Virtual Events Market Size, Share & Trends Analysis Report By Event Type, By Component, By Establishment Size, By End Use, By Application, By Industry Vertical, By Use Case, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-795-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Virtual Events Market Size & Trends

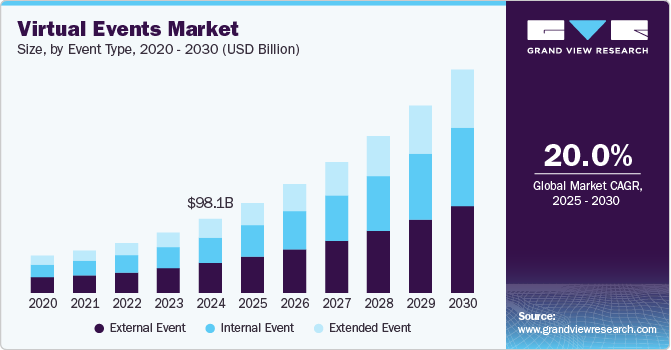

The global virtual events market size was estimated at USD 98.07 billion in 2024 and is projected to grow at a CAGR of 20.0% from 2025 to 2030. The extensive adoption of collaboration and communication tools across diverse industries, such as retail and e-commerce, healthcare, manufacturing, construction, and education, is expected to drive market growth. The increasing use of Unified Communication as a Service (UCaaS) solutions by organizations, including educational institutions, enables employees and resources to engage virtually in business activities, fostering a more efficient and effective workflow that is significantly influencing the virtual events industry.

The growing acceptance of remote and hybrid work models is further fueling the market growth. The COVID-19 pandemic accelerated this shift, as organizations sought alternatives to in-person gatherings, leading to increased demand for scalable and flexible event solutions. Virtual events offer advantages such as cost savings, global reach, and enhanced accessibility, making them an attractive option for businesses and event organizers. Additionally, advancements in digital communication technologies and the integration of features like live streaming, interactive sessions, and augmented reality (AR) have further fueled the market's growth, allowing for more engaging and immersive experiences.

In addition, a rise in interactive and immersive experiences, particularly among younger demographics such as Millennials and Gen Z is impacting the virtual events industry. These groups prefer events that offer networking opportunities and engaging content delivered through advanced technologies such as virtual reality (VR) and artificial intelligence (AI). Furthermore, there is a notable shift towards hybrid event formats that blend in-person and virtual elements, catering to diverse audience preferences. The increasing focus on data-driven insights also allows organizers to tailor content effectively and demonstrate return on investment (ROI), enhancing the overall value proposition of virtual events.

The increasing focus on data-driven insights allows organizers to tailor content effectively and demonstrate return on investment (ROI). By leveraging analytics from virtual event platforms, companies can gain valuable insights into attendee behavior, engagement levels, and content preferences. This data-centric approach not only enhances the planning and execution of future events but also strengthens the overall value proposition of virtual gatherings. As organizations seek to optimize their marketing strategies through effective event management, the integration of data analytics into virtual events is becoming increasingly vital, thereby driving virtual events industry expansion.

Moreover, the rise of sustainability concerns is prompting event planners to adopt greener practices by minimizing the environmental impacts associated with traditional gatherings. Additionally, advancements in technology will continue to play a crucial role in enhancing the immersive experience of virtual events. Features such as AI-driven networking tools and personalized content delivery will become standard expectations among attendees. These factors are expected to drive the virtual events industry’s expansion.

Event Type Insights

The external event segment recorded the largest revenue share of over 40% in 2024. This growth can be attributed to the increasing use of virtual event tools by businesses to engage with external stakeholders. Many organizations are partnering with technology firms to harness technological advancements and deliver premium services to their customers. The widespread implementation of digitally simulated tools for conducting or attending tradeshows, product launches, press conferences, client meetings, and other communication events is expected to further boost segmental growth.

The extended event segment is projected to register the fastest CAGR of over 20% from 2025 to 2030. The rising utilization of virtual platforms that enable remote audiences to participate effectively in events held at different geographical locations is expected to fuel this segment's expansion. Additionally, internal events—those organized within a company—are increasingly being conducted virtually as part of the work-from-home (WFH) policies adopted by many organizations during the pandemic. Leading market players have developed various platforms to assist organizations in virtualizing their routine communications, facilitating smoother departmental operations and workflow management. This version captures the essence of your original text while enhancing clarity and readability.

Service Insights

The communication segment accounted for the largest market share in 2024. The rise of hybrid work environments has intensified the need for effective communication tools that enable collaboration among dispersed teams. This segment benefits from advancements in unified communication technologies, which integrate voice, video, and messaging services into cohesive solutions. Furthermore, as organizations prioritize real-time communication and collaboration to enhance productivity and engagement, the demand for sophisticated communication solutions is expected to remain strong, solidifying its dominance in the virtual events market.

