- Home

- »

- Next Generation Technologies

- »

-

Visitor Management System Market Size, Share Report 2030GVR Report cover

![Visitor Management System Market Size, Share & Trends Report]()

Visitor Management System Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By Deployment (Cloud-based, On-premises), By Solution (Software, Services), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-265-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Visitor Management System Market Summary

The global visitor management system (VMS) market size was estimated at USD 1.63 billion in 2023 and is anticipated to reach USD 3.98 billion by 2030, growing at a CAGR of 13.4% from 2024 to 2030. The increasing focus on security and the need to protect sensitive information and assets drive the demand for VMS solutions.

Key Market Trends & Insights

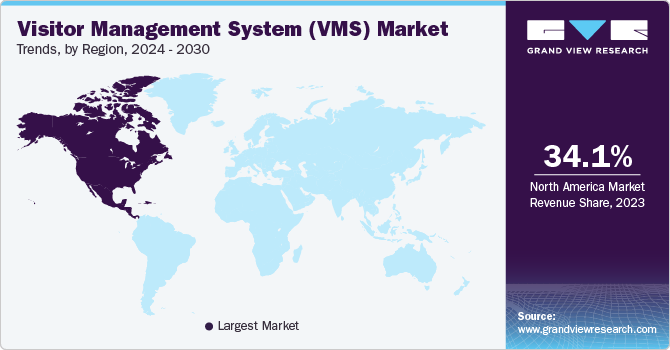

- North America held the largest market share of 34.11% in 2023.

- The visitor management system (VMS) market in the U.S. held the largest share of 88.28% in North America.

- Based on application, the compliance management & fraud detection segment held the largest market share of over 30% in 2023.

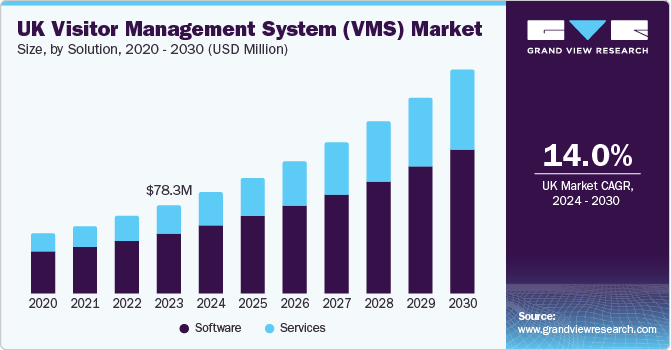

- Based on solution, software segment held the largest share in 2023.

- Based on vertical, BFSI segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.63 Billion

- 2030 Projected Market Size: USD 3.98 Billion

- CAGR (2024-2030): 13.4%

- North America: Largest market in 2023

VMS helps in enhancing security by managing visitor access, screening visitors, and ensuring compliance with security protocols. Many industries, such as healthcare, finance, and government, have strict regulatory requirements regarding visitor tracking, identity verification, and data privacy. VMS helps organizations comply with these regulations by maintaining accurate visitor records and access logs. VMS enhances the visitor check-in process, reduces wait times, and improves overall operational efficiency. By automating tasks such as registration, badge printing, and notifications, VMS allows organizations to focus on core activities and improve productivity. Integration capabilities with access control systems, CCTV cameras, and other security technologies enhance the functionality of VMS. This integration enables seamless monitoring of visitor activities and enhances overall security measures.

Implementing a VMS can save costs by reducing manual paperwork, minimizing security breaches, and optimizing resource utilization. The automation and streamlining of visitor management tasks contribute to overall cost-efficiency for organizations. The COVID-19 pandemic accelerated the adoption of contactless and touchless technologies, including VMS solutions. Organizations prioritize solutions that support contactless check-ins, health screenings, and capacity management to ensure a safe environment for visitors and employees.

Market Concentration & Characteristics

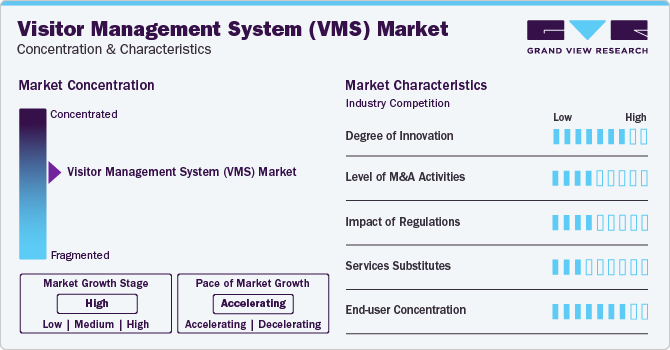

The VMS industry growth stage is high, and the pace of the market growth is accelerating. Advanced features such as facial recognition, mobile check-ins, pre-registration systems, and cloud-based deployments are becoming more common to meet the evolving needs of organizations.

