- Home

- »

- Distribution & Utilities

- »

-

Volt VAR Management Market Size And Share Report, 2030GVR Report cover

![Volt VAR Management Market Size, Share & Trends Report]()

Volt VAR Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software & Services), By Application (Distribution, Transmission, Generation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-394-1

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Volt VAR Management Market Summary

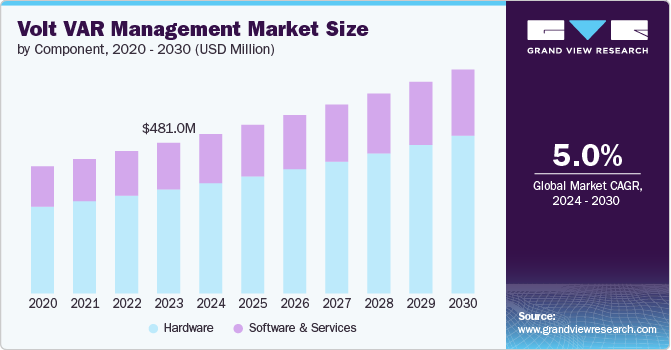

The global Volt VAR management market size was estimated at USD 481.0 million in 2023 and is projected to reach USD 715.1 million in 2030, growing at a CAGR of 5.0% from 2024 to 2030. The market is primarily driven by the growing demand for energy efficiency in power distribution systems.

Key Market Trends & Insights

- North America Volt/VAR management market accounted for the largest revenue share of 39.9% in 2023.

- The Volt/VAR management market in the U.S. is anticipated to grow at a CAGR of 5.5% from 2024 to 2030.

- Based on components, hardware segment dominated the market with a revenue share of 69.0% in 2023.

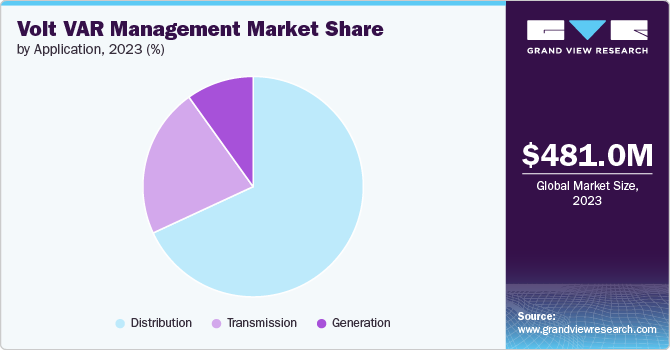

- Based on application, the distribution segment accounted for the largest revenue share of 68.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 481.0 Million

- 2030 Projected Market Size: USD 715.1 Million

- CAGR (2024-2030): 5.0%

- North America: Largest market in 2023

As utilities and grid operators strive to minimize losses and optimize voltage levels, VVM systems play a crucial role in improving the operational efficiency of electrical networks. These systems help reduce energy wastage by optimizing reactive power, which in turn minimizes energy losses in the transmission and distribution networks. The drive for greener, more efficient power systems, supported by regulatory mandates and incentives, further propels the market demand.Furthermore, increasing integration of renewable energy sources, such as solar and wind power, into the grid presents significant challenges for voltage and reactive power management. The intermittent and variable nature of renewable energy generation can cause voltage fluctuations and affect grid stability. Volt/VAR management technologies are essential for maintaining optimal voltage levels and ensuring reliable power supply despite these fluctuations. Hence, the rising demand for renewables in the energy mix thereby drives the overall product growth.

Advancements in technology related to Volt/VAR management and the development of smart grids are significant drivers of the market. Innovations in communication technologies, sensors, and data analytics enable more precise and real-time monitoring and control of voltage and reactive power. Smart grid initiatives, which include the deployment of advanced metering infrastructure (AMI) and distributed energy resources (DERs), rely heavily on Volt/VAR management systems to enhance grid reliability and efficiency. These technological advancements facilitate more effective voltage regulation and energy optimization is expected to further boost the product demand.

However, the high initial investment required for the deployment of these systems is expected to restrain market growth. Costs associated with advanced hardware, software, and integration can be substantial, particularly for utilities with limited financial resources. Additionally, the implementation of Volt/VAR management often involves significant infrastructure upgrades and modifications, further increasing costs. This financial burden can deter smaller utilities or those in developing regions from adopting VVM technologies, further limiting market growth.

