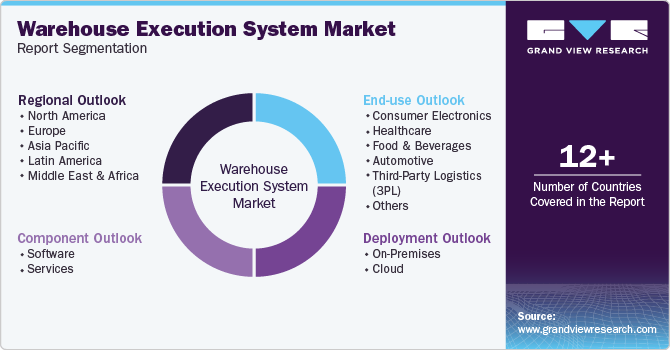

Warehouse Execution System Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-465-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Warehouse Execution System Market Trends

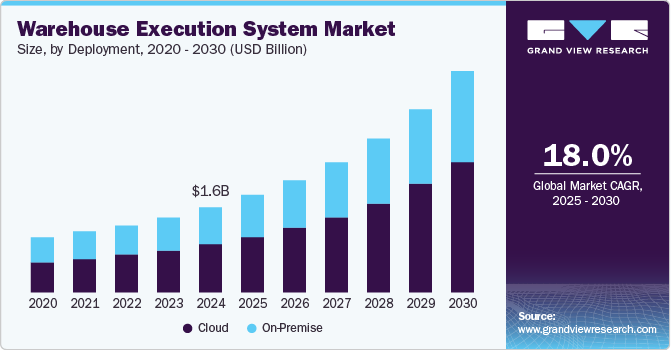

The global warehouse execution system market size was valued at USD 1.64 billion in 2024 and is projected to grow at a CAGR of 18.0% from 2025 to 2030. Unprecedented growth experienced by the e-commerce industry and online grocery shopping, rising inclination towards utilization of online on-demand delivery platforms for multiple products including consumer goods, electronics, homecare & decor, health & wellbeing, textile, kitchenware, home appliances, and others, and growing adoption of modern technologies in retail & warehousing businesses are contributing to the growth of this market.

An increase in order volumes and velocity is the primary reason for the increasing adoption of the warehouse execution system (WES). The enhancements in processing and operational workflow enabled by the WES ensure improved efficiency and effectivity in warehouses and distribution centers. This technology adoption minimizes the possibility of errors, reduces risks and losses and empowers businesses with quality assurance.

Warehouse execution system is a hybrid software system having capabilities of Warehouse Control System (WCS) and Warehouse Management System (WMS) and is an ideal solution for organizations having large order volumes and high throughput needs. It helps to coordinate equipment and labor through dynamic optimization, which helps facility owners manage resources and optimize facility operations. Moreover, with an increased order volume, the automated warehouse facilities must be equipped with the latest technologies to cater to the increasing need for agile fulfillment.

Manufacturers and warehousing service providers are increasingly focusing on automating processes in their facilities. More emphasis is being given to software solutions such as WES, which include various functions such as automation control, optimized order execution, intelligent routing, optimized workflows, automated sortation, real-time visibility, congestion management, among others.

Innovation and new product or solution launches by technology and automation companies worldwide are expected to contribute to the growth of this market. For instance, in March 2024, Körber AG, one of the prominent companies in the software technology and innovation industry, launched three additions to its diverse portfolio of warehouse solutions, which address common pain points in supply chain and productivity while assisting companies in unlocking novel capabilities. Körber Gamification, Körber’s Slotting.IQ and Körber’s Unified Control System (UCS) are expected to offer extra-ordinary growth in warehouse efficiency to its users.

Component Insights

Based on component, the software segment dominated the global warehouse execution system market with revenue share of 65.9% in 2024. The segment is also anticipated to remain dominant over the forecast period. The high growth of this segment is attributed to the capability of the WES solutions to increase the potential of automated warehouses. This is achieved by managing labor, inventory resources, and machines against high order volumes and strict delivery timelines. The warehouse execution system heightens visibility across the warehouse, comprising the best parts of the warehouse management and control systems. The features that increase end-to-end visibility include replenishment management, inventory management, mobile scanner integration, and receiving/shipping management. Small or medium-scale operations can be easily moved to a single WES software. Innovation and the inclusion of advanced technology assistance are adding to the growth opportunities of this segment. This includes overlapping wave order management, NexGen WES emulation, WES 1 million transaction testing, PickMate user tool, proprietary path planning algorithms, Barcode scanning, RFID technology, automated systems, and more.

