics and enable simulations to learn and adapt from real-world data, providing more realistic and actionable insights. Moreover, cloud computing offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses of all sizes. Cloud-based simulations can be accessed remotely, allowing for real-time collaboration and integration with other digital tools used across the supply chain. This shift is particularly relevant in the context of the increasing complexity and global nature of supply chains, where real-time data and flexibility are crucial.

The rise of e-commerce and the demand for faster delivery times have also driven interest in warehouse simulation. As companies strive to meet consumer expectations for rapid order fulfillment, the need for efficient warehouse operations has never been greater. Simulation tools help businesses design and test warehouse processes that can handle high volumes of orders quickly and accurately, reducing the likelihood of delays and errors.

The market operates within a regulatory framework that governs software development, data privacy, and industry-specific standards. In terms of software development, vendors must comply with international standards such as ISO/IEC 27001 for information security management and ISO/IEC 12207 for software life cycle processes. These standards ensure that the software is developed and maintained with a high level of security and quality, which is particularly important given the sensitive nature of the data being simulated. Data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, also impact the market. These regulations require companies to protect personal data and ensure that it is used in compliance with legal requirements. For warehouse simulation software that handles large amounts of data, often including customer information and transaction records, adherence to these regulations is crucial.

Globalization, the rise of e-commerce, and the need for rapid delivery have made warehouse operations more intricate and demanding. As companies face challenges such as fluctuating demand, labor shortages, and the need for customization, the ability to simulate and optimize warehouse processes has become essential. Warehousing is a significant cost center for many businesses, encompassing expenses related to space, labor, equipment, and inventory. Simulation tools help companies identify inefficiencies and optimize their operations, leading to significant cost savings. By testing different scenarios virtually, businesses can implement changes that minimize costs without disrupting day-to-day operations. Technological advancements also play a crucial role in driving the market growth. The integration of AI, ML, and the Internet of Things (IoT) into simulation software has enhanced its capabilities, making it more powerful and accessible. These technologies enable more accurate predictions, real-time data analysis, and automation of simulation processes, thereby increasing the value proposition of these tools.

Type Insights

The discrete event simulation (DES) segment dominated the market in 2023, capturing more than 50% of global revenue. This dominance is attributed to DES' effectiveness in modeling the complex and dynamic nature of warehouse operations. DES is particularly well-suited for environments where distinct events, such as the arrival of shipments, order picking, and dispatching, occur at specific points in time. By breaking down operations into individual events, DES allows for a detailed analysis of the interactions between different components of the warehouse system. This granularity provides insights into bottlenecks, resource utilization, and process efficiency, making DES an invaluable tool for optimizing warehouse layouts and workflows. The growing complexity of warehouse operations, driven by factors such as increased e-commerce activity and the demand for faster order fulfillment, has further propelled the adoption of DES. Companies are increasingly relying on this type of simulation to test various scenarios and strategies in a risk-free environment before implementing them in the real world.

The agent-based simulation (ABS) segment is anticipated to grow at the fastest CAGR over the forecast period. ABS is gaining traction due to its ability to model the behavior of individual agents, such as workers, robots, or vehicles, within a warehouse. This type of simulation is particularly effective in environments where autonomous systems or human behavior play a critical role. The rise of automation and robotics in warehousing, coupled with the increasing focus on worker safety and efficiency, is driving the demand for ABS. As warehouses become more automated and complex, ABS provides a robust framework for simulating interactions between human and automated agents, allowing companies to optimize their processes in a more granular and realistic manner. This trend is expected to continue as businesses look for more sophisticated tools to manage their increasingly complex operations.

Deployment Insights

The on-premises segment dominated the market in 2023, reflecting a strong preference among businesses for maintaining direct control over their simulation software and data. On-premises deployment offers several advantages, including enhanced security, greater customization options, and full control over system integration. For large enterprises with the resources to manage and maintain their IT infrastructure, on-premises solutions provide the reliability and performance needed to run complex simulations without depending on external networks. This deployment method is particularly favored by industries where data security is paramount, such as automotive, aerospace, and pharmaceuticals, where companies are often required to comply with stringent regulatory requirements.