The training segment is expected to register a considerable CAGR from 2025 to 2030, owing to the increasing demand for remote learning and skill development solutions. As organizations continue to embrace digital transformation, the need for effective training programs that can be delivered online has surged. This shift is driven by factors such as the growing adoption of e-learning technologies, the necessity for continuous employee upskilling in a rapidly changing job market, and the flexibility that virtual training offers compared to traditional methods.

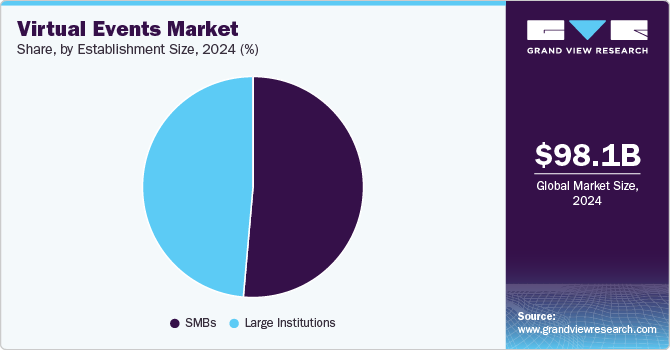

Establishment Size Insights

The large institutions segment accounted for the largest revenue share in 2024, primarily driven by their extensive resources and established infrastructure that facilitate the adoption of virtual events. These institutions leverage virtual platforms for various purposes, including global outreach, internal training, and stakeholder engagement, which are essential for maintaining competitiveness in a rapidly evolving digital landscape. The integration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) into their events enhances user experience and engagement, making virtual formats an attractive option compared to traditional in-person gatherings.

The SMB’s segment is anticipated to record the fastest CAGR from 2025 to 2030, driven by the growing recognition of virtual events as cost-effective and scalable solutions for business operations. Small and medium-sized businesses (SMBs) benefit from the flexibility that virtual platforms offer, allowing them to host and participate in events without incurring the high costs associated with physical venues. This affordability is particularly appealing as SMBs seek to expand their market reach and engage with a broader audience. Additionally, the increasing adoption of cloud-based solutions among SMBs enables them to leverage advanced event technologies that enhance their operational efficiency and customer engagement.

End Use Insights

The enterprises segment accounted for the largest revenue share 2024, owing to the substantial investments made by organizations in virtual event technologies to enhance their operational efficiency and employee engagement. Enterprises leverage virtual events for various purposes, including training, product launches, and stakeholder meetings, which facilitate broader participation without the logistical challenges of in-person gatherings. The ongoing digital transformation across industries has led businesses to prioritize innovative solutions that can streamline communication and collaboration, resulting in a significant demand for virtual event platforms. This trend is expected to continue as companies recognize the value of these technologies in driving productivity and fostering connections in an increasingly remote work environment.

The educational institution segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the growing adoption of digital learning tools and online education platforms. The shift towards remote learning has accelerated due to the pandemic, leading educational institutions to invest heavily in virtual event solutions for lectures, workshops, and conferences. This segment's growth is further supported by the rising demand for flexible learning options that cater to diverse student needs and the increasing acceptance of online qualifications in the job market. Additionally, as institutions strive to enhance student engagement and provide interactive learning experiences, the integration of advanced technologies into virtual events will likely contribute to its robust growth in the coming years.

Application Insights

The exhibition & trade shows segment accounted for the largest revenue share 2024, primarily driven by the increasing need for businesses to showcase their products, assess competition, promote their offerings, and stay updated on industry trends and opportunities. Utilizing digital platforms allows exhibitors to save on travel, promotional materials, accommodations, and other costs associated with hosting traditional trade shows and exhibitions. Additionally, the high-quality leads and attendees attracted to these events enhance networking opportunities and engagement for enterprises.

The conferences segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the increasing demand for virtual platforms that facilitate knowledge sharing and professional networking. As organizations continue to embrace remote work and digital communication, virtual conferences have emerged as a cost-effective and flexible alternative to traditional in-person events. This segment's growth is further supported by advancements in technology that enhance attendee engagement, such as real-time interaction tools, live streaming, and immersive experiences. The ability to connect with a global audience without geographical constraints allows companies to maximize participation and broaden their reach, making virtual conferences an essential component of modern business strategies.

Industry Vertical Insights

The IT segment accounted for the largest revenue share in 2024. This growth can be attributed to the increasing importance of virtual events in this sector, as they enhance geographical reach and enable professionals to participate and share knowledge from any location worldwide. Additionally, these events provide greater scheduling flexibility, allowing attendees to access sessions and content at their convenience, which accommodates various time zones. Furthermore, the rising use of virtual events for continuous learning and skill development through webinars, workshops, and technical sessions is further improving the market outlook.

