- Home

- »

- Advanced Interior Materials

- »

-

Wafer Vacuum Assembling Equipment Market Report, 2030GVR Report cover

![Wafer Vacuum Assembling Equipment Market Size, Share & Trends Report]()

Wafer Vacuum Assembling Equipment Market Size, Share & Trends Analysis Report By Product (Fully Automatic Vacuum Assembling Equipment), By Application (Semiconductor Industry), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-453-5

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

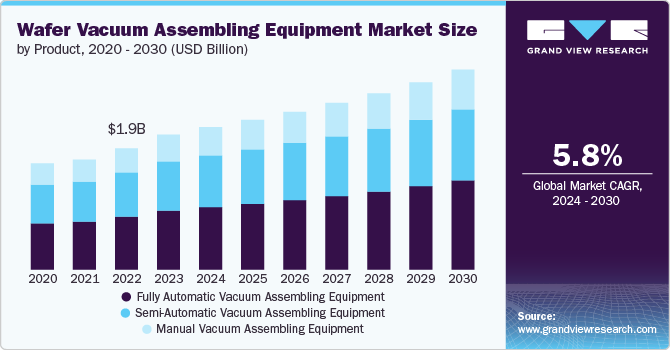

The global wafer vacuum assembling equipment market size was estimated at USD 2.11 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The demand for wafer vacuum assembling equipment is on a significant upswing, fueled by the growth in the semiconductor industry. Technological advancements, the surge in consumer electronics, and the expanding applications of semiconductors in various sectors such as automotive, healthcare, and IoT are further driving the market demand. This uptick in demand is further bolstered by the push for smaller, efficient chips and the increasing complexities involved in semiconductor manufacturing, necessitating highly precise and reliable vacuum assembly processes.

The rising demand for wafer vacuum assembling equipment is driven by the miniaturization of electronic devices, compelling chip manufacturers to pursue advancements in wafer-level packaging, where vacuum assembling plays a crucial role in ensuring the integrity and performance of ultra-thin wafers. Moreover, the rise of 5G technology and the onset of the 6G horizon are pushing the boundaries for faster, more efficient semiconductor components. This telecommunication evolution necessitates the fabrication of sophisticated chips, where vacuum assembly processes are indispensable for achieving the high precision and reliability required. Additionally, the automotive sector's swift move toward electric vehicles (EVs) and autonomous driving technology creates a new demand avenue. The semiconductors needed for these innovations must be of the highest quality, driving the need for advanced vacuum assembling equipment to produce power electronics, sensors, and control units.

Drivers, Opportunities & Restraints

The primary drivers of the market include the relentless technological advancement and the exponential growth of the consumer electronics sector. The incessant demand for smaller, more powerful, and energy-efficient devices necessitates sophisticated semiconductor chips, which require precise wafer vacuum assembling processes. Moreover, emerging technologies such as 5G, AI, IoT, and autonomous vehicles are pushing the boundaries of semiconductor capabilities, demanding higher precision and reliability from wafer assembly processes. Additionally, the global push toward electrification and sustainable technologies is fueling the need for more advanced semiconductors, directly impacting the demand for high-precision wafer vacuum assembling equipment.

One significant opportunity within the sector lies in the expansion of semiconductor manufacturing capabilities globally, spurred by the need to secure and diversify supply chains, especially in the wake of recent global disruptions. This global expansion represents a fertile ground for the deployment of new wafer vacuum assembling solutions. Furthermore, the shift toward more advanced packaging technologies, such as 3D packaging, and the increasing adoption of silicon carbide (SiC) and gallium nitride (GaN) in power electronics present substantial opportunities for innovation and growth within the equipment market. The push for more sustainable and energy-efficient manufacturing processes also opens avenues for advancements in vacuum technology, offering opportunities for equipment manufacturers to lead in green manufacturing initiatives.

However, the market faces several restraints, including the high costs associated with adopting and maintaining cutting-edge wafer vacuum assembling equipment. The significant investment required for advanced machinery can be a barrier for smaller manufacturers, potentially limiting market growth. Additionally, the complex technical requirements and the need for highly specialized skills for operating such equipment pose challenges for workforce development and can affect the rate of adoption. Finally, the rapid pace of technological change, while a driver of demand, also presents a restraint as equipment can quickly become obsolete, requiring continuous research and development efforts and investments to stay competitive and meet the evolving needs of the semiconductor industry.

