- Home

- »

- Pharmaceuticals

- »

-

Vitamin K2 Market Size And Share, Industry Report, 2030GVR Report cover

![Vitamin K2 Market Size, Share & Trends Report]()

Vitamin K2 Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (MK-4, MK-7), By Dosage Form, By Source, By Indication, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-335-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin K2 Market Summary

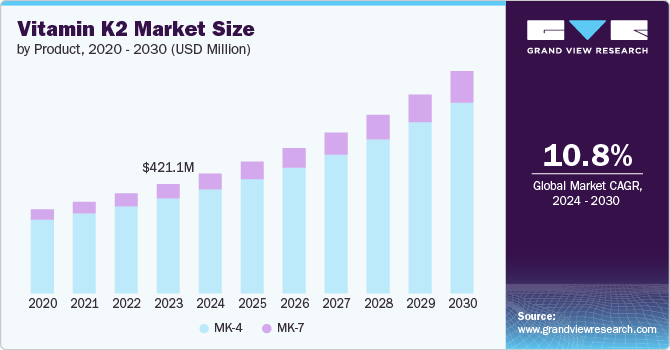

The global vitamin k2 market size was estimated at USD 292.4 million in 2024 and is projected to reach USD 602.0 million by 2030, growing at a CAGR of 13.5% from 2025 to 2030. Increasing consumer awareness of the health benefits of Vitamin K2, along with demographic factors such as an aging population, changing dietary preferences towards functional foods, and ongoing research validating its therapeutic properties, are key drivers contributing to the growth of the vitamin K2 industry.

Key Market Trends & Insights

- North America's vitamin K2 market held the largest market share of 35.18% in 2024.

- The vitamin K2 industry in the U.S. is projected to expand over the period.

- Based on dosage form, capsules/tablets segment dominated and holding a leading market share of 42.05%.

- Based on indication, the bone health segment held the largest market share of 36.41% in 2024.

- Based on product, the MK-7 segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 292.4 Million

- 2030 Projected Market Size: USD 602.0 Million

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2024

Growing consumer awareness of the health benefits of vitamins is a major market driver. Known for its positive effects on bone health, cardiovascular health, and overall well-being, vitamin K2 is gaining attention as more people focus on maintaining good health and preventing chronic diseases. As a result, the demand for vitamin K2 supplements is expected to rise.In April 2023, Petrovax Pharm, a prominent player in Russia's biotech sector, introduced SunDevit to the Russian market. This innovative complex, featuring a combination of vitamins D3 and K2, was specifically designed to enhance immune function and support muscle, bone, and joint health.

Rising rates of osteoporosis and cardiovascular diseases are further boosting the demand for vitamin K2 products. Vitamin K2 plays a crucial role in bone health by helping direct calcium to the bones, reducing fracture risks. In addition, research shows it can prevent arterial calcification and lower heart disease risk. With an aging population and increasing cases of these conditions, interest in vitamin K2 supplements continues to grow. A study published in February 2024 found that vitamin K2 significantly reduced weight, abdominal fat, and liver fat in mice on a high-fat diet, highlighting its protective role against non-alcoholic fatty liver disease (NAFLD).

The vitamin K2 industry’s growth is also driven by companies expanding their product offerings. Manufacturers create innovative formulations and delivery methods to meet diverse consumer preferences and improve product effectiveness. New formats like capsules, tablets, soft gels, liquids, and combinations with other supplements are expected to further propel demand in the nutraceutical industry. In January 2021, MENADIONA launched a new vitamin K2 MK-7 grade for nutraceutical use, adhering to US Pharmacopeia standards for purity. This expansion complements their existing vitamin K2 MK-4 offerings, strengthening their market presence.

Government agencies worldwide increasingly recognize the importance of preventive healthcare through nutrition and dietary supplements, leading to favorable regulatory frameworks that encourage innovation and quality assurance in vitamin K2 production. Moreover, ongoing scientific research continues to uncover new therapeutic applications of vitamin K2 beyond bone and heart health, creating new opportunities for market growth. For example, an October 2023 study in Food & Function revealed that vitamin K2 supplements help regulate fasting blood sugar and insulin resistance, potentially lowering the risk of type 2 diabetes mellitus (T2DM).

