- Home

- »

- Consumer F&B

- »

-

Vodka Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Vodka Market Size, Share & Trends Report]()

Vodka Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Flavored, Non-Flavored), By Distribution Channel (Off-Trade, On-Trade), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-924-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vodka Market Summary

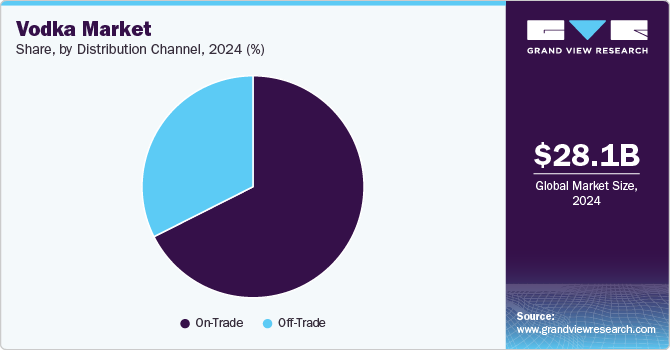

The global vodka market size was estimated at USD 28.07 billion in 2024 and is projected to reach USD 40.25 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The growth is attributed to the increasing demand for premium and craft vodka varieties, which appeal to consumers seeking unique flavors and high-quality products.

Key Market Trends & Insights

- North America vodka market dominated with the largest revenue share of 34.9% in 2024..

- The vodka market in the U.S. accounted for the largest market revenue share in North America in 2024.

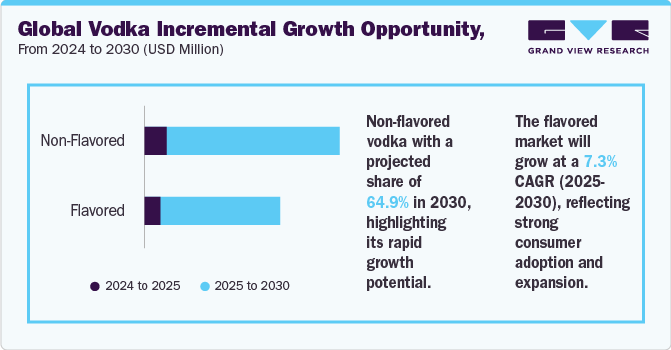

- Based on type, the non-flavored vodka segment led the market with the largest revenue share of 64.9% in 2024.

- Based on distribution channel, the on-trade segment led the market with the largest revenue share of 67.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.07 Billion

- 2030 Projected Market Size: USD 40.25 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

For instance, brands such as Belvedere and Żubrówka have capitalized on this trend by offering premium Polish vodka made from rye or potatoes, which is highly regarded for its quality and cultural authenticity.

One major factor is the rise of flavored and infused vodka, which caters to consumers looking for diverse and refreshing drinking experiences. For instance, Diageo’s Smirnoff has introduced flavored options such as cherry and watermelon, which have gained popularity among consumers seeking unique vodka-based cocktails. This trend towards flavored vodka is expected to continue driving market expansion.

Geographical factors also play a crucial role in the market's dynamics. North America currently dominates the market due to its established drinking culture and innovative distribution channels, including online platforms. The Asia-Pacific region, however, is emerging as a significant growth area due to rising disposable incomes and an increasing preference for Western spirits. This shift is driven by urbanization and the adoption of Western lifestyles, which are contributing to the market's expansion.

Sustainability and digital transformation are additional drivers of market growth. Manufacturers are adopting eco-friendly packaging and sustainable production practices to appeal to environmentally conscious consumers. Furthermore, the growth of e-commerce platforms has enhanced accessibility and allowed brands to engage directly with consumers, further fueling market expansion. As consumer preferences evolve, innovations in flavor, packaging, and marketing strategies will continue to drive the global vodka industry forward.

