- Home

- »

- Next Generation Technologies

- »

-

Virtual Reality In Gaming Market Size, Industry Report, 2030GVR Report cover

![Virtual Reality In Gaming Market Size, Share & Trends Report]()

Virtual Reality In Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Connecting Device (Gaming Console, PC/Desktop, Smartphone), By User (Commercial Spaces, Individual), By Region, And Segment Forecasts

- Report ID: 978-1-68038-585-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Reality In Gaming Market Summary

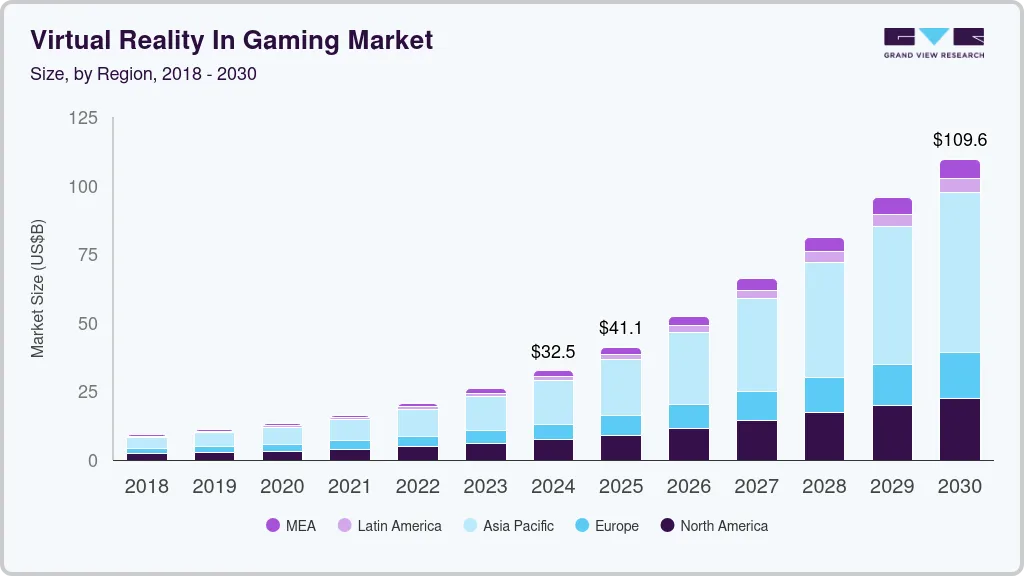

The global virtual reality in gaming market size is estimated at USD 32,491.5 million in 2024 and is projected to reach USD 109,589.8 million by 2030, growing at a CAGR of 21.6% from 2025 to 2030.The rising demand for immersive gaming experiences and advancements in VR hardware, such as improved headsets and controllers, are driving significant growth in the global virtual reality in gaming market.

Key Market Trends & Insights

- North America virtual reality in gaming market dominated the global market with a revenue share of over 22% in 2024.

- The U.S. virtual reality in gaming market held a dominant position in 2024.

- Based on component, the hardware segment recorded the largest revenue share of over 55% in 2024.

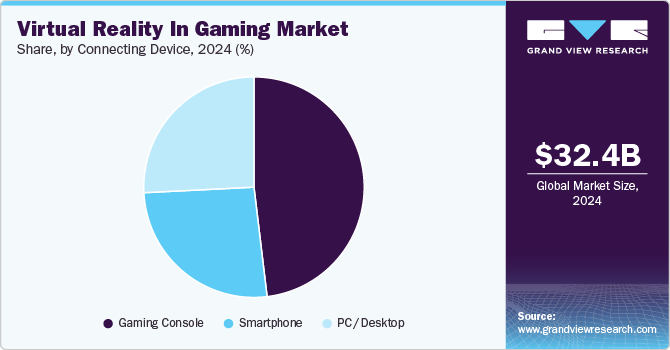

- Based on connecting device, the gaming console segment accounted for the largest revenue share in 2024.

- Based on user, the individual segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Revenue: USD 32,491.5 Million

- 2030 Projected Market Size: USD 109,589.8 Million

- CAGR (2025-2030): 21.6%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

This trend is further fueled by the increasing adoption of VR gaming platforms, the integration of AI technologies, and the growing demand for realistic and interactive gaming environments, which is expected to present lucrative opportunities for the virtual reality in gaming industry in the coming years. The development of advanced VR hardware, such as lightweight headsets with high-resolution displays and reduced latency, has greatly improved user experiences. Software innovations, including AI-driven game design and real-time rendering, have further enhanced the appeal of VR gaming by enabling richer, more dynamic gameplay. Additionally, cloud-based VR gaming platforms are gaining traction, offering seamless access to games without requiring high-end hardware. These advancements have improved accessibility and expanded the potential user base for VR gaming, driving the virtual reality in gaming industry expansion.

