- Home

- »

- Beauty & Personal Care

- »

-

Vitamin C Serum Market Size, Share & Trends Report, 2030GVR Report cover

![Vitamin C Serum Market Size, Share & Trends Report]()

Vitamin C Serum Market (2025 - 2030) Size, Share & Trends Analysis Report By Concentration (Below 10%, 10% to 20%), By Type (Mass, Luxury), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-356-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin C Serum Market Summary

The global vitamin C serum market size was estimated at USD 1.35 billion in 2024 and is expected to grow at a CAGR of 7.7% from 2025 to 2030. Vitamin C serums have become popular due to their multifaceted benefits in skincare.

Key Market Trends & Insights

- North America dominated the global vitamin C market with a revenue share of 31.18% in 2023

- By concentration, 10% - 20% segment dominated the market and accounted for a revenue share of 54.28% in 2023

- By type, the mass segment dominated the market, accounting for 45.95% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.35 Billion

- 2030 Projected Market Size: USD 2.10 Billion

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2023

They inhibit melanin synthesis, reduce hyperpigmentation, and are powerful antioxidants that combat photodamage. In addition, vitamin C boosts collagen production, improving skin texture and firmness. Despite stability challenges, combining vitamin C with ingredients like vitamin E or ferulic acid enhances its efficacy and shelf life, making it a sought-after treatment for various skin concerns, including melasma, post-inflammatory hyperpigmentation, and aging.

Vitamin C serum is suitable for all ages and offers benefits beyond anti-aging, such as reducing hyperpigmentation and enhancing skin texture. Young people, influenced by social media and a proactive approach to skincare, are increasingly incorporating Vitamin C into their routines. This broad appeal across age groups significantly contributes to the growing demand for Vitamin C serums, making them a staple in modern skincare.

Supporting this trend, Bubble Skincare, popular among teenagers, expanded into the UK market in December 2023 through an exclusive partnership with Boots. This expansion into physical stores, starting at Battersea Power Station and extending to over 200 Boots stores by January 2024, aims to make affordable, high-quality skincare products more accessible to teenagers, highlighting the growing interest and demand for skincare products among all age groups.

The rising trend of male beauty influencers and makeup artists has played a pivotal role in normalizing and popularizing skincare routines among men. New product developments and robust marketing strategies from key market players bolster this cultural shift. According to an October 2022 study in the Global Cosmetic Industry, around 27% of men expressed dissatisfaction with their current skincare products, citing inefficacy in addressing their specific facial skin concerns. Brands like The Man Company have responded to this demand by offering specialized skincare products for men. For instance, their vitamin C serum caters to combination skin types, effectively promoting skin radiance and addressing unique skincare needs. This tailored approach underscores the evolving landscape where men increasingly embrace skincare as an integral part of their grooming routines.

Innovation, exemplified by products like Westman Atelier's Suprême C, launched in 2024, drives demand for Vitamin C serums by addressing longstanding issues and enhancing efficacy. Suprême C's formulation with 100% lipophilic derivative of Vitamin C illustrates a breakthrough in stability and absorption, mitigating typical drawbacks like oxidation and unpleasant scents. This technological advancement promises rapid results-reducing fine lines, hyperpigmentation, and dullness in just two weeks-appealing to consumers seeking potent yet gentle skincare solutions. The serum's luxurious texture further sets it apart, offering a seamless application experience that absorbs quickly without residue, catering to discerning skincare enthusiasts seeking both effectiveness and elegance in their regimen.

Concentration Insights

The 10% - 20% segment dominated the market and accounted for a revenue share of 54.28% in 2023. This is due to their optimal balance of potency and safety. This range ensures maximum effectiveness in addressing skincare concerns like hyperpigmentation and aging while minimizing the risk of irritation associated with higher concentrations. It strikes a perfect balance, appealing to consumers seeking reliable results without compromising skin tolerance.

Demand for vitamin C serums with below 10% concentration is anticipated to rise at a CAGR of about 8.7% from 2024 to 2030.These lower concentrations offer skincare benefits such as antioxidant protection and mild brightening effects, catering to a broader demographic concerned with skin health without the potential irritation associated with higher concentrations. This trend reflects a growing preference for effective yet gentle skincare solutions across diverse consumer segments.

