- Home

- »

- Next Generation Technologies

- »

-

Virtual Production Market Size, Share, Industry Report, 2033GVR Report cover

![Virtual Production Market Size, Share & Trends Report]()

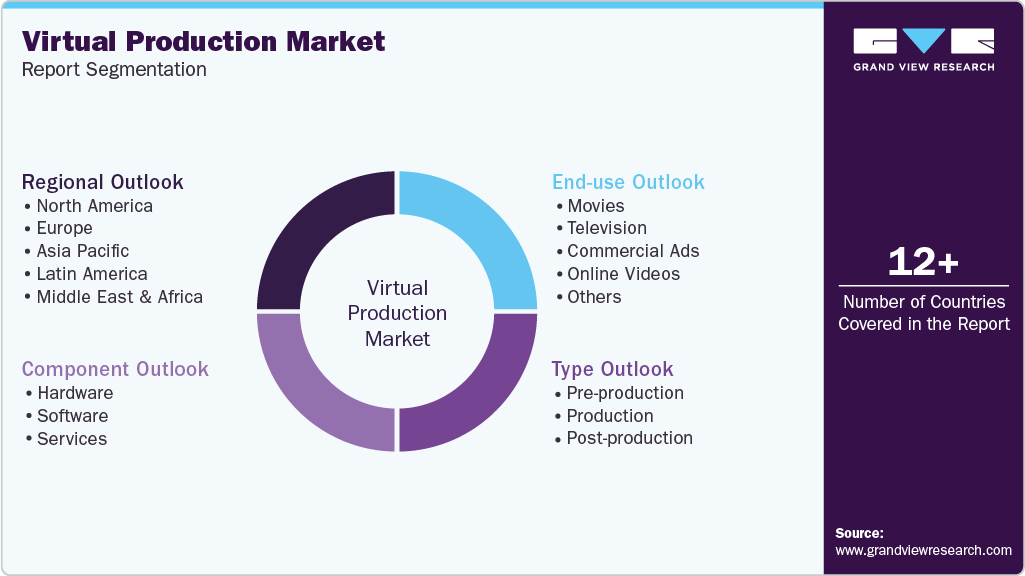

Virtual Production Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Pre-production, Production, Post-production ), By End Use (Movies, Television), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-317-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Production Market Summary

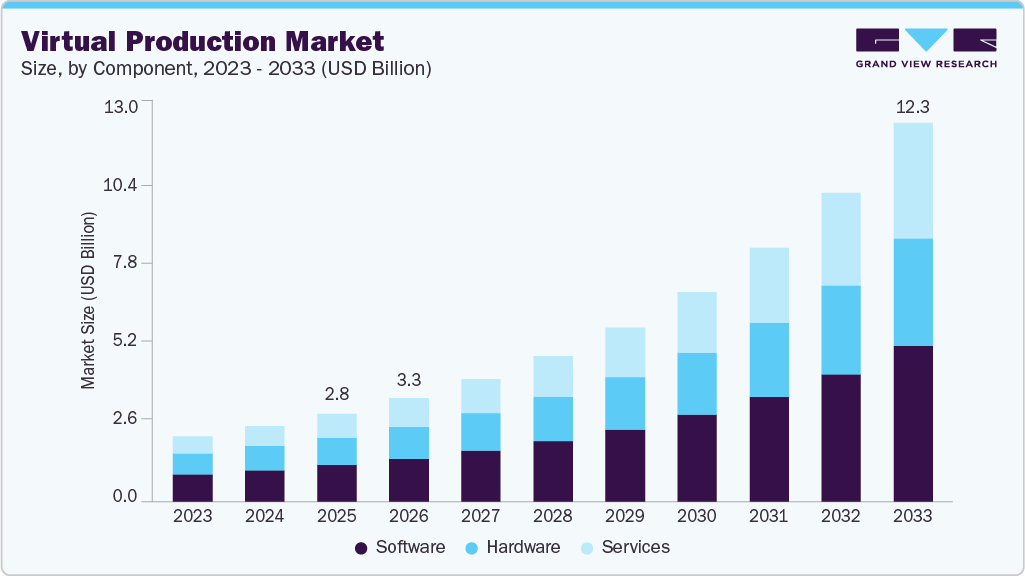

The global virtual production market size was valued at USD 2.84 billion in 2025 and is projected to reach USD 12.25 billion by 2033, growing at a CAGR of 20.4% from 2026 to 2033. The market is being shaped by the rapid adoption of LED volume stages for in-camera VFX, the increasing use of real-time game engines for photorealistic environments, the growing integration of AI-driven content creation tools, the expanding demand for remote and hybrid production workflows, and rising investments in virtual studios across major film and streaming hubs.