In addition, the rising popularity of VR gaming is driven by increasing consumer interest in interactive and social gaming experiences. Multiplayer VR games and e-sports have opened new opportunities for community building and collaboration among players. The affordability of entry-level VR headsets has also lowered the barrier to entry, enabling a broader audience to explore VR gaming. Furthermore, emerging trends such as mixed reality integration and customizable virtual environments are shaping the future of the VR gaming landscape, offering users increasingly personalized and immersive experiences.

Furthermore, the integration of compelling narratives in VR gaming experiences is another critical factor driving demand. Games that successfully incorporate storylines where player choices impact outcomes resonate significantly with audiences. Titles such as "Half-Life: Alyx" set a precedent for blending narrative depth with immersive gameplay; players reported feeling more emotionally invested due to the decision-making mechanics that influence story progression. This evolution in storytelling within VR reflects a broader trend towards creating personalized gaming experiences that engage players beyond mere entertainment.

Moreover, the rise of cross-platform compatibility is enabling VR gamers to access content across multiple devices and platforms seamlessly. Cloud VR gaming, powered by advancements in 5G and edge computing, is further removing the dependency on high-end hardware. These technologies allow players to experience VR gaming on-demand, reducing costs and expanding accessibility. Subscription-based cloud gaming models are gaining traction, offering consumers a diverse range of games at a lower entry point. Businesses investing in cross-platform and cloud-based solutions can tap into a growing audience seeking flexible gaming options. This trend is expected to drive the expansion of virtual reality in gaming industry.

Component Insights

The hardware segment recorded the largest revenue share of over 55% in 2024. This growth is attributed to the growing investments from tech companies and gaming studios, which is further driving the development of the VR gaming market. Major players are continually launching new hardware products designed to improve user experience and expand their market reach. The emergence of startups focusing on innovative VR solutions is also contributing to market dynamism. Additionally, trends such as storytelling-driven games and social multiplayer experiences are gaining traction, reflecting changing consumer preferences towards interactive content. This influx of investment not only accelerates technological advancements but also fosters a competitive environment that encourages creativity within the virtual reality in gaming industry.

The software segment is projected to register the highest CAGR of over 22% from 2025 to 2030. Companies are leveraging VR for training, remote collaboration, and prototyping, making it an asset beyond just gaming. Enhanced user interfaces and affordable VR hardware have led to greater adoption, as businesses discover the potential of immersive technologies for productivity improvements. Furthermore, the increasing integration of AI in VR applications is enabling personalized experiences, adapting environments based on user interaction and behavior. As VR technology becomes more mainstream, its applications in various industries are expanding, opening new opportunities for innovative software solutions.

Connecting Device Insights

The gaming console segment accounted for the largest revenue share in 2024. Wireless technology is transforming the console VR gaming experience by eliminating cumbersome cables and enhancing mobility for players. The introduction of wireless headsets allows gamers to move freely within their play space, creating a more immersive environment. Companies are investing in advanced wireless solutions to minimize latency and improve connectivity, which is crucial for maintaining a seamless gaming experience. This shift towards wireless technology is making VR more accessible and appealing to a broader audience, including casual gamers who may have previously been deterred by complex setups. As wireless options become standard, they are expected to drive further adoption of VR gaming on consoles.

The PC/Desktop segment is anticipated to record the highest CAGR from 2025 to 2030. The PC/Desktop segment of the VR gaming market is experiencing significant advancements, driven by improvements in hardware and software capabilities. High-performance gaming PCs are now equipped with powerful graphics cards and processors, enabling them to support advanced VR headsets that deliver high-resolution visuals and smooth gameplay. The integration of cutting-edge technologies such as ray tracing and AI-enhanced graphics is enhancing the realism of VR environments, making them more immersive for players. Additionally, the rise of VR-compatible peripherals, including motion controllers and haptic feedback devices, is further elevating user interaction within virtual spaces. As a result, the PC/Desktop segment is expected to maintain a strong growth trajectory, appealing to hardcore gamers seeking top-tier VR experiences.

User Insights

The individual segment accounted for the largest revenue share in 2024, driven by the notable rise in social VR gaming, where players can interact with friends and other users in virtual environments. This trend is driven by the increasing popularity of multiplayer games that emphasize collaboration and competition, enhancing user engagement. Furthermore, the emergence of user-generated content platforms is allowing gamers to create and share their own VR experiences, fostering a vibrant community around virtual reality in gaming industry. The integration of fitness-oriented VR games is also gaining traction, appealing to health-conscious consumers looking for enjoyable ways to stay active. As these trends continue to develop, they are likely to broaden the appeal of VR gaming and encourage more individuals to explore virtual reality experiences.

