Warehouse Order Picking Market Size, Share & Trends Analysis Report By Deployment, By Order Picking Method, By Technology (Conveyor Systems, Scanners), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-686-8

- Number of Report Pages: 250

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2025

- Industry: Technology

Warehouse Order Picking Market Trends

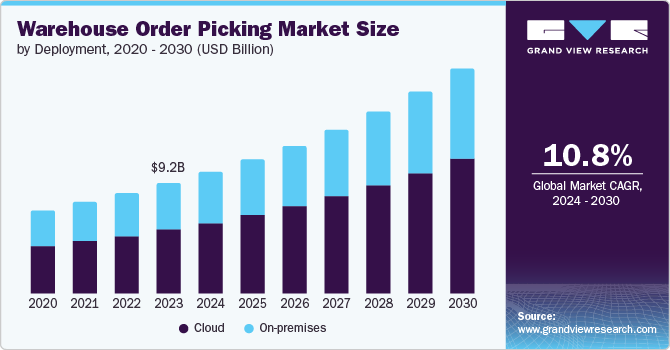

The global warehouse order picking market size was estimated at USD 9.19 billion in 2023 and is expected to grow at a CAGR of 10.8% from 2024 to 2030. The rapid development of the e-commerce industry, which has led to the emergence of order fulfillment centers worldwide, is the key factor driving the market growth. The growing preference among warehouse owners to incorporate automation technologies to reduce the lifting response time and increase order fulfillment productivity is anticipated to boost the deployment of order fulfillment systems. Furthermore, the globalization of supply chain networks is expected to majorly contribute to the increasing adoption of lifting technologies among warehouse operators.

The rapid expansion of the e-commerce sector has led to a surge in the establishment of fulfillment centers worldwide, thereby driving the deployment of advanced order picking systems. Furthermore, the growing utilization of technologies such as RFID and Automatic Identification and Data Capture (AIDC) has significantly improved the efficiency of order fulfillment processes. In response to the rising customer demand for quicker deliveries, warehouse owners are increasingly adopting new technologies to bolster productivity and efficiency, thus fueling the demand for sophisticated order picking systems.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in warehouse order picking has significantly enhanced operational efficiency and productivity. AI algorithms, utilizing real-world performance data, optimize order picking accuracy and reduce travel time within the facility by considering various variables such as work type, area, starting and ending travel locations, and product quantity. ML models have substantially reduced average order picking time by solving storage location assignment problems, leading to increased warehouse throughput and revenue. Automation of warehouse processes powered by AI and ML has improved consistency, accuracy, and profitability, while predictive analytics has revolutionized inventory management and demand forecasting, resulting in enhanced efficiency, reduced costs, and improved customer satisfaction.

The globalization of supply chains has acted as a key driver for the target market. As supply chains have become more globalized, there has been an increased need for efficient and responsive order picking processes within warehouses. The shift in supply chain strategies, rise of domestic supply chains, technological advancements, impact on supply chain management, and challenges in global supply chains have collectively contributed to the rising demand for warehouse order picking services. This demand is fueled by the necessity to effectively manage the flow of goods across diverse and interconnected supply chains, leading to a heightened focus on optimizing order picking operations to meet the demands of a globalized marketplace.

The shortage of skilled labor hinders the adoption of technological advancements in warehouse order picking. Automation and robotics are increasingly being utilized to optimize order picking processes. However, the effective implementation and operation of these technologies often require skilled labor. Skilled workers are essential for understanding, integrating, and maintaining these advanced systems, which can significantly enhance the efficiency and accuracy of order picking. The lack of skilled labor may impede the successful adoption of these technologies, limiting the potential efficiency gains and innovative solutions that could benefit warehouse operations.

