- Home

- »

- Next Generation Technologies

- »

-

Virtual Fitting Room Market Size And Share Report, 2030GVR Report cover

![Virtual Fitting Room Market Size, Share & Trends Report]()

Virtual Fitting Room Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Apparel, Eyewear), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-334-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Fitting Room Market Summary

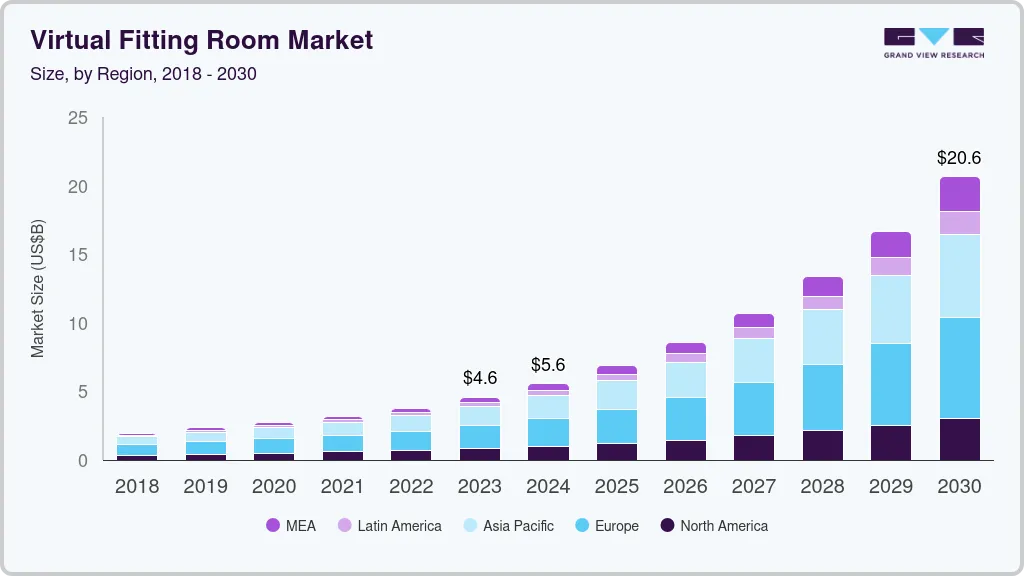

The global virtual fitting room market size was estimated at USD 5.57 billion in 2024 and is projected to reach USD 20.65 billion by 2030, growing at a CAGR of 24.6% from 2025 to 2030. The emergence of augmented reality (AR) and virtual reality (VR) technology in virtual fitting room solutions, offering enhanced realism and immersion, is expected to boost market expansion.

Key Market Trends & Insights

- Europe virtual fitting room market accounted for a leading revenue share of 36.8% in the global virtual fitting room market in 2024.

- The UK virtual fitting room market accounted for a leading revenue share of the regional market in 2024.

- By component, the software segment accounted for the largest revenue share of 48.3% in 2024.

- By application, the apparel segment accounted for the largest revenue share in 2024.

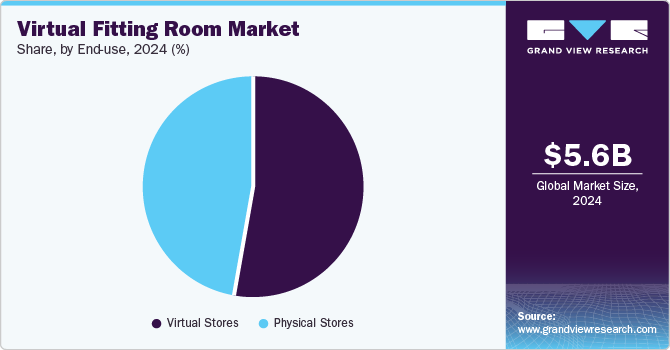

- By end-use, the virtual stores segment accounted for a higher revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.57 Billion

- 2030 Projected Market Size: USD 20.65 Billion

- CAGR (2025-2030): 24.6%

- Europe: Largest market in 2024

In addition, numerous companies are rapidly exploring the integration of VR shopping experiences into their physical storefronts and online platforms, as it enhances the user’s purchasing experience, which is expected to boost market growth over the forecast period. For instance, in March 2022, Walmart Inc. launched a virtual try-on tool to help their customers experience the clothing items with the help of a virtual model that suits the respective customer’s hair color, body type, and skin tone, which is driving the market growth.