Type Insights

The mass segment dominated the market, accounting for 45.95% in 2023. The growth of mass skincare products owes much to strategic marketing efforts and expanded product offerings by major personal care and cosmetics companies like Procter & Gamble and Beiersdorf. For instance, Beiersdorf's Nivea brand launched the "Strength in Numbers" campaign in May 2022 in the UK, focusing on mental health awareness among men, boosting brand visibility, and attracting new customers. Meanwhile, affordable product launches play a crucial role, such as Good Molecules' June 2024 release of its Vitamin C Serum with Oryzanol, priced at approximately USD 14. This serum features advanced vitamin C forms known for stability and efficacy in combatting oxidative stress and enhancing collagen production, catering to cost-conscious consumers seeking quality skincare solutions.

Demand for luxury vitamin C serums is expected to rise at a CAGR of about 8.1% from 2024 to 2030. The popularity of luxury skincare products is rising due to heightened consumer willingness among high net-worth and middle-class individuals to invest in high-end cosmetics. Brands like Tatcha capitalize on their effective marketing strategies, offering prestige and exclusivity through innovative packaging, superior ingredients, and personalized customer engagement via social media, driving allure and demand in the luxury beauty market. Tatcha’s Violet-C Brightening Serum, which has two forms of vitamin C, retails for USD 89 for its 30ml product.

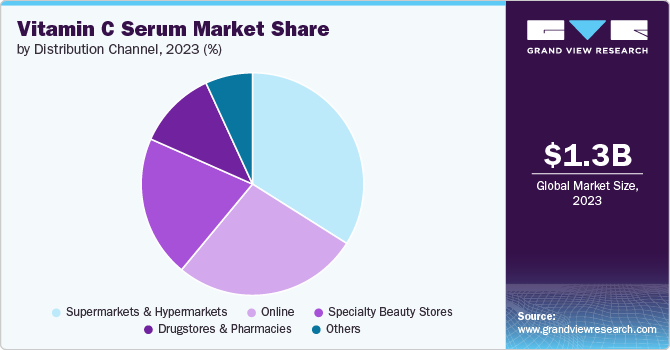

Distribution Channel Insights

The sales of vitamin C serum through hypermarkets & supermarkets accounted for a market share of 33.95% in 2023.Supermarkets and hypermarkets are progressively establishing themselves as reliable beauty retail locations by providing a wide assortment of skincare and makeup items. These establishments promote an engaging beauty buying experience by emphasizing visual merchandising and categorization. In 2022, over 100 UK stores started to provide skincare consultations powered by artificial intelligence (AI) and augmented reality (AR) due to a partnership between Sainsbury's, Garnier, and L'Oréal Paris. This technology analyzes consumers' faces to provide tailored skincare recommendations and reflects the growing interest in skin health and the demand for goods such as vitamin C serum.

Online sales of vitamin C serum are expected to grow at a CAGR of 8.8% from 2024 to 2030.The market's e-commerce growth is fueled by the convenience of online shopping, offering consumers easy access to a wide array of skin care products from home. According to a 2022 survey conducted by YouGov, approximately 10% of global consumers prefer to purchase health and beauty products online exclusively, while about 22% predominantly shop online. Increasing skincare shopping through e-commerce boosts the vitamin C serum market by expanding consumer access and choice, driving growth in online sales and market competitiveness.

Regional Insights

The vitamin C serum market in North America accounted for a market share of 31.18% in 2023. Consumers are increasingly aware of skincare benefits promoted through social media and digital platforms like TikTok and YouTube. In addition, the region's robust beauty market, driven by high consumer spending and a preference for effective, scientifically-backed products, contributes to the popularity of skincare items that promise anti-aging and skin-brightening benefits. This trend is amplified by a growing interest in maintaining a youthful appearance and proactively addressing skincare concerns among younger demographics influenced by digital media and older consumers seeking effective anti-aging solutions.

U.S. Vitamin C Serum Market Trends

The vitamin C serum market in the U.S. accounted for a market share of around 81% in 2023 in the North American market. The market offers a variety of skincare products catering to different needs and preferences. Brands like CeraVe, The Ordinary, and Tatcha have gained popularity for their effective formulations at accessible price points, appealing to a wide range of consumers. Also, continuous innovation in skincare formulations, such as advanced delivery systems and ingredient combinations, attracts consumers looking for cutting-edge solutions to their skincare concerns. Such trends bode well for vitamin C demand in the country.