The services segment is expected to experience the fastest CAGR of 20.1% during the forecast period. The warehouse execution system-related services include consulting, installation & integration, training, support & maintenance, and others. Multiple businesses worldwide have recently started to experience the need for upgrade execution systems owing to factors such as the emergence of modern technologies, including voice picking, smart packaging, robotics, intelligent process automation, and enormous growth in volume. In addition, multiple companies require training, support, and maintenance services for seamless adoption of newly integrated warehouse execution systems.

Deployment Insights

Cloud deployment dominated the global market for warehouse execution systems in 2024. Companies increasingly prefer cloud deployments for multiple factors, such as scalability, cost-effectiveness, flexibility, enhanced monitoring abilities, remote access, advanced capacities, and more. The rise of cloud-based technology across industries has significantly transformed business processes. The deployment of the WES offering on the cloud enables end-users to reduce upfront costs while substantially increasing warehouse efficiency. Cloud-based deployment has seen a drastic improvement in security over the years. Security improvements on account of curtailing data thefts have made cloud deployment a viable substitute for on-premises system deployment.

On premise deployment segment is expected to experience significant CAGR over forecast period. Enhanced control offered by the on premise deployment, improved data security and protection, customized features, reduced risks of data thefts, unauthorized access and more are some of the key growth drivers for this segment. Large enterprises prefer cloud deployments where multiple SMEs happen to deploy on premise solutions.

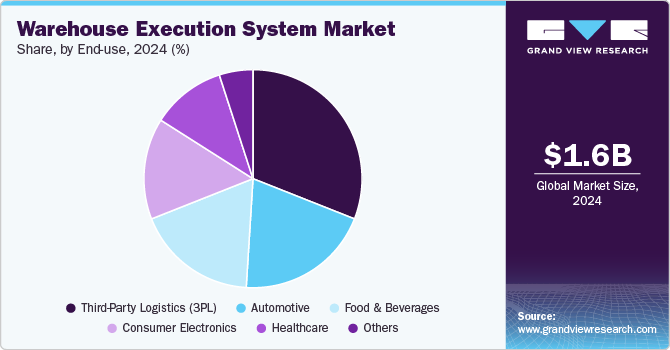

End-use Insights

Based on end use, third party logistics (3PL) sector dominated the global market in 2024. Third-party service providers handle a large volume of products, which necessitate the adoption of automation technologies. Moreover, the e-commerce industry is witnessing a drastic increase over the years, with a greater number of people using online channels for purchasing. This has further increased the number of goods handled by logistics providers. Therefore, advanced warehouse software, such as WES, is increasingly being implemented by the logistics companies to improve warehouse productivity, accuracy, visibility and control, and reduce operating costs, among other operational and non-operational efficiency.

The healthcare sector is expected to experience a noteworthy CAGR from 2025 to 2030. The industry relies on advanced warehouse execution systems for various integral aspects such as temperature control, regulatory compliance, security measures, picking, receiving, inventory management, and more. In addition, expiration dates, the temperature-sensitive nature of healthcare products, the physical features of medical equipment, and more require extraordinary attention while traveling across supply chains. These factors are expected to add growth opportunities for this sector in the approaching years.

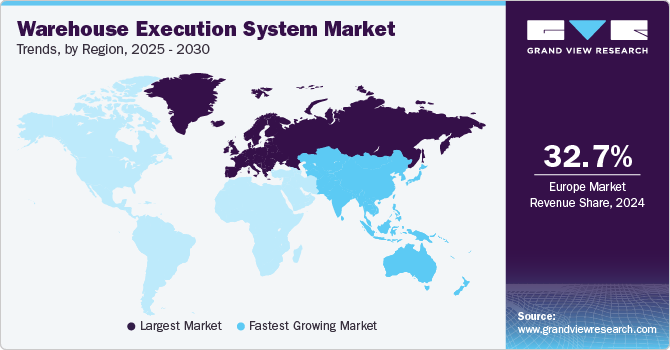

Regional Insights

Europe warehouse execution system market dominated the global industry with revenue share of 32.7% in 2024. The presence of multiple large global enterprises from the personal care manufacturing industry, food & beverages sectors, and growing e-commerce businesses, labor shortages and high labor costs, regulatory support for automation, modern technology integration, and changing consumer expectations are key growth drivers for this market.

