Wafer Processing Equipment Market Size, Share & Trends Analysis Report By Process (Deposition, Etch, Mass Technology, Strip & Clean), By Application (Memory Devices, Sensors), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-466-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Wafer Processing Equipment Market Trends

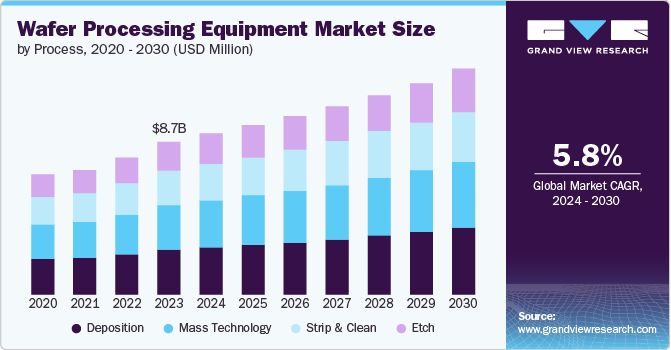

The global wafer processing equipment market size was estimated at USD 8,710.5 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The market has witnessed significant growth, spurred on by the increasing demand for consumer electronics and the expansion of emerging technologies such as artificial intelligence, 5G communication, and autonomous vehicles, which require advanced semiconductor components. This growth is further supported by the ongoing trend of miniaturization of electronic devices, necessitating the production of more compact and complex integrated circuits. As a result, semiconductor manufacturers are constantly seeking innovative and more capable wafer processing equipment to meet these stringent requirements, fueling the market's expansion.

The market encompasses a wide range of machinery and systems used for the production of semiconductor wafers, which are integral components in the manufacturing of electronic devices, including smartphones, computers, and many types of IoT devices. As technology continues to advance, the demand for more sophisticated and efficient processing equipment grows, driven by the need for smaller, faster, and more energy-efficient semiconductor chips.

The advent of extreme ultraviolet (EUV) lithography, a groundbreaking technology for producing extremely small features on chips, is set to revolutionize the industry and drive demand for new processing equipment. In addition, the global push towards cleaner energy and the electrification of the automotive sector are expected to increase the demand for power semiconductors, further bolstering the market.

Drivers, Opportunities & Restraints

The market is primarily driven by the relentless demand for advanced semiconductor chips, fueled by the rapid proliferation of consumer electronics, such as smartphones, tablets, and wearable devices. In addition, the advent of cutting-edge technologies, including 5G, Internet of Things (IoT), artificial intelligence (AI), and electric vehicles, necessitates the development of more sophisticated, high-performance semiconductor devices. This, in turn, requires the use of advanced wafer processing equipment capable of manufacturing smaller, faster, and more energy-efficient chips, thereby driving market growth.

The market is teeming with opportunities, especially from emerging technologies that require novel semiconductor devices. The shift towards electric and autonomous vehicles presents a significant opportunity for the expansion of the wafer processing equipment sector, as these vehicles rely heavily on advanced semiconductor components. Similarly, the global push towards renewable energy and the deployment of 5G networks are creating substantial demand for new semiconductor technologies, offering lucrative prospects for companies involved in the development and manufacturing of wafer processing equipment.

Despite the robust growth prospects, the market faces several restraints. High initial investments and the complexity of manufacturing processes pose significant barriers to entry and can deter new market participants. In addition, the cyclical nature of the semiconductor industry can lead to volatility in demand for wafer processing equipment, impacting manufacturers' revenue streams and investment capacity.

Process Insights

“The demand for etch segment is expected to grow at a CAGR of 6.2% from 2024 to 2030 in terms of revenue”

Based on process, the deposition process segment led the market with the largest revenue share of 29.3% in 2023. The deposition process segment within the market plays a pivotal role in semiconductor manufacturing, characterized by its emphasis on precision, uniformity, and material properties. The demand for deposition process equipment is soaring, driven by the semiconductor industry's push towards miniaturization and the need for advanced, multi-layered integrated circuits (ICs) with superior electrical properties. These deposition techniques enable the production of thin films with high purity and precision, essential for the functionality and performance of the semiconductor devices.