The cloud-based segment is projected to expand at the fastest CAGR during the forecast period. The shift towards cloud-based solutions is driven by the need for scalability, flexibility, and cost-efficiency. Cloud-based warehouse simulation tools allow companies to access sophisticated simulation capabilities without the need for significant upfront investments in hardware and software. They also offer the advantage of remote accessibility, enabling teams across different locations to collaborate in real time. This is particularly beneficial for companies with global operations, where coordinating warehouse management across multiple sites is critical. Furthermore, the increasing integration of cloud computing with other advanced technologies, such as artificial intelligence (AI) and machine learning (ML), enhances the value proposition of cloud-based simulation tools. These technologies enable real-time data analysis and predictive modeling, making cloud-based solutions more dynamic and responsive to changing market conditions.

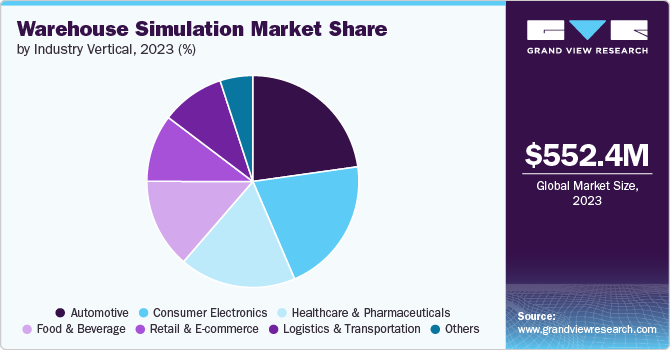

Industry Vertical Insights

The automotive segment dominated the market in 2023, driven by the sector's complex supply chain requirements and the need for precision in logistics operations. The automotive industry relies heavily on just-in-time (JIT) manufacturing, which necessitates highly efficient and synchronized warehouse operations. Warehouse simulation tools are critical in this context, as they help automotive companies optimize inventory levels, reduce lead times, and ensure that parts and components are available exactly when needed. In addition, the trend towards electric vehicles (EVs) and the corresponding shift in supply chains have further increased the complexity of warehouse operations in the automotive sector, making simulation tools indispensable for managing these changes effectively.

The consumer electronics segment is projected to grow at the fastest CAGR during the forecast period. The rapid expansion of the consumer electronics market, driven by increasing demand for smartphones, tablets, and other connected devices, is fueling the need for efficient warehousing solutions. The consumer electronics industry is characterized by fast product cycles, high product variability, and seasonal demand spikes, all of which place significant pressure on warehouse operations. Warehouse simulation tools help companies in this sector optimize space utilization, manage inventory more effectively, and streamline order fulfillment processes to meet consumer expectations for quick delivery. Moreover, the growing trend of omnichannel retailing in the consumer electronics industry, where companies need to manage both online and offline sales channels, is further driving the demand for sophisticated warehouse management solutions. Simulation tools enable companies to model different scenarios, such as peak demand periods or new product launches, allowing them to anticipate and mitigate potential disruptions.

Regional Insights

The warehouse simulation market in North America is expected to witness steady growth from 2024 to 2030. North America, particularly the U.S. and Canada, has long been a leader in adopting advanced technologies to enhance warehouse operations. The region's well-established e-commerce sector, combined with the increasing demand for faster and more efficient order fulfillment, is driving the need for sophisticated warehouse simulation tools. In addition to e-commerce, other industries such as automotive, pharmaceuticals, and retail are also contributing to the growth of the market in North America. Companies in these sectors are increasingly recognizing the value of simulation tools in optimizing warehouse layouts, improving inventory management, and reducing operational costs. Moreover, the region's focus on sustainability and energy efficiency is prompting businesses to adopt simulation solutions that can help minimize their environmental impact.

U.S. Warehouse Simulation Market Trends

The warehouse simulation market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030, driven by the country's leading position in technology adoption and innovation in logistics and supply chain management. The U.S. is home to some of the world's largest and most complex supply chains, with a strong emphasis on efficiency, cost reduction, and customer satisfaction. The rapid growth of e-commerce, coupled with the increasing complexity of omnichannel retailing, has heightened the need for advanced warehouse management solutions, including simulation tools. Furthermore, the U.S. government's investments in infrastructure development and the push for digital transformation across industries are supporting the adoption of warehouse simulation technologies. The rise of automation, robotics, and artificial intelligence (AI) in warehouse operations is also contributing to the demand for simulation software that can model and optimize these advanced systems.