As companies move towards utilizing omnichannel strategies to drive profits, the integration of immersive and seamless shopping experiences has become crucial, driving the use of virtual fitting rooms. They function as collaborative platforms between fashion brands and buyers, aiming to boost customer confidence and reduce the rate of returns or exchanges that arise due to sizing and fitting issues. Virtual solutions are also being considered as a move away from conventional changing rooms, which present several challenges for brands. For instance, a survey conducted by Zalando among European shoppers has found that 36% of people consider a negative shopping experience as a decisive factor in preventing any purchases. These mainly include rush issues and lack of space available in conventional fitting rooms.

Growing use of intelligent technologies such as smart mirrors, advanced smartphone cameras, and high-definition lenses has encouraged businesses to avail virtual fitting rooms. The online segment has become a particularly major application area, as increasing use of smartphones to make purchases and growing e-commerce activities globally have driven their popularity among consumers. As a result, fashion brands are undertaking partnerships with virtual fitting solution companies to ensure high levels of customer satisfaction. For instance, in December 2023, Inditex, the Spain-based fast fashion group that includes subsidiaries such as Zara and Pull&Bear, announced a strategic collaboration with 3DLook, a virtual try-on company. The agreement enables Inditex’s sub-brand, Bershka, to use 3DLook’s YourFit platform to offer precise fit and size recommendations to online customers. This is expected to help the brand minimize return rates of products and improve sales and conversions. Body scanning technologies are also being extensively utilized in this market to ensure accurate measurements of the body dimensions of customers and create their virtual avatars, which further enrich their buying experience.

The need to reduce returns and enhance customer satisfaction by providing a more accurate representation of the product and its fitting is expected to boost the market demand. In addition, the need to cater to the tailored demands of customers to survive in a highly competitive environment is also expected to create numerous growth opportunities for the market over the forecast period. The COVID-19 pandemic has had a profound impact on the overall market. The global industry observed a sharp dip as physical stores across the globe were shut down temporarily as directed by the governments and consumers to online shopping.

This led to innovative ways by retailers to provide an immersive shopping experience, which resulted in the integration of VR and AR technology to bridge the gap between physical and virtual fitting rooms. Moreover, the brick-and-mortar retailers are increasingly switching to online services as the web and mobile applications are ideal option as it can be operated with minimum human interaction. As a result, the utilization of virtual fitting room is anticipated to increase online purchases over the forecast period.

Component Insights

The software segment accounted for the largest revenue share of 48.3% in 2024 and is expected to maintain its position during the forecast period. Continuous advancements in AR and VR technologies and awareness among retailers regarding their importance in aiding customers in their decision-making have aided segment growth. Key market players are strongly focusing on targeting clients through continuous advancements and upgrades in their software, recognizing this component as a vital part of the virtual fitting room technology. Virtual fitting software helps apparel companies provide customers with detailed sizing information to help them make more informed purchases. Retailers can create customized sizing charts for various clothing items and even allow customers to create a size profile that suggests products with the best fit. Retailers have witnessed notable revenue growth in recent years through the use of cutting-edge fitting room technologies, highlighting the rising need for personalized “try-before-you-buy” software.

The services segment is anticipated to advance at a substantial CAGR from 2025 to 2030. This segment is further classified into installation, support & maintenance, and consulting. The increasing demand for virtual fitting technologies among clothing brands and other businesses has driven the need for installation services. This step involves the installation of necessary hardware such as cameras or display screens and seamless software integration with existing e-commerce platforms, inventory systems, and CRM tools. The consulting segment is anticipated to witness substantial growth in demand during the forecast period. Market competitors emphasize the provision of comprehensive consulting services that ensure effective operation of their highly advanced offerings. As this technology is still in the early development stages, providers are offering round-the-clock services to ensure that retail clients can effectively utilize the software for their businesses.

Application Insights

The apparel segment accounted for the largest revenue share in the global market in 2024, as virtual fitting rooms are being extensively deployed by clothing establishments to help customers understand their ideal fit and style. Additionally, the growing focus of businesses to minimize the rate of order returns due to size and fit issues or gaps in customer understanding of products has driven the demand for these solutions. The Harris Poll conducted among U.S. consumers stated that the leading cause of online returns was poor fit (46%), followed by damage (38%) and substandard product quality (36%). These trends have remained prevalent in recent years, incentivizing online apparel merchants to leverage tools that can help customers with the proper size and material selection from the very beginning of their purchase journey. The emergence of generative AI is further anticipated to ensure steady segment growth, with major tech firms entering this space. For instance, in June 2023, Google introduced a virtual try-on feature that aids users to choose models across a wider variety of body sizes, skin tones, and hair textures. This feature was initially applicable to women’s tops from notable brands such as Loft and H&M and has been expanded to include dresses in September 2024.