Key Market Trends & Insights

- North America dominated the global virtual production market with the largest revenue share of over 35% in 2025.

- The virtual production market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, software led the market and held the largest revenue share of over 41% in 2025.

- By type, the post-production segment held the dominant position in the market and accounted for the leading revenue share of over 49% in 2025.

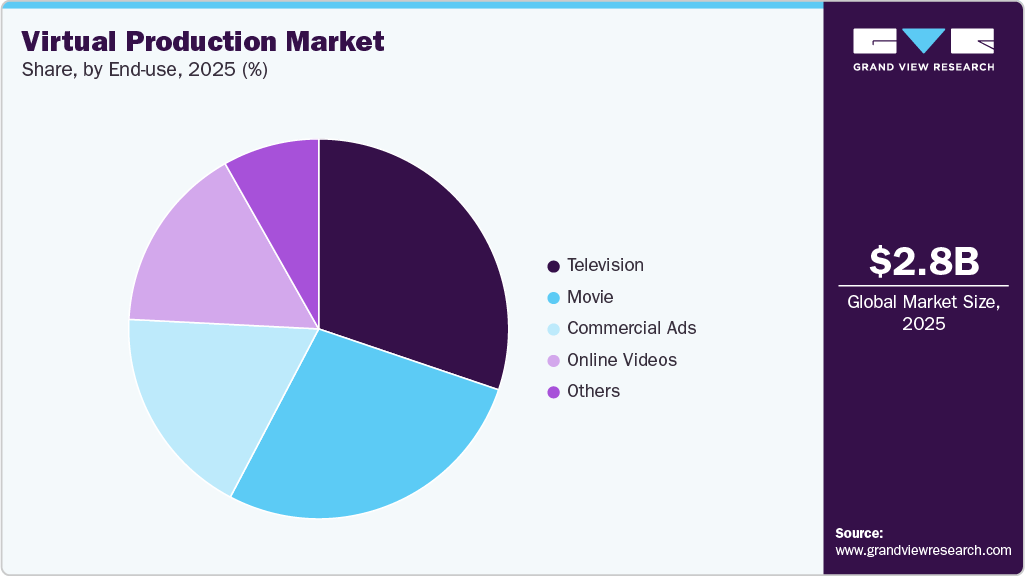

- By end use, the television segment is expected to grow at the fastest CAGR of over 21% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 2.84 Billion

- 2033 Projected Market Size: USD 12.25 Billion

- CAGR (2026-2033): 20.4%

- North America: Largest Market in 2025

The rapid expansion of LED volume stages is emerging as a core driver of virtual production adoption worldwide. These advanced displays enable high-fidelity in-camera VFX, reducing costly post-production cycles and physical location requirements. Their ability to deliver real-time, photorealistic environments enhances creative flexibility and accelerates shoot schedules. As installation costs trend downward, adoption is expanding beyond large studios to mid-tier production houses. This shift is positioning LED volumes as a foundational infrastructure element for next-generation content creation.

The increasing availability of virtual set libraries is driving operational efficiency across content pipelines. Pre-built digital environments reduce production design effort and allow teams to rapidly iterate during pre-visualization and shooting. This scalability supports faster time-to-market for content producers under accelerated release cycles. Customization features further enhance creative versatility while maintaining cost control. As libraries expand in variety and quality, they become a strategic asset for studios seeking speed, flexibility, and predictable production costs.

Real-time ray tracing is transforming visual quality standards in virtual production by delivering highly accurate lighting, reflections, and shadows on set. Advanced GPU capabilities enable filmmakers to view near-final imagery during live shoots, significantly enhancing the accuracy of their decision-making. This reduces dependency on time-consuming post-production adjustments and aligns creative teams early in the process. Technology elevates the realism of virtual scenes, strengthening their competitiveness against traditional location shoots. As GPU efficiency improves, real-time photorealism becomes a key differentiator for studios adopting virtual production.

Component Insights

The software segment led the market, accounting for over 41% of global revenue in 2025, driven by the increasing adoption of real-time rendering engines, virtual environment design tools, and advanced VFX software across production workflows. Increasing demand for scalable, cloud-enabled platforms that support collaboration, asset management, and remote production further strengthened the segment’s dominance. Continuous upgrades in AI-driven automation, motion tracking integration, and photorealistic rendering capabilities are accelerating software investment among studios and content creators. As virtual production becomes more mainstream, software platforms remain the central enabler of workflow efficiency, creative flexibility, and cost optimization.