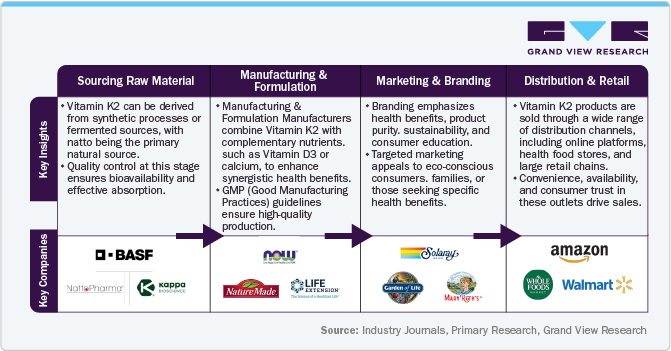

Value Chain Analysis

The market is growing rapidly as consumers become more aware of this nutrient's essential role in supporting bone health, cardiovascular wellness, and overall longevity. From sourcing raw materials to the final product reaching the consumer, the value chain for Vitamin K2 supplements involves several critical stages that ensure quality, efficacy, and consumer satisfaction. This analysis outlines the key steps in the Vitamin K2 value chain, highlighting the major players at each stage and the strategic insights that drive market growth.

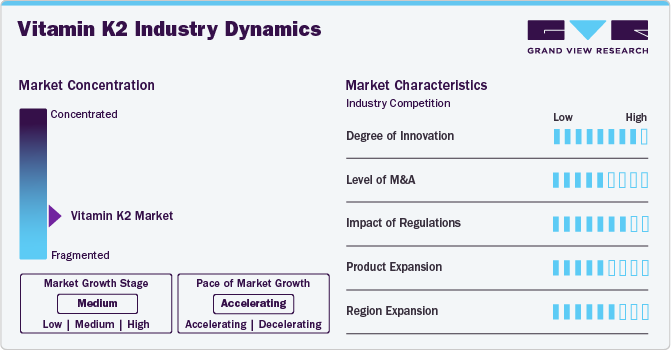

Market Concentration & Characteristics

The vitamin K2 industry is characterized by a high degree of innovation. New delivery formats, such as chewable tablets, capsules, and even K2-enriched foods, are being introduced to cater to diverse consumer preferences. Companies are also exploring novel ingredient combinations, blending vitamin K2 with other essential nutrients like vitamin D and calcium for enhanced benefits. In addition, advancements in sustainable sourcing and production methods drive the development of high-quality, eco-friendly vitamin K2 products.

The level of mergers and acquisitions (M&A) in the vitamin K2 industry is growing as companies seek to expand their product portfolios, access new markets, and enhance research and development capabilities. Larger firms are acquiring smaller, innovative players to capitalize on the increasing demand for health supplements and functional foods. These strategic moves allow companies to diversify their offerings, integrate cutting-edge technologies, and strengthen their competitive position. M&A activity also reflects the market's potential for growth as businesses look to stay ahead in an increasingly dynamic health and wellness sector.

Regulations significantly impact the vitamin K2 industry, influencing product formulation, marketing, and distribution. Strict regulations on supplement quality and safety ensure that consumers receive reliable and safe products, boosting trust in the market. However, regulatory requirements can also present challenges for manufacturers, particularly with regard to claims on health benefits, labeling, and ingredient sourcing. In regions like the EU and the US, these regulations push companies to focus on transparency, scientific validation, and compliance, which ultimately drives innovation and increases costs.

Product expansion in the vitamin K2 industry is becoming increasingly evident as companies diversify their offerings to meet the growing consumer demand for health supplements. Manufacturers are introducing new forms of vitamin K2, such as blends with other vitamins (like D or calcium) to enhance its benefits. There is also a rise in functional foods, including vitamin K2-enriched dairy products, beverages, and snacks. Companies are also expanding into personalized health products, offering targeted solutions based on age, lifestyle, or specific health concerns, further broadening the market’s reach and appeal.

Regional expansion in the vitamin K2 industry is driven by increasing health awareness and rising demand for supplements across various regions. Companies are actively entering emerging markets in Asia, the Middle East, and Africa, where consumer interest in bone and heart health is growing. The expansion is also fueled by the rising popularity of wellness trends and the aging population in these regions. Manufacturers are adapting products to local tastes and regulatory standards, ensuring that vitamin K2 supplements are more accessible to a global audience, from functional foods to dedicated supplements.