The etch process segment is a critical component of the market, playing an indispensable role in shaping and defining the intricate patterns required for semiconductor devices. Etching equipment is utilized to selectively remove material from the semiconductor wafer to create the desired circuit patterns, a process that is essential for the manufacturing of transistors, interconnects, and other key features of integrated circuits (ICs). Dry (plasma) etching and wet chemical etching are the primary methodologies employed, with dry etching gaining prominence due to its ability to offer finer precision, better controllability, and compatibility with photolithography patterns.

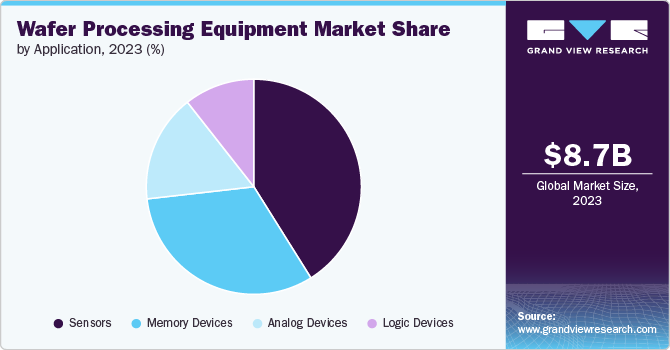

Application Insights

“The demand form memory devices application segment is expected to grow at a significant CAGR of 5.2% from 2024 to 2030 in terms of revenue”

Based on application, the sensors segment led the market with the largest revenue share of 41.1% in 2023. The sensors application segment within the market is experiencing robust growth, underpinned by the escalating demand for sensors in various industries such as automotive, consumer electronics, healthcare, and industrial automation. This surge is largely attributed to the increasing integration of sensors in devices for enhanced connectivity, monitoring, and data collection capabilities, particularly in the context of the Internet of Things (IoT) and smart devices. Wafer processing equipment tailored for sensor manufacturing must accommodate a diverse range of material types and complex structures, reflecting the varied nature of sensor applications, from pressure and temperature sensors in automotive applications to MEMS (Micro-Electro-Mechanical Systems) and advanced imaging sensors in smartphones and medical devices.

The memory devices segment remains a cornerstone of the market, driven by the insatiable global demand for data storage and rapid processing capabilities across a myriad of applications, from consumer electronics to enterprise-level data centers. This sector's growth is fueled by advancements in both volatile memory types, such as DRAM (Dynamic Random Access Memory), and non-volatile memory types, including NAND flash and newer technologies like 3D XPoint.

Regional Insights

“China to witness fastest market growth at 6.9% CAGR”

The wafer processing equipment market in North America is experiencing steady growth owing to significant investments in research and development, and strong presence of leading semiconductor companies. This region benefits from advanced technological infrastructure and a highly skilled workforce, facilitating the development and adoption of next-generation semiconductor technologies. North America is particularly strong in the design and manufacturing of high-end semiconductor equipment, driven by ongoing advancements in sectors such as artificial intelligence, 5G communication, automotive, and data storage.

U.S. Wafer Processing Equipment Market Trends

The growth of the wafer processing equipment market in the U.S. is fueled by rising demand for semiconductor devices across industries such as consumer electronics, automotive, and telecommunications. The advent of advanced technologies such as 5G and IoT (Internet of Things) drives the need for higher performance and miniaturized chips, necessitating sophisticated processing solutions. Additionally, increased investments in domestic semiconductor manufacturing and a focus on sustainable, energy-efficient practices further boost market expansion in the country.

Asia Pacific Wafer Processing Equipment Market Trends

Asia Pacific dominated the wafer processing equipment market with the largest revenue share of 47.58% in 2023, due to its strong semiconductor manufacturing base, with countries like South Korea, China, and Japan leading the charge. This region benefits from the presence of key semiconductor companies, extensive manufacturing facilities, and a rapidly growing electronics industry. The demand for consumer electronics, smart devices, and telecommunications infrastructure, particularly with the rollout of 5G networks, has further bolstered the need for advanced semiconductor components, subsequently driving the demand for wafer processing equipment.

The wafer processing equipment market in China is estimated to grow at a significant CAGR of 6.9% over the forecast period. The market in China is experiencing rapid growth, propelled by the country's ambitious goals to achieve self-sufficiency in semiconductor production and reduce its reliance on foreign technology.The Chinese government has been heavily investing in the semiconductor sector, including wafer processing equipment, through favourable policies, substantial financial injections, and the establishment of national projects and funds aimed at fostering innovation and scaling production capabilities.