The commercial spaces segment is anticipated to record the highest CAGR from 2025 to 2030. The commercial space segment is increasingly leveraging VR for training and simulation purposes, particularly in industries such as healthcare, military, and aviation. Businesses are adopting VR technologies to create realistic training environments that enhance skill development and reduce training costs. This trend is expanding the use of VR beyond entertainment, making it a valuable tool for professional development and operational efficiency. Additionally, partnerships between VR companies and entertainment venues are on the rise, leading to more immersive experiences in theme parks and events. As commercial applications of VR grow, they are expected to significantly contribute to the overall market expansion by attracting diverse audiences.

Regional Insights

North America virtual reality in gaming market dominated the global market with a revenue share of over 22% in 2024. This growth is driven by a robust ecosystem that includes major technology companies and game developers. The region enjoys a strong culture of early adoption of new technologies, which drives demand for innovative VR experiences. There is also a significant focus on location-based VR experiences, with an increase in VR arcades and entertainment centers catering to consumers seeking immersive gaming.

U.S. Virtual Reality In Gaming Market Trends

The U.S. virtual reality in gaming market held a dominant position in 2024. In the U.S., there is a growing emphasis on location-based VR experiences, with more VR arcades and entertainment centers opening across major cities. These venues provide players with access to high-end VR setups that may not be feasible for home use, and they drive interest in immersive gaming. Additionally, the rise of cross-platform gaming is enabling players to connect and compete regardless of their chosen device, enhancing the overall gaming experience.

Europe Virtual Reality In Gaming Market Trends

European virtual reality in gaming is expected to grow at a considerable CAGR of over 18% from 2025 to 2030. Europe is witnessing steady growth in the VR gaming market, driven by increasing investments in technology and content development. The region is home to several key players who are focusing on creating high-quality VR games that emphasize storytelling and interactivity. As European consumers become more engaged with VR content, the market is expected to continue its upward trajectory.

The UK virtual reality in gaming market is expected to grow rapidly in the coming years. The U.K. is seeing a surge in VR-focused festivals and exhibitions, showcasing the latest advancements in technology and game design. The emphasis on narrative-driven experiences within VR games is gaining traction, with developers exploring deeper storytelling techniques that leverage immersion. Furthermore, there is an increasing collaboration between the gaming industry and other sectors such as film and art, leading to innovative cross-media projects. The rise of social VR platforms is also encouraging players to connect in virtual spaces, enhancing community interactions around gaming.

Virtual reality in gaming market in Germany held a substantial market share in 2024. Germany's VR gaming market is benefiting from a strong focus on research and development, with universities collaborating with tech companies to explore new applications for VR technology. The country hosts numerous gaming conventions where developers showcase their latest projects, fostering networking opportunities within the industry. Additionally, there is an increasing interest in VR therapy applications, with some developers creating games designed for mental health benefits or rehabilitation purposes.

Asia-Pacific Virtual Reality In Gaming Market Trends

The virtual reality in the gaming market in the Asia-Pacific region is expected to grow at the highest CAGR of over 23% from 2025 to 2030. The Asia Pacific region is rapidly becoming a significant player in the VR gaming market, with countries such as China and Japan leading the charge. The increasing availability of affordable VR hardware has made immersive gaming experiences more accessible to a broader audience. Additionally, there is a notable trend towards integrating augmented reality (AR) elements into VR games, enhancing gameplay through mixed-reality experiences.

The Japan virtual reality in gaming market is expected to grow rapidly in the coming years. Japan's unique cultural landscape fosters a strong interest in anime-inspired VR games, attracting fans who seek immersive experiences based on their favorite franchises. The country has seen an increase in VR-themed cafes, where patrons can enjoy food and drinks while engaging with virtual reality games in a social setting. Japanese developers are also focusing on creating experiences that blend traditional storytelling with interactive gameplay elements, appealing to both local and international audiences, thereby driving the virtual reality in gaming industry expansion.

Virtual reality in gaming market in China is growing due to rapid urbanization and led to an increase in VR entertainment complexes, where consumers can experience cutting-edge virtual reality games in social settings. Local companies are investing heavily in developing multiplayer online games that leverage social interaction within virtual environments, catering to the preferences of younger audiences. The government’s support for technological advancements encourages innovation within the gaming industry, leading to collaborations between tech firms and educational institutions.

Key Virtual Reality In Gaming Company Insights

Some of the key players operating in the market include Sony Group Corporation and Microsoft Corporation, among others.

-

Sony Group Corporation is a multinational conglomerate that offers a diverse range of products and services, including electronics, gaming, entertainment, and financial services. In the gaming peripheral market, Sony has made a name for itself with its PlayStation gaming consoles and accessories. PlayStation is a line of gaming consoles developed and owned by Sony. The first PlayStation console was released in 1994, and since then, Sony has released several iterations of the console, including the PlayStation 2, PlayStation 3, PlayStation 4, and the latest PlayStation 5.

