Warehouse Conveying Equipment Market Size, Share & Trends Analysis Report By Type (Belt, Roller, Pallet), By Product (Unit Handling, Bulk Handling), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-318-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

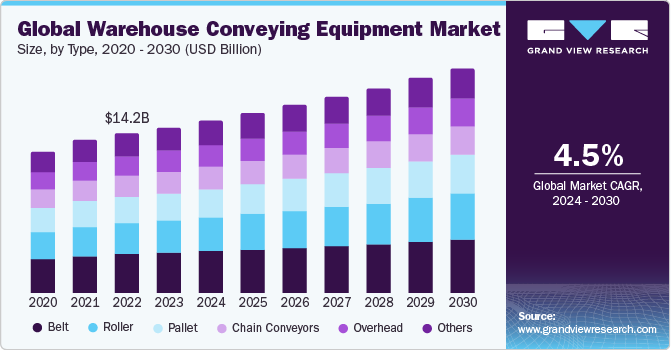

The global warehouse conveying equipment market size was estimated at USD 14.70 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The rising demand for warehouse conveying equipment is due to the booming e-commerce sector and the increased need for efficient logistics and distribution systems. As online shopping continues to grow at an unprecedented rate, warehouses & distribution centers are under immense pressure to expedite order fulfillment processes while minimizing errors.

Conveying equipment, such as belts, rollers, conveyors, and overhead, plays a pivotal role in achieving these purposes. They not only enhance the efficiency and speed of moving goods within the warehouse but also significantly reduce labor costs and the potential for workplace injuries.

The demand for warehouse conveying equipment is experiencing a notable surge, driven by the diverse requirements of modern warehouses & distribution centers. Among the different types of conveying equipment, rollers are witnessing significant demand due to their versatility and efficiency in handling a wide range of products. Rollers are especially favored in sectors where the rapid movement of goods is essential, such as in e-commerce fulfillment centers and packaging industries. They offer the advantage of facilitating smooth and quick transport of items across various points in the warehouse, thereby optimizing workflow and reducing manual handling.

The global demand for warehouse conveying equipment is on a significant upswing, propelled by the exponential growth of e-commerce, advancements in automation, and the continuous pursuit of operational efficiency within supply chains. This demand spans various types of equipment, including roller, belt, and others, each serving unique functions within the warehousing and distribution ecosystem. For instance, Amazon, a global e-commerce giant, has been at the forefront of integrating sophisticated conveyor systems and AGVs within its fulfillment centers to streamline order processing and delivery times. Similarly, DHL, a leading logistics company, employs advanced conveyor systems and sorting technologies in its distribution hubs to enhance parcel handling efficiency and accuracy, catering to the increasing volume of online shopping deliveries worldwide.

There is an increasing demand for warehouse conveying equipment, driven by the booming e-commerce sector in countries like China and India. Alibaba, another e-commerce behemoth, utilizes an extensive network of automated conveyors and sorting systems in its warehouses to manage the vast number of online orders efficiently. Moreover, the push towards automation and smart warehousing solutions in manufacturing sectors, especially in the automotive and electronics industries, further fuels the demand for conveying equipment. For example, BMW and Samsung have invested in sophisticated conveying and AGV systems in their manufacturing plants and warehouses to optimize material handling and intra-logistics processes. This global trend underscores the pivotal role of conveying equipment in enhancing operational efficiencies, reducing labor costs, and meeting the ever-growing consumer expectations for speedy and accurate deliveries.

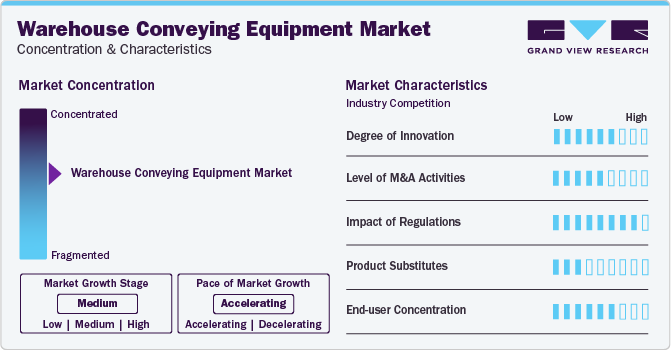

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by the need for increased efficiency, flexibility, and integration with advanced warehouse management systems. Companies like Daifuku and SSI Schaefer are at the forefront of this innovation, offering automated storage and retrieval systems (AS/RS) and AGVs that can be fully integrated with IoT devices and AI to optimize the flow of goods and data through a warehouse. These technological advancements improve operational efficiency and enhance scalability and adaptability to changing market demands. For instance, the development of modular conveyor systems allows for easy reconfiguration of warehouse layouts to accommodate seasonal fluctuations in inventory levels or shifts in product demand.

