Volumetric Construction Market Size, Share & Trends Analysis Report By Product (Relocatable, Permanent), By End-use (Residential, Commercial), By Region (North America, Asia Pacific, Europe, Central & South America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-522-9

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Volumetric Construction Market Trends

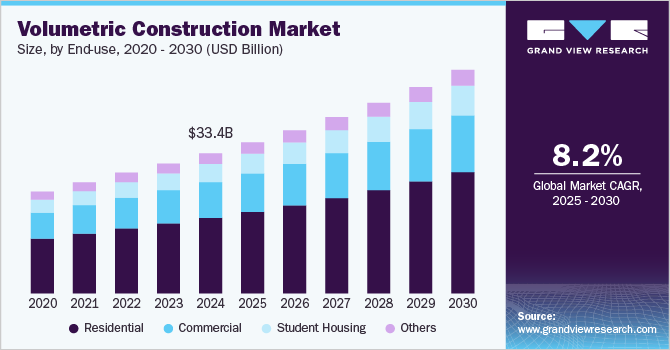

The global volumetric construction market size was estimated at USD 33.41 billion in 2024 and is expected to grow at a CAGR of 8.2% from 2025 to 2030. The global volumetric construction market is primarily driven by the increasing demand for faster and cost-effective building solutions. Traditional construction methods often face challenges such as labor shortages, material wastage, and extended project timelines, which have led developers to adopt modular and prefabricated construction techniques. Volumetric construction, which involves the off-site manufacturing of complete building modules, significantly reduces construction time and labor costs while improving efficiency. Additionally, governments and private investors are promoting modular construction to address the rising demand for housing and infrastructure, especially in rapidly urbanizing regions.

The growth of the commercial and healthcare infrastructure sector is also a significant factor propelling the industry. With increasing investments in office buildings, hotels, hospitals, and educational institutions, developers are turning to volumetric construction to expedite project completion without compromising quality. This method ensures strict compliance with building standards and allows for high precision in design, making it ideal for healthcare facilities where hygiene and efficiency are paramount. Additionally, the COVID-19 pandemic accelerated the need for modular hospitals and quarantine facilities, further demonstrating the benefits of volumetric construction in addressing urgent infrastructure demands.

Another key driver of market growth is the rising focus on sustainability and environmentally friendly building practices. Volumetric construction minimizes material waste, reduces carbon footprints, and allows for better resource management compared to traditional methods. The integration of energy-efficient materials, such as insulated panels and sustainable composites, enhances building performance while meeting global environmental regulations. Additionally, the ability to reuse or relocate prefabricated modules contributes to circular economy initiatives, further promoting the adoption of volumetric construction across residential, commercial, and industrial sectors.

Market Concentration & Characteristics

The global volumetric construction industry exhibits a moderate to high concentration, with key players leveraging advanced manufacturing techniques, automation, and material innovations to gain a competitive edge. The degree of innovation is substantial, as companies focus on prefabrication, modular integration, and sustainable building materials to improve efficiency and reduce construction time.

Technological advancements such as 3D printing, AI-driven design optimization, and robotic automation have enhanced the scalability and precision of volumetric construction, making it a viable solution for residential, commercial, and industrial projects. The growing emphasis on energy-efficient and net-zero buildings has further driven innovation, leading to the development of lightweight composite materials, improved insulation solutions, and smart construction techniques that meet stringent sustainability standards.

Regulatory frameworks play a significant role in shaping the volumetric construction market, with stringent building codes, zoning laws, and environmental regulations influencing design and material choices. While some regions, such as North America and Europe, have established clear guidelines promoting modular construction, others still face challenges related to standardization and certification.

Service substitutes, such as traditional on-site construction and panelized prefabrication, remain strong competitors; however, volumetric construction’s cost efficiency, reduced labor dependency, and faster project timelines continue to drive its adoption. The end-user concentration is largely observed in affordable housing, commercial real estate, and infrastructure development, with increasing demand from healthcare, hospitality, and educational institutions due to the need for rapid, scalable, and high-quality construction solutions.

End-use Insights

The residential segment dominated the market and accounted for the largest revenue share of 54.0% in 2024, driven by the increasing demand for affordable, high-quality, and rapidly built housing solutions. With rising urbanization and population growth, many regions face housing shortages, prompting governments and private developers to adopt volumetric construction as a faster and more efficient alternative to traditional building methods. The ability to prefabricate entire housing modules off-site significantly reduces construction time, labor costs, and material waste, making it an ideal solution for large-scale residential projects, multi-family housing, and affordable housing initiatives.

