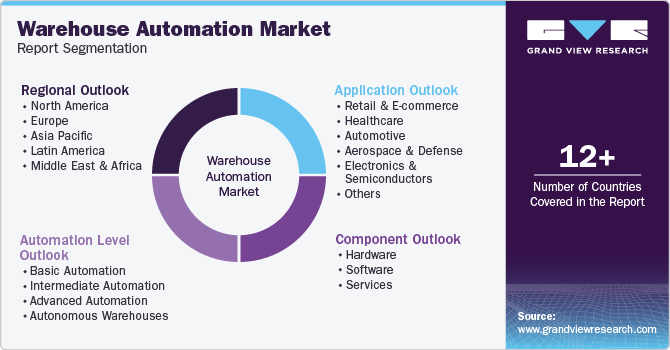

Warehouse Automation Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Automation Level, By Application (Retail & E-commerce, Healthcare, Automotive, Aerospace & Defense), By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Warehouse Automation Market Size & Trends

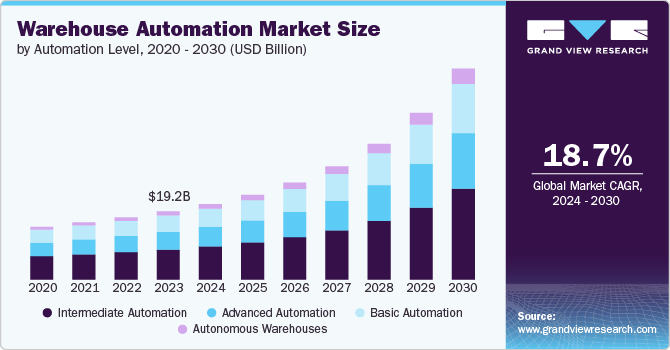

The global warehouse automation market size was estimated at USD 19.23 billion in 2023 and is projected to grow at a CAGR of 18.7% from 2024 to 2030. Warehouse automation refers to the use of technology and machinery to automate various tasks within a warehouse environment. This includes everything from automated storage and retrieval systems (AS/RS) to robotics, conveyors, automated guided vehicles (AGVs), and warehouse management software (WMS). Automation in warehouses aims to increase efficiency, reduce human error, and lower operating costs. The market encompasses a wide range of products and services, including hardware, software, and integration services. Warehouse automation solutions are implemented across various industries, including retail, manufacturing, healthcare, and logistics, catering to both large enterprises and small to medium-sized businesses.

Several key trends are shaping the warehouse automation market. One of the most significant is the growing adoption of robotics. Robotic systems, such as autonomous mobile robots (AMRs) and collaborative robots (cobots), are increasingly being used for tasks like picking, packing, and material handling. These robots are designed to work alongside human workers, enhancing productivity and safety. The integration of artificial intelligence (AI) and machine learning (ML) is also a notable trend, as these technologies enable more sophisticated data analysis, predictive maintenance, and optimized decision-making processes.

The surge in e-commerce has been a major driver of warehouse automation as companies strive to meet the demands of online shoppers for faster and more accurate order fulfillment. E-commerce giants like Amazon have set a high standard for speed and efficiency, prompting other retailers to invest in automation to remain competitive. This has increased demand for automated sorting systems, conveyor belts, and high-speed sortation equipment. Additionally, the concept of smart warehouses is gaining traction. Smart warehouses leverage the Internet of Things (IoT), AI, and data analytics to create highly connected and automated environments. These technologies enable real-time inventory monitoring, predictive equipment maintenance, and enhanced supply chain visibility. The implementation of 5G technology is expected to further accelerate the adoption of smart warehouse solutions by enabling faster and more reliable communication between devices.

The warehouse automation market is subject to various regulations, particularly in terms of safety standards and labor laws. Automation technologies must comply with occupational health and safety regulations to ensure that automated systems do not pose risks to human workers. In the European Union, for example, machinery used in warehouses must comply with the Machinery Directive, which sets out essential health and safety requirements. Similarly, in the U.S., the Occupational Safety and Health Administration (OSHA) provides guidelines for the safe use of robotic systems in workplaces. Data privacy and cybersecurity are also critical regulatory concerns, especially as warehouses become more connected through IoT devices and cloud-based management systems. Regulations like the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the U.S. require companies to implement stringent data protection measures. As warehouse automation systems often collect and process large amounts of data, compliance with these regulations is essential to avoid legal repercussions and maintain consumer trust.

