- Home

- »

- Consumer F&B

- »

-

Vitamin And Mineral Premixes Market, Industry Report, 2030GVR Report cover

![Vitamin And Mineral Premixes Market Size, Share & Trends Report]()

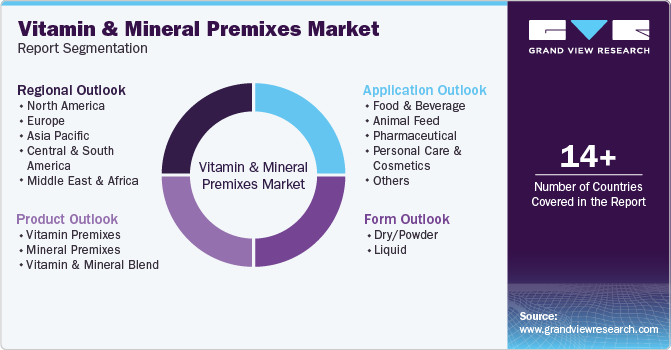

Vitamin And Mineral Premixes Market Size, Share & Trends Analysis Report By Product (Vitamin Premixes, Mineral Premixes), By Application (Food & Beverage, Animal Feed), By Form (Dry/Powder, Liquid), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-494-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Vitamin And Mineral Premixes Market Trends

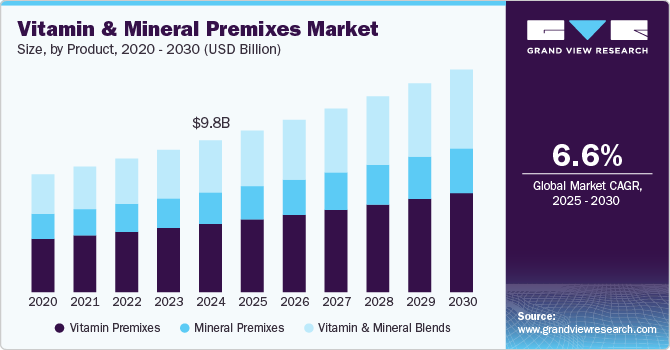

The global vitamin and mineral premixes market size was estimated at USD 9.81 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. Consumer health and wellness awareness is a significant market driver. As individuals become more conscious of their nutritional intake, a growing demand for fortified foods and dietary supplements enhances overall health. This trend is particularly pronounced in developed countries where consumers actively seek products to help prevent deficiencies and improve their well-being. The emphasis on preventive healthcare has increased interest in vitamin and mineral premixes, which offer a convenient way to ensure adequate nutrient intake.

Another key factor driving the market is the increasing use of vitamin and mineral premixes in animal feed. Livestock producers seek ways to improve animal health, productivity, and overall performance through better nutrition. Incorporating these premixes into animal feed helps address nutrient deficiencies and supports optimal growth rates in livestock. As the global demand for meat and dairy products continues to rise, the need for high-quality animal nutrition solutions will likely bolster the vitamin and mineral premixes industry.

The expanding market for functional foods-products enhanced with additional nutrients-has significantly contributed to the market growth. Consumers are increasingly looking for foods that satisfy hunger and provide health benefits. This shift has prompted food manufacturers to incorporate vitamin and mineral premixes into their products, ranging from breakfast cereals to beverages, thereby enhancing the nutritional profile of everyday foods. In addition, the rising popularity of dietary supplements has further fueled demand for these premixes, as they are often used to create multivitamin formulations that cater to specific health needs.

The prevalence of vitamin and mineral deficiencies, particularly in developing regions, presents both a challenge and an opportunity for the market. Many populations still face malnutrition due to inadequate dietary intake of essential nutrients. Vitamin and mineral premixes can play a crucial role in addressing these deficiencies by fortifying staple foods or being included in humanitarian aid programs aimed at improving nutrition in vulnerable communities. Manufacturers are increasingly focusing on creating affordable premix solutions to combat malnutrition, which can significantly expand their market reach.