Product Insights

“The demand for fully automatic vacuum assembling equipment product is expected to grow at a significant CAGR of 6.1% from 2024 to 2030 in terms of revenue”

The fully automatic vacuum assembling equipment segment led the market and accounted for 43.8% of the global market revenue share in 2023. The shift toward digitalization and smart manufacturing practices has propelled the demand for fully automatic vacuum assembling equipment to unprecedented levels. This surge is primarily driven by the semiconductor industry's pursuit of higher throughput, superior precision, and enhanced productivity to meet the escalating demands for advanced consumer electronics, automotive components, and IoT devices. Fully automatic systems offer significant advantages in terms of reduced human error, consistent product quality, and the ability to operate continuously, which significantly improves production efficiency and cost-effectiveness.

The demand for manual vacuum assembling equipment remains steady, particularly in niche markets and among small to medium-sized enterprises that derive value from the flexibility and lower initial costs of these systems. These manual systems are favored for certain specialized applications where the precision and customization offered by hands-on operation are paramount or where the scale of production does not justify the hefty investment in fully automatic systems. Moreover, in research and development environments, where the assembly requirements can frequently change, manual vacuum assembling equipment offers the adaptability needed without significant reconfiguration costs. Despite the trend toward automation, the demand for manual equipment is sustained by its affordability, ease of modification, and suitability for low-volume, high-precision tasks.

Application Insights

“The demand for electronics manufacturing application segment is expected to grow at a significant CAGR of 6.2% from 2024 to 2030 in terms of revenue”

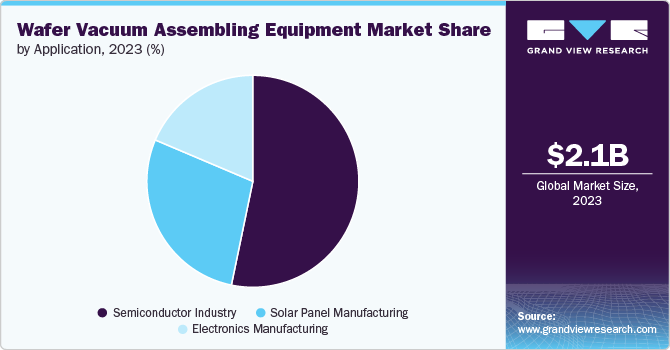

The semiconductor industry application segment led the market and accounted for 53.2% of the global revenue share in 2023. In the semiconductor industry, wafer vacuum assembly equipment plays a crucial role in the fabrication and assembly of semiconductor devices. These sophisticated machines are used for processes such as wafer bonding, chip encapsulation, and the precise alignment of wafer layers under vacuum conditions to ensure flawless adhesion without contaminants or air bubbles. The vacuum environment is essential for achieving the high level of precision and cleanliness required in semiconductor manufacturing, where even the smallest impurity or misalignment can lead to the failure of the semiconductor device. The increasing complexity of semiconductor devices, with more layers and finer circuits, has made the role of vacuum assembly equipment more critical than ever. This technology enables the mass production of semiconductors with high yield rates and reliability, supporting the rapid advancement and miniaturization of electronic devices.

In electronics manufacturing, wafer vacuum assembly equipment is utilized in the production of various components, such as sensors, MEMS (Micro-Electro-Mechanical Systems), and LEDs, which are integral to modern electronic devices. The use of vacuum assembly ensures that these components are manufactured within strictly controlled environments, minimizing the risk of contamination that could impair their performance or longevity. Particularly in the production of MEMS, which often combines mechanical and electrical components in a single silicon chip, the precision and environmental control provided by vacuum assembly are indispensable. This technology facilitates the integration of these components into a wide array of consumer electronics, automotive technologies, and medical devices, among others, enabling the development of smaller, more efficient, and reliable products. The push for greater functionality and compactness in electronic devices continues to drive the demand for wafer vacuum assembly equipment within the electronics manufacturing sector.