Component Insights

Based on components, hardware dominated the market with a revenue share of 69.0% in 2023 and is further expected to grow at the fastest rate over the forecast period. Hardware components effectively monitor and control of voltage and reactive power in electrical grids. Key hardware elements include sensors, voltage regulators, capacitor banks, and transformers. These components enable the real-time measurement and adjustment of electrical parameters, ensuring that voltage levels remain within desired ranges to optimize power delivery and reduce energy losses.

The adoption of advanced hardware technologies, such as smart sensors and automated control devices, enhances the precision and responsiveness of Volt/VAR management systems, making them more effective in managing grid stability and efficiency. Moreover, the increasing integration of renewable energy sources and the development of smart grids necessitate the deployment of sophisticated hardware infrastructure. For instance, dynamic voltage restorers and solid-state transformers are being utilized to address the challenges posed by the intermittent nature of renewable energy generation. These advanced hardware solutions provide utilities with the capability to quickly respond to voltage fluctuations and maintain power quality.

Software & services segment is expected to register a CAGR of 4.4% over the forecast period. These components offer the intelligence and analytical capabilities necessary for effective voltage and reactive power management. Software platforms in Volt/VAR management systems enable the collection, analysis, and visualization of data from various grid components, facilitating real-time decision-making and control.

In addition, services such as consulting, training, and maintenance are essential for the successful deployment and operation of Volt/VAR management systems. These services help grid operators design and implement customized VVM solutions that meet specific regulatory, operational, and economic requirements. Furthermore, the integration of cloud-based services and the increasing use of data analytics further enhance the capabilities of Volt/VAR management systems, providing utilities with comprehensive insights into grid performance and enabling proactive management strategies.

Application Insights

Based on application, the distribution segment accounted for the largest revenue share of 68.1% in 2023 and is further expected to grow at a substantial rate over the forecast period. Volt/VAR management focuses on optimizing voltage levels and reactive power to improve the efficiency and reliability of power delivery. In distribution networks, Volt/VAR management systems are crucial for minimizing energy losses and maintaining voltage within acceptable limits across various load conditions.

In transmission, the product is utilized to maintain grid stability and efficient power transfer over long distances. Transmission networks operate at high voltages, and even minor deviations can lead to significant power losses and instability. Volt/VAR management systems help control voltage levels and manage reactive power flows to prevent voltage collapse and other stability issues. This is particularly important in regions with high penetration of variable renewable energy sources, such as wind and solar farms, which can introduce significant variability into the grid.

Furthermore, VVM in transmission systems contributes to optimizing the overall power system operation. By managing reactive power, these systems help improve the power factor, reducing the amount of reactive power that needs to be generated and transmitted. This not only enhances the efficiency of the transmission system but also reduces operational costs and the need for additional reactive power compensation equipment. The integration of advanced VVM technologies, such as dynamic VAR compensators and static VAR compensators, is becoming increasingly common to address the challenges posed by a more dynamic and distributed power grid.

In power generation, Volt/VAR management is essential for controlling the output voltage and reactive power of generators, which is crucial for maintaining grid stability and power quality. Generators must operate within specific voltage and power factor limits to ensure efficient operation and compliance with grid codes. VVM systems help manage these parameters by adjusting the excitation systems of generators, thereby controlling the voltage and reactive power output. Therefore, the generation segment is expected to grow at a CAGR of 1.6% from 2024 to 2030.

Regional Insights

North America Volt/VAR management market accounted for the largest revenue share of 39.9% in 2023. U.S. and Canada are increasingly adopting VVM systems to reduce energy losses and enhance grid reliability, particularly in light of growing renewable energy integration. Moreover, government incentives and regulatory frameworks supporting smart grid initiatives are also supporting the market expansion. The region's mature energy sector, coupled with technological advancements, positions North America as a significant market for VVM solutions.

U.S. Volt VAR Management Market Trends

The Volt/VAR management market in the U.S. is anticipated to grow at a CAGR of 5.5% owing to increasing adoption of renewable energy sources, such as solar and wind. In addition, regulatory mandates and federal incentives for energy efficiency and carbon reduction further stimulate market growth. The presence of key market players and ongoing technological innovation also contribute to the robust expansion of the Volt/VAR management market in the U.S.