Consumer Behavior Analysis for the Vitamin K2 Market

The market is increasingly influenced by consumer demand for bone health, cardiovascular wellness, and preventative care. As more individuals prioritize long-term health and prevention, the role of Vitamin K2-especially in calcium regulation and bone mineralization-has gained significant attention. This growing interest is also tied to the shift toward natural, evidence-based solutions and the rising awareness about the health benefits of vitamins.

Health Consciousness and Preventative Care:

Consumers are becoming more health-conscious and proactive about maintaining bone health, preventing heart disease, and managing aging-related concerns. Vitamin K2 is highly appealing due to its well-documented benefits in supporting bone health and preventing arterial calcification. Brands like NOW Foods, Life Extension, and Jarrow Formulas cater to this demand by offering vitamin K2 supplements specifically designed to target bone and cardiovascular health. Nature Made and Garden of Life also play a significant role by offering highly trusted, widely available products that appeal to consumers looking for affordable and effective solutions.

Preference for Natural and Holistic Solutions:

A shift towards natural, plant-based, and clean-label products is a defining characteristic of modern health trends. Consumers increasingly prefer bioavailable, naturally sourced Vitamin K2, such as that derived from fermented foods like natto. Brands like Sports Research and NOW Foods have capitalized on this by offering plant-based Vitamin K2 supplements with a focus on natural, GMO-free ingredients. Garden of Life stands out by emphasizing its organic, plant-based ingredients, catering to health-conscious consumers who are particularly focused on sustainability and ethical sourcing.

Trust in Science and Transparency:

In the age of informed consumers, scientific validation and product transparency are pivotal factors in purchasing decisions. Life Extension is a prime example of a brand that appeals to consumers seeking scientifically-backed supplements, as the company highlights research supporting the effectiveness of Vitamin K2 in bone health. Pharmavite (Nature Made) has established consumer trust with its USP-certified products, focusing on transparency and quality assurance. Similarly, Pure Encapsulations and Jarrow Formulas are known for offering premium formulations committed to scientific integrity and clear labeling, attracting customers who value evidence-based health products.

Convenience and Product Accessibility:

Convenience plays a significant role in consumer decisions, with many seeking supplements that are easy to consume and widely available. Nature Made, NOW Foods, and Solaray dominate in offering widely accessible Vitamin K2 supplements in softgel, capsule, or gummy forms, appealing to mainstream users who prioritize ease and availability. These brands are well-established in the mass retail and online markets, making them convenient options for consumers looking to integrate Vitamin K2 into their daily routines without hassle.

Product Insights

The MK-7 segment held the largest market share in 2024 due to its natural form, menaquinone-7, derived from fermented foods like natto. MK-7 is preferred for its superior bioavailability and longer-lasting effects compared to MK-4. Studies have shown that MK-7 supports cardiovascular health by preventing arterial calcification and promoting healthy blood clotting. For example, in February 2024, it was reported that Kappa Bioscience’s Vitamin K2 MK-7, at a daily dose of 375 µg, may reduce heart disease risk by slowing arterial stiffness in diabetic chronic hemodialysis patients over 24 weeks. However, the rise in vegan and plant-based diets has increased demand for MK-7 supplements, which are often sourced from non-animal origins. Growing consumer awareness of the benefits of different forms of vitamin K2 has led to increased sales of MK-7 products, further driving segment growth.

The MK-4 segment is expected to grow significantly from 2025 to 2030, driven by high demand for MK-4 as a synthetic form of menaquinone-4. MK-4 is known to enhance bone health by improving bone mineral density, reducing fracture risk, and benefiting cardiovascular health by lowering the risk of arterial calcification. The increasing consumer interest in MK-4 supplements for these health benefits is fueling its demand. In October 2023, Smidge launched grass-fed Australian Emu Oil capsules, a premium source of real food vitamin K2 in the MK-4 form. These softgels, sourced from Heritage-bred emus, offer a blend of natural nutrients, including vitamin K2 (MK-4) and omega fatty acids, catering to health-conscious consumers.