Europe Wafer Processing Equipment Market Trends

The wafer processing equipment market in Europe is experiencing growth fuelled by a combination of factors, including increased investment in semiconductor research and manufacturing, government initiatives aimed at bolstering the tech industry, and the rising demand for advanced electronics. Europe's strategy focuses on strengthening its position in the global semiconductor industry by enhancing innovation and securing supply chains, particularly in response to the global chip shortage that highlighted vulnerabilities in tech dependencies.

Key Wafer Processing Equipment Company Insights

Some of the key players operating in the market include Applied Materials Inc., ASML Holding Semiconductor Company, and Tokyo Electron Limited, among others.

-

Applied Materials, Inc. is a leading global company in the market, renowned for its broad portfolio of innovative solutions that serve the semiconductor, display, and related industries. The company's pioneering products and services are critical in the manufacturing of virtually every new chip and advanced display in the world. With a strong commitment to facilitating the acceleration of the electronic revolution

-

ASML Holding N.V. is a pivotal player within the global semiconductor industry, particularly renowned for its leadership in the photolithography sector of wafer processing equipment. ASML specializes in developing, producing, and selling advanced semiconductor equipment, with a keen focus on lithography systems integral to the fabrication of integrated circuits (ICs)

Key Wafer Processing Equipment Companies:

The following are the leading companies in the wafer processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Applied Materials Inc

- ASML Holding Semiconductor Company

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- DISCO

- Hitachi Kokusai Linear

- KLA Corporation

- Lam Research Corporation

- Motorola Solutions, Inc.

- Nikon Corporation,

- Plasma-Therm

- Spts Technologies Ltd

Recent Developments

-

In June 2023, Lam Research Corporation has recently announced the launch of its innovative Coronus DX system, designed to enhance the capabilities of advanced wafer semiconductor manufacturing. This state-of-the-art system addresses critical challenges in fabricating next-generation semiconductor devices, offering unparalleled precision and efficiency

-

In July 2023, Applied Materials recently introduced a groundbreaking wafer manufacturing platform designed to revolutionize the semiconductor industry by reducing the requisite cleanroom space by an impressive 30%. This innovative platform embodies a leap forward in semiconductor manufacturing technology, addressing both the demand for increased efficiency and the need to lower operational costs

Wafer Processing Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9,197.4 million |

|

Revenue forecast in 2030 |

USD 12,895.3 million |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Process, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Applied Materials, Inc.; ASML Holding Semiconductor Company Tokyo Electron Limited; Lam Research Corporation; KLA Corporation; DISCO; Hitachi Kokusai Linear; KLA Corporation Lam Research Corporation; Motorola Solutions; Inc.; Nikon Corporation; Plasma-Therm; Spts Technologies Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wafer Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wafer processing equipment market report based on the process, application and region:

-

Process Outlook (Revenue, USD Million; 2018 - 2030)

-

Deposition

-

Etch

-

Mass Technology

-

Strip and Clean

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Memory Devices

-

Logic Devices

-

Analog Devices

-

Sensors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The wafer processing equipment market is primarily driven by the relentless demand for advanced semiconductor chips, fueled by the rapid proliferation of consumer electronics, such as smartphones, tablets, and wearable devices. Additionally, the advent of cutting-edge technologies, including 5G, Internet of Things (IoT), artificial intelligence (AI), and electric vehicles, necessitates the development of more sophisticated, high-performance semiconductor devices. This, in turn, requires the use of advanced wafer processing equipment capable of manufacturing smaller, faster, and more energy-efficient chips, thereby driving market growth.

b. The global wafer processing equipment market size was estimated at USD 8,710.5 million in 2023 and is expected to reach USD 9,197.4 million in 2024.

b. The global wafer processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 12,895.3 million by 2030.

b. Asia Pacific dominated the wafer processing equipment market with a revenue share of 47.5% in 2023. The Asia Pacific region holds a significant share in the global wafer processing equipment market, primarily due to its strong semiconductor manufacturing base, with countries like South Korea, China, and Japan leading the charge.

b. Some of the key players operating in the wafer processing equipment market include Applied Materials Inc, ASML Holding Semiconductor Company, Tokyo Electron Limited, Lam Research Corporation, KLA Corporation, DISCO, Hitachi Kokusai Linear, KLA Corporation, Lam Research Corporation, Motorola Solutions, Inc., Nikon Corporation,, Plasma-Therm, Spts Technologies Ltd.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."