Government initiatives aimed at improving public health through better nutrition are also contributing to market growth. Many countries have implemented regulations encouraging food fortification to combat nutrient deficiencies among their populations. These supportive policies create a favorable environment for developing and adopting vitamin and mineral premixes across various applications, from food products to dietary supplements. As awareness of nutrition-related issues grows globally, regulatory frameworks will likely evolve to promote further use of these beneficial ingredients.

The vitamin and mineral premixes industry faces challenges hindering its growth and development. One key challenge is high production costs. Producing vitamin and mineral premixes can be costly due to the high prices of raw materials and the expenses associated with research and development. These costs may lead to higher retail prices for fortified products, potentially deterring price-sensitive consumers from purchasing them, thereby impacting overall market demand.

The increasing number of brands and products in the vitamin and mineral premixes industry has increased competition. This saturation can create confusion among consumers, making it difficult to choose the right product for their needs. In addition, aggressive pricing strategies among competitors may lead to diminished perceived value, potentially affecting sales.

There are growing concerns regarding the potential side effects of over-fortification, which can result in adverse health effects if consumers exceed recommended intake levels. This concern can lead to hesitancy among consumers when purchasing fortified products, impacting demand for vitamin and mineral premixes.

Product Insights

The vitamin premixes segment led the market with the largest revenue share of 45.05% in 2024. The market growth is significantly driven by rising health consciousness among consumers and an increasing demand for fortified foods and dietary supplements. As individuals become more aware of the importance of nutrition in maintaining overall health, there is a growing preference for products that provide essential vitamins and minerals. This trend is particularly pronounced in developed regions where consumers actively seek out fortified food options to address nutritional gaps in their diets. The surge in popularity of ready-to-eat meals and convenience foods, often lacking in essential nutrients, has further propelled the demand for vitamin premixes as manufacturers look to enhance the nutritional profile of these products.

The vitamin and mineral blend premixes segment is expected to grow at the fastest CAGR of 7.2% from 2025 to 2030. One significant advantage of blend premixes is their ability to provide a comprehensive combination of essential nutrients in a single product. This convenience appeals to consumers who prefer not to take multiple supplements separately, as it simplifies their dietary regimen. In addition, the synergistic effects of combining vitamins and minerals can enhance the overall efficacy of the nutrients, leading to better absorption and health outcomes. This holistic approach aligns with the growing consumer trend towards complete nutrition, making vitamin and mineral blends a more attractive option.

Manufacturers benefit from using vitamin and mineral blend premixes as they streamline production processes and reduce complexity. By utilizing a single premix instead of managing multiple individual ingredients, manufacturers can enhance operational efficiency, minimize the risk of formulation errors, and ensure consistent quality across their products. This efficiency not only lowers production costs but also improves compliance with regulatory standards, as the uniform distribution of nutrients helps maintain product integrity. As the demand for fortified foods and dietary supplements continues to rise, the versatility and practicality of vitamin and mineral blend premixes position them favorably in the market, driving their growth relative to individual vitamin or mineral offerings.

Application Insights

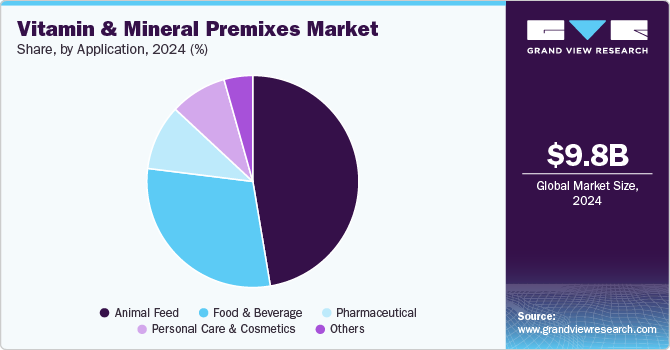

Based on application, the animal feed segment led the market with the largest revenue share of 47.5% in 2024. The global population is continuously growing, leading to an increased demand for animal-derived products such as meat, milk, and eggs. This surge in demand necessitates efficient and effective feeding strategies to enhance livestock productivity. Vitamin and mineral premixes are crucial in optimizing animal nutrition, ensuring that livestock receive the essential nutrients required for growth, reproduction, and overall health. By improving feed efficiency and promoting better weight gain, these premixes help producers meet the rising demand for high-quality animal protein while maintaining sustainable production practices.

