Virtual Power Plant Market Size, Share & Trends Analysis Report By Technology (Distributed Energy , Resource, Demand Response, Mixed Asset), By End Use (Industrial, Commercial, Residential), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-146-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Virtual Power Plant Market Size & Trends

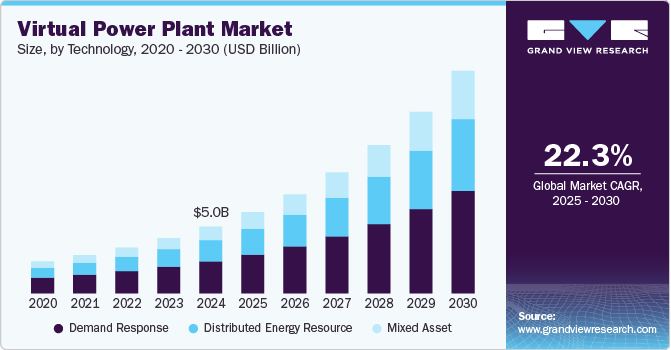

The global virtual power plant market size was estimated at USD 5.01 billion in 2024 and is projected to grow at a CAGR of 22.3% from 2025 to 2030. The market growth can be attributed to the rising initiatives for reducing carbon emissions that have sparked a remarkable surge in the installation of renewable energy sources, specifically solar and wind. This acceleration is driven by a growing recognition of the urgent need to transition away from fossil fuels to mitigate the impacts of climate change.

According to the International Energy Agency (IEA), there was nearly a 50% rise in the annual addition of renewable energy capacity worldwide, reaching close to 510 gigawatts (GW) in 2023. This represents the highest growth rate observed in over twenty years. This was the 22nd consecutive year that renewable capacity additions have set a new record.

Several companies across the globe are focusing on launching virtual power plant software that offers better benefits to the end users. For instance, in February 2024, Nokia Corporation introduced the Virtual Power Plant (VPP) Controller Software, a cutting-edge, near-real-time platform that allows mobile operators to effectively monetize backup batteries at base station sites. This innovative software enables operators to efficiently switch from grid power to backup batteries, reducing energy costs in electricity spot markets, generating revenue in grid frequency balancing markets, and lowering carbon emissions. After completing several successful trials, Nokia plans to make the solution available later this year. This launch underscores Nokia’s ongoing commitment to developing market-leading solutions that minimize energy consumption, carbon emissions, and related costs for mobile networks.

The growing deployment of smart grids is transforming the way energy is managed and distributed. Smart grids incorporate advanced digital technologies to enhance grid management, enabling real-time monitoring and control of electricity flow. This facilitates demand response programs, allowing consumers to adjust their energy usage based on grid signals, thereby balancing supply and demand dynamically. The integration of smart grids with virtual power plants offers significant benefits, such as improved grid stability, optimized energy storage solutions, and enhanced connectivity through the Internet of Things (IoT). These advancements are crucial for the efficient operation and expansion of VPPs, making them an integral part of modern energy infrastructure.

The rise of decentralized energy generation is another significant trend propelling the virtual power plant industry forward. As renewable energy sources such as solar panels and wind turbines are increasingly installed at residential, commercial, and industrial sites, the energy landscape is shifting from centralized power plants to a more distributed model. This decentralization requires advanced management solutions to coordinate the disparate energy resources effectively. VPPs play a critical role in aggregating and optimizing these distributed energy resources, ensuring efficient power generation and distribution. This shift not only enhances energy resilience and reliability but also empowers consumers to become active participants in the energy market, further driving the adoption of VPP solutions.

Companies and governments worldwide are under increasing pressure to reduce their carbon footprints and adhere to stringent environmental regulations. Virtual power plants offer a viable solution by enabling more efficient use of renewable energy and reducing reliance on fossil fuels. By optimizing energy consumption and storage virtual power plants help in lowering greenhouse gas emissions and promoting cleaner energy use. However, regulatory hurdles and data security concerns act as a challenge for the virtual power plant industry. Overcoming these requires harmonizing regulations, investing in advanced grid management technologies, and implementing robust cybersecurity measures.

Technology Insights

Based on technology the demand response segment led the market with the largest revenue share of 47.97% in 2024. The demand response segment has emerged due to its vital role in achieving a sustainable and efficient energy ecosystem. Demand response programs enable consumers to actively engage in energy management by adjusting their electricity usage during peak demand periods. This not only reduces strain on the grid but also empowers users to save on energy costs. In the context of VPPs, demand response becomes a cornerstone for grid optimization. By aggregating the flexibility of numerous small-scale resources, VPPs, underpinned by demand response, enhance grid reliability and resilience while accommodating the integration of renewable energy sources.