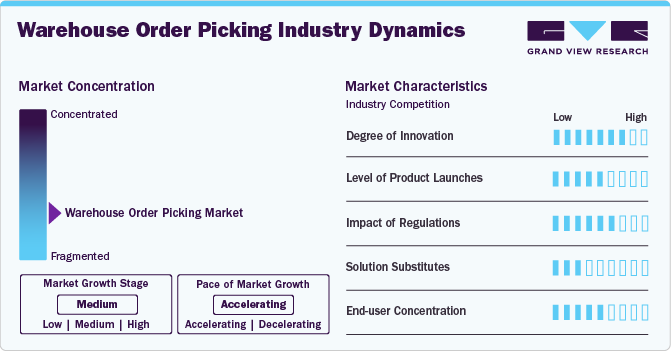

Market Concentration & Characteristics

The degree of innovation in the warehouse order picking market has witnessed remarkable advancements in recent years, largely fueled by the imperative to enhance efficiency, accuracy, and overall performance in distribution centers and supply chains. This rapid evolution has been characterized by the integration of cutting-edge technologies and the exploration of innovative order picking systems. In addition, one of the most significant trends in this space is the integration of machine learning, artificial intelligence, and robotics to bolster the intelligence of robots and streamline order picking processes. Furthermore, technologies such as pick-to-color systems, autonomous mobile robots (AMRs), and automated guided vehicles (AGVs) have gained traction as essential tools for optimizing order picking operations in warehouses.

The level of product launches in the target market can be categorized as medium due to the significant advancements and innovations observed in the industry. This includes the introduction of robotic material handlers, cloud-based software, and rugged touch computers designed to streamline warehouse operations and enhance the customer experience. The surge in product launches reflects a concerted effort by industry players to innovate and enhance the efficiency of warehouse order picking processes, particularly in response to the growing demands of the logistics and e-commerce sectors.

The impact of regulation on the target market can be classified as medium. One of the primary areas affected is worker safety and health. Regulations, such as the Hazardous Products Regulation in Canada, are designed to ensure the well-being of workers. Compliance with these regulations may necessitate specific handling procedures for certain products, impacting the methods and equipment used in the order picking process. This focus on safety and health is essential for protecting warehouse personnel and reducing the risk of workplace injuries. Regulations such as the European Union's Waste Framework Directive and the U.S. Environmental Protection Agency (EPA) guidelines promote sustainable practices in warehouses. This includes reducing energy consumption, minimizing waste, and implementing green logistics initiatives.

The impact of product substitutes on the target market can be classified as low. Manual picking is the primary substitute for automated or semi-automated warehouse order picking systems. Automated and semi-automated picking systems are significantly more efficient than manual picking. They can handle larger volumes of orders more quickly and accurately, reducing the time and labor required for order fulfillment. In addition, automated systems are more scalable than manual picking. As order volumes increase, automation can easily scale up to meet demand without a proportional increase in labor costs or complexity. Moreover, the integration of IoT and wireless connectivity in warehouse order pickings further reduces the viability of substitutes. Overall, the advantages and advancements of warehouse order picking solutions result in a low impact from product substitutes in the market.

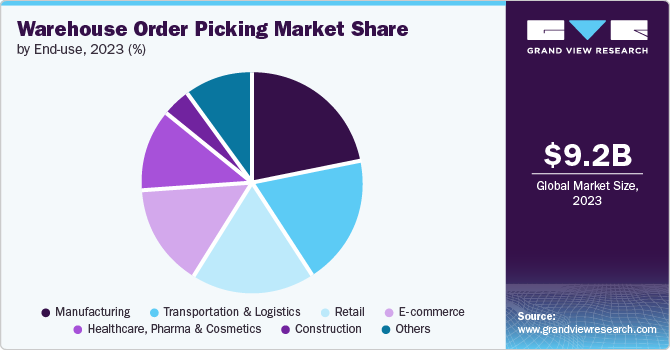

The end-user concentration in the target market can be classified as moderate. This market serves a variety of sectors, including construction, manufacturing, retail, e-commerce, healthcare, pharma & cosmetics, transportation & logistics, and others, resulting in a diverse customer base. This diversity in end use sectors contributes to the complexity and dynamism of the market, as businesses must cater to the specific needs and demands of each sector they serve. The focus on B2B transactions in the target market, driven by derived demand from consumer goods, further emphasizes the importance of understanding and catering to the needs of a diverse end-user base.

