- Home

- »

- Next Generation Technologies

- »

-

Vision Positioning System Market Size, Industry Report, 2030GVR Report cover

![Vision Positioning System Market Size, Share & Trends Report]()

Vision Positioning System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Sensors, Camera, Markers), By Location (Indoor, Outdoor), By Platform, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-290-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vision Positioning System Market Summary

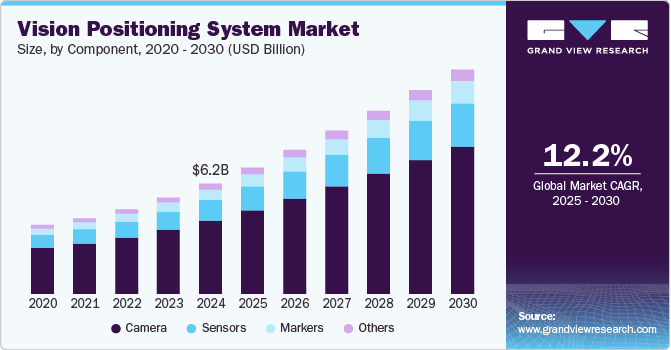

The global vision positioning system market size was estimated at USD 6.18 billion in 2024 and is projected to reach USD 12.60 billion by 2030, growing at a CAGR of 12.2% from 2025 to 2030. The market is largely driven by the rising demand for automation across various industrial operations.

Key Market Trends & Insights

- North America vision positioning system market is dominated with a revenue share of over 37% in 2024.

- The vision positioning system market in the U.S. held a dominant position in 2024.

- Based on component, the camera segment recorded the largest revenue share of over 66% in 2024.

- Based on location, the outdoor segment accounted for the largest market share in 2024.

- Based on platform, the unmanned aerial vehicles segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.18 Billion

- 2030 Projected Market Size: USD 12.60 Billion

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These systems play a vital role in facilitating automation and enhancing operational efficiency within industries. In addition, the increasing popularity of unmanned aerial vehicles (UAVs), the growing need for AI-powered optical sensors, and the expanding use of Automated Guided Vehicles (AGVs) in both commercial and defense sectors are expected to significantly boost market expansion. The rising popularity of autonomous vehicles, including drones and cars, drives innovation and the adoption of visual positioning systems (VPS). Companies are actively investigating VPS technology to enhance their autonomous vehicle initiatives. The increasing incorporation of VPS in transportation solutions aligns with a global focus on developing smart cities. Moreover, VPS significantly contributes to sustainable urban planning efforts by providing critical data on traffic patterns, pedestrian movements, and public space utilization. This information is essential for urban planners aiming to create more efficient and environmentally friendly cities.In addition, the continuous advancements in camera systems, sensors, artificial intelligence, and data analytics are driving progress in vision positioning systems. Ongoing innovations, strategic business expansions, new product introductions, and partnerships among industry players are expected to further stimulate market growth. Companies across various sectors are strategically utilizing these technologies to improve their products and services. For instance, in February 2024, ABB Ltd. acquired Sevensense, an AI-driven 3D vision navigation technology provider for autonomous mobile robots (AMRs). This acquisition represents a strategic investment in cutting-edge AI navigation technology that is set to transform the field of autonomous mobile robotics and foster innovation across multiple industries.

Furthermore, the vision positioning system industry is experiencing a surge in demand due to the increasing deployment of UAVs, which are utilized for data collection in remote areas. Various industries are actively investigating and launching new UAV models to improve their operations and services. For instance, in November 2023, the US Department of Defense and Airbus U.S. Space and Defense introduced a new business segment dedicated to military UAVs, focusing on system deployment, scaling, and optimization. This initiative is spearheaded by seasoned industry experts and former military drone operators, aiming to meet the evolving requirements of defense applications with cutting-edge UAV technology.