Dosage Form Insights

In 2024, capsules/tablets dominated the market, holding a leading market share of 42.05%. This is due to their ease of production, strong stability, and precise dosage control. These forms are widely used in pharmaceuticals and nutraceuticals because they protect active ingredients from oxidation, light, and moisture, thus extending shelf life. Furthermore, their solid format makes them convenient for storage and transportation. In December 2022, J-Oil Mills secured trademarks for Menatto, a vitamin K2 MK-7 ingredient, across the U.S., Japan, Europe, and Australia. Produced in a certified Japanese facility, Menatto is approved for use in food, beverages, and dietary supplements and is available in various formats, such as tablets, capsules, oil, and powder.

The softgel segment is expected to grow rapidly over the forecast period, driven by their excellent absorption rate and user convenience. Softgels, made from gelatin or other materials, contain liquid forms of active ingredients, which are easier for the body to absorb. This form is especially advantageous for individuals struggling to swallow pills or capsules. For example, Smidge offers softgels made from Heritage-bred emus, providing a natural blend of essential nutrients, including vitamin K2 (MK-4) and omega fatty acids, supporting a well-rounded diet.

Source Insights

In 2024, synthetic vitamin K2 dominated the market, holding the largest market share. This is primarily due to its cost-effectiveness and scalability. Synthetic vitamin K2 is produced at a lower cost compared to natural extraction methods, making it an affordable option for producers. In addition, it allows for standardized potency and purity, ensuring consistent product quality. Many supplement manufacturers opt for synthetic vitamin K2 for these benefits, especially in formulations where cost control and precise dosages are critical. For example, Life Extension offers Bone Restore Elite with Super Potent K2 to help reduce the risk of age-related bone density loss, particularly affecting post-menopausal women.

The natural segment is expected to grow at the highest CAGR over the forecast period, driven by increasing consumer preference for natural and organic products, including those containing naturally sourced vitamin K2. Furthermore, there is a rising demand for vitamin K2 derived from natto, a traditional Japanese food, as consumers perceive natural products to be healthier and more environmentally friendly. In October 2023, MD Logic Health introduced a new Natural Vitamin D3 + K2 supplement, combining naturally sourced vitamin D3 with both MK-4 and MK-7 forms of vitamin K2. This product is designed to support bone, dental, and cardiovascular health by leveraging the synergistic benefits of vitamins D3 and K2.

Indication Insights

The bone health segment held the largest market share of 36.41% in 2024. Vitamin K2 plays a crucial role in regulating calcium metabolism and promoting calcium deposition into bones, which is essential for maintaining bone density and reducing the risk of osteoporosis. It is particularly beneficial for enhancing bone mineral density and lowering fracture risks in postmenopausal women. The aging global population and increasing incidence of bone disorders have contributed to the rising demand for vitamin K2 supplements. Consumers often take vitamin K2 alongside calcium and vitamin D to support overall bone health. In July 2021, Disproquima introduced a soy-based, sustainable vitamin K2 to improve bone health. The company emphasizes that higher levels of MK-7 in the body are directly linked to improved bone density. These factors are expected to drive continued growth in the bone health segment.

The heart health segment is projected to grow at the highest CAGR from 2025 to 2030. Vitamin K2 is essential for cardiovascular health as it helps prevent artery calcification and reduces the risk of cardiovascular disease. Studies show that vitamin K2 activates proteins that inhibit calcium buildup in arteries, reducing arterial stiffness and the likelihood of cardiovascular events. There is increasing consumer interest in supplements and diets that support heart health, particularly those containing vitamin K2. Healthcare providers are increasingly recommending vitamin K2 supplements for preventing cardiovascular diseases. In November 2022, Conagen announced the development of new vitamin K2 forms through its fermentation platform, designed to enhance heart health. This new product is expected to significantly improve cardiovascular health, driving growth in the heart health segment over the forecast period.

Application Insights

In 2024, the health supplements segment led the market in revenue, holding a dominant share, and is projected to grow at the highest CAGR over the forecast period. This growth is driven by increasing consumer awareness of the importance of maintaining optimal health and wellness, rising health consciousness, and growing demand for nutritional products. Higher disposable incomes globally have boosted the popularity of premium health supplements, including those containing vitamin K2. In July 2022, the Industry Transparency Center's survey of 3,500 dietary supplement consumers revealed that 63% of consumers actively manage their health, 76% use dietary supplements, and 62% have used vitamin K2, ranking it among the top 10 ingredients.