Deployment Insights

The cloud segment held the largest market share of 58.0% in 2023 in the warehouse order picking market due to its ability to enhance real-time tracking, reduce errors, facilitate the integration of advanced technologies, and improve overall operational efficiency. The growing use of cloud-based technologies in warehouse operations aligns with the increasing adoption of advanced software solutions in the industry. Cloud deployment offers scalability, flexibility, and accessibility, allowing businesses to adapt to changing demands and integrate advanced technologies more effectively. In addition, cloud-based solutions facilitate the integration of automation technologies, such as RFID and automatic identification and data capture (AIDC), which enhance order fulfillment procedures and contribute to the overall efficiency of warehouse operations.

On-premises registered a significant CAGR of 10.0% in the target market. On-premises solutions are often more cost-effective for small- and medium-sized businesses, which prefer low-budget operations. This contributes to the growth of the on-premises market segment. Moreover, traditional order picking methods such as barcode scanning and paper-based picking are typically operated within the premises, requiring manual labor for inventory handling. This preference for traditional methods also supports the growth of the on-premises segment.

Order Picking Method Insights

The multiple order picking method held the largest market share of 58.6% in 2023. Multiple order picking reduces the time spent traveling in the warehouse since pickers collect items for multiple orders at the same time. This significantly increases productivity, especially in large-scale operations. Moreover, by reducing the time driving between picks, batch picking can help minimize wear and tear on equipment and cut labor costs, resulting in lower operational costs over time. Furthermore, the use of warehouse automation technologies, such as autonomous mobile robots, helps manage large amounts of orders while lowering the chance of errors, further enhancing the effectiveness of the multiple order picking method.

The single order picking method registered a significant CAGR of 10.4% over the forecast period. Single order picking offers adaptability and cost-effectiveness. Its simplicity makes it inexpensive to implement and execute, making it suitable for smaller warehouses with smaller orders and a limited range of SKUs. In addition, multiple warehouse management systems (WMS) support single order picking methods, making it feasible to automate most picking activities, thus ensuring scalability.

Technology Insights

On the basis of technology, the market is classified into automated storage and Retrieval systems (AS/RS), automated guided vehicles/autonomous mobile robots (AGV/AMR), conveyor systems, scanners, and others. The conveyor segment dominated the market with a revenue share of 37.7% in 2023. The rising demand for automation in warehouses to reduce response time and increase order fulfillment productivity has been a significant driver of market growth. This demand for automation aligns with the capabilities of conveyors, which are integral to automated order picking and fulfillment processes, contributing to their dominance in the market.

The automated guided vehicles/autonomous mobile robot (AGV/AMR) segment is anticipated to register the highest CAGR of 12.8% over the forecast period. The growth in e-commerce has been a major driver of the demand for AGVs and AMRs in warehouse automation. With global e-commerce sales growing at a significant CAGR over the last decade and expected to continue growing, there is a heightened need for efficient and flexible automation solutions to handle the increasing volume of orders and the diverse range of products associated with e-commerce operations. In addition, the adaptability and scalability of AGVs and AMRs have made them well-suited for the evolving needs of warehouse operations. These robots can be integrated with other automation technologies and processes, providing a flexible and scalable solution for handling diverse warehouse tasks.

End-use Insights

The manufacturing segment held the highest market share of 21.9% in 2023. The rising concern of the manufacturing industry for cycle time reductions, moving into smaller lot sizes, and point-of-use delivery has significantly contributed to this market's revenue share. This focus on efficiency and productivity aligns with the capabilities of warehouse order picking solutions, making them well-suited for the specific needs of the manufacturing sector.