Moreover, there is an ongoing emphasis on establishing stricter safety standards for autonomous systems that utilize visual positioning systems (VPS). The increasing trend toward standardizing data formats and communication protocols within the VPS industry is anticipated to enhance interoperability and improve communication between various systems.

Component Insights

The camera segment recorded the largest revenue share of over 66% in 2024. The rising popularity of drone deliveries across various sectors, including e-commerce, logistics, and emergency services, has led to an increased demand for advanced camera technologies. In addition, the growth of the camera segment in the market is fueled by the necessity to capture visual data of the environment, advancements in machine vision, and the rise of autonomous vehicles, drone deliveries, and automated guided vehicles (AGVs).

The markers segment is projected to register the highest CAGR of over 13% from 2025 to 2030, owing to the increasing adoption of AI-based markers and the rising demand for marker-based VPS solutions in diverse industries such as healthcare, defense, industrial sectors, transportation and logistics, hospitality, and more. Furthermore, market expansion is supported by the growing use of LiDAR (Light Detection and Ranging) technology alongside other sensors in conjunction with cameras to provide a comprehensive view of the surroundings.

Location Insights

The outdoor segment accounted for the largest market share in 2024.This segment's growth is driven by the increasing demand for vision positioning systems that offer greater reliability, accuracy, and data richness to overcome the limitations of traditional GPS in outdoor environments. The market is expanding due to the rising adoption of VPS in infrastructure development and smart city initiatives. Moreover, innovations in VPS technology, such as improved accuracy, resilience in harsh outdoor conditions, and real-time data processing, are contributing to the segment's growth.

The indoor segment is expected to register a considerable CAGR from 2025 to 2030. This growth can be attributed to the rising demand for precise indoor positioning solutions across various sectors, including manufacturing, warehousing, logistics, retail, and hospitality. Moreover, the increasing prevalence of smartphones equipped with advanced sensors and cameras is encouraging consumers to adopt VPS-enabled applications, further driving market expansion. The use of VPS in industries such as augmented reality (AR) and virtual reality (VR) is also enhancing immersive indoor experiences, contributing to vision positioning system industry growth.

Platform Insights

The unmanned aerial vehicles segment accounted for the largest revenue share in 2024, primarily driven by the increasing popularity of UAVs across various sectors such as construction, surveying, infrastructure inspection, and agriculture. Furthermore, advancements in visual positioning systems-including improvements in sensors, cameras, and image processing algorithms-are enhancing UAVs' ability to navigate and operate reliably in challenging environments. This technological progress makes UAVs more suitable for a broader range of applications, fueling vision positioning system industry growth.

The automated guided vehicles segment is anticipated to record a significant CAGR from 2025 to 2030. This growth is largely due to the rising adoption of AGVs in diverse industries for material handling and transportation tasks, which leads to improved operational efficiency, reduced reliance on manual labor, and streamlined material flow within industrial and logistical settings. The integration of AGVs into existing systems and processes, along with the development of AI-enabled AGVs featuring advanced technologies such as machine learning and natural language processing, is anticipated to create lucrative growth opportunities within this segment.

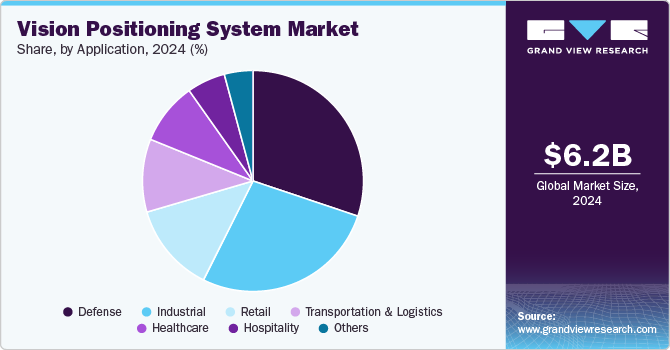

Application Insights

The defense segment accounted for the largest revenue share 2024, owing to the significant government initiatives and increased military spending, reflecting a robust commitment to enhancing national security and modernizing armed forces. Furthermore, the segmental growth is driven by the increasing adoption of VPS technology by military personnel to obtain real-time, high-resolution visual data, which is essential for situational awareness and informed decision-making in complex environments. Additionally, the rising need for enhanced border security and search-and-rescue missions further propels the growth of this segment, as defense agencies prioritize innovative solutions to address evolving security challenges.