The beauty & cosmetics segment is anticipated to expand at the fastest CAGR during the forecast period. The growing rate of purchase of beauty products and cosmetics from online marketplaces and increasing awareness regarding the ideal product for different skin types have compelled consumers to utilize virtual platforms that allow them to try make-up, hairstyles, and skincare products digitally using AR and VR technologies. The use of advanced algorithms has helped in creating a more realistic depiction of the appearance of products based on skin type, texture, and lighting. Furthermore, users can receive tailored recommendations that would suit their skin tone and preferences while also adhering to latest trends. Virtual try-on technology has gained significant traction in recent years in this segment, as it allows consumers to gather meaningful insights on cosmetics and beauty brands such as their product range and quality and the ingredients they use.

End-use Insights

The virtual stores segment accounted for a higher revenue share in the global market in 2024, owing to the ease of use of e-commerce websites and the extensive product portfolios they offer. Companies are increasingly focusing on expanding their online presence to boost their user base and drive sales, leading to the integration of several advanced features, one of which is virtual fitting rooms. The extensive use of AR and 3D modeling technologies ensures an enhanced shopping experience by encouraging customers to try different items at their own convenience before making a purchase. This also helps customers in getting to understand brands better and the types of products they offer, increasing their chances of making repeated purchases. Major brands such as ASOS, Zara, and Warby Parker have begun implementing such technologies to improve their online retail services. In October 2024, Camweara, which provides AR solutions for the jewelry and fashion industries, announced a revamped interface for its virtual try-on tool. This feature is expected to provide a more immersive and personalized shopping experience to users looking to try products in real-time.

The physical stores segment is anticipated to advance at a substantial CAGR in the coming years, as outlets are increasingly aiming to deploy this technology to drive customer traffic and improve their sales. The growing availability of multi-sensor body scanners, smart mirrors, and advanced interactive screens has substantially increased their application in physical stores. Moreover, these stores deploy experienced staff that can help customers with their queries regarding various features of virtual fitting rooms while also offering opinions and insights regarding the ideal fit of apparel or footwear, enabling buyers to make a more well-rounded buying decision. Through this approach, stores can also showcase a wider range of sizes and styles in a virtual format, reducing the need for extensive physical stock and ensuring that visitors utilize their time optimally.

Regional Insights

Europe virtual fitting room market accounted for a leading revenue share of 36.8% in the global virtual fitting room market in 2024. The market demand is fueled by the increased awareness regarding technological innovations in the retail industry and the extensive use of analytics tools to understand customer behavior. Furthermore, the presence of various well-known global fashion brands in economies such as France, Italy, and the UK and their increasing competition has necessitated the integration of advanced solutions to improve the overall buying experience for customers. As a result, they have substantially increased the adoption of innovative digital technologies to boost footfall and engagement levels. These factors are anticipated to act as major enablers of regional market expansion. In October 2024, Zalando, a Germany-based online retailer of fashion products and shoes, announced the integration of the company’s body measurement technology with its virtual fitting room. The solution has been made available for 14 European markets and would enable customers to try a curated selection of Levi’s offerings for women and men.

UK Virtual Fitting Room Market Trends

The UK virtual fitting room market accounted for a leading revenue share of the regional market in 2024. The increasing pace of online product purchases and rapid advancements in retail technologies have created a fast-growing market for virtual fitting rooms in the economy. The younger demographic, which includes working professionals, spends substantially on clothes and fashion accessories to keep up with global trends. As a result, brands are coming up with cutting-edge solutions that can help customers choose the right product for themselves without requiring any physical trials. Additionally, rising rate of product returns has compelled clothing and accessory brands to introduce virtual fitting solutions that can save the time and effort of customers and minimize the occurrence of returns. According to a report by Whistl, in the UK, clothing items were the most returned products by consumers, followed by shoes and bags & accessories. Consequently, companies are focusing on using innovative technologies to improve customer relationship and strengthen their loyalty by minimizing return rates.

Asia Pacific Virtual Fitting Room Market Trends

The Asia Pacific virtual fitting room market is anticipated to advance at a substantial CAGR from 2025 to 2030, aided by the steadily increasing regional population and the expansion of the clothing and e-commerce sector. Economies such as China, Japan, and Australia have witnessed a significant growth in the number of people buying products online, as a result of rising disposable income levels and the presence of major global fashion brands. Moreover, shoppers are seeking more interactive and personalized shopping experiences. Virtual fitting rooms offer an innovative solution that can engage customers and increase their confidence in purchasing decisions. Companies are announcing strategic partnerships with virtual solution providers to boost their sales and customer engagement. For instance, in May 2023, TaylorMade Japan, a part of TaylorMade USA that manufactures golf equipment, announced that it would be leveraging the ‘Perfitly’ AI-powered AR/VR fitting room. This would enable the company’s apparel collection to be tried before purchase, increasing customer convenience and optimizing their shopping experience.

