- Home

- »

- Next Generation Technologies

- »

-

Voice Commerce Market Size, Share & Growth Report, 2030GVR Report cover

![Voice Commerce Market Size, Share & Trends Report]()

Voice Commerce Market (2024 - 2030) Size, Share & Trends Analysis Report By Device Type (Smart Speakers, Smartphones), By Industry Vertical (Consumer Goods & Retail, Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-453-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Voice Commerce Market Summary

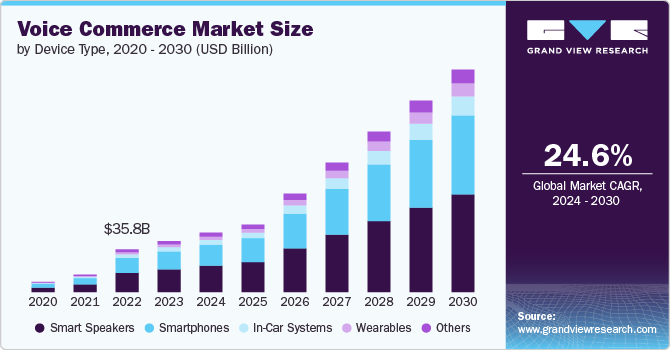

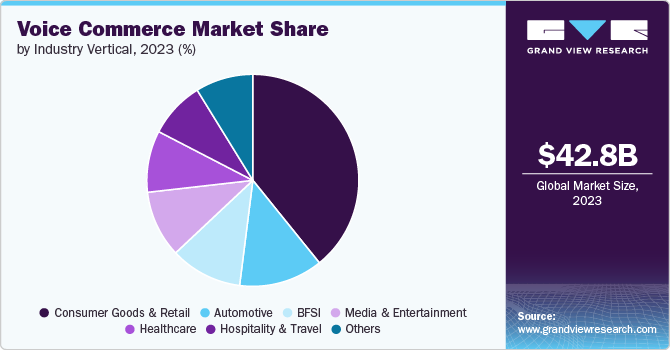

The global voice commerce market size was estimated at USD 42.75 billion in 2023 and is projected to reach USD 186.28 billion by 2030, growing at a CAGR of 24.6% from 2024 to 2030. The market is expanding rapidly, driven by the growing adoption of smart speakers, smartphones, and IoT devices that enable voice-based interactions.

Key Market Trends & Insights

- North America led the voice commerce market, with the largest revenue share of over 37% in 2023.

- By device type, the smart speakers segment led the market, with a revenue share of over 44% in 2023.

- By industry vertical, the consumer goods segment led the market, with a revenue share of over 39.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 42.75 Billion

- 2030 Projected Market Size: USD 186.28 Billion

- CAGR (2024-2030): 24.6%

- North America: Largest market in 2024

Consumers are increasingly using voice assistants like Amazon Alexa and Google Assistant for shopping due to the convenience of hands-free, quick transactions. These devices allow consumers to perform tasks, including shopping, using simple voice commands, making the process more convenient and accessible from anywhere.

The proliferation of IoT-connected devices further enhances this capability, enabling seamless voice-activated shopping experiences in a variety of environments. This trend is gaining traction in sectors such as retail, consumer goods, and food and beverage services, where routine tasks like reordering items, checking prices, and placing orders can be seamlessly managed through voice commands. As AI and natural language processing technologies improve, the market is poised for significant growth.

The integration of voice commerce capabilities by e-commerce giants like Amazon, Walmart, and Alibaba has significantly expanded the market. By enabling users to shop via voice commands on these platforms, consumers can easily reorder products, check delivery statuses, and make purchases hands-free. This integration simplifies the shopping experience and makes it more convenient for a broader audience. As major retailers continue to embrace voice commerce, they drive wider adoption, transforming how people interact with online shopping and creating new opportunities for growth in the e-commerce sector.

Advancements in artificial intelligence (AI) and natural language processing (NLP) have significantly improved the accuracy of voice recognition systems. These technologies enable more natural and intuitive conversations between consumers and devices, making voice interactions smoother and more reliable. This enhanced reliability has increased consumer trust in voice commerce, streamlining the purchasing process by reducing errors and improving response times. As a result, voice commerce is becoming an integral part of the e-commerce ecosystem, with continued growth expected as technology evolves.