Asia Pacific Warehouse Simulation Market Trends

The Asia Pacific warehouse simulation market dominated globally in 2023 and accounted for a global revenue share of 39.1%. This dominance is largely attributed to the region's rapid industrialization, booming e-commerce sector, and expanding manufacturing base, particularly in countries such as China, Japan, South Korea, and India. The widespread adoption of advanced technologies, such as automation and robotics, in warehouse operations has further propelled the demand for simulation tools in the region. Companies across various industries, including retail, automotive, and consumer electronics, are increasingly leveraging warehouse simulation software to optimize their logistics and supply chain processes, reduce costs, and enhance efficiency. Moreover, government initiatives supporting digitalization and smart manufacturing have also played a pivotal role in driving the adoption of warehouse simulation solutions. Countries in the Asia Pacific region are investing heavily in infrastructure development, including the modernization of logistics and warehousing facilities, to cater to the growing demand for efficient supply chain management.

The warehouse simulation market in South Korea is expected to grow at a significant CAGR from 2024 to 2030, driven by the country's robust manufacturing sector and the increasing adoption of automation technologies. South Korea is home to some of the world's largest electronics and automotive manufacturers, which require highly efficient and optimized warehouse operations to support their production processes. The growing complexity of supply chains, coupled with the need for faster delivery times and just-in-time inventory management, is pushing companies to adopt advanced simulation tools to streamline their warehouse operations. In addition, the South Korean government's focus on Industry 4.0 and smart manufacturing initiatives is encouraging the integration of digital technologies, including warehouse simulation, into the country's industrial landscape. The increasing demand for customized and flexible logistics solutions, driven by the rise of e-commerce and the shift towards online retail,is also contributing to the growth of the warehouse simulation market in South Korea.

Europe Warehouse Simulation Market Trends The warehouse simulation market in Europe is expected to grow at a significant CAGR from 2024 to 2030, driven by the region's strong focus on innovation, sustainability, and efficiency in supply chain operations. Europe has a well-established industrial base, with key sectors such as automotive, manufacturing, and pharmaceuticals playing a crucial role in the region's economy. These industries require highly optimized warehouse operations to support their production and distribution processes, which is fueling the demand for advanced simulation tools. In addition, European companies are increasingly adopting warehouse simulation solutions to comply with stringent regulatory requirements related to safety, traceability, and environmental impact. The European Union's commitment to sustainability and reducing carbon emissions is also prompting businesses to seek out simulation tools that can help them optimize energy usage and minimize waste in their warehouse operations. The growing trend towards digitalization and the adoption of Industry 4.0 technologies across Europe are further driving the demand for warehouse simulation solutions, positioning the region for strong growth in the market over the coming years.

The warehouse simulation market in France is expected to grow at the fastest CAGR from 2024 to 2030. France has a diverse industrial base, with significant contributions from sectors such as automotive, aerospace, and consumer goods, all of which require efficient and optimized warehouse operations. The French government's initiatives to promote digitalization and support the adoption of advanced technologies in manufacturing and logistics are playing a key role in driving the growth of the warehouse simulation market. Moreover, the rise of e-commerce and the increasing demand for faster and more efficient order fulfillment are prompting French companies to invest in warehouse simulation tools to enhance their operational capabilities. The focus on sustainability and reducing the environmental impact of logistics operations is also contributing to the adoption of simulation solutions in France.

Key Warehouse Simulation Company Insights

Some of the key companies operating in the warehouse simulation industry include Siemens, and The AnyLogic Company, among others.

-

Siemens is a global provider of advanced technology solutions in the fields of automation, electrification, and digitalization. The company offers a wide range of products and services, including power generation and transmission systems, drive and automation technologies, and software for medical diagnostics. Siemens specializes in automation systems, process control systems, machine-to-machine communication products, sensors, and radio frequency identification (RFID) systems. It also delivers comprehensive solutions for production and product lifecycle management (PLM) in industrial settings. The company is a leader in simulation technologies, providing software for the simulation and testing of mechatronic systems and industrial processes. Siemens also offers Industrial Internet of Things (IIoT) operating systems and services aimed at supporting a sustainable energy transition. Siemens' portfolio extends to rail automation, intelligent traffic systems, and innovative diagnostic and therapeutic healthcare solutions.