Asia Pacific Vitamin C Serum Market Trends

The vitamin C serum market in Asia Pacific is anticipated to grow at a CAGR of about 8.9% from 2024 to 2030. The skincare industry is booming in the Asia Pacific due to rising consumer interest in mass and prestige beauty products, driven by a cultural emphasis on beauty, an increasing middle class, and greater access to products. This growth signifies a significant opportunity for the vitamin C serum market as consumers seek effective and potent skincare solutions. The demand for high-quality, bioavailable products like vitamin C serums is expected to rise, making it a lucrative segment for beauty brands targeting this region.

Key Vitamin C Serum Company Insights

The market is fragmented. Many brands have recognized untapped opportunities in their product offerings and have adopted marketing campaigns, mergers & acquisitions, and product launches to gain market share. In June 2024, for instance, Estee Lauder Companies, Inc. finalized its acquisition of DECIEM Beauty Group Inc., a Canadian-based vertically integrated company with multiple brands. Following Estee Lauder Companies, Inc.'s initial investment in 2017 and majority ownership acquisition in 2021, DECIEM has utilized these resources to achieve significant growth and enhance its global presence.

Key Vitamin C Serum Companies:

The following are the leading companies in the vitamin c serum market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A.

- Galderma S.A.

- Amorepacific Group Inc.

- KOSÉ Corporation

- Clarins Inc.

- Unilever plc

- Shiseido Company Limited

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Procter & Gamble Co.

Recent Developments

-

In July 2024, L'Oréal Group collaborated with Debut, a biotech beauty company, to innovate over a dozen essential bio-identical ingredients intended to replace conventional sources currently utilized in L'Oréal's global beauty and personal care products spanning hair, skin, color cosmetics, and fragrance categories. The initiative seeks to revolutionize ingredient-sourcing methods within the beauty industry by utilizing advanced biotechnology processes like fermentation and cell-free technology.

-

In February 2024, Shiseido Company, Limited’s subsidiary, Shiseido Americas Corporation, announced the completion of the acquisition of DDG Skincare Holdings LLC, the parent company of the Dr. Dennis Gross Skincare brand. This acquisition is part of Shiseido's strategic framework, which focuses on skin beauty and aims to strengthen its presence and growth in the Americas region while enhancing geographic diversification.

-

In August 2021, Shiseido Company Limited’s brand Drunk Elephant launched a new version of its vitamin C serum, C-Firma Fresh. The product features l-ascorbic acid, recognized as the most potent form of vitamin C, provided in powder form separate from the liquid serum. This innovative approach ensures maximum potency and bioavailability upon mixing, enhancing efficacy and maintaining freshness for prolonged shelf life.

Vitamin C Serum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.45 billion

Revenue forecast in 2030

USD 2.10 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Concentration, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

L'Oréal S.A.; Galderma S.A.; Amorepacific Group Inc.; KOSÉ Corporation; Clarins Inc.; Unilever plc; Shiseido Company Limited; Beiersdorf AG; Estée Lauder Companies Inc.; Procter & Gamble Co.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Vitamin C Serum Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the vitamin C serum market report based on concentration, type, distribution channel, and region:

-

Concentration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 10%

-

10% to 20%

-

20% and Above

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

Luxury

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global vitamin C serum market was estimated at USD 1.27 billion in 2023 and is expected to reach USD 1.36 billion in 2024.

b. The global vitamin C serum market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 2.10 billion by 2030.

b. Europe dominated the vitamin C serum market with a share of around 32% in 2023. This is due to its its advanced skincare industry and high consumer awareness and demand for premium skincare products.

b. Key players in the vitamin C serum market are L'Oréal S.A.; Galderma S.A.; Amorepacific Group Inc.; KOSÉ Corporation; Clarins Inc.; Unilever plc; Shiseido Company Limited; Beiersdorf AG; Estée Lauder Companies Inc.; Procter & Gamble Co.

b. Key factors that are driving the vitamin C serum market growth include the he rising popularity of clean beauty products, increasing online retail channels, and the growing influence of social media beauty trends.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.