Europe Volt VAR Management Market Trends

The Volt/VAR management market in Europe accounted for USD 131.5 million in 2023. European Union's ambitious climate targets drive the adoption of advanced grid management technologies, including Volt/VAR management systems. Countries like Germany, the UK, and France are leading in the implementation of smart grid initiatives, which incorporate VVM solutions to accommodate the growing share of renewable energy. The region's strong regulatory framework, combined with substantial investments in grid infrastructure, supports the steady growth of the Volt/VAR management market.

Asia Pacific VOLT VAR Management Market Trends

The Volt/VAR management market in Asia Pacific is fueled by increasing energy demand and substantial investments in grid modernization. Countries such as China, India, and Japan are focusing on enhancing grid efficiency and reliability to support their expanding industrial base and urbanization. The integration of renewable energy sources, along with government initiatives for smart grid deployment, is driving the adoption of Volt/VAR management systems.

Key VOLT VAR Management Company Insights

Some of the key players operating in the market include ABB Ltd., Siemens AG, Schneider Electric, Eaton, and General Electric:

-

ABB Ltd., headquartered in Zurich, Switzerland, is engaged in manufacturing electrification and automation products. The company provides innovative products, services, and solutions across industries such as energy, transportation, and manufacturing. ABB's offerings in Volt/VAR management include advanced grid automation solutions, transformers, and switchgear, which are crucial for optimizing voltage levels and reactive power in power distribution networks.

-

Siemens AG is a multinational conglomerate headquartered in Munich, Germany, with a strong presence in the industrial, energy, healthcare, and infrastructure sectors. Siemen offers a range of products and solutions, including smart grid technologies, digital substations, and energy automation systems.

S&C Electric Company, DC Systems, Beckwith Electric, Utilidata, and Open Systems International are some of the emerging market participants in the market.

-

S&C Electric Company, based in Chicago, Illinois, specializes in the design and manufacture of switching and protection products for electric power transmission and distribution. The company is known for its solutions that improve grid reliability and operational efficiency. The company offers products like voltage regulators, capacitor banks, and automation systems that help utilities manage voltage and reactive power effectively.

-

DC Systems focuses on developing software and hardware solutions for utility and industrial markets, with a strong emphasis on digitalization and smart grid technologies. The company provides advanced SCADA systems, grid automation software, and VVM solutions that enable efficient grid management and energy optimization.

Key Volt VAR Management Companies:

The following are the leading companies in the volt var management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Siemens AG

- S&C Electric Company

- DC Systems

- Beckwith Electric

- Utilidata

- Open Systems International

- Landis+Gyr

- Advanced Control Systems

- Schneider Electric

- Eaton

- General Electric

Recent Developments

- In February 2024, Siemens AG announced the launch of Gridscale X, a software that enables utilities to scale grid capacity and increase DER visibility, essential for grid decarbonization. Moreover, Gridscale X is launched under Siemens Xcelerator portfolio which complements Siemens Xcelerator’s open partner ecosystem.

Volt VAR Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 509.0 million

Revenue forecast in 2030

USD 715.1 million

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

ABB Ltd.; Siemens AG; S&C Electric Company; DC Systems; Beckwith Electric; Utilidata, Open Systems International; Landis+Gyr; Advanced Control Systems; Schneider Electric; Eaton; General Electric

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Volt VAR Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Volt VAR management market report based on component, application and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution

-

Transmission

-

Generation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Volt VAR management market size was estimated at USD 481.0 million in 2023 and is expected to reach USD 509.0 million in 2024.

b. The global Volt VAR management market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 715.1 million by 2030.

b. Based on components, hardware dominated the market with a revenue share of 69.0% in 2023 as hardware components effectively monitor and control of voltage and reactive power in electrical grids.

b. Some of the key players operating in the Volt VAR management market include ABB Ltd., Siemens AG, S&C Electric Company, Schneider Electric, Eaton, and General Electric.

b. The key factor that is driving Volt VAR management market is growing demand for energy efficiency in power distribution systems as utilities and grid operators strive to minimize losses and optimize voltage levels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.