The healthcare segment is anticipated to record the highest CAGR from 2025 to 2030. This growth is largely fueled by advancements in medical technology and a growing emphasis on digital health solutions. The rising demand for telemedicine, remote patient monitoring, and IoT-enabled healthcare devices is transforming the landscape of healthcare delivery. As population’s age and chronic diseases become more prevalent, investments in healthcare innovations are expected to accelerate significantly. This trend positions the healthcare sector for sustained growth as stakeholders prioritize improving patient outcomes and operational efficiencies through technological integration.

Regional Insights

North America vision positioning system market is dominated with a revenue share of over 37% in 2024. This growth can be attributed to several factors, including significant investments in advanced technologies and a strong regional focus on innovation. The integration of VPS with cutting-edge technologies such as artificial intelligence and machine learning has enhanced its effectiveness across various applications, particularly in sectors like defense, healthcare, and logistics.

U.S. Vision Positioning System Market Trends

The vision positioning system market in the U.S. held a dominant position in 2024. The increasing demand for automation and smart solutions in industries such as construction and transportation is propelling the industry'sgrowth in the U.S.

Europe Vision Positioning System Market Trends

The vision positioning system market in Europe is expected to grow at a considerable CAGR of over 11% from 2025 to 2030, driven by a strong emphasis on technological innovation and regulatory compliance. The region is witnessing significant investments in smart city initiatives and infrastructure development, which are increasingly incorporating VPS to enhance navigation and operational efficiency.

The UK vision positioning system market is expected to grow rapidly in the coming years. The UK government’s initiatives to promote innovation and digital transformation are encouraging businesses to adopt VPS solutions for improved operational efficiency. Furthermore, the increasing focus on safety and compliance in industries such as construction and logistics is driving the demand for reliable VPS technologies that can navigate complex environments effectively.

The vision positioning system market in Germany held a substantial market share in 2024. The country's strong industrial base is increasingly adopting VPS technologies to enhance automation and improve precision in processes such as assembly and logistics.

Asia Pacific Vision Positioning System Market Trends

The vision positioning system market in the Asia Pacific region is expected to grow at the highest CAGR of over 13% from 2025 to 2030, owing to the increasing adoption of automation across diverse industries. Countries such as China and Japan are leading this trend with significant investments in advanced technologies such as robotics and artificial intelligence. The rise of smart cities in APAC is also driving demand for VPS solutions that enhance urban mobility and infrastructure management. In addition, the growing e-commerce sector is pushing logistics companies to implement VPS.

Japan vision positioning system market is expected to grow rapidly in the coming years. Japan's market is characterized by its emphasis on innovation and high-quality manufacturing. The country’s strong focus on robotics and automation across industries such as automotive, healthcare, and logistics is driving the adoption of VPS technologies.

The vision positioning system market in China held a substantial market share in 2024. China's booming e-commerce industry is further fueling demand for efficient logistics solutions that rely on VPS for accurate tracking and navigation. Moreover, advancements in artificial intelligence and machine learning are enhancing VPS capabilities, making them increasingly attractive for applications in transportation, agriculture, and urban planning.

Key Vision Positioning System Company Insights

Some of the key players operating in the market include ABB Ltd, Cognex Corporation, Fanuc Corporation, among others.

-

ABB Ltd. is known for its innovative solutions and contributions to the industry. The company is involved in the development and deployment of advanced technologies, including visual simultaneous localization and mapping (Visual SLAM) for autonomous mobile robots. ABB's commitment to technological advancements and strategic initiatives underscores its position as a key player in the vision positioning system market.