The increasing demand for premium and craft vodka varieties is a significant factor, driven by consumers seeking unique flavors and high-quality products. In addition, the rise of cocktail culture and mixology has boosted vodka's versatility as a base for various drinks. For instance, brands such as Absolut have capitalized on this trend by introducing innovative products such as paper bottles, appealing to environmentally conscious consumers while maintaining premium quality. The growth of ready-to-drink cocktails and online distribution channels further fuels vodka sales, offering convenience without compromising on quality. These trends reflect evolving consumer preferences for authentic, sustainable, and premium spirit experiences

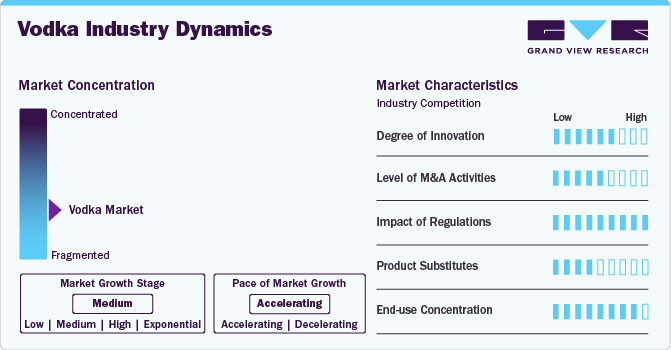

Market Concentration & Characteristics

Companies operating in the vodka industry rely on a combination of offline and online distribution channels. When it comes to buying vodka, commercial customers prefer bulk orders to cut down the per-unit price. Commercial customers generally sign a contract with the distributor since they require large quantities on a cyclic basis.

Several companies are gradually increasing their focus on the online sales channel. With rising digitization, increasing smartphone penetration, and growing access to the Internet, businesses are gradually shifting from brick-and-mortar stores to e-commerce platforms. To expand product visibility, especially in emerging markets, manufacturers are highlighting their products across online platforms, such as company-owned portals and e-retailing. Rapid digitalization across all aspects of e-commerce has positively affected the penetration of craft spirits across the globe.

The vodka industry is characterized by the presence of several well-established players, and a few small- & mid-sized emerging players such as Constellation Brands, Inc., Distell Group Holdings Limited, Proximo Spirits, Inc., Stoli Group, and Iceberg Vodka Corporation. Companies operating in the vodka industry compete on the price and quality of vodka flavor. Several vodka manufacturing companies are focusing on flavors as consumers’ preferences for varying vodka flavors have increased rapidly in recent times.

The tremendous growth of the vodka industry offers manufacturers a lucrative opportunity. Packaging and labeling play a crucial role in vodka sales. Manufacturers are recommended to encourage consumers to focus on the flavor of their alcohol. Lowering the price of vodka helps consumers consider it a luxury that anyone and everyone can afford. A well-established distribution channel is expected to improve market penetration.

Social media can also play a vital role in improving product reach among consumers. Influencer marketing, paid posts, and sponsored content on social media platforms like Instagram can be used to promote vodka brands.

Type Insights

Based on type, the non-flavored vodka segment led the market with the largest revenue share of 64.9% in 2024. Key drivers for non-flavored vodka include its versatility and neutral taste, which make it ideal for mixing with other beverages. The growth of cocktail culture and the preference for using non-flavored vodka as a base for personalized drinks further support its market presence.

The flavored market is projected to grow at the fastest CAGR of 7.3% from 2025 to 2030. The increasing demand for diverse and unique flavors among consumers, particularly millennials, who are eager to explore new taste experiences, has driven the market. This trend is supported by the rise of cocktail culture and mixology, where flavored vodka offers bartenders and enthusiasts a wide range of creative possibilities. For instance, brands such as Bacardi launched products, including TAILS COCKTAILS, that cater to the growing demand for premium flavored vodka drinks by providing easy-to-make, high-quality cocktails at home.

Distribution Channel Insights

Based on distribution channel, the on-trade segment led the market with the largest revenue share of 67.5% in 2024. One major driver is the increasing demand for diverse and unique flavors among consumers, particularly millennials, who are eager to explore new taste experiences. This trend is supported by the rise of cocktail culture and mixology, where flavored vodka offers bartenders and enthusiasts a wide range of creative possibilities. In addition, the growth of online and offline retail channels has made flavored vodka more accessible, further fueling its market expansion.

The off-trade segment is projected to grow at the fastest CAGR of 7.5% from 2025 to 2030. The pandemic has amplified the increasing preference for at-home consumption. Consumers are leveraging the convenience offered by retail outlets such as supermarkets and online platforms, where they can access a wide variety of vodka products at competitive prices. For instance, companies such as Walmart and Tesco collaborate with vodka manufacturers to offer exclusive deals and promotions, enhancing consumer engagement and driving sales. In addition, the rise of e-commerce platforms has further accelerated off-trade growth by providing easy access to premium and super-premium vodka products, allowing consumers to explore new brands and flavors from the comfort of their homes.