The warehouse automation market is being propelled by several key factors, including the growing need for efficiency and accuracy in operations, the rapid expansion of e-commerce, labor shortages, and the ongoing pressure to reduce costs. As global trade becomes more complex and consumer expectations for quick, accurate delivery rise, businesses are increasingly turning to automation to manage these challenges. Automated systems optimize inventory management, streamline order processing, and minimize errors, enhancing customer satisfaction, and providing a competitive edge. Additionally, labor shortages in the warehousing sector, exacerbated by an aging workforce and a shrinking labor pool, are pushing companies to adopt automation to ensure continuous operation and reduce dependence on human labor. Automated systems, which can operate around the clock, are proving to be a critical solution to these challenges.

Cost reduction is another critical driver of warehouse automation adoption. Automated systems help lower operational expenses by reducing the need for manual labor, minimizing errors, and improving the utilization of resources. Technologies such as automated storage and retrieval systems (AS/RS) maximize warehouse space, cutting down on the need for large storage facilities and reducing real estate costs. Moreover, automation often leads to efficiency gains that result in lower energy consumption and reduced waste, contributing to both cost savings and sustainability efforts. The market also presents abundant opportunities, particularly with the integration of AI and machine learning, which offer advanced analytics and decision-making capabilities. These technologies are particularly beneficial in emerging markets such as Asia-Pacific and Latin America, where the rapid growth of e-commerce is driving the need for automated fulfillment centers to manage increasing order volumes.

Component Insights

The hardware segment dominated the market in 2023 and accounted for more than 58% share of global revenue, due to the substantial investments required for the physical infrastructure of automated systems. Hardware components such as automated storage and retrieval systems (AS/RS), conveyors, robotic arms, and automated guided vehicles (AGVs) are integral to the core operations of an automated warehouse. These systems offer significant improvements in speed, accuracy, and efficiency, which are essential for meeting the high demands of modern logistics and supply chain operations. As a result, the hardware segment commands the largest market share, driven by the need to modernize warehouse facilities and replace outdated manual systems. However, despite its dominance, the hardware segment faces challenges related to high initial capital costs and ongoing maintenance, which can be prohibitive for smaller businesses.

The software segment is projected to expand at the fastest growth rate during the forecast period 2024 to 2030. This growth is fueled by the increasing reliance on advanced software solutions for managing and optimizing automated systems. Warehouse management systems (WMS), warehouse control systems (WCS), and integrated data analytics platforms are becoming essential as companies seek to harness the full potential of their automated hardware. The software enables real-time decision-making, predictive analytics, and seamless integration with other enterprise systems, such as enterprise resource planning (ERP) and transportation management systems (TMS).

Automation Level Insights

The intermediate automation segment dominated the market in 2023, accounting for a significant portion of overall revenue. Intermediate automation involves the implementation of partially automated systems that require human intervention for certain tasks, such as oversight and decision-making. This level of automation strikes a balance between cost and operational efficiency, making it an attractive option for many businesses, particularly those transitioning from manual operations to more automated environments. Intermediate automation systems typically include automated picking, packing, and sorting systems that enhance productivity while still leveraging human workers for more complex tasks. The dominance of this segment is due to its affordability and the relative ease with which it can be integrated into existing warehouse infrastructures, allowing businesses to gradually scale their automation efforts.

The autonomous warehouses segment is projected to expand at the fastest growth rate during the forecast period 2024 to 2030. Autonomous warehouses operate with minimal human intervention, relying heavily on advanced robotics, AI-driven software, and IoT connectivity. These fully automated environments offer unparalleled efficiency, accuracy, and speed, which are increasingly demanded by sectors such as e-commerce and retail, where order fulfillment speed and precision are critical. The rapid growth of this segment is driven by the need for businesses to stay competitive in an environment where consumer expectations for fast and accurate delivery are constantly rising. Although the initial investment for autonomous warehouses is significantly higher, the long-term benefits in terms of reduced labor costs, improved throughput, and enhanced scalability are compelling factors that are driving its adoption.

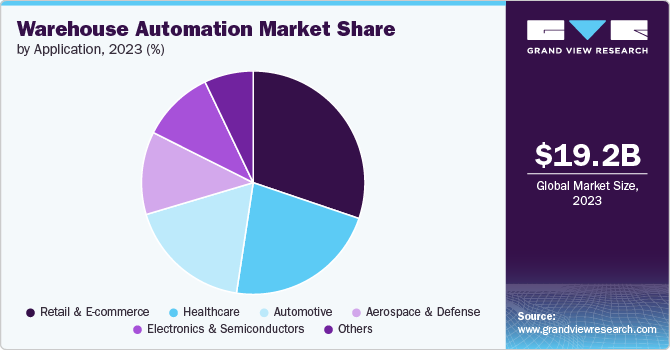

Application Insights

The retail and e-commerce segment dominated the market in 2023 and is also the fastest-growing application area. The rise of online shopping has dramatically reshaped the logistics landscape, creating immense pressure on retailers and e-commerce companies to deliver orders quickly, accurately, and cost-effectively. Automated warehouses are crucial in meeting these demands, as they enable faster order processing, reduce errors, and optimize inventory management. Retailers and e-commerce giants, such as Amazon and Alibaba, have heavily invested in automation technologies like robotics, AS/RS, and high-speed sortation systems to enhance their operational efficiency and maintain a competitive edge. The relentless growth of e-commerce, accelerated by the COVID-19 pandemic, has only intensified the demand for warehouse automation, making this application segment the most dynamic and critical in the market.