-

Cognex Corporation is known for its significant contributions and innovative solutions in the industry. The company is recognized for its expertise in machine vision technology, offering a range of products and solutions that enhance automation, quality control, and productivity in various sectors. The company’s presence in the market underscores its role as a leading player driving advancements in vision positioning systems

Some of the emerging market players in the vision positioning systems include Senion AB, Seegrid Corporation, among others

-

Senion AB company operates in several verticals, including indoor positioning and navigation, wayfinding, and asset tracking. They provide advanced solutions to help organizations enhance their operations and improve the experiences of their customers and employees.

-

Seegrid Corporation is a company that specializes in the design and manufacturing of autonomous mobile robots (AMRs) for material handling and logistics. Their AMRs are used in various industries, including manufacturing, warehousing, and e-commerce.

Key Vision Positioning System Companies:

The following are the leading companies in the vision positioning system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- SICK AG

- SZ DJI Technology Co., Ltd.

- Cognex Corporation

- OMRON Corporation

- Fanuc Corporation

- Senion AB (Verizon Communications Inc.)

- Parrot Drones SAS

- Seegrid Corporation

- Pepperl+Fuchs GmbH

Recent Developments

-

In February 2024, Sick AG launched the W10 photoelectric proximity sensor. It is the first laser triangulation sensor of its kind that comes with a user-friendly touchscreen interface, selectable operating modes, durable stainless-steel housing with IP69K rating, and IO-Link functionality. This innovative product is intended to address various detection challenges in automation technology.

-

In February 2024, Seegrid Corporation launched its latest lift AMR, the Palion Lift CR1, an autonomous lift truck, at MODEX 2024 booth #C7685. This innovative solution is designed to meet the evolving demands of autonomous material handling in warehouses, manufacturing facilities, and logistics operations.

-

In January 2024, OMRON Corporation introduced its latest product, the K7DD-PQ Series - an innovative device for monitoring motor conditions that automate the detection of abnormalities in manufacturing facilities. The K7DD aligns with OMRON's philosophy of smart maintenance, which involves collecting, monitoring, and analyzing real-time data to empower users to make informed decisions.

Vision Positioning System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.08 billion

Revenue forecast in 2030

USD 12.60 billion

Growth rate

CAGR of 12.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, location, platform, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; SICK AG; SZ DJI Technology Co., Ltd.; Cognex Corporation; OMRON Corporation; Fanuc Corporation; Senion AB (Verizon Communications Inc.); Parrot Drones SAS; Seegrid Corporation; Pepperl+Fuchs GmbH

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vision Positioning System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vision positioning system market report based on component, location, platform, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensors

-

Camera

-

Marker

-

Others

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Unmanned Aerial Vehicles

-

Automated Guided Vehicles

-

Space Vehicles

-

Industrial Robots

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Healthcare

-

Defense

-

Industrial

-

Transportation & Logistics

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vision positioning system market size was estimated at USD 6.18 billion in 2024 and is expected to reach USD 7.08 billion in 2025.

b. The global vision positioning system market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 12.60 billion by 2030.

b. North America dominated the vision positioning system market in 2024 by holding a revenue share of over 37%. The region has been at the forefront of technological advancements in terms of both indoor and outdoor vision positioning systems and is likely to maintain market dominance owing to the high adoption of UAVs, AGVs, industrial robots, and space vehicles.

b. The key players in this vision positioning system market include ABB, Sick AG, Seegrid Corporation, Omron Corporation, Fanuc Corporation, Dettwiler and Associates Ltd., DJI, and Cognex Corporation, among others.

b. Key factors that are driving the market growth include the growing application of Automated Guided Vehicles (AGVs) for commercial and defense purposes, increasing use of Unmanned Aerial Vehicles (UAVs), and rise in demand for Artificial Intelligence (AI)-enabled optical sensors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.