Regulations and safety standards also significantly impact the market, with stringent requirements influencing the design and operation of conveying equipment. Safety standards such as those set by the Occupational Safety and Health Administration (OSHA) in the U.S. or the European Machinery Directive in the EU necessitate that equipment manufacturers incorporate features to protect workers from accidents and injuries. This has led to innovations such as enhanced safety guards, emergency stop functions, and ergonomic designs that not only comply with regulations but also improve the overall safety and efficiency of warehouse operations. Furthermore, environmental regulations encourage the development of energy-efficient and low-emission conveying solutions, shaping manufacturers' R&D efforts.

In terms of product substitutes, the market faces competition from manual handling methods and non-automated machinery, especially in regions with lower labor costs or where businesses are hesitant to make significant capital investments in automation. However, the growing awareness of the long-term benefits of automation, such as reduced labor costs, increased accuracy, and higher throughput, is gradually shifting the preference towards advanced conveying solutions. For instance, even though manual pallet jacks serve as a low-cost alternative to automated conveyors for moving goods, the efficiency, speed, and scalability offered by automated systems make them a preferred choice for growing businesses aiming to optimize their operations.

End-user concentration in the market varies significantly across industries and regions. E-commerce, warehouse & distribution, automotive, and airports represent major end-users, each with specific requirements that drive demand for customized conveying solutions. For instance, Amazon's massive investment in conveyor belts and robotics for its fulfillment centers reflects the high concentration of end-user demand within the e-commerce sector. Similarly, automotive manufacturers like Toyota and General Motors rely on specialized conveying systems for assembly line operations, showcasing the industry-specific demand. This diversity in end-user requirements necessitates a broad product portfolio and customization capabilities from equipment manufacturers, influencing market dynamics and competitive strategies.

Type Insights

Based on type, the belt segment led the market with the largest revenue share of 24.24% in 2023. Belt-type warehouse conveying equipment is extensively used to efficiently transport goods, streamlining the movement of items between different sections of a warehouse or distribution center. These systems are pivotal in reducing manual handling, thereby minimizing the risk of damage and improving overall operational speed. In addition, they are highly adaptable, supporting a variety of goods, from lightweight packages to bulkier items, making them an indispensable tool in modern logistics and supply chain management.

The roller segment projected to grow at a significant CAGR over the forecast period. Roller-type warehouse conveying equipment is crucial for facilitating the smooth and efficient movement of goods, especially for items that require quick and easy transportation over short to medium distances. These systems excel in simplifying the sorting and assembly processes, ensuring that products are moved safely with minimal effort. Moreover, their modular design allows for flexibility in warehouse layout planning, accommodating various shapes and sizes of goods, which significantly enhances operational efficiency and productivity.

Product Insights

The unit handling segment led the market with the largest revenue share of 43.29% in 2023. Unit handling and conveying equipment in warehouses plays a vital role in automating and streamlining the movement and management of discrete products or units. These systems are designed to transport, sort, and organize goods efficiently, reducing the need for manual labor and minimizing the risk of damage during handling. Common uses include facilitating the smooth flow of items from receiving to storage areas, improving the accuracy and speed of order-picking processes, and connecting different stages of production or packaging lines. By optimizing the internal logistics, unit handling conveyors significantly enhance operational efficiency, scalability, and the overall responsiveness of supply chain operations.

Warehouse conveying equipment encompasses a variety of parts & attachments, each serving specific functions to enhance the system's efficiency, versatility, and safety. Common parts include rollers, belts, motors, sensors, and control systems, which together facilitate the smooth and automated movement of goods. Attachments such as sorters, diverts, and lifts are integrated to enable precise sorting, directional changes, and vertical transport within the warehouse, adapting to various operational needs.

Application Insights

Based on application, the sorting segment led the market with the largest revenue share of 45.49% in 2023. Sorting systems accelerate the process of picking, packing, and shipping products, significantly reducing the time between order placement and delivery. Automated sorters can quickly identify and direct items to specific packing stations or directly into shipping containers, improving customer satisfaction through faster delivery times. Moreover, by efficiently categorizing incoming goods into their respective storage areas, sorting applications aid in maintaining accurate inventory levels. This ensures that products are readily available when orders are placed, minimizing stock outs or overstock situations.

