- Home

- »

- Sensors & Controls

- »

-

Volatile Organic Compound (VOC) Gas Sensor Market ReportGVR Report cover

![Volatile Organic Compound (VOC) Gas Sensor Market Size, Share & Trends Report]()

Volatile Organic Compound (VOC) Gas Sensor Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Photo-Ionization Detector, Infrared-based detection), By Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-135-1

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global volatile organic compound (VOC) gas sensor market size was valued at USD 154.1 million in 2022 and is projected to reach USD 233.3 million by 2030, growing at a CAGR of 5.5% from 2023 to 2030. Increasing adoption of volatile organic compound gas sensors to sense and measure the presence of harmful VOCs in the air is a major factor behind the market’s growth. Volatile organic compounds originate from various sources, such as the exhaust gases produced by the combustion of fuel and transportation, as well as emissions from furniture, building materials, and decorative materials, among others. The rising use of VOC gas sensors in indoor air monitoring devices owing to their exceptional characteristics, such as their ability to deliver accurate sensing results, small and portable design, and compact size is further driving the growth of the market.

The widespread adoption of VOC gas sensors in various industries can be attributed to the growing enforcement of regulations and policies by government agencies such as the Mine Safety and Health Administration (MSHA) and the U.S. Environmental Protection Agency (EPA). At the federal level, the regulation of VOCs in the U.S. is regulated by the EPA through 40 CFR 59, which is the national volatile organic compound emission standard for consumer and commercial products. In addition, in Canada, on January 5, 2022, the Volatile Organic Compound Concentration Limits for Certain Products Regulations were issued, which mandate importers and manufacturers to comply with concentration limits for VOCs in about 130 product subcategories and categories. This, in turn, propels the demand for VOC gas sensors in various end-use industries.

Rising integration of the Internet of Things (IoT), advancements in sensing technology, increasing focus on energy efficiency, and rising development of smart cities are some of the major trends propelling the growth of volatile organic compound gas sensor market. The integration of IoT technology is a significant trend in the development of VOC gas sensors. By incorporating IoT, VOC sensors can be connected to the internet and other digital devices, enabling remote monitoring and control of air quality in real time. On the other hand, advanced nanostructured sensing materials have emerged as a promising technique for detecting low concentrations of VOCs in complex gas mixtures, making them suitable for a variety of applications such as environmental monitoring, air quality, medical, and health applications.

Leading manufacturers in the VOC gas sensor market are developing advanced sensors for applications such as the detection of harmful VOC gases and the monitoring of indoor air quality. For instance, in December 2021, Sensirion AG, a leading company in environmental sensing introduced the SGP41 VOC+NOx sensor which detects Volatile Organic Compounds (VOC) and Nitrogen Oxides (NOx) for monitoring indoor air quality. The sensor is created with advanced digital technology that enables it to function as both a smart switch and a control unit for air treatment devices, such as air purifiers.

COVID-19 Insights

The global economy has been adversely impacted by the COVID-19 pandemic. The pandemic has caused significant economic downturns and disruptions in the supply chain across many countries. To prevent the spread of the virus, governments worldwide implemented complete lockdowns, resulting in industry shutdowns and subsequent disruptions in the supply chain. The lockdowns also caused a shortage of labor and materials worldwide, leading to delays in the manufacturing and distribution of gas sensors thereby, negatively affecting the VOC gas sensor market growth.

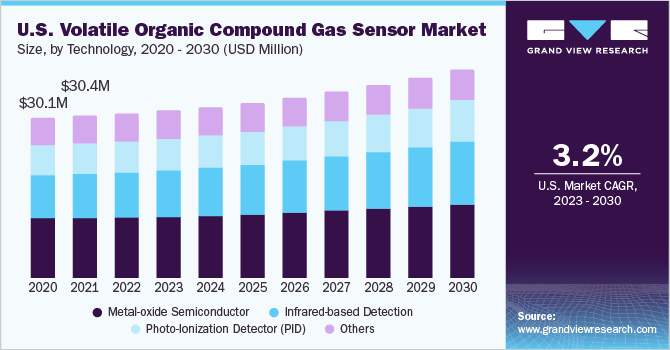

Technology Insights

The metal-oxide semiconductor segment led the market and accounted for more than 37.0% share of the global revenue in 2022. Metal oxide semiconductor gas sensors detect the presence of VOC gases by measuring changes in the conductivity or resistivity of metal oxide surfaces when the gas comes in contact with them. The electronic circuitry of the sensors measures this change and indicates the presence of the gas. These sensors are cost-effective, detect toxic and combustible gases, are resistant to corrosion, and have a longer lifespan. Due to these benefits, they are widely used by various industries such as automotive, petrochemical, and medical.