-

Microsoft Corporation is a multinational technology company that offers a wide range of software, hardware, and gaming related products and services. In the gaming peripheral market, Microsoft Corporation has made a name for itself with its Xbox gaming consoles and accessories. Xbox is a line of gaming consoles developed and owned by Microsoft Corporation. The first Xbox console was released in 2001, and since then, Microsoft Corporation has released several iterations of the console, including the Xbox 360, Xbox One, and the latest Xbox Series X/S.

Some of the emerging market players in the virtual reality in gaming market include Electronic Arts, Inc., Nintendo Co.,Ltd., among others

-

Nintendo Co. Ltd. is a Japanese multinational consumer electronics and video game company that is known for its innovative gaming consoles and software. In the gaming peripheral market, Nintendo has made a name for itself with its popular gaming consoles and accessories. Nintendo has a long history in the gaming industry, having released its first gaming console, the Nintendo Entertainment System (NES), in 1983.

-

Electronic Arts Inc. (EA) is a prominent video game company that develops publishing and distributes interactive entertainment software globally. EA is known for producing and publishing a wide range of popular video game franchises across multiple platforms, including console, PC, and mobile.

Key Virtual Reality In Gaming Companies:

The following are the leading compfreelance platformsies in the virtual reality in gaming market. These compfreelance platformsies collectively hold the largest market share freelance platformsd dictate industry trends.

- Sony Corporation

- Microsoft Corporation

- Nintendo Co. Ltd.

- Linden Research, Inc.

- Electronic Arts Inc.

- Meta Platforms, Inc.

- Samsung Electronics Co. Ltd.

- Google LLC (Alphabet, Inc.)

- HTC Corporation

- Virtuix

- Ultraleap Limited

- Tesla Studios

- Qualcomm Technologies, Inc.

- Lucidcam.com

Recent Developments

-

In April 2024, Meta Platforms, Inc. partnered with Asus, Microsoft Corporation, and Lenovo to expand its Horizon OS to devices from other manufacturers, aiming to compete with Apple in the virtual and mixed reality market. This collaboration seeks to promote an open computing model and increase Horizon OS adoption. The initiative strengthens Meta's position in the growing mixed reality sector.

-

In March 2024, Virtuix launched the Omni One, a 360-degree VR treadmill paired with a customized Pico 4 Enterprise headset and a catalog of 35 compatible games. This setup offers users an unparalleled immersive gaming experience with seamless motion integration. The launch showcases Virtuix’s dedication to revolutionizing VR gameplay through hardware innovation.

-

In February 2024, Apple, Inc. launched its Vision Pro mixed reality visor, boasting a unique user interface controlled by eyes, hands, or voice, and offering a fully immersive 4K display experience. The device comes with over one million applications, including 600 exclusive ones designed specifically for Vision Pro. This moves positions Apple as a major player in the mixed reality space, providing immersive experiences for gaming and entertainment.

Virtual Reality In Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41,135.2 million

Revenue forecast in 2030

USD 109,589.8 million

Growth rate

CAGR of 21.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025- 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connecting device, user, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Sony Corporation; Microsoft Corporation; Nintendo Co. Ltd.; Linden Research, Inc.; Electronic Arts Inc.; Meta Platforms Inc.; Samsung Electronics Co. Ltd.; Google LLC (Alphabet, Inc.); HTC Corporation; Virtuix; Ultraleap Limited; Tesla Studios; Qualcomm Technologies, Inc.; Lucidcam.com

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Reality In Gaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual reality in gaming market report based on component, connecting device, user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Connecting Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Gaming Console

-

PC/Desktop

-

Smartphone

-

-

User Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Spaces

-

Individual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global virtual reality in gaming market size was estimated at USD 32,491.5 million in 2024 and is expected to reach USD 41,135.2 million in 2025.

b. The global virtual reality in gaming market is expected to grow at a compound annual growth rate of 21.6% from 2025 to 2030, to reach USD 109,589.8 million by 2030.

b. Asia Pacific dominated the virtual reality in gaming market with a share of over 48% in 2024. This is attributable to the early adoption of new technologies and similar consumer preferences.

b. Some key players operating in the virtual reality in gaming market include Linden Labs; Electronic Arts; Meta; Samsung Electronics Co. Ltd.; Google Inc.; HTC Corporation; Virtuix; Leap Motion Inc.; and Qualcomm Incorporated.

b. Key factors that are driving the virtual reality in gaming market growth include the rising demand for gaming among the young population, increasing competitiveness in the virtual reality gaming space, and increasing disposable income of buyers in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.