The distribution segment in context of warehouse conveying equipment refers to the strategic use of conveyor systems to streamline the distribution process of goods from the warehouse to the end consumer or retail outlets. These systems are designed to enhance the efficiency, accuracy, and speed of moving products through the distribution chain, from initial receipt to final shipping. For instance, conveyor systems are used to transport goods quickly and safely across different sections of a distribution center, such as from storage areas to packing stations or loading docks. This reduces manual handling, minimizes the risk of damage, and accelerates the distribution process.

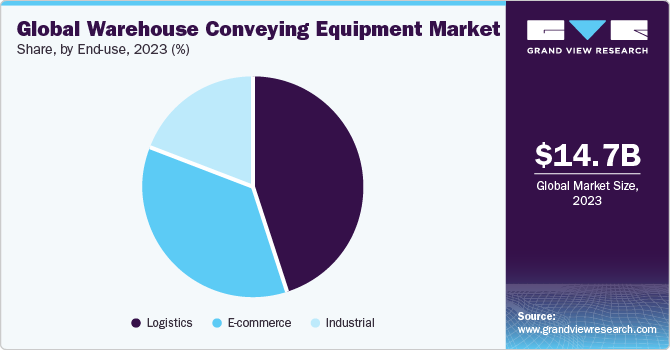

End use Insights

Based on end use, the logistics end-use segment led the market with the largest revenue share of 45.38% in 2023. The demand for conveying equipment in the logistics industry is witnessing a notable surge, propelled by the escalating requirements for faster, more efficient order fulfillment processes amidst the booming e-commerce sector and the global emphasis on supply chain optimization. This uptrend is further fueled by the integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and robotics into conveying systems, making them smarter, more adaptable, and capable of handling a diverse range of products with greater precision and less downtime.

The e-commerce segment demand for conveying equipment is on a notable rise, driven by the sector's unique requirements for hygiene, efficiency, and compliance with stringent health standards. Moreover, innovations such as modular conveyors that can be easily cleaned and sanitized and smart conveying technologies equipped with sensors and IoT capabilities for real-time monitoring and traceability are becoming increasingly prevalent. These advancements not only enhance operational efficiency but also cater to the growing consumer demand for transparency and sustainability.

Regional Insights

The warehouse conveying equipment market in North America is witnessing a robust trend towards automation and digitalization, driven by the booming e-commerce sector and the need for faster, more efficient fulfillment operations. The region is seeing a surge in the adoption of smart, interconnected conveying systems that leverage IoT, AI, and robotics to optimize material handling processes and enhance operational flexibility.

U.S. Warehouse Conveying Equipment Market Trends

The warehouse conveying equipment market in U.S. held 82.2% share in the North America in 2023. The market is driven by advanced manufacturing capabilities, technological expertise, commitment to quality & innovation across various industrial sectors, and a highly developed warehouse & distribution network. In June 2023, Walmart opened its high-tech fulfillment center, which is sprawling across 2.2 million square feet, is situated 20 miles northeast of Indianapolis. This state-of-the-art facility stands as Walmart's biggest fulfillment center thus far, designed to significantly enhance the company's order fulfillment capacity and speed. Such new developments in warehousing to improve the distribution is likely to generate demand for conveying equipment to handle vast product portfolios.

The Canada warehouse conveying equipment market held 11.6% share in the North America in 2023, fueled by the expansion of the e-commerce sector and the push towards automation in logistics and manufacturing industries. Companies like Dematic and Honeywell Intelligrated are leading examples, providing advanced conveyor systems and solutions that enhance efficiency, reduce operational costs, and support the growing need for fast, reliable order fulfillment processes across the country.

Asia Pacific Warehouse Conveying Equipment Market Trends

Asia Pacific dominated the warehouse conveying equipment market with the revenue share of 46.9% in 2023. The market is driven by rapid industrialization, expansion of the e-commerce sector, and the strategic modernization of logistics and supply chain infrastructure across countries like China, India, and Japan. This region's market growth is further bolstered by the increasing adoption of automation technologies within warehouses and distribution centers to meet the soaring consumer demand for quick and efficient delivery services. Governments in the Asia Pacific are also implementing policies that encourage the use of advanced technologies in manufacturing and logistics, providing a significant impetus to the adoption of sophisticated conveying solutions.