The healthcare segment is projected to grow at a significant rate during the forecast period 2024. The healthcare industry has unique requirements for inventory management, including the need for precise tracking of pharmaceuticals, medical devices, and other critical supplies. Automated systems in healthcare warehouses help ensure the accurate and timely distribution of these items, which is vital for patient safety and regulatory compliance. Moreover, the increasing complexity of supply chains in the healthcare sector, driven by global distribution networks and stringent regulatory requirements, is propelling the adoption of automation technologies. Automated storage systems, temperature-controlled environments, and real-time tracking solutions are particularly crucial for managing the delicate and time-sensitive nature of healthcare products. As the healthcare industry continues to expand and evolve, the adoption of warehouse automation is expected to grow, contributing significantly to the overall market's development.

Regional Insights

The North America region dominated the warehouse automation market in 2023 and accounted for a 36.7% share of the global revenue. This is due to the region's advanced industrial base, early adoption of cutting-edge technologies, and significant investments in logistics infrastructure. The U.S. has been a leader in adopting automation to meet the demands of its vast e-commerce industry, which continues to set high standards for speed, accuracy, and efficiency in order fulfillment. The region's mature economy and high labor costs have also made automation an attractive option for companies looking to reduce operational expenses while maintaining a competitive edge. In addition, North America's robust technological ecosystem, including the presence of major automation and robotics companies, has fostered innovation and the rapid deployment of automated solutions across various industries, including retail, manufacturing, and logistics.

U.S. Warehouse Automation Market Trends

The warehouse automation market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030, fueled by the relentless expansion of e-commerce, the need for more efficient supply chain operations, and the growing trend of reshoring manufacturing activities. Companies are heavily investing in automation technologies to meet consumer demand for faster delivery times and to mitigate the challenges posed by labor shortages. The U.S. market is characterized by a high level of technological adoption, with companies leveraging AI, robotics, and IoT to optimize warehouse operations. Additionally, the ongoing shift towards more localized manufacturing and distribution in response to global supply chain disruptions has heightened the demand for automated systems that can enhance operational efficiency and reduce dependency on manual labor. The U.S. government's focus on strengthening domestic manufacturing capabilities and improving supply chain resilience is expected to further drive investment in warehouse automation.

Europe Warehouse Automation Market Trends

The warehouse automation market in Europe is expected to grow at a significant CAGR from 2024 to 2030. European countries, particularly Germany, the U.K., and France, are at the forefront of adopting advanced automation technologies to improve warehouse efficiency and reduce carbon footprints. The European market is characterized by its emphasis on high-quality standards, precision engineering, and stringent regulatory requirements, which have encouraged the adoption of automation solutions that enhance operational efficiency while complying with environmental and safety regulations. The region's growing e-commerce sector, coupled with rising labor costs and an aging workforce, has further accelerated the shift towards automation. Additionally, Europe's strong commitment to sustainability has led to the development and implementation of energy-efficient and environmentally friendly automation systems. This focus on green technologies, combined with the region's robust industrial base and innovation in automation, positions Europe as a significant player in the global warehouse automation market, with continued growth anticipated as companies increasingly prioritize efficiency and sustainability.

Asia Pacific Warehouse Automation Market Trends

The warehouse automation market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030, driven by rapid industrialization, the explosive expansion of e-commerce, and increasing investments in logistics infrastructure. Countries such as China, Japan, and India are leading the charge, with businesses in these regions aggressively adopting automation technologies to meet the demands of their burgeoning consumer markets. The rise of e-commerce giants like Alibaba and JD.com in China has set new benchmarks for warehouse efficiency, prompting widespread adoption of automation solutions to handle the immense volume of orders. Additionally, the region's growing focus on improving supply chain resilience and reducing labor costs has further fueled the demand for automated systems. The Asia Pacific market is also benefiting from strong government support for industrial automation and smart manufacturing initiatives, particularly in China and Japan, where there is a significant push towards integrating AI, robotics, and IoT in warehousing and logistics. As a result, the Asia Pacific region is emerging as the fastest-growing market for warehouse automation, with significant potential for continued expansion as more companies in the region seek to enhance their operational capabilities and compete on a global scale.