Regional Insights

North America wafer vacuum assembling equipment market is growing as in this region, particularly in the U.S., the semiconductor industry is a pivotal sector, with the demand for wafer vacuum assembling equipment being robust and consistently driven by the innovation-centric technology landscape. The U.S. government's focus on revitalizing domestic semiconductor manufacturing capacity, exemplified by significant investments and policy support, underscores the strategic importance of this sector. This environment fosters a strong demand for cutting-edge semiconductor production technologies, including advanced vacuum assembling systems, to maintain competitiveness and security in the global technology arena. Furthermore, the presence of leading semiconductor companies and research institutions contributes to sustained demand for sophisticated wafer vacuum assembling machinery to facilitate the development of next-generation semiconductor technologies.

Asia Pacific Wafer Vacuum Assembling Equipment Market Trends

“India to witness the fastest market growth at 7.4% CAGR”

The wafer vacuum assembling equipment market in Asia Pacific stands as the largest and fastest-growing market, driven by the rapid expansion of the semiconductor industry in countries such as China, South Korea, Taiwan, and Japan. This region is home to some of the world's largest semiconductor foundries and electronics manufacturers, necessitating state-of-the-art production capabilities to meet both domestic and global electronics demand. The continuous push for technological advancements, coupled with substantial investments in semiconductor manufacturing expansion and upgrades, fuels the demand for sophisticated wafer vacuum assembling systems. Furthermore, the region's role as a global electronics manufacturing hub, exporting to international markets, ensures sustained high demand for such equipment to maintain efficiency and production quality standards.

India wafer vacuum assembling equipment market is witnessing a notable increase, primarily driven by the country's burgeoning electronics manufacturing sector and ambitious government initiatives aimed at boosting the domestic production of semiconductors. With policies like the 'Make in India' campaign, there is a significant push toward establishing India as a hub for semiconductor manufacturing, attracting investments from both national and international entities. Additionally, the country's expansive consumer electronics market, one of the largest globally, underscores a compelling need for localized semiconductor production capabilities, further propelling the demand for high-precision equipment like wafer vacuum assemblers. As India gradually makes strides toward self-reliance in semiconductor production, the demand for such specialized equipment is expected to grow steadily.

Europe Wafer Vacuum Assembling Equipment Market Trends

The wafer vacuum assembling equipment market in Europe is heavily influenced by its strong automotive industry, renewable energy initiatives, and a strategic focus on enhancing semiconductor manufacturing capabilities within the region. European semiconductor manufacturers are increasingly investing in advanced manufacturing technologies to produce high-quality, energy-efficient chips essential for electric vehicles (EVs), smart grids, and IoT applications. Additionally, the European Union's initiatives to bolster technological sovereignty and reduce dependency on external semiconductor supplies spark investments in local semiconductor production, further driving the demand for specialized equipment like wafer vacuum assemblers. Europe's approach to greener and more sustainable manufacturing processes also emphasizes the need for advanced, efficient assembly equipment in the semiconductor sector.

Key Wafer Vacuum Assembling Equipment Company Insights

Some of the key players operating in the market include Applied Materials Inc., Lam Research Corporation, KLA Corporation, among others.

-

Applied Materials Inc. operates in three business segments, namely Semiconductor systems, applied global services (AGS), display, and adjacent markets. The semiconductor systems market develops, manufactures, and sells a diverse range of manufacturing equipment used to fabricate the semiconductor chips, termed as ICs. The AGS segment provides solutions to optimize fab performance and productivity, including upgrades, spares, and services. It also provides solutions to optimize the earlier generation equipment and factory automation software for semiconductors, displays, and other products.

-

Lam Research Corporation is a USA-based wafer fabrication equipment manufacturer and related service provider in the semiconductor industry. It designs and builds products in front-end wafer processing, including equipment for thin film deposition, photoresist strips, and plasma etch. The company provides manufacturing and servicing of wafer-processing semiconductor manufacturing equipment. It allows customers to build smaller and better-performing devices.

Ted Pella, Inc. and AMAC Technologies are some of the emerging market participants in the wafer vacuum assembling equipment market.

-

Ted Pella, Inc. is a family-owned American company specializing in manufacturing and distributing high-quality tools and equipment for microscopy and related fields. Established in 1968 and headquartered in Redding, California, the company has built a reputable standing in the market for supplying a wide range of products, including microscopes, specimen preparation tools, and vacuum assembling equipment. Their product offerings cater to various sectors, such as research and development, materials science, electronics, and biomedical sciences. Ted Pella, Inc. is known for its commitment to quality, customer service, and innovation, constantly expanding its product line to meet the evolving needs of scientists and researchers worldwide.