The Infrared-based (IR) detection technology segment is anticipated to expand at the highest CAGR during the forecast period. Increasing the use of VOC gas sensors in infrared gas detection systems is boosting the segment’s growth. Compared to other technologies, the utilization of infrared gas measurement technology is a relatively new and modern approach, which is increasingly gaining popularity in industrial settings.

Type Insights

The multiple gas detection sensor segment dominated the market and accounted for more than 65.0% share of the global revenue in 2022. Portable and cost-effective multiple gas detection sensors are extensively used in the oil and gas industry for pipeline operations monitoring and detecting a range of gases, including benzene, methylene chloride, perchloroethylene, and formaldehyde, among others. Furthermore, these products are used as efficient VOC analyzers, aiding in the detection of leakages in various components such as pumps, valves, compressors, connectors, and open-ended lines.

The single gas detection sensor segment is expected to expand at the highest CAGR over the forecast period. Primarily utilized in automotive applications, single gas detection sensors are capable of detecting one gas at a time and are ideal for identifying combustible gases, as well as other gases such as butadiene, acetone, toluene, xylene, tetrachloroethylene, methylene chloride, and benzene. Single gas detection sensors are designed to detect the existence of gases within facilities or laboratories and determine their concentration levels. These detectors effectively notify personnel of the presence of hazardous gases, thereby ensuring safety in such indoor settings.

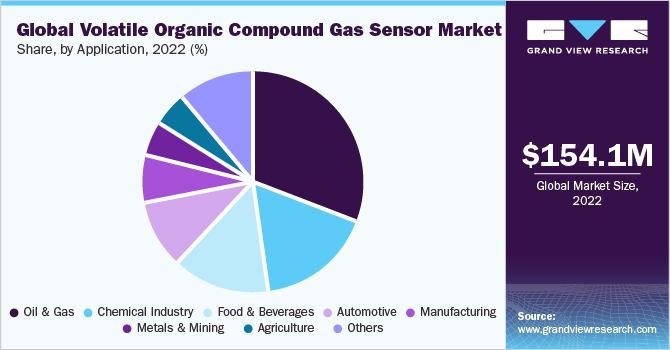

Application Insights

The oil and gas segment accounted for over 31.0% share of the market in 2022. The oil and gas sector comprises a range of operations and equipment, spanning from wells and natural gas gathering lines to processing facilities, transmission pipelines, storage tanks, and distribution networks. The sector is responsible for the highest level of emissions of VOCs among all industrial sources. As a result, the use of VOC gas sensors is growing at a rapid pace for the real-time tracking of the reservoir environment, monitoring of benzene leaks, monitoring of pipelines, and remote monitoring of plant equipment. Furthermore, the surge in demand for petroleum and natural gas has given rise to potential hazards in their production, such as the possibility of being exposed to toxic and flammable gases during extraction. Thus, the rising adoption of VOC gas sensors to detect toxic gases is boosting the segment’s growth.

The food and beverages segment is anticipated to expand at the highest CAGR over the forecast period. The food and beverage manufacturing industry is expected to witness the rapid adoption of digital transformation and smart manufacturing initiatives in the forthcoming years. This growth is expected to arise from numerous food processing industry players that are functional across the value chain. VOC gas sensors are utilized in the industry to detect and measure the presence of gases emitted during the production and storage of food products.

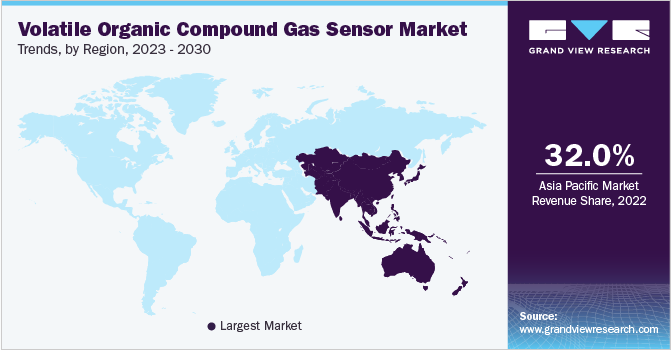

Regional Insights

The Asia Pacific region dominated the market and accounted for more than a 32.0% share of the global revenue in 2022. The region is expected to expand at the highest CAGR during the forecast period. The growth of the market can be attributed to the growing demand for environmental and industrial monitoring solutions across the region. The region comprises several emerging countries, such as India, Japan, Australia, and Taiwan, which are witnessing rapid urbanization and industrialization, resulting in high levels of air pollution and environmental degradation. This has led to a surge in demand for VOC gas sensors, which are extensively used for air quality monitoring and pollution control in various industries, including automotive, and manufacturing. The increasing adoption of IoT and smart technologies in the region is also boosting the growth of the VOC gas sensor market.