The warehouse conveying equipment market in China held 37.5% share in the Asia Pacific in 2023, owing to the country's rapid industrialization, the expansion of the e-commerce sector, and significant investments in logistics and supply chain infrastructure. As the world's largest e-commerce market, China's push towards automation to enhance operational efficiency and reduce labor costs in warehouses and distribution centers has been a key driver for this surge. For instance, according to the International Trade Administration 2024 report, the e-commerce industry in China generates almost 50% of the world’s transactions.

The Japan warehouse conveying equipment market held 19.9% share in the Asia Pacific in 2023, owing to country's focus on optimizing logistics and manufacturing processes through automation and technological innovation. Facing a shrinking workforce due to an aging population, Japan has turned to advanced conveying systems to improve efficiency and productivity in warehouses and distribution centers.

Europe Warehouse Conveying Equipment Market Trends

The warehouse conveying equipment in Europe is experiencing robust growth, fueled by the region's embrace of e-commerce, the push for automation in manufacturing and logistics, and a strong focus on sustainability. European companies are leading the charge in adopting green and efficient conveying solutions to reduce their environmental impact. For instance, BEUMER Group, offers advanced conveying and sorting solutions tailored for various industries, focusing on energy efficiency and low emissions.

The Germany warehouse conveying equipment market held 22.1% share in the Europe in 2023, owing to the country's strong manufacturing base and the rapid growth of the e-commerce sector, necessitating efficient logistics and distribution systems. The push towards Industry 4.0, emphasizing automation and data exchange in manufacturing technologies, further accelerates the adoption of sophisticated conveying solutions. In addition, Germany's commitment to sustainability and energy efficiency aligns with integrating eco-friendly and advanced conveying systems, catering to operational efficiency and environmental standards.

The warehouse conveying equipment market in UK held 11.8% share in the Europe market, which is driven by the exponential growth of e-commerce, which requires highly efficient and automated systems for sorting, packing, and shipping goods. The push towards digitalization and the adoption of Industry 4.0 technologies are driving warehouses to upgrade to smart conveying systems that enhance throughput and accuracy.

Central & South America Warehouse Conveying Equipment Market Trends

The warehouse conveying equipment market in Central & South America is expected to witness at a significant CAGR during the forecast period, owing to increasing industrial investments in the e-commerce, automotive, food & beverage, and airport industries. Moreover, the e-commerce industry represents a significant segment, leveraging the demand for warehouse conveying equipment.

The Brazil warehouse conveying equipment market held a 32.7% share in the Central & South America in 2023, owing the growing manufacturing in the automotive sector and warehouse & distribution sector are expected to boost the demand for the market growth during the forecast period.

Middle East & Africa Warehouse Conveying Equipment Market Trends

The warehouse conveying equipment market in the Middle East and Africa is driven by investments in e-commerce and industrial diversification initiatives. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced technologies to enhance the efficiency and reliability of their industrial components, creating opportunities for conveying equipment to provide solutions for reliable and process-controlled manufacturing.

The Saudi Arabia warehouse conveying equipment market held 32.8% share in the Middle East & Africa in 2023. It is primarily driven by the country's ambitious Vision 2030 initiative, which aims to diversify the economy and includes significant investments in logistics and e-commerce infrastructure. In addition, the push towards modernizing and automating supply chain operations in the region to enhance efficiency and productivity has further fueled the demand for advanced conveying solutions.

Key Warehouse Conveying Equipment Company Insights

Some of the key players operating in the market include Daifuku Co., Ltd., BEUMER GROUP, Fives Group, TGW Logistics Group, and FlexLink.

-

Daifuku Co., Ltd. was established in 1937 and is headquartered in Osaka, Japan. The company manufactures and supplies transport systems, conveying systems, control systems, storage systems, sorting & picking systems, and material handling systems. It also engages in consulting, engineering, design, production, installation, and post-sale services for logistics systems and material handling equipment. In October 2022, Daifuku North America Holding Company announced the opening of its new manufacturing plant in Boyne City, Michigan. The manufacturing facility has brought together the operations of the former Boyne City, Harbor Springs, and Pellston facilities under one roof. It is run by Jervis B. Webb Company, a subsidiary of Daifuku North America

-

BEUMER GROUP is a prominent German industrial and engineering company. It has a long history dating back to its establishment in 1935. Specializing in creating and producing intralogistics solutions, including conveyance, loading, palletizing, packaging, sorting, and distribution systems, with a global workforce of 5,400 employees. Achieving annual revenues close to USD 1.2 billion

Murata Machinery, Ltd, Kardex, and Phoenix Conveyor Belt Systems are some of the emerging market participants in the market.