Regional Insights

North America vodka market dominated with the largest revenue share of 34.9% in 2024. North America's robust cocktail culture and high demand for premium and flavored vodkas are major contributors to this dominance. The region's strong distribution networks, including both on-trade and off-trade channels, enhance accessibility and visibility for vodka brands. For instance, brands such as Grey Goose have capitalized on this trend by offering premium vodka products that appeal to American consumers seeking high-quality ingredients and refined distillation processes.

U.S. Vodka Market Trends

The vodka market in the U.S. accounted for the largest market revenue share in North America in 2024. The increasing demand for premium and flavored vodkas appeals to consumers seeking unique and high-quality drinking experiences. In addition, the rise of e-commerce platforms and direct-to-consumer sales models has enhanced accessibility and allowed brands to engage directly with consumers, further fueling market expansion. The growing popularity of craft vodka and innovative marketing strategies also contribute to this growth, as consumers increasingly seek distinctive and inventive drinking experiences.

The Canada vodka market is projected to grow at the fastest CAGR of 4.3% from 2025 to 2030. The increasing demand for premium and craft spirits, along with the growing popularity of vodka-based cocktails, contributes significantly to this growth. In addition, the rise of e-commerce platforms has enhanced accessibility, allowing consumers to explore a wide range of vodka products. For instance, brands such as Smirnoff, led by Diageo, have maintained a strong presence in Canada by offering diverse vodka options that cater to evolving consumer preferences. However, market saturation and regulatory challenges, such as high excise taxes, may limit the growth rate compared to other regions. Despite these challenges, innovations in flavors and formulations continue to attract consumers seeking unique drinking experiences.

Europe Vodka Market Trends

The vodka market in Europe is projected to grow at a significant CAGR of 6.6% from 2025 to 2030. The increasing demand for premium and luxury vodka products is a significant driver, as consumers are willing to pay more for exclusive and high-quality offerings. In addition, the vibrant cocktail culture in Europe fuels the demand for vodka, which is a fundamental component in many creative drinks. Furthermore, the growth of online vodka sales and social media advertising also contribute to market expansion by enhancing accessibility and visibility for vodka brands across the region.

The UK vodka market is projected to grow at the fastest CAGR of 7.8% from 2025 to 2030. The increasing demand for premium and craft vodkas, particularly among younger consumers, is a significant driver. In addition, the UK's vibrant cocktail culture and sophisticated retail networks enhance product accessibility and brand visibility. For instance, brands such as Belvedere have successfully capitalized on this trend by offering high-quality, super-premium vodka products that appeal to consumers seeking unique and authentic drinking experiences. Furthermore, the growth of artisanal and craft vodkas, which emphasize traditional manufacturing techniques and locally sourced ingredients, also contributes to market expansion by catering to consumers seeking distinctive and authentic spirits.

The vodka market in Germany is projected to grow at a substantial CAGR of 6.8% from 2025 to 2030. The increasing demand for premium and sustainable vodka products is a significant driver, as consumers seek high-quality and environmentally friendly options. For instance, the popularity of organic and sustainable vodkas aligns with German consumers' growing preference for responsible consumption and reduced environmental impact. In addition, the vibrant cocktail culture and mixology trends in Germany fuel the demand for vodka, which is versatile and widely used in various drinks. Brands such as Henkell & Co. Sektkellerei have capitalized on these trends by offering innovative products and leveraging strong distribution channels, including food and drinks specialists and hypermarkets, to enhance market presence and drive growth.

Asia Pacific Vodka Market Trends

The vodka market in Asia Pacific is projected to grow at a significant CAGR of 7.0% from 2025 to 2030. Urbanization and economic development in the region have led to increased disposable incomes, enabling consumers to spend more on premium spirits such as vodka. The thriving tourism and hospitality industry also boosts demand, as tourists and locals alike consume vodka in hotels, bars, and restaurants. In addition, the adoption of Western lifestyles and the growing popularity of mixology culture have fueled the demand for vodka-based cocktails. For instance, brands such as Suntory have capitalized on this trend by offering premium vodka products that appeal to consumers seeking high-quality and unique drinking experiences, further driving market expansion in the region.

The Japan vodka market accounted for the largest market revenue share of 8.5% in 2024. The market's share is influenced by factors like consumer preferences for premium and unflavored vodka. Brands such as Beluga have maintained a strong presence by offering high-quality products that appeal to Japanese consumers seeking authentic vodka experiences.

