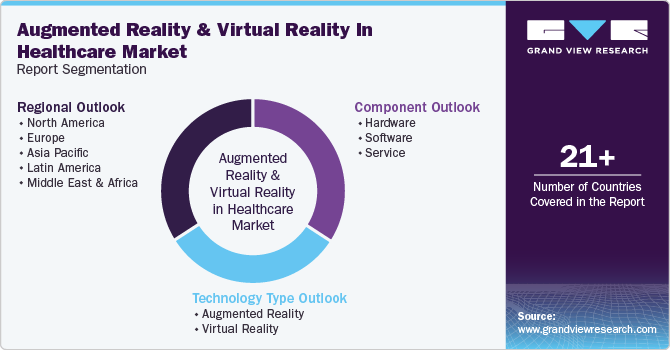

Augmented Reality And Virtual Reality In Healthcare Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology Type (Augmented Reality, Virtual Reality), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-855-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

AR & VR In Healthcare Market Size & Trends

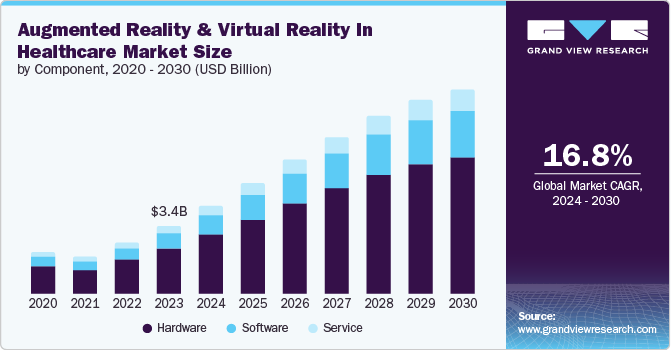

The global augmented reality and virtual reality in healthcare market size was estimated at USD 3.4 billion in 2023 and is projected to grow at a CAGR of 16.8% from 2024 to 2030. Technological advancements and digitalization in healthcare, favorable government initiatives, rising healthcare expenditure, growing usage in surgical procedures, and medical training are some of the fundamental factors anticipated to boost the growth and adoption of augmented reality (AR) and virtual reality (VR) technologies in the healthcare industry.

AR and VR are crucial innovations in immersive technology. AR enhances real-world perception by directly integrating digital information-such as sounds, images, or text into our real-world viewpoint. This facilitates interactive experiences, allowing for the visualization of complex concepts within a tangible context. Whereas, VR offers a comprehensive immersion, transporting users to a simulated environment. This allows for interaction within a digital space, offering an experience entirely distinct from the real world. These technologies are instrumental in advancing user engagement and understanding in various sectors.

Virtual reality is revolutionizing medical education by offering immersive and interactive experiences that enhance knowledge retention and furnish environments for training devoid of risks. For instance, in March of 2023, Dr. Kei Ouchi, an Associate Professor of Medicine at Harvard Medical School and advisor of Jolly Good, collaborated with Brigham and Women's Hospital to create VR content designed for emergency care. Under the guidance and supervision of Dr. Ouchi, Jolly Good is expected to develop live-action VR content across various medical specialties, with a collaborative focus on evaluating its educational impact.

Similar to VR, AR is significantly transforming medical education. It allows students to examine anatomical structures and disease pathologies through an interactive, three-dimensional format. For instance, in March 2024, Fresenius Medical Care (FME) launched an AR application to promote easier learning for nursing staff working in Kidney Replacement Therapy in the Intensive Care Unit (ICU). The AR glasses, integrated with digital learning modules, enable nursing staff to acquire proficiency in operating acute dialysis machines directly within ICUs. These glasses offer a stream of visual and auditory recordings as users engage with the dialysis equipment, equipping professionals with an immersive and comprehensive educational experience.

Case Study Insights

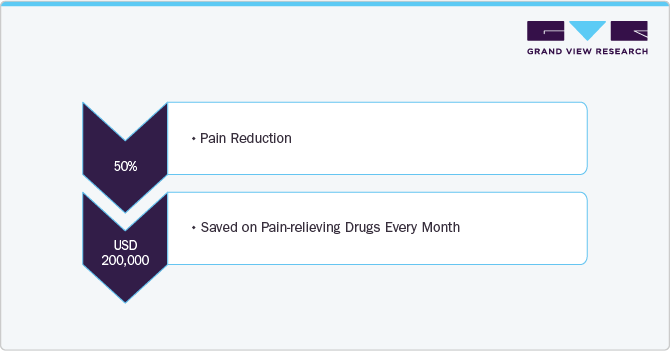

St. Jude Research Hospital Used VR as a Drug-Free Method of Coping with Chronic Pain

A biologic therapy manufacturer collaborated with AllazoHealth and Lash Group to transform therapy initiation through AI-driven patient support.