The mixed asset segment is anticipated to register at a significant CAGR during the forecast period. Mixed asset virtual power plants can provide grid services such as frequency regulation, voltage support, and reactive power control, enhancing grid stability and reliability. Mixed asset virtual power plants help respond quickly to grid fluctuations, helping to mitigate the impact of intermittent renewable energy sources. By managing a mix of renewable energy sources and storage, mixed asset virtual power plants can smooth out the variability of renewables and ensure a consistent power supply to the grid. Thus, the capability to contribute to a more reliable and resilient energy system while reducing greenhouse gas emissions is expected to bode well for segment growth.

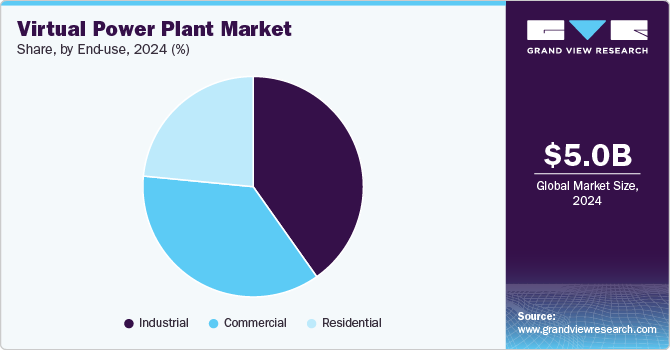

End Use Insights

Based on end use, the industrial segment led the market with the largest revenue share of 40.21% in 2024. The industrial sector has emerged as a dominant force due to its unique energy demands and sustainability imperatives. Industries often operate power-intensive processes that require a stable and uninterrupted energy supply, making them highly receptive to the benefits of VPPs. These intelligent systems enable industrial end users to effectively manage energy resources, optimize power consumption, and reduce electricity costs during peak demand periods.

The residential segment is experiencing a noteworthy surge due to evolving consumer preferences and the growing emphasis on decentralized energy systems. Residential end use are increasingly adopting distributed energy resources, such as rooftop solar panels and home energy storage solutions. VPPs empower these homeowners to transform their residences into mini power plants, allowing them to generate, store, and even sell excess energy back to the grid. This shift aligns with the rising interest in energy self-sufficiency and the desire to reduce electricity bills.

Regional Insights

North America virtual power plant market dominated with the largest revenue share of 37.15% in 2024. North American governments and regulatory bodies have proactively supported virtual power plant adoption. Policies, incentives, and regulations at the federal, state, and local levels promote the integration of distributed energy resources, demand response, and grid modernization, all aligning with virtual power plant adoption deployment. North American energy markets, particularly in the U.S., are relatively open and competitive. This environment encourages innovation and investment in technologies such as virtual power plants that can provide grid services and enhance energy efficiency.

U.S. Virtual Power Plant Market Trends

The virtual power plant market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The virtual power plant industry in the U.S. is increasing as government initiatives promoting clean energy contribute to a favorable environment for virtual power plant deployment, with demand response and energy trading driving significant investment.

Europe Virtual Power Plant Market Trends

The virtual power plant market in Europe is expected to register at a moderate CAGR from 2025 to 2030. The region's commitment to sustainability and decarbonization initiatives is driving the deployment of VPPs as a means to optimize energy resources and enhance grid stability.

The Germany virtual power plant market held a substantial market share in Europe in 2024. The market growth is driven by the increasing trend of German firms collaborating to introduce virtual power plants to medium-sized businesses.

The virtual power plant market in France is expected to grow at a rapid CAGR during the forecast period. The virtual power plant industry in France is driven by innovative energy solutions catering to its digitally savvy population. This reflects France's commitment to sustainable energy development and digital transformation in the energy sector.

Asia Pacific Virtual Power Plant Market Trends

The virtual power plant market in Asia Pacific is anticipated to grow at a significant CAGR during the forecast period.Many countries in the Asia Pacific region are experiencing significant urbanization and population growth. The rapid development in the region is expected to lead to increased energy demand, and virtual power plants can help efficiently manage and distribute energy resources in densely populated urban areas. Furthermore, virtual power plants enhance energy security by reducing dependence on centralized power generation and transmission infrastructure. Virtual power plants can provide backup power during power outages, which may be common in developing countries in the Asia Pacific region.