The student housing segment is expected to grow significantly at a CAGR of 8.6% over the forecast period. Sustainability and energy efficiency are key factors influencing the adoption of volumetric construction in student housing projects. Many universities and institutions are focusing on green building initiatives to reduce their environmental footprint. Modular construction allows for better insulation, energy-efficient designs, and waste reduction, aligning with global sustainability goals.

Product Insights

The permanent segment led the market and accounted for the largest revenue share of 63.8% in 2024, driven by the growing demand for sustainable, cost-efficient, and rapidly deployable building solutions across various sectors, including residential, commercial, healthcare, and education.

The relocatable segment is expected to grow at the fastest CAGR of 7.9% over the forecast period, driven by the growing need for flexible, reusable, and cost-efficient building solutions across various industries. Relocatable modular structures offer quick deployment, easy dismantling, and reusability, making them an ideal choice for temporary housing, disaster relief, military applications, educational facilities, and commercial spaces.

Regional Insights

North America volumetric construction market is driven by the growing demand for cost-effective and time-efficient building solutions. The region is experiencing a surge in residential and commercial construction projects, fueled by rapid urbanization and population growth. Volumetric construction, which involves manufacturing building modules off-site and assembling them on-site, significantly reduces construction timelines and labor costs compared to traditional methods. The ongoing labor shortage in the construction sector further accelerates the adoption of modular solutions, as developers seek alternatives that require less on-site workforce while maintaining high-quality standards.

U.S. Volumetric Construction Market Trends

The volumetric construction market in the U.S. is driven by the growing need for affordable and rapid housing solutions, particularly in response to rising urbanization and housing shortages. With increasing real estate costs and labor shortages in the traditional construction sector, developers are turning to volumetric construction to accelerate project timelines and reduce expenses. Prefabricated and modular building techniques allow for faster assembly, minimizing on-site disruptions and optimizing material usage.

Asia Pacific Volumetric Construction Market Trends

The Asia-Pacific (APAC) volumetric construction market is primarily driven by rapid urbanization and increasing infrastructure development across key economies such as China, India, Japan, and Southeast Asian nations. As cities expand to accommodate growing populations, there is a rising demand for efficient, cost-effective, and scalable construction solutions, making volumetric construction a preferred choice. Governments in the region are investing heavily in smart cities, affordable housing, and commercial real estate, further accelerating the adoption of modular and prefabricated building solutions.

The volumetric construction market in China is further propelled by government-backed infrastructure projects and public-private partnerships aimed at enhancing the country’s built environment. Large-scale initiatives such as the Belt and Road Initiative (BRI) and the development of new urban districts and smart cities have created a strong demand for modular and prefabricated construction methods. These projects require rapid, scalable, and cost-effective building solutions, making volumetric construction an ideal choice. Additionally, China's dual-carbon goals, which aim to achieve peak carbon emissions by 2030 and carbon neutrality by 2060, have driven the adoption of energy-efficient and low-waste construction techniques, further boosting the volumetric construction market.

Europe Volumetric Construction Market Trends

Europe volumetric construction market accounted for the largest revenue share of about 45.72% in 2024, driven by the rising demand for affordable and sustainable housing solutions. With increasing urbanization and population growth, several European countries face a housing shortage, prompting governments and private developers to adopt modular and volumetric construction techniques for faster and more cost-effective building solutions. Additionally, stringent energy efficiency regulations, such as the EU Green Deal and Nearly Zero-Energy Buildings (NZEB) directive, have accelerated the shift towards volumetric construction, as prefabricated modules can be designed to meet high sustainability and insulation standards, reducing energy consumption in residential and commercial buildings.

The volumetric construction market in Germany is further driven by the government’s push for digitalization and automation in the construction industry. The adoption of Building Information Modeling (BIM), AI-driven design optimization, and robotics has significantly improved the precision and efficiency of modular construction. These technologies allow for streamlined planning, reduced material waste, and better integration of smart building systems. The German government has been actively promoting digital transformation in the construction sector through initiatives like the National Platform for the Digitalization of Construction. These policies encourage companies to integrate advanced prefabrication techniques and automation, leading to increased adoption of volumetric construction in both residential and commercial developments

Latin America Volumetric Construction Market Trends

The growth of sustainable and energy-efficient construction practices is accelerating the adoption of volumetric construction in the Latin America market. With governments and private sectors focusing on green building certifications, energy efficiency, and carbon footprint reduction, modular construction using recyclable materials, improved insulation, and renewable energy integration have gained traction. The push toward net-zero buildings and the need to meet international environmental standards have led developers to opt for prefabricated solutions that align with sustainability goals while reducing waste and emissions.