Goal: Minimize the consumption of addictive opioids and assist contraindicated sedation patients

Solution: The hospital used a VR platform, EaseVRx, that uses headsets and goggles to establish an immersive 3D world. The solution offered:

-

Pain distraction via immersive games

-

Escapes in relaxing environments

-

Educational tools for pain management

Outcome:

Benefits:

-

Reduced use of highly addictive opioids in therapy

-

Fewer hospital admissions due to the effectiveness of VR treatment

-

Safe treatment for analgesics intolerant individuals

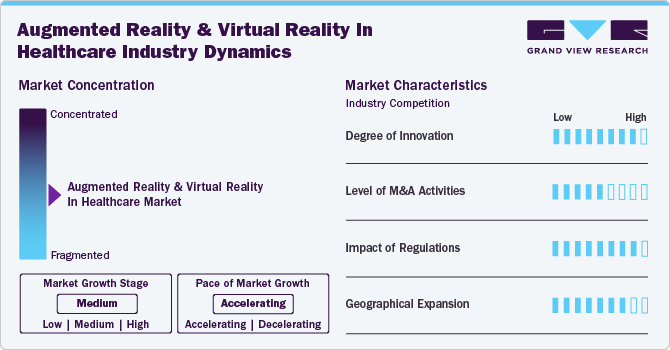

Industry Dynamics

The degree of innovation in AR and VR in the healthcare industry is high. AR and VR technologies are used in several healthcare domains. For instance, in April 2024, SimBioSys collaborated with Magic Leap to advance surgical oncology, integrating SimBioSys' medical imaging AI evaluation expertise with Magic Leap's advanced AR technology.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in March 2023, Madison Industries acquired CAE's CAE Healthcare division. CAE Healthcare is a prominent player in the AR and VR healthcare industry. Thus, this acquisition is expected to strengthen Madison Industries' position in this industry.

The impact of regulations is significant in the industry. AR/VR technology is used in several aspects of the healthcare industry. Hence, when companies launch devices using AR/VR technology, they must have 510(k) clearance, a granted De Novo request, or Premarket Approval by the FDA or a different regulatory body as per the region or country.

Companies in the industry undergo geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. For instance, in April 2023, XRHealth, specializing in virtual treatment rooms in Boston, U.S., and Amelia Virtual Care, offering a virtual reality platform for mental health professionals in Barcelona, Spain, announced their plans to merge into a single company, XRHealth.

Component Insights

In 2023, the hardware segment dominated the market for AR and VR in healthcare and accounted for the largest revenue share of 67.4%. Devices such as head-mounted displays, smart glasses, and 3D sensors hold significant shares in the market for AR & VR in healthcare. Head-mounted devices and smart glasses are widely used in training and simulation, surgeries, diagnostics, telementoring, and many other applications. In the current market scenario, AR/VR hardware has a large, commercialized product base with a high adoption rate, especially in developed countries, as companies are actively investing in advancing AR and VR devices to enhance their applications in healthcare. For instance, in January 2024, Ocutrx Technologies, Inc. launched the ORLenz headset. This product is engineered to replace traditional optical surgical loupes, providing an advanced digital substitute with superior resolution and increased magnification. Furthermore, it enhances ergonomics, aiming to increase the comfort and efficiency of surgeons throughout surgical operations.

The service segment is expected to grow at the fastest CAGR during the forecast period. The complexity of AR and VR technologies necessitates specialized expertise for their implementation, integration, customization, maintenance, and support within healthcare systems. Moreover, healthcare institutions often require customized solutions that seamlessly integrate AR/VR with existing systems like medical imaging devices. In addition, the demand for AR and VR in medical training, education, and simulation is driving service providers to offer training programs and simulation development, further fueling the growth of this segment. Furthermore, companies provide ongoing support, maintenance, updates, and scalability options as healthcare organizations expand their AR/VR initiatives, demonstrating measurable ROI and encouraging further adoption and investment in these technologies.