The functional foods & beverages segment is expected to grow significantly due to heightened consumer awareness of vitamin K2's health benefits. This growth is further fueled by rising rates of osteoporosis and cardiovascular diseases, combined with an aging population. Technological advances in food production have also facilitated the addition of vitamin K2 to a variety of products, such as dairy, beverages, and supplements, leading to the launch of new fortified items. Moreover, a study conducted by the University of Copenhagen in October 2022 and published in the *International Journal of Nephrology and Renovascular Disease* demonstrated that daily MK-7 supplements for six weeks effectively raised vitamin K levels in chronic kidney disease patients at risk of deficiency, outperforming a vitamin-rich diet in reducing deficiency indicators. This research highlights the growing interest in functional foods and beverages containing vitamin K2 as part of a health-conscious lifestyle.

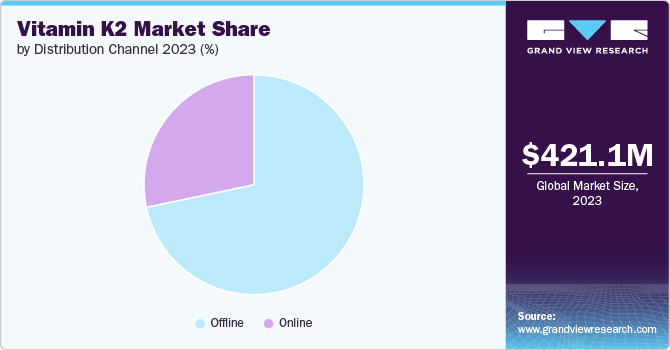

Distribution Channel Insights

The offline segment held the largest market share in 2024. Brick-and-mortar stores, including pharmacies, health food stores, and supermarket outlets, offer immediate purchase convenience and allow consumers to assess product quality directly. These physical outlets provide a significant advantage in terms of consumer trust, accessibility, and the immediate availability of products. The ability to see and touch products and the opportunity to consult with knowledgeable staff enhances consumer confidence in their purchase decisions. These factors are expected to continue driving the demand for offline stores globally, thereby contributing to the segment’s growth over the forecast period.

The online segment is expected to witness the highest CAGR over the forecast period. This growth can be attributed to convenience, accessibility, competitive pricing, and the ability to shop anytime and anywhere. Online shopping also offers benefits such as home delivery, a wider range of brands and products compared to physical stores, and the ability to compare prices and read customer reviews. The shift toward purchasing health supplements like vitamin K2 online is driven by increased internet usage, busy lifestyles, and the ease of researching products before purchasing. These factors are expected to propel the growth of the online segment over the forecast period.

Regional Insights

North America's vitamin K2 market held the largest market share of 35.18% in 2024, driven by increasing awareness of the health benefits of vitamin K2, particularly for bone and heart health. Economic factors like rising middle-class and healthcare spending and the popularity of vegan and vegetarian diets are boosting demand for plant-based K2. Technological advancements in production are also enhancing K2 product quality and availability. In March 2022, LT Health Solutions, Inc. announced plans to distribute J-Oil Mills' menatto Vitamin K2 (MK-7) across North America for cardiovascular, bone, and overall health benefits. Thereby boosting the demand for vitamin K2 over the forecast period.

U.S. Vitamin K2 Market Trends

The vitamin K2 industry in the U.S. is projected to expand over the period, owing to the growing consumer awareness of its benefits for bone and heart health. The market is shaped by an aging population focusing on preventive health measures. FDA approvals of health claims related to vitamin K2 further stimulate demand. Advances in production technology have also contributed to market growth. Sales of vitamin K2 supplements are on the rise across different sales channels. In October 2022, Kappa Bioscience launched the first USDA organic-certified vitamin K2-MK7 under the K2Vital brand. This bioactive form is tailored for oil-based supplements, allowing manufacturers to create better-quality organic health products and enter the growing organic market segment. These factors are anticipated to boost market growth.