The Japan virtual power plant market is expected to grow at a moderate CAGR during the forecast period.The market is gaining momentum as businesses and consumers seek innovative ways to optimize energy usage and reduce carbon emissions. With a shifting regulatory landscape and increasing investments in renewable energy, Japan is poised to become a key player in the global market.

The virtual power plant market in China held a substantial market share in Asia Pacific in 2024. The China market is driven by the increasing adoption of renewable energy and smart grid technologies, particularly by tech giants such as Alibaba and Tencent.

Key Virtual Power Plant Company Insights

Some of the key companies in the global virtual power plant industry include Tesla, Inc., Siemens AG, ABB Ltd., TOSHIBA CORPORATION, Hitachi, Ltd., and others. Organizations are focusing on integrating AI, machine learning, and data analytics to optimize energy management, forecast demand, and improve grid stability. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Siemens AG is one of the major players in the virtual power plant (VPP) industry, renowned for its innovative energy management solutions and extensive global presence. With a focus on grid modernization and renewable energy integration, Siemens offers advanced VPP platforms that optimize energy resources, enhance grid stability, and enable seamless energy management. Leveraging its expertise in automation, digitalization, and energy technology, Siemens AG is at the forefront of shaping the future of VPPs and sustainable energy solutions worldwide.

-

ABB Ltd. is another key player in the VPP market, known for its comprehensive portfolio of grid automation and power management solutions. The company’s VPP offerings enable efficient aggregation and optimization of distributed energy resources, facilitating grid stability and resilience. With a strong emphasis on digitalization and smart grid technologies, ABB is driving innovation in VPPs, helping utilities, businesses, and communities optimize energy usage and accelerate the transition to renewable energy sources.

Key Virtual Power Plant Companies:

The following are the leading companies in the virtual power plant market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- TOSHIBA CORPORATION

- Next Kraftwerke GmbH

- Hitachi, Ltd

- ABB Ltd.

- Tesla, Inc.

- AutoGrid Systems, Inc.

- Limejump Limited

- Sunverge Energy, Inc.

- Centrica plc

View a comprehensive list of companies in the Virtual Power Plant Market

Recent Developments

-

In November 2024, NRG Energy Inc. announced a partnership with Renew Home, a prominent VPP company, to enhance its residential VPP capabilities. The collaboration aims to distribute numerous VPP-powered smart thermostats by 2035 and develop an approximately 1 GW AI-powered VPP, supported by Google Cloud technology. This initiative is designed to strengthen the resiliency of the Texas grid while helping households reduce and manage their energy costs.

-

In March 2023, Eaton, a power management company, expanded its strategic partnership with Sunverge to help utilities manage residential electric vehicle charging infrastructure. The partnership would bring together Eaton’s innovative EV charging solutions and Sunverge’s intelligent, advanced, and real-time multi-service VPP platform to enable utilities to advance flexible load management, aggregate, orchestrate, and value stack grid services, and provide reliability, resiliency, and flexibility to the grid and accelerate decarbonization.

Virtual Power Plant Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.09 billion |

|

Revenue forecast in 2030 |

USD 16.65 billion |

|

Growth rate |

CAGR of 22.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa |

|

Key companies profiled |

Siemens AG; TOSHIBA CORPORATION; Next Kraftwerke GmbH; Hitachi, Ltd.; ABB Ltd.; Tesla, Inc.; AutoGrid Systems, Inc.; Limejump Limited; Sunverge Energy, Inc.; and Centrica plc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Virtual Power Plant Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual power plant market report based on technology, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Distributed Energy Resource

-

Demand Response

-

Mixed Asset

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual power plant market size was estimated at USD 5.01 billion in 2024 and is expected to reach USD 6.09 billion in 2025.

b. The global virtual power plant market is expected to grow at a compound annual growth rate of 22.3% from 2025 to 2030 to reach USD 16.65 billion by 2030.

b. North America dominated the virtual power plant market with a share of 37.15% in 2024. North American governments and regulatory bodies have proactively supported virtual power plant adoption. Policies, incentives, and regulations at the federal, state, and local levels promote the integration of distributed energy resources, demand response, and grid modernization, all aligning with virtual power plant adoption deployment.

b. Some key players operating in the virtual power plant market include Siemens AG, TOSHIBA CORPORATION, Next Kraftwerke GmbH, Hitachi, Ltd., ABB Ltd., Tesla, Inc., AutoGrid Systems, Inc., Limejump Limited, Sunverge Energy, Inc., and Centrica plc.

b. Key factors that are driving the market growth include the expansion of renewable energy resources and the continual expansion of capacity renewable energy plants.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."