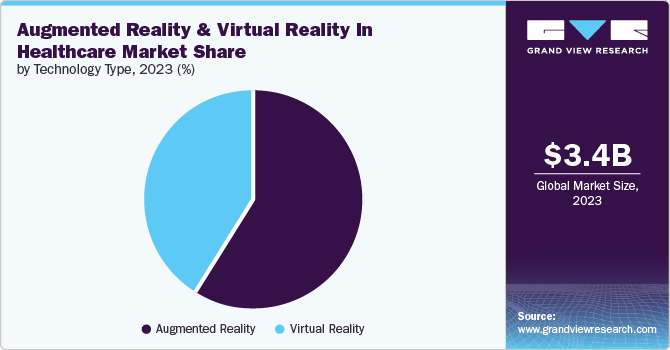

Technology Type Insights

Based on technology type, the augmented reality segment dominated the market with the highest share of 58.7% in 2023. The growth is attributed to its use in various medical sciences, such as surgical preparation and minimally invasive surgery. Technological advancements and rising demand for reducing the complexity of medical procedures result in increased adoption of augmented reality technology. Market players operating in AR technology are partnering with domestic players to expand their product reach and launch new products. For instance, in April 2023, Vuzix, specializing in smart glass and AR technology, collaborated with VSee, offering telemedicine solutions, to develop smart glass for the telemedicine industry.

The virtual reality segment is expected to grow at the fastest CAGR during the forecast period. The growth is due to various healthcare IT companies increasingly investing in this sector, considering the potential growth opportunities. For instance, in September 2022, OssoVR raised USD 14 million, led by Kaiser Permanente. The company plans to use the funds to develop VR-based surgical and medical device training modules. Moreover, VR has applications in diverse areas, such as surgery simulation, skills training, robotic surgery, and phobia treatment. In addition, the advantage of the ease of performing and learning surgical procedures that virtual reality offers to medical professionals and trainees is expected to boost the adoption of virtual reality technology in the market.

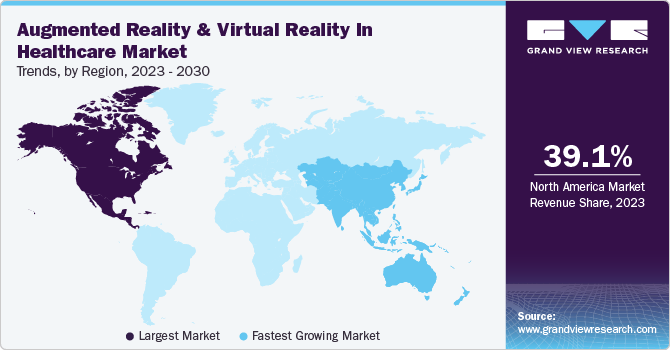

Regional Insights

The augmented reality and virtual reality in healthcare market in North America accounted for the largest global revenue share of 39.1% in 2023. Factors driving growth in this region are higher adoption of these technologies, investment in R&D activities, and favorable government initiatives. Moreover, the growing number of complex surgeries in the region is expected to contribute to the market growth. For instance, in October 2023, Surgical Theater, a company specializing in AR/VR devices in healthcare, partnered with Stanford Medicine to perform the first spine surgery using the company's AR technology. The AR spine surgery used Surgical Theater SyncAR Spine, incorporating the Microsoft HoloLens headsets.

U.S. Augmented Reality And Virtual Reality In Healthcare Market Trends

The U.S. augmented reality and virtual reality in healthcare market ccounted for the largest share in North America in 2023 due to the introduction of several solutions, supportive government policies, technical advancements, and the presence of key companies undertaking strategic initiatives. For instance, in March 2023, SimX partnered with the U.S. Air Force (USAF) to develop a new augmented reality & virtual reality in healthcare training capability with funding of USD 750,000 from the USAF's Small Business Innovation Research (SBIR) program. This VR capability aims to train the Aeromedical Evacuation (AE) personnel and the USAF's Critical Care Air Transport Teams (CCATT).

Europe Augmented Reality And Virtual Reality In Healthcare Market Trends

Augmented reality and virtual reality in the healthcare market in Europe are expected to grow significantly during the forecast period. The growth is attributed to increased government initiatives to promote virtual reality in the healthcare industry. For instance, the VReduMED project received around USD 2.3 million from the European Regional Development Fund (ERDF). It was initiated in April 2023 and is expected to be completed by March 2026. It aims to enhance the cooperation between medtech suppliers (particularly start-ups/SMEs) and healthcare education, using VR to make care work more interesting and provide quality care services.

The Germany augmented reality and virtual reality in healthcare market had a substantial revenue share in 2023. This can be attributed to the increasing use of VR technology for several medical purposes. For instance, in August 2021, Fresenius Medical Care used the stay safe MyTraining VR VR technology to train patients to perform peritoneal dialysis in Germany.

The augmented reality and virtual reality in healthcare market in the UK is expected to grow significantly during the forecast period due to increasing investments and various initiatives undertaken to boost the adoption of AR &VR. In March 2024, University of Birmingham students received access to training methods developed by the RESILIENCE Centre. It uses virtual reality and mixed reality scenarios, giving students ‘near-real-life’ experiences of the pharmaceutical manufacturing environment and conventional teaching methods.