MEA Virtual Fitting Room Market Trends

The Middle East & Africa region is anticipated to advance at the fastest growth rate from 2025 to 2030, aided by the rapidly accelerating presence of major clothing, footwear, eyewear, cosmetics, and accessory brands in the region. Economies such as the UAE and Saudi Arabia attract a substantial population from across the globe, driving the need to make available different types of products across retail stores and supermarkets. Moreover, regional governments are significantly investing in partnerships with technological leaders and experts from the AR/VR industry to optimize customer experience in the retail space, leading to the rising adoption of solutions such as virtual fitting rooms.

Key Virtual Fitting Room Company Insights

Some of the major companies involved in the global virtual fitting room market include AstraFit, Fit Analytics, and Virtusize, among others.

-

AstraFit is a Ukraine-based technology organization that provides solutions for retail & e-commerce businesses. The company is known for its advanced online virtual fitting room offering, called ‘AstraFit Virtual Fitting Room,’ which enables customers to try on clothes virtually before making a purchase. It further provides a fit recommendation algorithm that can suggest ideal clothing sizes to customers. AstraFit majorly caters to small and large retailers in the e-commerce sector. Its Easy Start Plan service is a 3-month introductory plan that allows businesses to integrate the virtual fitting room and evaluate its efficacy.

-

Fit Analytics is a Berlin, Germany-based company that leverages webcams to measure individual dimensions of online customers and provide clothing size recommendations. The company’s Fit Finder solution is a machine learning-enabled size advisor for shoes and clothing items that offers personalized fit and size recommendations. Fit Analytics further provides analytics and insights derived from machine learning technology to aid retailers in understanding customer preferences and purchasing behavior.

Key Virtual Fitting Room Companies:

The following are the leading companies in the virtual fitting Room market. These companies collectively hold the largest market share and dictate industry trends.

- AstraFit

- ELSE Corp Srl

- FXGear Inc.

- Metail

- Fit Analytics

- Zugara Inc.

- SIZEBAY

- Magic Mirror

- Memomi Labs Inc

- SenseMi

- triMirror

- Virtusize

- Visualook

- Reactive Reality GmbH

View a comprehensive list of companies in the Virtual Fitting Room Market

Recent Developments

-

In March 2024, Fit Analytics announced that it had separated from Snap Inc. and would conduct its operations henceforth as Fit Analytics Innovation GmbH.

-

In November 2023, Metail announced a strategic partnership with the Slovenian company Tronog, a visualization studio that specializes in offering creative 3D services to the automotive and apparel industries.

Virtual Fitting Room Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.87 billion

Revenue forecast in 2030

USD 20.65 billion

Growth rate

CAGR of 24.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

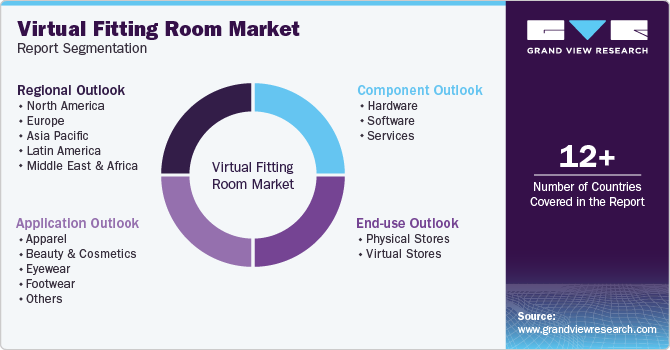

Segments covered

Component, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, Australia, Brazil, Mexico, UAE, Saudi Arabia

Key companies profiled

AstraFit; ELSE Corp Srl; FXGear Inc.; Metail; Fit Analytics; Zugara Inc.; SIZEBAY; Magic Mirror; Memomi Labs Inc; SenseMi; triMirror; Virtusize; Visualook; Reactive Reality GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Fitting Room Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual fitting room market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

On-premise

-

Cloud

-

-

Services

-

Installation

-

Support & Maintenance

-

Consulting

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Beauty & Cosmetics

-

Eyewear

-

Footwear

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical Stores

-

Virtual Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.