The e-commerce segment is anticipated to register the highest CAGR of 13.4% over the forecast period. The rapid growth of the e-commerce industry has led to an increase in the number of order fulfillment centers across the globe. This surge in e-commerce has created a heightened demand for efficient and flexible automation solutions to handle the increasing volume of orders and the diverse range of products associated with e-commerce operations. As a result, the increasing trend to adopt new technologies to improve productivity and efficiency among warehouse owners is expected to drive the demand for order picking systems. Furthermore, the emerging foreign trade activities are expected to contribute to the deployment of solutions in the transportation and logistics warehouses where the shipments are stored. Thus, the transportation and logistics segment is anticipated to capture a significant revenue share in the market.

Regional Insights

The warehouse order picking market in North America held a significant market share of 37.6% in 2023. The region has witnessed high adoption of order fulfillment technologies by companies operating majorly in e-commerce, manufacturing, and retail. This high adoption is expected to boost the market share of North America, positioning it as a dominant region in the target market. In addition, the presence of a large number of significant order picking solution providers, including Honeywell International and Bastian Solutions, LLC, has contributed to the market growth in North America.

U.S. Warehouse Order Picking Market Trends

The rising demand for automation in warehouses to reduce response time and increase order fulfillment productivity has been a key factor driving the market growth in the U.S. The U.S. has emerged as one of a leading market for warehouse order picking, with significant revenue share attributed to the adoption of advanced technologies and solutions in the region.

Asia Pacific Warehouse Order Picking Market Trends

The Asia Pacific market is projected to grow at the highest rate, with an estimated CAGR of over 12% over the forecast period. The growth can be attributed to increasing retail and e-commerce sales and rapid digitalization in the industry. Furthermore, the fast-growing logistics industry, manufacturing sector, and favorable policies promoting domestic production in prominent economies such as Japan and India are significant factors influencing the growth of the market in this region.

In 2023, the China warehouse order picking market held the largest share, 29.4%, in the Asia Pacific region. The presence of wide networks of third-party logistics (3PL) companies and large companies with global distribution operations and warehousing in China has played a significant role in propelling the growth of the target market in the region.

Europe Warehouse Order Picking Market Trends

The adoption of automation and robotics in European warehouses is driving the demand for warehouse order picking solutions as companies seek to improve efficiency, reduce labor costs, and enhance customer satisfaction. Automated order-picking systems use robots or machines to pick and pack items, reducing the need for manual labor and improving accuracy. In addition, automation and robotics can reduce errors and improve accuracy in warehouse operations, ensuring that orders are fulfilled correctly and on time.

The integration of advanced technologies, such as voice-directed, augmented reality (AR), and pick-to-light systems has been a notable trend in the UK warehouse order picking market. These technologies aim to enhance warehouse efficiency and streamline the picking process, reflecting a broader industry shift towards automation and advanced operational solutions.

Key Warehouse Order Picking Company Insights

Some of the key companies operating in the warehouse order picking market include Knapp AG and Dematic (KION Group AG), among others.

-

·KNAPP AG is a provider of warehouse logistics solutions. It specializes in delivering intelligent automation solutions tailored for manufacturing and intralogistics applications. With a diverse clientele spanning industries such as fashion, retail, healthcare, and food retail, the company offers customized solutions to companies seeking to optimize their operations. Its extensive product portfolio includes automated picking systems and autonomous mobile robots designed for efficient material handling operations. With a global presence, KNAPP AG has a dedicated workforce operating from 62 locations around the world.

-

Dematic is a global enterprise specializing in intelligent intralogistics and automation solutions, utilizing advanced technology and extensive industry knowledge to optimize supply chains and improve operational efficiency. In June 2016, Dematic was acquired by KION Group AG and operates as a subsidiary company. Dematic's comprehensive range of solutions covers manual and automated processes across all customer supply chain functions. This includes solutions for goods inward, multishuttle warehouse systems, and order picking. The company serves customers across Europe, the Middle East, Africa, North and South America, and Asia.

Bastian Solutions, LLC and TGW Logistics Group are some of the emerging market companies in the target market.