Asia Pacific Augmented Reality And Virtual Reality In Healthcare Market Trends

The Asia Pacific augmented reality and virtual reality in the healthcare market is expected to be the fastest-growing market over the forecast period. The growth is attributed to increasing awareness among the population and improving healthcare infrastructure. Developing markets such as India and China are promising destinations for outsourcing services related to developing and distributing AR and VR technologies in healthcare.

Augmented reality and virtual reality in healthcare market in Japan had the largest market share in 2023. Growing investments in companies offering AR and VR solutions to the healthcare industry is one of the factors contributing to the market growth. For instance, in August 2023, Asteria Corporation announced that it had invested in Holoeyes, Inc., a company specializing in medical virtual reality (VR) software service.

The India augmented reality and virtual reality in healthcare market is expected to grow significantly during the forecast period. The growth is attributed to the growing adoption of AR and VR in hospitals. For instance, in June 2023, a hospital in Kerala, India, used AR and VR for disease diagnosis, patient care, medical training, and research.

Key Augmented Reality And Virtual Reality In Healthcare Company Insights

The augmented reality and virtual reality in healthcare industry is fairly competitive, and some of the most notable participants in the market are CAE Healthcare Inc., Siemens Healthineers, GE HealthCare, and others. These players are involved in new product launches, partnerships, and acquisitions to gain a competitive edge over each other.

Key Augmented Reality And Virtual Reality In Healthcare Companies:

The following are the leading companies in the augmented reality and virtual reality in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- CAE Healthcare Inc.

- Siemens Healthineers

- Koninklijke Philips N.V.

- Hologic, Inc.

- EON Reality, Inc.

- Intuitive Surgical Operations, Inc.

- GE HealthCare

- Layar.eu

- WorldViz, Inc.

- TheraSim, Inc.

Recent Developments

-

In March 2024, Siemens Healthineers launched an app developed for Apple Vision Pro to enable medical students, surgeons, and patients to view interactive, immersive holograms of the human body in medical scans in real-world settings. It can assist in medical education, surgical planning, or visualizing procedures.

-

In December 2023, EON Reality announced the renewal of its strategic partnership with the Children’s Hospital of Orange County (CHOC). This partnership highlights a mutual dedication to leveraging advanced AR and VR technologies to revolutionize pediatric healthcare education and improve patient experiences.

-

In November 2022, GE Healthcare and MediView XR, Inc. partnered to combine medical imaging with mixed reality solutions by developing the OmnifyXRTM Interventional Suite System.

-

In March 2022, CAE Healthcare launched an updated CathLabVR cardiac training tool. This cardiovascular noninvasive simulator, combined with Microsoft HoloLens 2, delivers realism while practicing cardiac and vascular tissue treatments.

Augmented Reality And Virtual Reality In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.5 billion |

|

Revenue forecast in 2030 |

USD 11.3 billion |

|

Growth rate |

CAGR of 16.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

CAE Healthcare Inc.; Siemens Healthineers; Koninklijke Philips N.V.; Hologic, Inc.; EON Reality, Inc.; Intuitive Surgical Operations, Inc.; GE HealthCare; Layar.eu; WorldViz, Inc.; TheraSim, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Augmented Reality And Virtual Reality In Healthcare Market Report Segmentation

This report forecasts revenue growth and provides analysis at global, regional, and country levels of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global augmented reality and virtual reality in healthcare market report based on component, technology type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality

-

Surgical Application

-

Rehabilitation

-

Training & Continuing Medical Education

-

-

Virtual Reality

-

Simulation

-

Diagnostics

-

Virtual Reality Exposure Therapy (VRET)

-

Rehabilitation

-

Pain Distraction

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global augmented reality and virtual reality in healthcare market size was estimated at USD 3.4 billion in 2023 and is expected to reach USD 4.5 billion in 2024.

b. The global augmented reality and virtual reality in healthcare market is expected to grow at a compound annual growth rate of 16.8% from 2024 to 2030 to reach USD 11.3 billion by 2030.

b. The hardware segment dominated the AR and VR in healthcare market with a share of 67.4% in 2023. This is attributable to the growing importance of hardware devices such as desktops, head-mounted displays, and other display devices while using these technologies.

b. Some key players operating in the AR and VR in healthcare market include CAE Healthcare Inc.; Siemens Healthineers; Koninklijke Philips N.V.; Hologic, Inc.; EON Reality, Inc.; Intuitive Surgical Operations, Inc.; GE HealthCare; Layar.eu; WorldViz, Inc.; TheraSim, Inc.

b. Key factors driving the augmented reality and virtual reality in healthcare market growth include the growing integration of technology & digitalization in healthcare, increasing healthcare expenditure & focus on the delivery of efficient health services, and its significance in training healthcare professionals worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."