- Home

- »

- Food Additives & Nutricosmetics

- »

-

Vitamin C Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Vitamin C Market Size, Share & Trends Report]()

Vitamin C Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (Regular, Medium), By Distribution Channel (Offline, Online), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin C Market Summary

The global vitamin C market size was estimated at USD 1.95 billion in 2023 and is projected to reach USD 2.61 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. Vitamin C, also known as ascorbic acid, has the ability to promote collagen synthesis, which enhances skin elasticity and diminishes the appearance of fine lines and wrinkles.

Key Market Trends & Insights

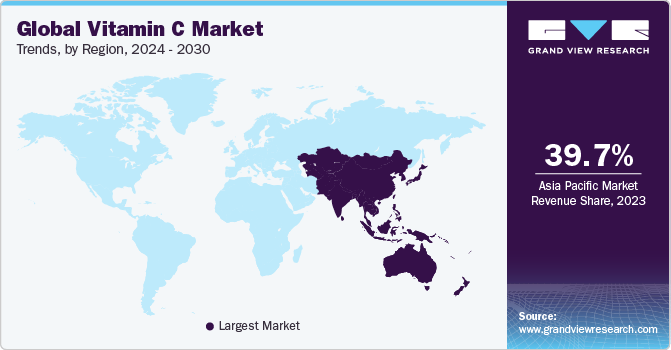

- Asia Pacific led the global vitamin C market, with the largest revenue share of 39.65% in 2023.

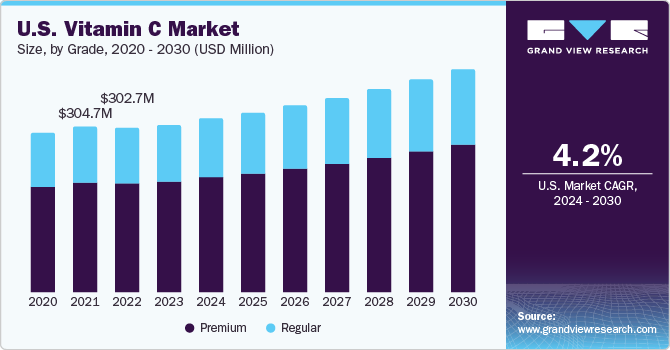

- By grade, the premium grade segment led the market, with the largest revenue share of 73.98% in 2023.

- By distribution channel, the offline channel segment led the market, with the largest revenue share of 82.66% in 2023.

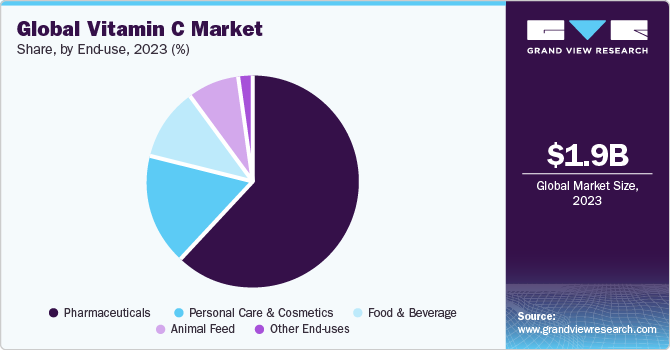

- By end use, the pharmaceuticals industry segment led the market, with the largest revenue share of 61.83% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.95 Billion

- 2030 Projected Market Size: USD 2.61 Billion

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

Consequently, products such as serums, creams, and lotions that incorporate ascorbic acid have become immensely popular for achieving a more youthful and radiant complexion. The growing awareness regarding the health benefits associated with consuming products fortified with ascorbic acid is anticipated to trigger the market over the forecast period.

The U.S. has a well-established personal care and cosmetics industry, which is a key application for ascorbic acid. It is home to key players in the cosmetics industry, such as Procter & Gamble, Estee Lauder, L’Oréal, and others. An increasing number of customers are looking for personal care products with eco-friendly credentials or natural ingredients. This forms a significant driver for vitamin C, which is used as an antioxidant and a shield against suspended pollutants in the air.