The services segment is poised to foresee significant growth over the forecast period as studios increasingly rely on specialized expertise to implement and operate advanced virtual production workflows. Demand is rising for consulting, system integration, LED volume design, and real-time engine optimization services that ensure seamless on-set performance. As productions adopt hybrid and remote models, service providers are playing a critical role in enabling cloud collaboration, asset management, and workflow customization. The complexity of virtual production pipelines is also driving the need for continuous technical support, training, and maintenance services. Together, these factors position the services segment as a key growth engine supporting the industry’s rapid technological evolution.

Type Insights

The post-production segment accounted for the largest market revenue share in 2025, driven by the increasing complexity of digital effects and the rising demand for high-quality, photorealistic content. Advanced editing, compositing, color grading, and VFX pipelines are becoming essential as studios push for more immersive and visually rich productions. The shift toward hybrid workflows has further expanded the role of post-production teams, who now integrate real-time assets captured on LED volumes with CGI enhancements. The growing adoption of AI-driven tools is also streamlining post-production processes, reducing turnaround times, and enhancing creative precision. As content expectations rise across film, streaming, and advertising, the post-production segment remains a key anchor for value creation within the virtual production ecosystem.

The production segment is expected to experience significant growth during the forecast period, driven by the increasing adoption of real-time rendering, LED volume stages, and advanced camera-tracking systems during filming. Studios are increasingly adopting virtual environments at the production stage to minimize location shoots and shorten overall timelines. This shift enables directors and cinematographers to achieve near-final visuals directly on set, improving creative accuracy and reducing dependence on post-production adjustments. The growing preference for hybrid sets that blend physical elements with digital backdrops is further boosting demand for production-focused virtual tools. These advancements are positioning the production stage as a significant contributor to the global expansion of virtual production.

End Use Insights

The television segment accounted for the largest market revenue share in 2025, owing to the rising demand for high-volume, fast-turnaround content production across streaming platforms and broadcast networks. Virtual production tools enable television studios to create diverse settings quickly, eliminating the need for extensive location shoots and significantly improving scheduling efficiency. The use of LED walls, real-time rendering, and digital backdrops enhances visual quality while keeping production budgets under control. These capabilities support the creation of episodic content that requires consistent visual continuity across multiple shoots. Together, these factors have positioned television as the leading segment adopting virtual production technologies.

The online videos segment is predicted to witness significant growth over the forecast period, driven by the surge in digital content consumption across social media and streaming platforms. Content creators and brands are increasingly using virtual production tools to deliver high-quality visuals with shorter turnaround times. Cost-effective LED backdrops, real-time engines, and compact virtual sets enable smaller teams to produce professional-grade videos. This shift encourages wider adoption of virtual workflows among influencers, marketing agencies, and independent studios. With rising demand for visually engaging short-form and long-form digital content, the online videos segment is set to expand rapidly.

Regional Insights

The North America virtual production industry dominated the market and accounted for over 35% share in 2025, supported by the region’s strong film, TV, and streaming ecosystem. Increasing adoption of real-time engines, LED volume stages, and advanced motion-capture systems is accelerating regional investments. Major studios and technology vendors in the U.S. and Canada are expanding virtual production infrastructure to reduce production cycles and enhance creative flexibility. Continued technological innovation and high content demand position North America as the most influential market for virtual production globally.

U.S. Virtual Production Market Trends

The U.S. virtual production industry is being driven by rapid advancements in real-time 3D engines and widespread deployment of LED wall-based stages across major studios. The growing demand for high-quality streaming content is driving productions to adopt virtual workflows that reduce location costs and enhance creative control. The presence of leading technology providers, visual effects studios, and camera manufacturers strengthens the ecosystem. Overall, the U.S. continues to lead innovation by integrating AI, real-time rendering, and next-generation hardware into modern production pipelines.

Europe Virtual Production Market Trends

The virtual production industry in Europe is being driven by rising investments in digital filmmaking technologies and government-backed initiatives to modernize studio infrastructure. Increasing collaboration between film studios, VFX houses, and technology vendors is enhancing the adoption of real-time production tools across the region. Demand for cost-efficient, sustainable production methods is also encouraging the shift toward virtual environments and remote workflows. As a result, Europe is emerging as a strong adopter of virtual production, supported by creative talent and expanding LED stage facilities.

Asia Pacific Virtual Production Market Trends

The virtual production industry in the Asia Pacific is anticipated to register the fastest CAGR over the forecast period, driven by strong growth in regional film industries and digital content consumption. Countries such as China, South Korea, Japan, and India are rapidly adopting real-time rendering, virtual sets, and advanced VFX workflows. Expanding investments in studio modernization and LED volume installations further strengthen market momentum. This rapid technological adoption positions the Asia Pacific as the fastest-growing hub for virtual production globally.