Regulatory compliance, particularly in sectors like healthcare, government, and finance, significantly influences the adoption and development of VMS solutions. Data privacy regulations such as GDPR and HIPAA have implications for visitor data handling and security practices.

The demand for VMS solutions spans across various industries, including corporate offices, healthcare facilities, educational institutions, government buildings, manufacturing plants, and hospitality venues. Different end-user segments may have unique requirements, leading to the customization and specialization of VMS offerings to cater to specific verticals.

Application Insights

Based on application, the compliance management & fraud detection segment held the largest market share of over 30% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Businesses and institutions prioritize fraud detection and risk mitigation strategies to protect against unauthorized access, data breaches, and fraudulent activities. VMS platforms equipped with advanced fraud detection algorithms, biometric authentication, and real-time monitoring capabilities are essential tools for identifying and preventing potential security threats posed by visitors.

The ongoing digital transformation across industries drives the adoption of technology-driven solutions like VMS to replace manual and paper-based visitor management processes. Digital VMS platforms enable organizations to streamline workflows, improve efficiency, and enhance overall visitor experiences while ensuring compliance with regulatory requirements.

Solution Insights

Based on solution, software held the largest share in 2023. User-friendly interfaces and intuitive designs contribute significantly to the success of software products. Companies that prioritize user experience and regularly update their software based on user feedback tend to have higher market shares. With the increasing importance of data security and privacy, software companies that invest in robust security measures and comply with industry regulations attract more customers, especially in sectors like finance, healthcare, and government.

The services segment is expected to grow at the fastest CAGR during the forecast period. The increasing adoption of cloud computing services is driving demand for related services such as cloud migration, integration, management, and optimization. Businesses are leveraging cloud technologies to scale their operations, reduce IT infrastructure costs, and access advanced capabilities like AI and data analytics.

Vertical Insights

Based on vertical, BFSI held the largest market share in 2023. The BFSI sector is heavily regulated, with stringent compliance requirements related to data security, privacy, anti-money laundering (AML), Know Your Customer (KYC) regulations, and financial reporting. Software solutions that help BFSI companies ensure compliance and manage regulatory complexities are in high demand. BFSI companies prioritize risk management to mitigate financial, operational, and cybersecurity risks.

IT & Telecom is expected to grow at the fastest CAGR over the forecast period. Telecom companies are increasingly adopting cloud services for infrastructure management, data storage, and software deployment. This shift to cloud-based solutions drives demand for software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) offerings.

Deployment Insights

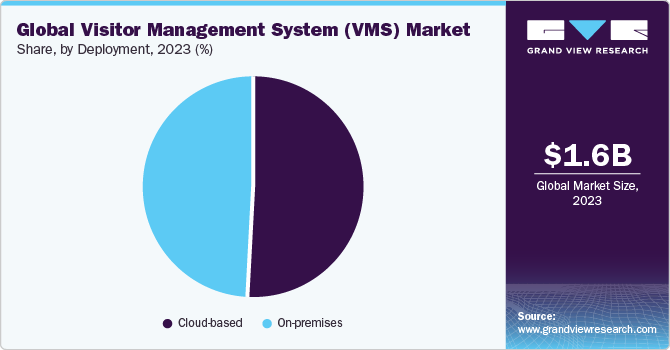

Based on deployment, the cloud-based segment held the largest market share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Cloud-based VMS solutions offer scalability, allowing organizations to easily accommodate fluctuating visitor volumes without significant infrastructure investments. They also provide flexibility in terms of deployment, enabling seamless integration with existing systems and support for remote access and management, thereby driving the segment growth.

Cloud VMS solutions offer anytime, anywhere access via web browsers or mobile apps, allowing authorized personnel to manage visitor registrations, access control, and compliance tasks remotely. This accessibility enhances operational efficiency and visitor experience by eliminating geographical constraints and enabling real-time monitoring and response capabilities.

Regional Insights

North America held the largest market share of 34.11% in 2023. Stringent regulatory requirements, such as privacy regulations in North America (e.g., CCPA, HIPAA), compel organizations to implement VMS solutions that adhere to data protection and privacy standards. Compliance with regulations drives the adoption of VMS with robust data management and access control features.

U.S. Visitor Management System (VMS) Market trends

The visitor management system (VMS) market in the U.S. held the largest share of 88.28% in North America. The adoption of cloud-based VMS solutions continues to grow due to benefits such as scalability, remote accessibility, automatic updates, and cost-effectiveness. Cloud-based VMS platforms offer flexibility for organizations of all sizes, allowing them to manage visitor data securely without heavy on-premises infrastructure. Advanced VMS platforms offer data analytics, reporting tools, and customizable dashboards that provide insights into visitor traffic, demographics, peak visit times, compliance metrics, and security incidents. Data-driven analytics enables organizations to make informed decisions, optimize resources, and improve operational efficiency in visitor management.