Germany Warehouse Execution System Market Trends

Germany warehouse executions system market held the significant revenue share in European industry owing to robust manufacturing industry, highly regulated business environment, strong culture and early adoption trends for innovation in the country, presence of multi-channel warehousing systems, investments by large enterprises in software solutions and more.

North America Warehouse Execution System Market Trends

North America warehousing execution system market held a significant revenue share of the global industry in 2024 due to large-scale warehousing businesses operating in the region, growing demand for processed food items, increasing inclusion of smart packaging, and enhanced shelf life of perishable foods, rising trends of online grocery shopping, performance enhancements requirements of warehousing businesses and significant participation in global import exports. North America is home to multiple applauded brands in food & beverages, fresh produce, dairy products, consumer electronics, and more.

U.S. Warehouse Execution System Market Trends

The U.S. held the largest revenue share of the regional industry for the warehousing execution system market in 2024. The U.S. industry comprises multiple companies from the e-commerce industry that operate on a global scale and numerous domestic and global manufacturing organizations that continuously require highly efficient supply chain management and warehousing execution systems to ensure improved consumer experiences, timely delivery of promised goods, seamless operations, and continuance in business. The presence of a robust IT & telecom industry and multiple warehousing facilities across states, participation in global trade, increasing demand for warehouse excellence solutions, and innovation by key companies in the country are adding to the growth opportunities for this market.

Asia Pacific Warehouse Execution System Market Trends

Asia Pacific warehouse execution system market is expected to experience the fastest CAGR of 19.4% from 2025 to 2030. Growing economies such as China and India, rising demand for e-commerce industry offerings, increasing inclination towards online shopping, the emergence of multiple online delivery platforms in the region, and significant share in worldwide trade for multiple important commodities including rice, cotton, castor seeds, coconuts, sugarcane, electrical and electronic products, textiles, silk, gold, essential oils and more.

China warehousing execution system market is expected to experience the fastest CAGR in the regional market during the forecast period. The large-scale e-commerce industry, digital transformation of the retail sector, robust manufacturing industry, and higher share in global trade are adding to the market's growth potential.

Key Warehousing Execution System Company Insights

Some of the key companies operating in the warehouse execution system market include Honeywell International Inc., SSI SCHAEFER, Softeon, Bastian Solutions, LLC, Fortna Inc. and others. To address growing demand and increasing competition in global and regional markets, key companies are adopting strategies such as innovation, new launches, new partnerships & collaborations, acquisitions, portfolio enhancements and more.

-

Honeywell International Inc., one of the prominent companies in the technology and innovation sector, offers diverse portfolio of solutions and services associated with technology transformation, automation, energy transition and more. Its Momentum warehouse execution system software assists organization in orchestration of diverse automation systems.

-

SSI SCHAEFER, major market participant in the warehousing excellence technology sector, offers wide range of solutions, products, software, services, insights and more. Company’s WAMAS WES, a fulfillment solution for the automated warehousing facilities, manages process complexities, maintain flexibility, and ensure performance improvements.

Key Warehouse Execution System Companies:

The following are the leading companies in the warehouse execution system market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- SSI SCHAEFER

- Bastian Solutions, LLC

- Softeon

- PTC

- Made4net

- Swisslog Holding AG

- VARGO

- Manhattan Associates

- FORTNA Inc.

- WESTFALIA TECHNOLOGIES, INC.

- Invata Intralogistics

Recent Developments

-

In September 2024, Softeon, one of the prime companies in warehouse management system (WMS) business, announced its operational expansion Australia and New Zealand (ANZ). The company is expected to facilitate the third party logistics industry growth through its latest expansion in the region.

-

In February 2024, Blue Yonder Inc., a major market participant in supply chain solutions, announced it has acquired flexis AG, flexible information systems provider for enhanced supply chain operations. The acquisition is expected to strengthen Blue Yonder’s positioning in automotive and industrial original equipment manufacturer (OEM) sector.

Warehouse Execution System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.88 billion |

|

Revenue forecast in 2030 |

USD 4.28 billion |

|

Growth Rate |

CAGR of 18.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa |

|

Key companies profiled |

Honeywell International Inc.; SSI SCHAEFER; Bastian Solutions, LLC; Softeon; PTC; Made4net; Swisslog Holding AG; VARGO; Manhattan Associates; FORTNA Inc.; WESTFALIA TECHNOLOGIES, INC.; Invata Intralogistics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehouse Execution System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global warehouse execution system market report based on product, application, end use and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Consulting

-

Installation & Integration

-

Training and Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Healthcare

-

Food & Beverages

-

Automotive

-

Third-Party Logistics (3PL)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."