-

Murata Machinery, Ltd was established in 1935 and is headquartered in Kyoto, Japan. The company has a strong market presence in Japan and provides solutions under the brand Muratec. It operates its business through six divisions such as logistics & automation, sheet metal machinery, textile machinery, machine tools, and communication equipment. Under the logistics and automation division provides a Logistics Center, Automated Storage & Retrieval Systems (AS/RS), Transportation Systems, Picking Systems, Sorting Systems, and Data Management Systems

-

Kardex is a leading global partner in the field of intralogistics, offering a wide range of automated storage solutions and material handling systems. The company is structured into two independently managed divisions: Kardex Remstar and Kardex Mlog. Kardex Remstar specializes in developing, manufacturing, and servicing dynamic storage and retrieval systems, while Kardex Mlog is focused on providing integrated material handling systems and automated high-bay warehouses. Kardex employs around 2,100 people across more than 30 countries, demonstrating its global reach and commitment to excellence in intralogistics solutions

Key Warehouse Conveying Equipment Companies:

The following are the leading companies in the warehouse conveying equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Daifuku Co., Ltd.

- BEUMER GROUP

- Fives Group

- FlexLink

- Jungheinrich AG

- Kardex

- Kion Group AG

- KUKA AG

- Murata Machinery, Ltd

- Phoenix Conveyor Belt Systems

- Siemens

- TGW Logistics Group

- Continental AG

- Emerson Electric Co.

Recent Developments

-

In July 2023, Jungheinrich AG disclosed that by October 2024, it would be building a new logistics warehouse in Freilassing for Hawle Armaturen GmbH. The scope of delivery from Jungheinrich AG includes a full conveyor system featuring order-picking workstations, five stacker cranes with SPS, and silo steel rack constructions with roof and wall cladding

-

In June 2023, TGW Logistics Group announced that it would be building a high-performance e-commerce system for SKECHERS USA, Inc., a manufacturer of premium-quality shoes, about 50 km north of Shanghai. The automated system is expected to go active in the summer of 2025. The core element of the TGW Logistics Group offers is a 13-kilometer-long network of energy-effective KingDrive conveyors that not only link every part of the system to one another but also ensure that they are connected to the current fulfillment center

Warehouse Conveying Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.32 billion |

|

Revenue forecast in 2030 |

USD 20.00 billion |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Daifuku Co., Ltd.; BEUMER GROUP; Fives Group; FlexLink; Jungheinrich AG; Kardex; Kion Group AG; KUKA AG; Murata Machinery, Ltd; Phoenix Conveyor Belt Systems; Siemens; TGW Logistics Group; Continental AG; Emerson Electric Co. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehouse Conveying Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the warehouse conveying equipment market report based on type, product, application, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Belt

-

Roller

-

Pallet

-

Overhead

-

Chain conveyors

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unit handling

-

Bulk handling

-

Parts & attachments

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sorting

-

Loading & unloading

-

Distribution

-

-

End use Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-commerce

-

Logistics

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global warehouse conveying equipment market size was estimated at USD 14.70 billion in 2023 and is expected to reach USD 15.32 billion in 2024.

b. The warehouse conveying equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 20.00 billion by 2030

b. Belt type segment led the market and accounted for 24.2% of the global revenue share in 2023. Belt-type warehouse conveying equipment is extensively used for the efficient transportation of goods, streamlining the movement of items between different sections of a warehouse or distribution center.

b. Some of the key players operating in the warehouse conveying equipment market include Daifuku Co., Ltd., BEUMER GROUP, Fives Group, FlexLink, Jungheinrich AG, Kardex, Kion Group AG, KUKA AG, Murata Machinery, Ltd, Phoenix Conveyor Belt Systems, Siemens, TGW Logistics Group, Continental AG, and Emerson Electric Co. among others

b. The surge in warehouse conveying equipment demand is driven by the increase demand for e-commerce and the need for effective logistics. With online shopping growing rapidly, warehouses and distribution centers are being pushed to speed up fulfillment and reduce mistakes. Equipment like belt, roller conveyors, and overhead systems are key to meeting these challenges.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."