Europe Vitamin K2 Market Trends

The vitamin K2 market in Europe is recognized as a lucrative region owing to the rising interest in preventive healthcare and a growing preference for natural and organic products. The aging population's demand for bone health support drives growth in the vitamin K2 supplement market. Furthermore, strict health claims and product quality regulations influence consumers to choose high-quality vitamin K2 products. In February 2024, ILSI Europe launched a new Vitamin K2 Task Force composed of industry experts and academics to promote awareness and deepen scientific understanding of Vitamin K2's health. This is expected to boost the growth of the vitamin K2 industry over the forecast period.

Germany vitamin K2 market is experiencing significant growth, fueled by rising awareness of its health benefits, particularly for bone and cardiovascular health. Consumers increasingly favor MK-7 due to its superior bioavailability and longer half-life. There’s a notable shift towards organic, plant-based, and clean-label supplements, reflecting broader health and sustainability trends. Germany’s robust health and wellness sector and high consumer trust in quality supplements contribute to a dynamic market for Vitamin K2 products, with continued expansion expected.

The vitamin K2 market in the UK is witnessing steady growth, driven by rising consumer awareness about the benefits of vitamin K2 in bone health, cardiovascular wellness, and overall vitality. Increasing interest in natural supplements and the growing trend of proactive health management fuel demand for K2 products. With more consumers adopting healthy lifestyles, particularly in the aging population, the market is shifting towards high-quality, bioavailable forms of vitamin K2, such as MK-7, for better absorption and effectiveness.

Asia Pacific Vitamin K2 Market Trends

The vitamin K2 market in Asia Pacific is projected to grow at a significant CAGR over the forecast period. Growth in the region is driven by a rising middle-class population with greater disposable incomes and increasing awareness of nutritional supplements for overall health. Countries like Japan and South Korea, known for their focus on traditional medicine, show significant adoption of vitamin K2 products. Advances in manufacturing technology are making these supplements accessible to consumers across various income levels. In December 2023, South Korea's Ministry of Food and Drug Safety (MFDS) proposed approving vitamin K2 as a health-functional food ingredient, responding to industry requests and recognizing its global use in health supplements. Minister Oh Yu-Kyoung's visit to local vitamin K2 manufacturer GF-Fermentech highlights the ministry's proactive role in evaluating this ingredient. Similarly, in June 2022, Fermenta Biotech and Kappa Bioscience, a Norwegian company, partnered to distribute K2VITAL Vitamin K2 MK-7 in India. This collaboration combines Kappa's manufacturing and Fermenta's distribution expertise, enhancing the supply of Vitamin K2, which supports calcium transport and works well with vitamin D3. These factors are anticipated to propel the demand for vitamin K2 over the forecast period.

China vitamin K2 market is expanding rapidly, influenced by a growing awareness of the importance of bone and cardiovascular health. As the population ages, there is a rising demand for supplements that support overall well-being. The Chinese market is also shifting toward natural and functional foods, with vitamin K2 products gaining popularity in both the wellness and food sectors. Traditional Chinese medicine contributes to accepting K2 supplements as part of a holistic health approach.

The vitamin K2 market in Japan is seeing consistent growth, largely due to the country’s aging population and increasing focus on health maintenance. Japanese consumers are highly receptive to supplements supporting bone health, cardiovascular function, and longevity. Vitamin K2 is often integrated into functional foods and supplements, particularly on MK-7, and is known for its superior bioavailability. Japan’s strong health-conscious culture and advancements in health research continue to drive the demand for vitamin K2 products.

Middle East and Africa Vitamin K2 Market Trends

The vitamin K2 market in the Middle East and Africa (MEA) is gradually growing as health awareness increases. Rising concerns about bone health, especially in countries with aging populations, drive demand for K2 supplements. In addition, the popularity of natural and organic health products is boosting the market. Consumer interest in preventative health, combined with the adoption of Western wellness trends, is prompting more people to incorporate vitamin K2 into their daily routines, contributing to the market's expansion.

Saudi Arabia vitamin K2 market is gaining traction as the population becomes more health-conscious, particularly regarding bone and heart health. The country’s increasing focus on wellness and adopting preventative healthcare practices drive the demand for K2 supplements. With a growing interest in natural and functional foods, vitamin K2 is being integrated into dietary supplements and fortified products. The rise of lifestyle-related health conditions also contributes to the popularity of K2 in maintaining overall well-being.