Key Virtual Production Company Insights

Some key companies in the virtual production industry include Epic Games, NVIDIA Corporation, Autodesk Inc., Technicolor, and Arashi Vision Inc. (Insta360), among others.

-

Epic Games specializes in real-time rendering and virtual production through its industry-leading Unreal Engine platform. The company enables filmmakers to create photorealistic digital environments and in-camera VFX that significantly reduce production time and cost. Its tools support advanced previsualization, virtual scouting, and real-time content manipulation on set. Epic Games continues to drive innovation in virtual production by expanding its ecosystem for film, TV, gaming, and immersive experiences.

-

NVIDIA specializes in high-performance computing and GPU-accelerated technologies that form the backbone of real-time virtual production workflows. The company’s GPUs and Omniverse platform enable ultra-realistic rendering, collaborative 3D content creation, and AI-enhanced production processes. NVIDIA’s solutions empower studios to build complex virtual sets, digital humans, and real-time simulations with exceptional visual quality. With its strong AI and graphics capabilities, NVIDIA plays a crucial role in enabling scalable and efficient virtual production pipelines.

Key Virtual Production Companies:

The following are the leading companies in the virtual production market. These companies collectively hold the largest market share and dictate industry trends.

- 360Rize

- Adobe

- Arashi Vision Inc. (Insta 360)

- Autodesk Inc.

- BORIS FX, INC

- Epic Games, Inc.

- HTC Corporation (VivePort)

- HumanEyes Technologies

- Mo-Sys Engineering Ltd.

- NVIDIA Corporation.

- Panocam3d.com

- Pixar (The Walt Disney Company)

- Side Effects Software Inc (SideFX)

- Technicolor

- Vicon Motion Systems Ltd

Recent Developments

-

In October 2025, SWR partnered with Sony to launch a three-month trial of advanced real-time virtual studio production technology, featuring a Sony VERONA LED wall and live camera tracking. This initiative will reportedly allow presenters and performers to interact with digital backgrounds that respond in real time to camera movement, creating realistic visuals without post-production. A key part of the trial is Fehler im System, an interactive pen-and-paper show developed with Midflight Productions, which combines gaming, streaming, and television formats to advance virtual production workflows. The project demonstrates how broadcasters can assess and adopt immersive virtual production technologies to improve creative flexibility and operational efficiency.

-

In April 2025, Samsung and Vu Technologies announced a partnership at the NAB Show in Las Vegas to introduce an integrated virtual production solution. This collaboration combines Samsung’s high-performance LED displays with Vu’s Vū Studio software and production systems, enabling broadcasters and content creators to interact with digital elements live on set. The solution, which features Samsung’s IVC Series Direct View LED technology and Vu’s production tools such as Vu One and Vu One Mini, streamlines workflows and reduces the need for costly on-location shoots and post-production. This partnership demonstrates both companies’ commitment to advancing innovation in immersive content creation.

Virtual Production Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.34 billion

Revenue forecast in 2033

USD 12.25 billion

Growth rate

CAGR of 20.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

360Rize; Adobe; Arashi Vision Inc. (Insta 360); Autodesk Inc.; BORIS FX, INC; Epic Games, Inc.; HTC Corporation (VivePort); HumanEyes Technologies; Mo-Sys Engineering Ltd.; NVIDIA Corporation.; Panocam3d.com; Pixar (The Walt Disney Company); Side Effects Software Inc (SideFX); Technicolor; Vicon Motion Systems Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Production Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global virtual production market report based on component, type, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-production

-

Production

-

Post-production

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Movies

-

Television

-

Commercial Ads

-

Online Videos

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (Middle East and Africa)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual production market size was estimated at USD 2.84 billion in 2025 and is expected to reach USD 3.34 billion in 2026.

b. The global virtual production market is projected to grow at a compound annual growth rate (CAGR) of 20.4% from 2026 to 2033, reaching a value of USD 12.25 billion by 2033.

b. North America dominated the virtual production market, accounting for over 35% share in 2025, supported by the region’s strong film, TV, and streaming ecosystem. Increasing adoption of real-time engines, LED volume stages, and advanced motion-capture systems is accelerating regional investments.

b. Some key players operating in the virtual production market include 360Rize; Adobe; Arashi Vision Inc. (Insta 360); Autodesk Inc.; BORIS FX, INC; Epic Games, Inc.; HTC Corporation (VivePort); HumanEyes Technologies; Mo-Sys Engineering Ltd.; NVIDIA Corporation.

b. Key factors driving the growth of the virtual production market include the rapid adoption of LED volume stages for in-camera VFX, the increasing use of real-time game engines for creating photorealistic environments, and rising investments in virtual studios across major film and streaming hubs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.