-

Bastian Solutions, LLC is one of the leading providers of warehouse management and order fulfillment solutions. In 2017, Bastian Solutions LLC was acquired by TOYOTA INDUSTRIES CORPORATION. The company offers a range of services and solutions, including automated material handling systems, warehouse management software, and supply chain integration. With offices in several countries, the company has a significant global presence, enabling them to serve clients across different regions and industries.

-

TGW Logistics Group is a provider of automated warehouse solutions. Specializing in tailor-made fulfillment solutions, the company caters to the unique needs of each customer. Its comprehensive range of end-to-end fulfilment solutions enables smooth and efficient material flow throughout customers' distribution centers. With a global presence across 24 locations in North America, Europe, and Asia Pacific, the company serves a diverse range of industries, including industrial and consumer goods, grocery, as well as fashion and apparel.

Key Warehouse Order Picking Companies:

The following are the leading companies in the warehouse order picking market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International

- Körber AG

- Bastian Solutions, LLC

- Knapp AG

- Barcodes, Inc.

- Swisslog Holding AG

- Dematic (KION Group AG)

- TGW Logistics Group

- AB&R (American Barcode and RFID)

- BEUMER GROUP

Recent Developments

-

In February 2024, BEUMER GROUP announced that it had acquired FAM Group, a supplier of conveyor systems and loading technology. This acquisition has allowed the BEUMER GROUP to enhance its expertise in conveying and loading technology, particularly in the field of bulk material transport.

-

In April 2023, Barcodes, Inc. launched its portfolio of automated mobile robots (AMR) to serve various applications, such as warehousing fulfillment and manufacturing. This offering aims to provide businesses with easily implementable intelligent automation that ensures a quick return on investment. In addition, a recent collaboration with SVT Robotics aims to expedite deployment for customers and reduce the intricacies typically associated with automation and robotics implementations.

-

In November 2023, TGW Logistics Group showcased its Future Fulfillment Center, a cutting-edge, highly automated logistics facility providing a glimpse into the future of fulfillment. The advanced center offers valuable insights into operational mechanisms, advantages, and state-of-the-art technology employed.

Warehouse Order Picking Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.12 billion |

|

Revenue forecast in 2030 |

USD 18.70 billion |

|

Growth rate |

CAGR of 10.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, order picking method, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Honeywell International; Körber AG; Bastian Solutions, LLC; Knapp AG; Barcodes, Inc.; Swisslog Holding AG; Dematic (KION Group AG); TGW Logistics Group; AB&R (American Barcode and RFID); BEUMER GROUP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehouse Order Picking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global warehouse order picking market report based on deployment, order picking method, technology, end use, and region.

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Order Picking Method Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Order Picking

-

Multiple Order Picking

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Automated Storage and Retrieval Systems (AS/RS)

-

Automated Guided Vehicles/Autonomous Mobile Robot (AGV/AMR)

-

Conveyor Systems

-

Scanners

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Construction

-

Manufacturing

-

Retail

-

E-commerce

-

Healthcare, Pharma & Cosmetics

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global warehouse order picking market size was valued at USD 9.19 billion in 2023 and is expected to reach USD 10.12 billion in 2024.

b. The global warehouse order picking market is expected to witness a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 18.70 billion by 2030.

b. The cloud segment claimed the largest market share of 58.0% in 2023 in the warehouse order picking market, driven by its scalability, cost efficiency, real-time data access, integration, flexibility, continuous updates, and robust security. Additionally, implementing cloud-based systems can reduce capital expenditure on IT infrastructure and maintenance. The subscription-based model allows warehouses to pay only for what they use.

b. Some key players operating in the warehouse order picking market include Honeywell International, Körber AG, Bastian Solutions, LLC, Knapp AG, Barcodes, Inc., Swisslog Holding AG, Dematic (KION Group AG), TGW Logistics Group, AB&R (American Barcode and RFID), and BEUMER GROUP.

b. Key factors that are driving the market growth include rising demand for automation, the rapid development of the e-commerce industry, growth in the logistics and manufacturing sectors, and the increasing adoption of new technologies to improve productivity and efficiency in warehouses.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."