Middle East & Africa Volumetric Construction Market Trends

Another key driver is the growing investment in commercial infrastructure and hospitality projects, particularly in the Gulf Cooperation Council (GCC) countries. With the region positioning itself as a global business and tourism hub, there is an increasing demand for hotels, office spaces, and mixed-use developments that can be constructed quickly and efficiently. The volumetric construction approach significantly reduces project timelines, making it highly attractive for developers looking to meet tight deadlines. Mega-projects such as NEOM in Saudi Arabia and Expo City Dubai are further accelerating the adoption of modular construction technologies, as they emphasize sustainability, smart city infrastructure, and cutting-edge building techniques.

Key Volumetric Construction Company Insights

Some key players operating in the market include Guerdon, LLC, and Synergy, Inc.

-

Guerdon, LLC serves a wide range of industries, including multifamily housing, hospitality, student housing, and workforce accommodations. Guerdon’s product offerings include custom-engineered modular structures designed for both permanent and temporary applications. The company provides fully integrated building modules that encompass structural elements, interior finishes, and mechanical, electrical, and plumbing (MEP) systems. Its modular units are manufactured off-site and assembled on location, significantly reducing construction time and costs while ensuring superior quality and durability.

-

Synergy, Inc. is a modular construction company specializing in volumetric building solutions tailored for commercial, residential, and institutional projects. The company’s product offerings include customized modular units, prefabricated building components, and fully assembled volumetric modules. Synergy provides turnkey solutions, including design, engineering, manufacturing, and on-site installation, ensuring a seamless construction process.

The Boldt Company, DMD Modular p.s.aare some emerging market participants in the volumetric construction industry.

-

Boldt’s product offerings include pre-engineered modular buildings, structural modular components, and prefabricated healthcare facilities. The company integrates Building Information Modeling (BIM) and Lean construction principles to optimize project efficiency and reduce waste. Its volumetric modules are designed for rapid deployment, making them ideal for temporary medical units, modular hospitals, and large-scale institutional projects.

-

DMD Modular’s product offerings include fully prefabricated modular units for hotels, student accommodations, and residential developments. The company provides high-tech modular solutions integrated with smart home technologies, passive energy systems, and sustainable construction materials. Its hotel and multifamily modular solutions are particularly popular in Europe, offering rapid deployment, minimal site disruption, and cost savings for developers.

Key Volumetric Construction Companies:

The following are the leading companies in the volumetric construction market. These companies collectively hold the largest market share and dictate industry trends.

- Guerdon, LLC

- Synergy, Inc.

- The Boldt Company

- DMD Modular p.s.a

- VOLUMETRIC MODULAR LTD.

- Vision Volumetric

- H.A. Marks Construction Limited

- MPH Building Systems Ltd

- Enevate Homes Limited

Recent Developments

-

In July 2024, InstaBuilt announced the launch of its panelized and volumetric housing solutions in the U.S. market, marking a significant advancement in the volumetric construction industry. With a focus on affordable, energy-efficient, and rapid construction, InstaBuilt's innovative approach integrates prefabricated panelized and fully volumetric modules to streamline the building process, reducing labor costs and construction timelines. The company’s expansion aligns with the growing demand for sustainable and scalable housing solutions, particularly in urban and disaster-relief housing projects.

Volumetric Construction Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 36.03 billion |

|

Revenue forecast in 2030 |

USD 53.34 billion |

|

Growth rate |

CAGR of 8.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America;, Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; Australia, Brazil, Saudi Arabia |

|

Key companies profiled |

Guerdon, LLC; Synergy, Inc.; The Boldt Company; DMD Modular p.s.a; VOLUMETRIC MODULAR LTD.; Vision Volumetric; H.A. Marks Construction Limited; MPH Building Systems Ltd; Enevate Homes Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Volumetric Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global volumetric construction market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Relocatable

-

Permanent

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Student Housing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global volumetric construction market size was estimated at USD 33.41 billion in 2024 and is expected to reach USD 36.03 billion in 2025.

b. The global volumetric construction market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 53.34 billion by 2030.

b. Based on end use, the residential segment dominated the market and accounted for the largest revenue share of 54.0% in 2024, driven by the increasing demand for affordable, high-quality, and rapidly built housing solutions.

b. Some of the key players operating in the volumetric construction market include Guerdon, LLC, Synergy, Inc., The Boldt Company, DMD Modular p.s.a, VOLUMETRIC MODULAR LTD., Vision Volumetric, H.A. Marks Construction Limited, MPH Building Systems Ltd, and Enevate Homes Limited.

b. The key factors that are driving the volumetric construction market is growing demand for affordable housing, student accommodations, healthcare facilities, and commercial spaces.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."