The rise of e-commerce platforms and online retail has revolutionized the vitamin market. Consumers now have easy access to a wide range of vitamin products, often with detailed product descriptions, customer reviews, and personalized recommendations. The convenience and variety offered by online retailers have contributed to the surge in demand for vitamins, as consumers can now select and purchase products that align with their specific needs and preferences from the comfort of their homes.

Ascorbic acid faces several industry challenges due to its high instability and reactivity. One of the main challenges is its high instability as ascorbic acid is easily oxidized, leading to the loss of its beneficial properties. This instability poses a significant hurdle for the industry, in terms of manufacturing and formulating products that contain ascorbic acid.

Grade Insights

Based on grade, the premium grade segment accounted for the largest revenue share of 73.98% in 2023. This is attributed to its usage in niche applications in key industries such as pharmaceuticals, personal care products & cosmetics, food & beverage, and biotechnology. It is also used in research activities and other specialized applications. The food & beverages industry uses ascorbic acid to manufacture high-quality customized vitamin C supplements. The maintenance of the highest level of quality in ascorbic acid ensures that it can be used for medicinal purposes.

Regular grade is another major type of vitamin C with extensive applications in the food & beverages industry for the cost-effective addition of vitamin C to food products & beverages. This acid is also used as a dough conditioner in bread making. It is utilized for fortifying bakery products as well. Ascorbic acid has an innate quality to neutralize chlorine which makes it an important ingredient in water treatment processes.

Distribution Channel Insights

Based on distribution channel, the offline channel segment accounted for the largest revenue share of 82.66% in 2023. This is attributed to the offline distribution of ascorbic acid comprises a network of manufacturers that produce this acid in powder or liquid forms, as well as its subsequent suppliers acting as intermediaries between manufacturers and end-use industries. Ascorbic acid is primarily supplied in the form of water-soluble white crystalline powder by manufacturers.

The online distribution channel segment witnessed significant growth in the last few years supported by the increasing digitalization of businesses and surging international trade activities. The growth of global e-commerce platforms such as Amazon and Alibaba has created a global marketplace for ascorbic acid. The convenience and variety offered by online distribution channels in terms of manufacturers, suppliers, quality, and quantity of ascorbic acid have led consumers to increasingly prefer them over traditional or brick-and-mortar modes of purchase.

End-use Insights

Based on end-use, the pharmaceuticals industry segment accounted for the largest revenue share of 61.83% in 2023. This is attributed to its rising applications as an ingredient in tablets or capsules used to prevent or treat low levels of vitamin C, which can result in scurvy, causing symptoms such as joint pain, weakness, tiredness, rashes, or tooth loss. It is also used as an antioxidant, helping the body to heal wounds, enhance the absorption of iron content from plant foods, and support the immune system.

Personal care and cosmetics is another major end-user industry for vitamin C (ascorbic acid), where it is used as an ingredient in the manufacturing process. Vitamin C acts as a potent antioxidant drug and hence is used in dermatology to prevent and treat changes associated with the phenomenon of photoaging. It is also used for treating other skin problems, such as hyperpigmentation. It has an innate quality to fight free radicals or toxins that may come into contact with human skin through air pollution.

Ascorbic acid is often added to cereals, fruit juices, dried fruits, frozen fruits, and fruit-flavored candies to add or fortify a citrus flavor. It also acts as a preservative to prevent spoiling of food such as cured meats, jams, jellies, and bread. Growing awareness regarding the importance of nutritious and fortified food for a healthy lifestyle has led to a surge in demand for nutrient-enriched food along with adequate flavor, which has increased the consumption of vitamin C.

Regional Insights

Asia Pacific accounted for the largest revenue share of 39.65% in 2023. This is attributed to presence of large-scale pharmaceutical companies along with major consumptions in other sectors such as animal feed and cosmetics. Asia Pacific leads the world in animal feed production, producing a total of 465.54 million metric tons in 2022, down from 467.92 million metric tons in 2021. Asia Pacific is also one of the largest pharmaceutical industries in the world, with countries such as Japan, India, and China leading the way in different fields, such as vaccine production, generic drugs, and other services.