The BFSI segment is anticipated to record a significant CAGR from 2025 to 2030, driven by the growing importance for effective internal communication in the banking and financial sectors as they adopt new technologies and enhance client interactions. In addition, several leading firms are developing virtual platform tools tailored for the BFSI sector to ensure secure transactions and facilitate convenient banking services, which is expected to further contribute to substantial segmental growth.

Use Case Insights

The large scale events segment accounted for the largest revenue share 2024. This growth is attributed to the significant appeal of large-scale virtual events, such as major conferences, global summits, and trade shows, which can attract thousands of participants from around the world. The ability to connect with a vast audience without geographical limitations has made these events increasingly popular among organizations looking to showcase their products, share knowledge, and foster collaboration. Moreover, advancements in virtual event technologies, including interactive features and immersive experiences, have enhanced engagement levels, further driving the segmental growth.

The everyday events segment is anticipated to record a significant CAGR from 2025 to 2030. This growth is driven by the increasing reliance on virtual platforms for routine activities such as team meetings, training sessions, webinars, and internal gatherings. As remote work and hybrid models become more prevalent, organizations are turning to everyday virtual events to maintain communication and productivity among employees. The flexibility and cost-effectiveness of these events make them an attractive option for businesses aiming to streamline operations while engaging their workforce effectively.

Regional Insights

North America virtual events market dominated the market with a revenue share of over 39% in 2024. This growth is driven by the increasing demand for remote operations, which has led businesses to adopt virtual platforms for various corporate events, including meetings, conferences, and product launches. This shift allows companies to reach wider audiences at reduced costs while facilitating effective communication across geographical boundaries.

U.S. Virtual Events Market Trends

The virtual events industry in the U.S. held a dominant position in 2024, fueled by advancements in technology that enable immersive experiences and interactive features, catering to modern audience preferences. The increasing importance of data analytics for measuring engagement and outcomes is also shaping the landscape as organizations seek to optimize their virtual event strategies, further propelling market growth in the U.S.

Europe Virtual Events Market Trends

The virtual events industry in Europe is expected to grow at a considerable CAGR of over 19% from 2025 to 2030, driven by the increasing adoption of digital communication tools and the shift towards remote and hybrid work models. The COVID-19 pandemic accelerated this transition, prompting organizations across various sectors to embrace virtual platforms for hosting events such as conferences, webinars, and trade shows. This shift not only allows companies to reach a broader audience but also reduces costs associated with traditional in-person gatherings.

The UK Virtual events market is expected to grow rapidly in the coming years, propelled by the rising demand for work-from-home policies and an increase in sponsorship for online events. As companies become more cautious about travel expenses due to the ongoing impact of the pandemic, they are turning to virtual platforms to conduct meetings and host events.

The virtual events market in Germany held a substantial market share in 2024, driven by lucrative opportunities within the event management and planning sectors. The country's strong emphasis on technological innovation facilitates the integration of advanced solutions such as artificial intelligence (AI) and virtual reality (VR) into event platforms, enhancing participant engagement and interaction.

Asia Pacific Virtual Events Market Trends

The virtual events industry in Asia Pacific is expected to grow at the significant CAGR of over 21% from 2025 to 2030, primarily driven by rapid digital transformation and increasing internet penetration across the region. The widespread adoption of high-speed internet and mobile devices has made it easier for organizations to host and participate in virtual events, such as webinars, online conferences, and trade shows. Additionally, the region's tech-savvy population is embracing these digital platforms, facilitating seamless transitions to virtual formats.

The Japan virtual events market is expected to grow rapidly in the coming years. The market is driven by advancements in technology and a cultural shift towards digital engagement. The country's robust infrastructure supports high-speed internet access, enabling organizations to conduct virtual events efficiently. Japanese businesses are increasingly adopting virtual platforms to enhance communication and collaboration, especially in light of the COVID-19 pandemic, which has accelerated the need for remote interactions. Furthermore, the rising popularity of e-learning and online training programs is driving demand for virtual events in educational institutions and corporate training settings.

The virtual events market in China held a substantial market share in 2024, owing to its large consumer base and significant investment in digital infrastructure. The country's push towards high-speed 5G networks has enhanced connectivity and enabled more immersive virtual experiences. Additionally, the increasing adoption of cloud-based solutions among businesses facilitates the hosting of large-scale virtual events, making them an attractive alternative to traditional gatherings.

Key Virtual Events Company Insights

Some of the key players operating in the market include Zoom Video Communications, Inc. and Microsoft Corporation.