The Europe region is expected to expand at a significant CAGR during the forecast period. The high focus of the governments on energy efficiency and VOC gas emission control standards has resulted in the proliferation of VOC gas sensors in the region. The growth in end-use industries and increasing application areas are also expected to be the major factors driving regional growth. In addition, the vast presence of VOC gas sensor manufacturers such as Siemens AG, Sensirion AG, and Ion Science Ltd. in the region is further propelling the growth of the VOC gas sensor market.

Key Companies & Market Share Insights

The market players in the VOC gas sensor industry are continuously working towards new product development and up-gradation of their existing product portfolio. For strategic growth, players such as Ion Science Ltd.; ABB Ltd.; and Bosch Sensortec GmbH, prefer collaborations with other players or EV manufacturers. For instance, in April 2023, Renesas Electronics Corporation released firmware for their ZMOD digital air quality sensors, enabling engineers to customize the sensors to comply with a range of green air quality standards for public & commercial buildings. ZMOD digital gas sensors sense total volatile organic compounds (TVOC), Ozone, and Nitrogen Dioxide gases.

In addition, in November 2022, ION Science Ltd. launched a range of portable VOC detectors under the name Tiger XT, offering users improved levels of durability and performance. The Tiger XT model is equipped with MiniPID sensor technology. This technology plays a vital role in the instrument's outstanding performance by providing swift response time, highly sensitive detection capabilities for low levels of gas, and an exceptionally wide measurement range.

Furthermore, in March 2021, Robert Bosch GmbH’s Bosch Sensortec introduced a new gas sensor, known as the BME688, which integrates four types of environmental measurements, including gas, humidity, temperature, and barometric pressure sensing. Notably, this cutting-edge sensor incorporates artificial intelligence technology to provide enhanced air quality analysis. With its advanced capabilities, the gas sensor can effectively detect a wide range of volatile organic compounds and various other gases that contribute to indoor air pollution. Some of the prominent players in the volatile organic compound (VOC) gas sensor market include:

-

Alphasense

-

Honeywell International Inc.

-

Bosch Sensortec GmbH

-

ABB Ltd.

-

Siemens AG

-

Ion Science Ltd.

-

SGX Sensortech

-

Renesas Electronics Corporation

-

EcoSensors

-

Sensirion AG

Volatile Organic Compound Gas Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 160.3 million

Revenue forecast in 2030

USD 233.3 million

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; France; Germany; China; India; Japan; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Alphasense; Honeywell International Inc.; Bosch Sensortec GmbH; ABB Ltd.; Siemens AG; Ion Science Ltd.; SGX Sensortech; Renesas Electronics Corporation; EcoSensors; Sensirion AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

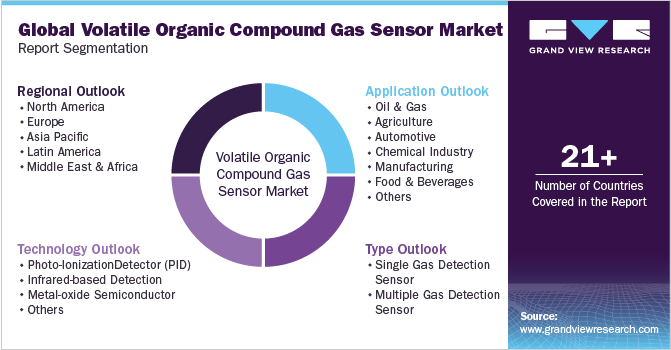

Global Volatile Organic Compound Gas Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global volatile organic compound (VOC) gas sensor market report based on technology, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Photo-Ionization Detector (PID)

-

Infrared-based Detection

-

Metal-oxide Semiconductor

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Gas Detection Sensor

-

Multiple Gas Detection Sensor

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Agriculture

-

Automotive

-

Chemical Industry

-

Manufacturing

-

Food & Beverages

-

Metals & Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global volatile organic compound gas sensor market size was estimated at USD 154.1 million in 2022 and is expected to reach USD 160.3 million in 2023.

b. The global volatile organic compound (VOC) Gas Sensor Market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 233.3 million by 2030.

b. Some key players operating in the volatile organic compound gas sensor market include Alphasense; Honeywell International Inc.; Bosch Sensortec GmbH; ABB Ltd.; Siemens AG; Ion Science Ltd.; SGX Sensortech; Renesas Electronics Corporation; EcoSensors; Sensirion AG

b. Asia Pacific dominated the volatile organic compound gas sensor market with a share of more than 32.0% in 2022. This is attributable to the increasing industrial automation, where these sensors are largely used in chemical and petrochemical and oil and gas industries.

b. Key factors driving the volatile organic compound gas sensor market growth include increasing awareness about environment safety is driving the adoption of products used in the air monitoring systems to detect pollution levels and volatile organic compounds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.