The vitamin K2 market in Kuwait is gradually expanding as awareness of its health benefits grows, especially concerning bone health and cardiovascular wellness. The country’s affluent population is increasingly investing in health supplements as part of a preventive approach to well-being. With a strong focus on natural and high-quality products, Kuwaiti consumers are turning to vitamin K2 supplements to complement their healthy lifestyles.

Key Vitamin K2 Company Insights:

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Vitamin K2 Companies:

The following are the leading companies in the vitamin K2 market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- Life Extension

- Pharmavite (Nature Made)

- Nestlé (Garden of Life)

- Bronson

- NatureWise

- Solaray

- Natural Factors

- Source Naturals

- MaryRuth Organics

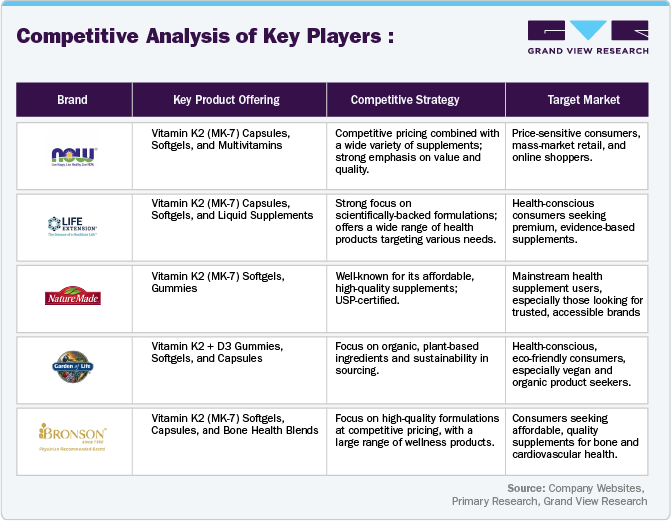

Competitive Analysis of Key Players

Recent Developments

-

In March 2024, SunWay Biotech and Gnosis by Lesaffre launched MenaQ7 Metabolic, a blend of vitamin K2 and a statin-free red yeast rice fermentate, Ankascin 568-R, designed to support heart and bone health. This new ingredient, which is free of Monacolin K and has achieved NDI status, is backed by over 130 scientific studies on its metabolic benefits.

-

In April 2023, Kappa Bioscience, renowned for producing vitamin K2 through its flagship brand K2VITAL, plans to demonstrate for the first time the combined benefits of its all-trans vitamin K2 MK-7 ingredients alongside the comprehensive offerings of the Balchem Human Nutrition & Health (HN&H) portfolio at Vitafoods Europe.

-

In June 2022, Balchem Corp. announced their agreement to acquire Kappa Bioscience, a market-leading producer of vitamin K2. This strategic deal aligns with Balchem's vision of promoting health and wellness. Kappa Bioscience is committed to developing high-quality health solutions centered around vitamin K2 to enhance people's quality of life.

Vitamin K2 Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 320.0 million

Revenue forecast in 2030

USD 602.0 million

Growth rate

CAGR of 13.47% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, dosage form, source, indication, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

NOW Foods; Life Extension; Pharmavite; Nestlé; Bronson; NatureWise; Solaray; Natural Factors; Source Naturals; MaryRuth Organics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitamin K2 Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vitamin K2 market report based on product, dosage form, source, indication, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

MK-7

-

MK-4

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Softgels

-

Liquid

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone Health

-

Heart Health

-

Blood Clotting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Health Supplements

-

Functional Foods and Beverages

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Pharmacies & Drug Stores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vitamin K2 market size was estimated at USD 292.4 million in 2024 and is expected to reach USD 320.0 million in 2025.

b. The global vitamin K2 market is expected to grow at a compound annual growth rate of 13.47% from 2025 to 2030 to reach USD 602.0 million by 2030.

b. North America dominated the vitamin K2 market with a share of 35.18% in 2024 and is expected to grow at a significant CAGR over the forecast period. This is attributable to rising healthcare awareness coupled with the growing geriatric population.

b. Some key players operating in the vitamin K2 market include NOW Foods, Life Extension, Pharmavite, Nestlé, Bronson, NatureWise, Solaray, Natural Factors, Source Naturals, MaryRuth Organics

b. Key factors that are driving the vitamin K2 market growth include increasing consumer awareness of its health benefits, increasing geriatric population, and changing dietary preferences towards functional foods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.