-

The AnyLogic Company is a simulation software provider offering solutions for industries such as supply chains, manufacturing, transportation, warehouse operations, rail logistics, and more. Known for its innovative multimethod modeling, The company enables users to simulate complex systems and processes in a risk-free environment. The software provides valuable insights into dynamic operations by allowing users to create 2D/3D animated models for enhanced visualization. Its industry-specific libraries, such as the Process, Material Handling, and Rail Libraries, streamline simulations for business processes, warehouse operations, and logistics. The company also offers cloud-based simulations, integration with GIS maps, and support for digital twins and AI, making it a comprehensive tool for decision-making, efficiency improvements, and risk management.

FlexSim Software Products, Inc. and Simio LLC are some of the emerging market companies in the target market.

-

FlexSim Software Products, Inc. is a 3D simulation modelling and analysis software company that helps organizations optimize systems and processes. The company's offerings enable users to build dynamic computer models of real-world operations, test "what-if" scenarios, and make data-driven decisions. The company's advanced simulation capabilities go beyond traditional static analysis by accounting for variables such as time, space, and system complexities. The company, through its offering, allows users to gain deeper insight into its systems through enhanced visualization and validation.

Key Warehouse Simulation Companies:

The following are the leading companies in the warehouse simulation market. These companies collectively hold the largest market share and dictate industry trends.

- FlexSim Software Products, Inc.

- Simio LLC

- The AnyLogic Company

- Rockwell Automation

- Siemens

- Dassault Systèmes

- Autodesk Inc

- Lanner

- Manhattan Associates

- Honeywell International Inc

- ProModel Corporation

Recent Developments

-

In May 2024, Siemens introduced Simcenter X, a cloud-based simulation and test solution as part of its Siemens Xcelerator as a Service portfolio. It provides scalable high-performance computing (HPC) for engineers, enabling pay-as-you-go access to advanced simulation capabilities like Simcenter STAR-CCM+. This SaaS model allows companies, including those in warehouse operations, to accelerate simulations, reduce costs, and increase flexibility without requiring upfront investments in hardware or IT expertise.

-

In February 2024, Dassault Systèmes and Clarins Group have partnered to transform Clarins' manufacturing operations with the deployment of Dassault Systèmes' "Perfect Production" solution on the 3DEXPERIENCE platform. This initiative supports Clarins' expansion efforts by enhancing efficiency, streamlining processes, and ensuring high-quality production at both its Paris facility and a new, state-of-the-art plant in Troyes. The solution will facilitate warehouse simulation and management, optimizing inventory synchronization and logistics to support Clarins Group's goal of a paperless, real-time operational environment.

Warehouse Simulation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 625.5 million |

|

Revenue forecast in 2030 |

USD 1,417.6 million |

|

Growth rate |

CAGR of 14.6% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, industry vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, United Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), South Africa |

|

Key companies profiled |

FlexSim Software Products, Inc., Simio LLC, The AnyLogic Company, Rockwell Automation, Siemens, Dassault Systèmes, Autodesk Inc., Lanner, Manhattan Associates, Honeywell International Inc, and ProModel Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehouse Simulation Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global warehouse simulation market report based on type, deployment, industry vertical, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Discrete Event Simulation (DES)

-

Agent-Based Simulation (ABS)

-

System Dynamics Simulation

-

Hybrid Simulation

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premises

-

Cloud-Based

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare and Pharmaceuticals

-

Food and Beverage

-

Retail and E-commerce

-

Logistics and Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global warehouse simulation market size was estimated at USD 552.4 million in 2023 and is expected to reach USD 625.5 million in 2024.

b. The global warehouse simulation market is expected to grow at a compound annual growth rate of 14.6% from 2024 to 2030 to reach USD 1,417.6 million by 2030.

b. Asia Pacific dominated the warehouse simulation market with a share of over 39.1% in 2023. This is attributable to the to the region's rapid industrialization, booming e-commerce sector, and expanding manufacturing base, particularly in countries like China, Japan, South Korea, and India.

b. Some key players operating in the warehouse simulation market include FlexSim Software Products, Inc., Simio LLC, The AnyLogic Company, Rockwell Automation, Siemens, Dassault Systèmes, Autodesk Inc., Lanner, Manhattan Associates, Honeywell International Inc, and ProModel Corporation.

b. Key factors driving market growth include the rising demand for efficient warehouse operations, increasing adoption of automation and robotics, cost reduction and risk mitigation, demand for real-time monitoring and data-driven decisions, and growth of industry 4.0.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."