-

AMAC Technologies stands at the forefront of vacuum sealing and packaging solutions, providing advanced and efficient machinery for various industries, including food, pharmaceutical, and electronics. Since its establishment, the company has been dedicated to innovation, designing equipment that enhances productivity, preserves product integrity, and extends shelf life. AMAC Technologies is recognized for its comprehensive range of products, from fully automatic vacuum packaging systems to specialized vacuum sealing equipment. The company prides itself on offering custom-tailored solutions that address specific customer needs and exceptional customer service. With a focus on technology-driven solutions and sustainability, AMAC Technologies continues to lead in providing vacuum packaging equipment that meets the rigorous demands of modern industry standards.

Key Wafer Vacuum Assembling Equipment Companies:

The following are the leading companies in the wafer vacuum assembling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Shin-Etsu Chemical Co., Ltd.

- Nitto Denko Corporation

- H-Square Corporation

- Ted Pella, Inc.

- AMAC Technologies

- SIPEL ELECTRONIC SA

- Hefei TREC Precision Equipment Co., Ltd.

- Applied Materials Inc.

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

Recent Developments

-

In October 2023, SA-Foundry sp. z o.o. finalized the creation of a state-of-the-art facility designed to produce premium aluminum alloy castings through the High Pressure Die Casting (HPDC) method for a new client. This newly established HPDC facility is customized to meet the specific needs of the client, enabling them to enhance their output of superior aluminum alloy castings.

Wafer Vacuum Assembling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.22 billion

Revenue forecast in 2030

USD 3.12 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Shin-Etsu Chemical Co., Ltd., Nitto Denko Corporation, H-Square Corporation, Ted Pella, Inc., AMAC Technologies, SIPEL ELECTRONIC SA, Hefei TREC Precision Equipment Co., Ltd., Applied Materials Inc., Tokyo Electron Limited, Lam Research Corporation, KLA Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wafer Vacuum Assembling Equipment Market Report Segmentation

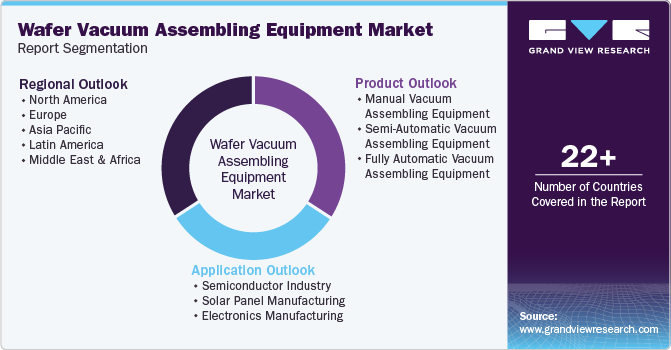

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wafer vacuum assembling equipment market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Vacuum Assembling Equipment

-

Semi-Automatic Vacuum Assembling Equipment

-

Fully Automatic Vacuum Assembling Equipment

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Semiconductor Industry

-

Solar Panel Manufacturing

-

Electronics Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wafer vacuum assembling equipment market size was estimated at USD 2.11 billion in 2023 and is expected to reach USD 2.22 billion in 2024.

b. The wafer vacuum assembling equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 3.12 billion by 2030.

b. The semiconductor industry application segment led the market and accounted for 53.2% of the global market revenue share in 2023. In the semiconductor industry, wafer vacuum assembly equipment plays a crucial role in the fabrication and assembly of semiconductor devices. These sophisticated machines are used for processes such as wafer bonding, chip encapsulation, and the precise alignment of wafer layers under vacuum conditions to ensure flawless adhesion without contaminants or air bubbles.

b. Some of the key players operating in the wafer vacuum assembling equipment market include Shin-Etsu Chemical Co., Ltd., Nitto Denko Corporation, H-Square Corporation, Ted Pella, Inc., AMAC Technologies, SIPEL ELECTRONIC SA, Hefei TREC Precision Equipment Co., Ltd., Applied Materials Inc., Tokyo Electron Limited, Lam Research Corporation, KLA Corporation.

b. The demand for wafer vacuum assembling equipment is on a significant upswing, fueled by the growth in the semiconductor industry. Technological advancements, the surge in consumer electronics, and the expanding applications of semiconductors in various sectors such as automotive, healthcare, and IoT are further driving the market demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."