Key Warehouse Automation Company Insights

The competitive landscape of the warehouse automation market is characterized by intense competition, driven by the rapid adoption of advanced technologies and the increasing demand for efficient supply chain solutions. The market is dominated by a mix of established players and emerging companies, all vying to capitalize on the growing need for automation across various industries. Key players like Honeywell Intelligrated, Dematic, and Swisslog lead the market, offering comprehensive automation solutions that include hardware, software, and integration services. These companies leverage their extensive industry experience, global presence, and strong research and development capabilities to maintain a competitive edge.

Emerging players and niche companies are also making significant strides by focusing on innovative technologies such as robotics, AI, and IoT integration. Startups and specialized firms often target specific aspects of warehouse automation, such as autonomous mobile robots (AMRs) or advanced warehouse management software (WMS), allowing them to carve out unique market positions. Strategic partnerships, mergers, and acquisitions are common strategies employed by companies to expand their product portfolios and market reach. Additionally, the competitive landscape is shaped by the need for customization and scalability, as businesses increasingly seek tailored automation solutions to meet their specific operational needs. As the market continues to grow, competition is expected to intensify, driving further innovation and consolidation within the industry.

-

In March 2024, KNAPP AG and Sonepar, a B2B company focusing on electrical product distribution, are expanding their partnership by implementing an advanced automation solution at Sonepar's warehouse in Holzwickede, Germany. The solution includes cutting-edge shuttle technology, ergonomic goods-to-person workstations, and the company's comprehensive KiSoft software, which will enhance the handling of small parts and improve Sonepar's delivery service for electrical wholesale.

-

In January 2024, Honeywell integrated AI and machine learning into its Guided Work Solutions to enhance retail operations by improving task efficiency and customer experience. The AI-driven speech technology supports retail associates in performing tasks like order fulfillment and shelf restocking, increasing productivity by over 30% and achieving up to 99% accuracy. This update aligns with the company's focus on automation.

Key Warehouse Automation Companies:

The following are the leading companies in the warehouse automation market. These companies collectively hold the largest market share and dictate industry trends.

- DematicLegal

- Daifuku Co., Ltd.

- Swisslog Holding AG

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery, Ltd.

- KNAPP AG

- TWG Living Logistics

- Kardex

- Mecalux, S.A.

- BEUMER Group

- SSI Schaefer

Warehouse Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 21.30 billion |

|

Revenue forecast in 2030 |

USD 59.52 billion |

|

Growth rate |

CAGR of 18.7% from 2024 to 2030 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, automation level, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

DematicLegal; Daifuku Co., Ltd.; Swisslog Holding AG; Honeywell International Inc.; Jungheinrich AG; Murata Machinery, Ltd.; KNAPP AG; TWG Living Logistics; Kardex; Mecalux, S.A.; BEUMER Group; SSI Schaefer |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Warehouse Automation Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the warehouse automation market based on component, automation level, application, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Autonomous Robots (Agv, Amr)

-

Automated Storage And Retrieval Systems (As/Rs)

-

Automated Sorting Systems

-

De-Palletizing/Palletizing Systems

-

Conveyor Systems

-

Automatic Identification And Data Collection (Aidc)

-

-

Software

-

Warehouse Management System (WMS)

-

Warehouse Execution Systems (WES)

-

Labor Management Systems (LMS)

-

-

Services

-

Analytics and Reporting Tools

-

Consulting, Training & Education

-

Installation And Integration

-

Maintenance And Support

-

-

-

Automation Level Outlook (Revenue, USD Billion, 2017 - 2030)

-

Basic Automation

-

Intermediate Automation

-

Advanced Automation

-

Autonomous Warehouses

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Aerospace & Defense

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

- South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global warehouse automation market size was estimated at USD 19.23 billion in 2023 and is expected to reach USD 21.30 billion in 2024.

b. The global warehouse automation market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 59.52 billion by 2030.

b. North America dominated the warehouse automation market with a share of over 36.7% in 2023. This is attributable to the region's advanced industrial base, early adoption of cutting-edge technologies, and significant investments in logistics infrastructure. The U.S. has been a leader in adopting automation to meet the demands of its vast e-commerce industry, which continues to set high standards for speed, accuracy, and efficiency in order fulfillment.

b. DematicLegal, Daifuku Co., Ltd., Swisslog Holding AG, Honeywell International Inc., Jungheinrich AG, Murata Machinery, Ltd., KNAPP AG, TWG Living Logistics, Kardex, Mecalux, S.A., BEUMER Group, and SSI Schaefer

b. Key factors driving market growth include the e-commerce growth, labor shortages and rising labor costs, consumer demand for faster delivery, and supply chain efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."