Device Type Insights

The smart speakers segment accounted for the largest revenue share of over 44% in 2023. Smart speakers like Amazon Echo and Google Home are seeing widespread consumer adoption due to their convenience and hands-free functionality. These devices simplify everyday tasks, including shopping, by allowing users to make purchases through voice commands. As part of the growing ecosystem of IoT-connected devices, smart speakers seamlessly integrate into smart homes, enabling users to control various aspects of their environment, including shopping, through voice interaction. This seamless integration offers more opportunities for voice-based tasks, contributing to the increased use of smart speakers in the voice commerce market. The combination of convenience and IoT connectivity drives their growing popularity.

The wearables segment is expected to grow at a CAGR of 26.5% during the forecast period. Wearables with advanced health and fitness monitoring capabilities are increasingly integrating voice commerce features. This integration allows users to order health products, supplements, or services directly through voice commands on their devices, such as smartwatches or fitness trackers. This seamless connection between wearables and voice commerce enhances user convenience by enabling quick and easy purchases related to their fitness routines. Additionally, wearables offer hands-free access to voice assistants, making them particularly valuable during activities where manual interaction is impractical, such as workouts, driving, or multitasking. This hands-free functionality ensures users can manage shopping and other tasks efficiently while engaged in various activities.

Industry Vertical Insights

The consumer goods segment held a market share of over 39.2% in 2023 and is expected to dominate the market by 2030. Integration of voice commerce with smart home devices enhances the shopping experience by allowing users to manage and purchase consumer goods directly through smart speakers and other connected devices. This seamless integration enables consumers to use voice commands to order products, track deliveries, and manage reorders without needing to interact manually with a computer or smartphone. The ability to control these tasks hands-free simplifies the process, making it more convenient and efficient. As smart home ecosystems become more interconnected, this integration will continue to streamline shopping and increase accessibility for purchasing everyday consumer goods.

The hospitality & travel segment is expected to grow at a CAGR of 26.4% over the forecast period.Voice commerce significantly enhances the customer experience in the hospitality and travel sectors by allowing travelers and hotel guests to book flights, make reservations, and access services hands-free. This hands-free functionality offers a more convenient and personalized experience, eliminating the need for manual interaction. Integration with voice assistants streamlines the booking process by enabling users to make travel arrangements and secure accommodations using simple voice commands. This seamless booking capability reduces friction in the reservation process, making it faster and more efficient for consumers. Overall, voice commerce improves accessibility and convenience, leading to a more enjoyable and user-friendly travel and hospitality experience.

Regional Insights

North America voice commerce market held the largest market share of 37% in 2023.North America’s high adoption of smart devices, including Amazon Echo, Google Home, and Apple HomePod, significantly drives the growth of voice commerce. The widespread use of these voice-enabled devices makes voice interactions more prevalent and accessible, facilitating the expansion of voice commerce. Additionally, the region's advanced technology infrastructure, including high-speed internet, supports the efficient operation of voice commerce platforms and services. This robust technological foundation ensures that voice commands are processed quickly and accurately, enhancing the overall user experience and enabling seamless voice-based transactions. Together, these factors contribute to the growing popularity and effectiveness of voice commerce in North America.

U.S. Voice Commerce Market Trends

The voice commerce market in the U.S. is expected to grow significantly at a CAGR of 22.3% from 2024 to 2030. In the U.S., the strong presence of major e-commerce platforms like Amazon and Walmart has significantly fueled the growth of voice commerce. These platforms have integrated voice commerce capabilities, allowing users to place orders, check statuses, and manage shopping lists using voice commands. This integration streamlines the purchasing process, making it more efficient and convenient for consumers. By leveraging their extensive product catalogs and established customer bases, these e-commerce giants enhance the accessibility and appeal of voice commerce, driving increased adoption and expanding the market.