Europe holds a significant position in the market, with countries such as Germany, UK, and France driving its growth. The growth can be attributed to growth in the pharmaceutical industry in Europe. In addition, Europe has a robust research and development foundation in the pharmaceutical industry with various universities, research centers, and biotech companies contributing to innovation and development of new drugs. These factors collectively contribute to the expansion of the pharmaceutical industry, driving the demand for the ascorbic acid market.

Key Companies & Market Share Insights

Majority of the manufacturing companies and suppliers are based in the Asia Pacific region especially, in China. Abundant availability of raw materials, cheap labor, rapid industrialization, and economic progress contribute to market growth in the region. Companies are focusing on new product development to meet consumer needs for vitamin C.Notably, the global market is currently dominated by key industry leaders such as Spectrum Chemical, Sinofi Ingredients, and Botanic Healthcare.

Numerous manufacturing companies are now-a-days adopting a number of strategies like new product launches, partnerships, expansion, and mergers & acquisitions, to name a few. For instance, in June 2023, DSM-Firmenich, a leading company in vitamin industry, announced the reconstruction of its vitamin business. This decision was undertaken considering the current market trends, conditions, and a notable weakening of the overall vitamin markets globally.

Key Vitamin C Companies:

- Spectrum Chemical

- Sinofi Ingredients

- DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd

- Fengchen Group Co., Ltd

- Fooding

- Northeast Pharmaceutical Group Co., Ltd (NEPG)

- Botanic Healthcare

- CSPC Pharmaceutical Group Limited

- Foodchem International Corporation

- Global Calcium PVT LTD

- JOSHI AGRO

- M.C. Biotec Inc.

- Pharmavit

- NAGASE & CO., LTD.

- Reckon Organics Private Ltd.

- RX MARINE INTERNATIONAL

- Shandong Luwei Pharmaceutical Co., Ltd.

- VATJAT PHARMA FOODS PRIVATE LIMITED

- VCos Cosmetics Pvt Ltd.

- Honson Pharmatech Group.

- Anhui BBCA Group

Vitamin C Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.01 billion

Revenue forecast in 2030

USD 2.61 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Spectrum Chemical; Sinofi Ingredients; DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd; Fengchen Group Co., Ltd; Fooding, Northeast Pharmaceutical Group Co., Ltd (NEPG); Botanic Healthcare; CSPC Pharmaceutical Group Limited; Foodchem International Corporation; Global Calcium PVT LTD; JOSHI AGRO; M.C. Biotec Inc.; Pharmavit; NAGASE & CO., LTD.; Reckon Organics Private Ltd.; RX MARINE INTERNATIONAL; Shandong Luwei Pharmaceutical Co., Ltd.; VATJAT PHARMA FOODS PRIVATE LIMITED; VCos Cosmetics Pvt Ltd.; Honson Pharmatech Group.; Anhui BBCA Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Vitamin C Market Report Segmentation

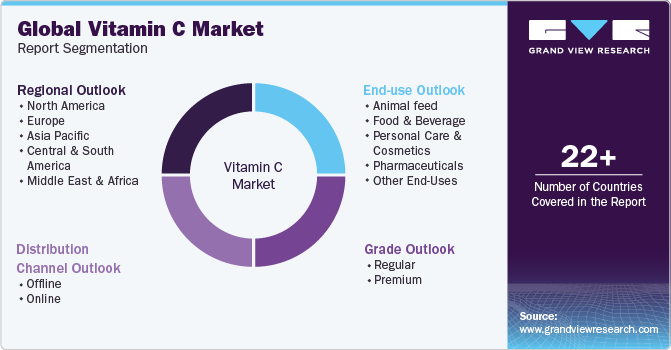

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vitamin C market report based on grade, end-use, distribution channel and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Regular

-

Premium

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Animal feed

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Other End-Uses

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.