The vodka market in India is projected to grow at the fastest CAGR of 7.8% from 2025 to 2030. The increasing disposable incomes and a growing middle class have led to a rise in premiumization, with consumers seeking high-quality vodka products for sophisticated drinking experiences. In addition, the growing popularity of cocktail culture and mixology trends has fueled demand for vodka as a versatile base spirit. For instance, brands such as Magic Moments Vodka, owned by Radico Khaitan Ltd., have achieved significant sales growth by catering to evolving consumer preferences and offering a range of flavors.

Latin America Vodka Market Trends

The vodka market in Latin America is projected to grow at a substantial CAGR of 6.0% from 2025 to 2030. Increasing disposable incomes and urbanization are leading to a rise in demand for premium spirits, including vodka has driven the market. In addition, the growing popularity of Western-style drinking culture and the expansion of modern retail channels have enhanced accessibility to vodka products. For instance, brands such as Absolut have successfully entered the Latin American market by offering a range of flavored vodkas that appeal to local consumers seeking unique and refreshing drinking experiences.

Middle East & Africa Vodka Market Trends

The vodka market in the Middle East & Africa is projected to grow at a substantial CAGR of 4.7% from 2025 to 2030. Urbanization and the growing middle class in the region have increased disposable incomes, leading to a rise in demand for premium spirits like vodka. In addition, the influx of tourists and expatriates, particularly in countries such as the UAE, has fueled the demand for international vodka brands. For instance, Dubai's vibrant nightlife and cosmopolitan lifestyle have made it a hub for vodka consumption, with brands such as Absolut and Grey Goose being popular among both locals and visitors. The region's evolving social attitudes towards alcohol, coupled with the growing popularity of Western drinking cultures, further contribute to this growth as consumers seek unique and high-quality vodka experiences.

Key Vodka Company Insights

Established companies and emerging players create a competitive environment by focusing on product innovation, quality, and pricing strategies. In the vodka industry, key companies employ strategies to maintain a competitive edge by launching innovative products, focusing on premiumization, and adopting sustainable practices. They leverage marketing and advertising to enhance brand visibility and engage with consumers. In addition, companies invest in eco-friendly packaging and production methods to appeal to environmentally conscious consumers. Strategic acquisitions and partnerships also play a role in expanding product portfolios and strengthening market presence.

Key Vodka Companies:

The following are the leading companies in the vodka market. These companies collectively hold the largest market share and dictate industry trends.

- Brown-Forman Corporation

- Diageo

- Pernod Ricard

- Belvedere Vodka

- Bacardi Limited

- Constellation Brands, Inc.

- Proximo Spirits, Inc.

- Distell Limited

- Stoli Group

- Iceberg Vodka Corporation

Vodka Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.39 billion

Revenue Forecast in 2030

USD 40.25 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Russia: China; Japan; India; Brazil; Argentina; South Africa

Key companies profiled

Brown-Forman Corporation; Diageo; Pernod Ricard; Belvedere Vodka; Bacardi Limited; Constellation Brands, Inc.; Proximo Spirits, Inc.; Distell Limited; Stoli Group; Iceberg Vodka Corporation

Customization scope

Avail customized purchase options to meet your exact research needs. Explore purchase options

Pricing and purchase options

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Vodka Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global vodka market report based on the type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Non-Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vodka market was estimated at USD 28.07 billion in 2024 and is expected to reach USD 29.39 billion in 2025.

b. The global vodka market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 40.25 billion by 2030.

b. North America dominated the vodka market with a share of 34.90% in 2024, driven by robust cocktail culture and high demand for premium and flavored vodkas. The region's strong distribution networks, including both on-trade and off-trade channels, enhance accessibility and visibility for vodka brands.

b. Some of the key market players in the vodka market are Brown-Forman Corporation, Diageo, Pernod Ricard, Belvedere Vodka, Bacardi Limited, Constellation Brands, Inc., Proximo Spirits, Inc., Distell Limited, Stoli Group, and Iceberg Vodka Corporation.

b. Key factors that are driving the vodka market growth include an increase in disposable income along with changes in preferences toward premium products and growing demand for alcoholic beverages on e-commerce portals. Consumers, particularly millennials and Gen Z, are increasingly seeking unique taste experiences beyond traditional unflavored vodka. This demand has fueled innovation and the introduction of a wide array of fruit-infused, herbal, and even savory vodka variants. Furthermore, the growing focus on craft spirits and small-batch production is impacting the market, with consumers showing a preference for locally sourced and artisanal vodkas that offer perceived authenticity and quality. This shift is forcing major players to adapt and diversify their product portfolios to cater to these evolving consumer preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.