Asia Pacific Voice Commerce Market Trends

The voice commerce market in Asia Pacific is expected to grow significantly at a CAGR of 27.1% from 2024 to 2030. In Asia Pacific, the high adoption of smartphones facilitates the widespread use of voice assistants, driving the growth of voice commerce through mobile devices. As more consumers use smartphones, they increasingly engage in voice-based shopping, boosting market expansion. Additionally, improved internet infrastructure and rising connectivity in the region support the smooth operation of voice commerce platforms. Enhanced internet speeds and reliability ensure that voice commands are processed efficiently, leading to a better user experience and fostering greater adoption of voice commerce services across diverse markets in Asia Pacific.

Europe Voice Commerce Market Trends

The voice commerce market in Europe is expected to grow significantly at a CAGR of 24.0% from 2024 to 2030. Europe’s advanced technological infrastructure and high-speed internet support the efficient operation of voice commerce platforms, ensuring smooth and reliable voice interactions for users. This robust tech foundation enhances the overall effectiveness of voice commerce services. Additionally, major European e-commerce platforms and retailers have integrated voice commerce capabilities into their systems, making it easier for consumers to shop using voice commands. This integration streamlines the purchasing process, reduces friction, and boosts market growth by expanding the accessibility and appeal of voice-based shopping across the region.

Key Voice Commerce Company Insights

Key players operating in the voice commerce market include Amazon.com Inc., Apple Inc., Alphabet Inc., Google LLC, Samsung Electronics Co., Alibaba Group Holding Ltd., Sony Corp., Salesforce Inc., Baidu Inc., Adobe Inc., Twilio Inc., Vizio Inc., Sonos Inc., BigCommerce Pty. Ltd., and Algolia Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Voice Commerce Companies:

The following are the leading companies in the voice commerce market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Algolia Inc.

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- BigCommerce Pty. Ltd.

- Google LLC

- Salesforce Inc.

- Samsung Electronics Co.

- Sonos Inc.

- Sony Corp.

- Twilio Inc.

- Vizio Inc.

Recent Developments

-

In August 2024, Samsung upgraded its AI voice control for Bespoke appliances, enhancing home life by allowing users to manage appliances through improved voice commands. The advanced AI technology offers more precise and intuitive control, making it easier to operate and customize Samsung’s smart home appliances.

-

In May 20222, Sonos announced it is introducing new voice assistant features, set to enhance its speakers with more advanced voice control capabilities. The update will provide improved voice recognition and functionality, allowing users to interact more effectively with their Sonos audio systems, making voice commands more intuitive and responsive.

Voice Commerce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.68 billion

Market Size forecast in 2030

USD 186.28 billion

Growth Rate

CAGR of 24.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Device type, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa.

Key companies profiled

Adobe Inc., Algolia Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., Apple Inc., Baidu Inc., BigCommerce Pty. Ltd., Google LLC, Salesforce Inc., Samsung Electronics Co., Sonos Inc., Sony Corp., Twilio Inc., and Vizio Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Voice Commerce Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global voice commerce market report based on device type, industry vertical, and region:

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Speakers

-

Smartphones

-

Wearables

-

In-Car Systems

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Goods & Retail

-

Healthcare

-

Automotive

-

BFSI (Banking, Financial Services, and Insurance)

-

Media & Entertainment

-

Hospitality & Travel

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global voice commerce market size was estimated at USD 42.75 billion in 2023 and is expected to reach USD 49.68 billion in 2024.

b. The global voice commerce market is expected to grow at a compound annual growth rate of 24.6% from 2024 to 2030 to reach USD 186.28 billion by 2030.

b. The North America held the largest market share of 37% in the Voice Commerce Market in 2023. North America’s high adoption of smart devices, including Amazon Echo, Google Home, and Apple HomePod, significantly drives the growth of voice commerce. The widespread use of these voice-enabled devices makes voice interactions more prevalent and accessible, facilitating the expansion of voice commerce.

b. Some key players operating in the voice commerce market include Adobe Inc., Algolia Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., Apple Inc., Baidu Inc., BigCommerce Pty. Ltd., Google LLC, Salesforce Inc., Samsung Electronics Co., Sonos Inc., Sony Corp., Twilio Inc., and Vizio Inc.

b. The voice commerce market is expanding rapidly, driven by the growing adoption of smart speakers, smartphones, and IoT devices that enable voice-based interactions. Consumers are increasingly using voice assistants like Amazon Alexa and Google Assistant for shopping due to the convenience of hands-free, quick transactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.