Increasingly stringent regulations regarding animal health and food safety are encouraging livestock producers to adopt higher standards of nutrition. Governments are implementing policies aimed at improving the quality of animal products, which often include guidelines for proper feeding practices. Vitamin and mineral premixes help farmers comply with these regulations by providing a reliable means of ensuring that animals receive adequate nutrition throughout their life cycles.

The food and beverage segment is expected to grow at the fastest CAGR of 6.7% from 2024 to 2030. The growth of vitamin and mineral premixes in the food and beverage industry is primarily driven by the increasing consumer demand for fortified products that enhance nutritional value. As health consciousness rises among consumers, there is a significant shift towards foods that offer additional health benefits beyond basic nutrition. This trend is particularly evident among middle-aged and health-focused individuals who seek to improve their overall well-being through diet. Manufacturers are responding to this demand by incorporating vitamin and mineral premixes into various products, including ready-to-eat meals, beverages, and snacks, enhancing their nutritional profiles and appealing to health-conscious consumers.

Form Insights

Based on form, the powder or dry form segment led the market with the largest revenue share of 77.6% in 2024. Powdered vitamin and mineral premixes generally offer more excellent stability and longer shelf life than their liquid counterparts. This stability is crucial for maintaining the efficacy of the nutrients over time, as powders are less prone to degradation caused by light, heat, or moisture. The extended shelf life reduces waste and allows for easier storage and transportation, making powdered forms more convenient for manufacturers who need to manage inventory effectively.

The production and transportation of powdered vitamin and mineral premixes are often more cost-effective than liquid forms. Powders typically require less packaging volume, reducing shipping costs and storage space requirements. In addition, the manufacturing process for powders can be more streamlined, leading to potential savings in labor and production costs. This cost efficiency can translate into lower consumer prices, driving higher demand for powdered premixes.

Powdered premixes allow for precise customization in formulations tailored to specific dietary needs or health goals. Manufacturers can easily adjust the composition of powder blends to meet consumer preferences or regulatory requirements. This flexibility is particularly beneficial in the growing market for personalized nutrition, where consumers seek products that cater to their unique health needs. Powdered forms of vitamins and minerals can offer improved bioavailability compared to liquids when properly formulated. Certain delivery systems used in powdered premixes can enhance nutrient absorption in the body, making them a more effective option for consumers seeking optimal health benefits from their supplements.

Regional Insights

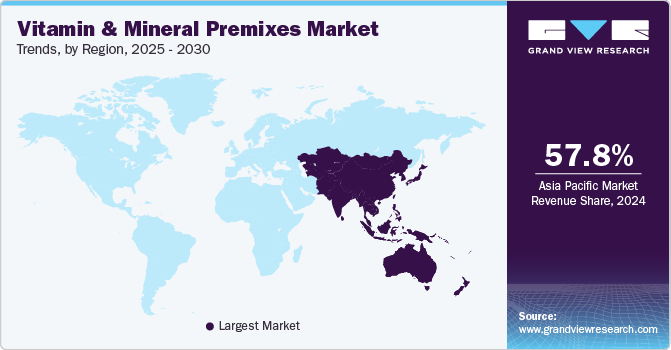

The vitamin & mineral premixes market in North America is expected to grow at the fastest CAGR during the forecast period. A significant increase in health awareness among consumers in North America leads to a growing demand for fortified foods and dietary supplements. As individuals become more educated about nutrition and its role in preventing chronic diseases such as diabetes, heart disease, and osteoporosis, they actively seek products to help meet their nutritional needs. This trend is particularly pronounced among the aging population, which is increasingly focused on maintaining health and wellness through diet. The demand for customized vitamin and mineral premixes tailored to specific health concerns is also rising, further driving market growth.

U.S. Vitamin & Mineral Premixes Market Trends

The vitamin & mineral premixes market in the U.S. accounted for the largest market share in North America in 2024. The high consumption of processed and convenience foods in the U.S. has resulted in lower consumer exposure to essential nutrients. As busy lifestyles lead to a reliance on these foods, there is a corresponding rise in demand for products that can enhance nutritional value. Vitamin and mineral premixes provide an effective solution for food manufacturers looking to fortify their products, making them more appealing to health-conscious consumers. This trend has led to the incorporation of premixes into various applications, including cereals, dairy products, beverages, and nutritional supplements.