VMS solutions that can integrate seamlessly with access control systems, surveillance cameras, and IoT devices are preferred by European organizations. Integration allows for centralized management, automated workflows, and enhanced security functionalities, contributing to the adoption of VMS in various industries.

Europe Visitor Management System (VMS) Market trends

The visitor management system (VMS) market in Europe held a considerable share in 2023. VMS that offers user-friendly interfaces, mobile check-in options, and personalized visitor experiences contributes to improved customer satisfaction and loyalty.

The U.K. visitor management system (VMS) market held the largest market revenue share in 2023. Providing a positive visitor experience is crucial for businesses and institutions in the U.K. Developments in VMS providers offering innovative features such as facial recognition, biometric authentication, cloud-based deployments, and analytics-driven insights attract customers looking for cutting-edge solutions.

The visitor management system (VMS) market in France is expected to grow at the fastest CAGR over the forecast period. French businesses and organizations are undergoing digital transformation initiatives to improve operational efficiency, streamline processes, and enhance customer experiences. VMS solutions play a vital role in digitizing visitor registration, automating workflows, reducing manual tasks, and providing real-time insights through analytics and reporting capabilities.

Key Visitor Management System Company Insights

Some of the key companies operating in the global visitor management system market are Acre Security, Honeywell Forge, Envoy, Greetly and others. Acre Security's Visitor Management System offers comprehensive features designed to enhance security and streamline visitor management processes. The system includes visitor registration capabilities, check-in/check-out functionalities, badge printing for identification, notifications to hosts upon visitor arrival, integration with access control systems for temporary access credentials, watchlist screening for security checks, visitor tracking and reporting tools for analytics and compliance, as well as customizable options to match organizational needs and ensure data security.

Honeywell Forge offers visitor pre-registration capabilities for a smoother check-in process, integrates with access control systems to manage visitor access permissions, provides customizable visitor badges for identification, and sends notifications to hosts upon visitor arrival. It includes features like watchlist screening for security checks, visitor tracking for audit trails and analytics, real-time reporting tools for insights into visitor traffic, and compliance features to meet data security and privacy regulations.

Key Visitor Management System Companies:

The following are the leading companies in the visitor management system market. These companies collectively hold the largest market share and dictate industry trends.

- Acre Security

- ALICE Receptionist

- Envoy

- Greetly

- Honywell Forge

- iLobby

- Proxyclick

- Sign In Solutions Inc.

- SwipedOn

- Visitly

Recent Developments

-

In January 2021, Legrand introduced a cutting-edge addition to its smart home product lineup with the launch of a smart video doorbell featuring a high-definition wide-angle camera. This innovative doorbell not only enhances home security but also offers advanced convenience and connectivity features. The high-definition camera provides clear and crisp video footage with a wide viewing angle, allowing homeowners to monitor their doorstep and surroundings effectively.

-

In March 2024, Envoy launched its latest innovative security solutions designed to safeguard workplaces and ensure the safety of employees and visitors. It includes a range of cutting-edge technologies and features aimed at enhancing security protocols and mitigating risks within office environments. Envoy's solutions encompassed advanced access control systems, real-time monitoring capabilities, visitor management tools with contactless check-ins and health screenings, as well as integration with smart building systems for seamless security management.

Visitor Management System (VMS) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.87 billion

Revenue forecast in 2030

USD 3.98 billion

Growth rate

CAGR of 13.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Acre Security; ALICE Receptionist; Envoy; Greetly; Honeywell Forge; iLobby; Proxyclick; Sign In Solutions Inc.; SwipedOn; Visitly

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Visitor Management System (VMS) Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global visitor management system (VMS) market report based on application, deployment, solution, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parking Management

-

Compliance Management & Fraud Detection

-

Historical Visitor Tracking

-

Security Management

-

Contact Tracing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global visitor management system market size was estimated at USD 1.63 billion in 2023 and is expected to reach USD 1.87 billion in 2024

b. The global visitor management system market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030, reaching USD 3.98 billion by 2030

b. North America dominated the visitor management system market with a revenue share of 34.11% in 2023. The increasing need to comply with regulations drives the adoption of VMS with robust data management and access control features.

b. Some key players operating in the visitor management system market include Acre Security; ALICE Receptionist; Envoy; Greetly; Honeywell Forge; iLobby; Proxyclick; Sign In Solutions Inc.; SwipedOn; Visitly

b. Factors such as the increasing focus on security and the need to protect sensitive information and assets drive the demand for VMS solutions are driving the growth of the visitor management system market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.