Asia Pacific Vitamin & Mineral Premixes Market Trends

Asia Pacific dominated the vitamin & mineral premixes market with the largest revenue share of 57.81% in 2024. The rapid urbanization in many Asia-Pacific countries contributes to lifestyle changes favoring convenience and processed foods. As urban populations grow, there is a higher demand for ready-to-eat meals and snacks that often lack essential nutrients. Vitamin and mineral premixes provide an effective solution for food manufacturers looking to enhance the nutritional profile of their products, catering to the busy lifestyles of consumers. The increasing demand for dairy products and compound animal feed drives market growth in Asia Pacific. With a growing population and rising income levels, there is a heightened need for high-quality animal protein sources. Vitamin and mineral premixes are essential for ensuring the health and productivity of livestock, making them critical components in animal nutrition. Investments in the dairy industry and livestock farming across the region further support this trend.

Key Vitamin And Mineral Premixes Company Insights

The vitamin and mineral premixes industry is characterized by continuous innovation, product launches, mergers, acquisitions, and strategic partnerships among these key players. The increasing demand for fortified foods due to rising consumer health consciousness drives growth in this sector. In addition, regulatory support for food fortification further enhances opportunities for these companies to expand their product offerings.

Key Vitamin And Mineral Premixes Companies:

The following are the leading companies in the vitamin and mineral premixes market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Glanbia Plc

- Corbion

- Vitablend Nederland BV

- SternVitamin GmbH & Co. KG

- ADM

- Wright Enrichment Inc.

- Nutreco

- Farbest-Tallman Foods Corporation

- Barentz

- RITS Lifesciences Private Limited

- Bioven Ingredients

- NAGASE & CO., LTD.

- AMINO GmbH

- Jubilant Life Sciences

Vitamin And Mineral Premixes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.45 billion

Revenue forecast in 2030

USD 14.39 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

DSM; Glanbia Plc; Corbion; Vitablend Nederland BV; SternVitamin GmbH & Co. KG; ADM; Wright Enrichment Inc.; Nutreco; Farbest-Tallman Foods Corporation; Barentz; RITS Lifesciences Private Limited; Bioven Ingredients; NAGASE & CO., LTD.; AMINO GmbH; Jubilant Life Sciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitamin And Mineral Premixes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vitamin & mineral premixes market report based on the product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin Premixes

-

Mineral Premixes

-

Vitamin & Mineral Blend

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry/Powder

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vitamin and mineral premixes market was valued at USD 9.81 billion in 2024 and is expected to reach USD 10.45 billion in 2025.

b. The global vitamin and mineral premixes market is expected to grow at a CAGR of 6.6% from 2025 to 2030 to reach USD 14.39 billion by 2030.

b. Vitamin premixes was the most extensive product category for the market with revenue of USD 4.15 billion in 2024. The growth of the vitamin premixes market is significantly driven by rising health consciousness among consumers and an increasing demand for fortified foods and dietary supplements. As individuals become more aware of the importance of nutrition in maintaining overall health, there is a growing preference for products that provide essential vitamins and minerals.

b. Some key players operating in the vitamin and mineral premixes market include DSM; Glanbia Plc; Corbion; Vitablend Nederland BV; SternVitamin GmbH & Co. KG; ADM; Wright Enrichment Inc.; Nutreco; Farbest-Tallman Foods Corporation; Barentz; RITS Lifesciences Private Limited; Bioven Ingredients; NAGASE & CO., LTD.; AMINO GmbH; Jubilant Life Sciences

b. Consumer health and wellness awareness is a significant vitamin and mineral premixes market driver. As individuals become more conscious of their nutritional intake, a growing demand for fortified foods and dietary supplements enhances overall health. This trend is particularly pronounced in developed countries where consumers actively seek products to help prevent deficiencies and improve their well-being. The emphasis on preventive healthcare has increased interest in vitamin and mineral premixes, which offer a convenient way to ensure adequate nutrient intake.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."