-

Zoom Video Communications, Inc. is an American technology company specializing in video conferencing solutions. The company's flagship product, Zoom Meetings, allows users to host video conferences, webinars, and virtual events with high-quality audio and video capabilities. Its user-friendly interface and robust features have made it particularly popular for businesses, educational institutions, and individuals seeking reliable remote communication tools.

-

Microsoft Corporation is renowned for its software products, including the Windows operating system and Microsoft Office suite, which have become staples in both personal and professional environments. The company has diversified its portfolio to include cloud computing services through Azure, enterprise solutions, and gaming with the Xbox brand. The company has focused heavily on cloud technology and artificial intelligence, positioning itself as a leader in digital transformation. The company's commitment to innovation extends to its virtual event capabilities through Microsoft Teams and other integrated solutions that facilitate seamless online collaboration and communication for organizations worldwide.

Some of the emerging market players in the virtual events market include Vosmos Events and Hubilo

-

Vosmos Events is a tech startup specializing in creating customizable virtual event solutions, that empower users to design and host both small and large-scale virtual events with ease. The platform supports a wide range of participants, from 100 to over 100,000, and offers features such as 3D environments, live streaming, marketing analytics, and networking capabilities.

-

Hubilo is an emerging player in the virtual events industry known for its focus on enhancing attendee engagement and delivering seamless event experiences. The platform offers a highly interactive solution that includes features such as live chats, polls, Q&A sessions, and gamification elements to create dynamic virtual environments. The company also provides comprehensive analytics tools and integrates with various marketing platforms, making it easier for organizers to manage events effectively.

Key Virtual Events Companies:

The following are the leading companies in the virtual events market. These companies collectively hold the largest market share and dictate industry trends.

- Vosmos Events

- Hubilo

- 6Connex

- ALIVE

- Avaya LLC

- ALE International

- NTT Limited

- Cisco Systems Inc.

- Cvent Inc.

- EventX Limited

- George P.Johnson

- GES

- Kestone

- Martiz Holdings Inc.

- Microsoft Corporation

- Pathable

- uBivent GmbH

- Veritas Events

- vFairs

- Zoom Video Communications, Inc.

Recent Developments

-

In September 2024, Vosmos Events introduced a suite of AI-powered solutions aimed at transforming virtual events, enhancing planning, management, and audience engagement. The platform features innovative tools such as VIRSA for smart matchmaking, VosmosGPT for seamless event setup, and vClip for automated video editing.

-

In September 2024, Zoom Video Communications, Inc. and Mitel announced a strategic partnership aimed at enhancing communication solutions for businesses. This collaboration will integrate Zoom's video conferencing capabilities with Mitel's communication systems, allowing for seamless connectivity and improved user experiences in virtual meetings and events.

-

In July 2024, Martiz Holdings, Inc. acquired Convention Data Services (CDS), a registration and lead services provider, from Freeman. This acquisition aims to enhance the company’s position in the events industry by expanding its portfolio and client base, particularly in the trade show and association event sectors.

Virtual Events Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 119.62 billion |

|

Revenue forecast in 2030 |

USD 297.16 billion |

|

Growth rate |

CAGR of 20.0% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Event type, component, establishment size, end use, application, industry vertical, use case, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Vosmos Events; Hubilo; 6Connex; ALIVE; Avaya LLC; ALE International; NTT Limited; Cisco Systems Inc.; Cvent Inc.; EventX Limited; George P. Johnson; GES; Kestone; Martiz Holdings Inc.; Microsoft Corporation; Pathable; uBivent GmbH; Veritas Events; vFairs; Zoom Video Communications, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Virtual Events Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual events market report based on event type, component, establishment size, end use, application, industry vertical, use case, and region:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal

-

External

-

Extended

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Web-based

-

XR

-

-

Services

-

Communication

-

Recruitment

-

Sales & Marketing

-

Training

-

-

-

Establishment Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMB’s

-

Large Institutions

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Educational Institutions

-

Corporate

-

Government

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conferences and Conventions

-

Exhibitions & Trade Shows

-

Seminars and Workshops

-

Corporate Meetings and Training

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Consumer Electronics

-

Healthcare

-

IT

-

Manufacturing

-

Media & Entertainment

-

Telecom

-

Others

-

-

Use Case Outlook (Revenue, USD Billion, 2018 - 2030)

-

Everyday Events

-

Large-scale Events

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global virtual events market size was estimated at USD 98.07 billion in 2024 and is expected to reach USD 119.62 billion in 2025.

b. The global virtual events market is expected to grow at a compound annual growth rate of 20.0% from 2025 to 2030 to reach USD 297.16 billion by 2030.

b. North America dominated the virtual events market with a share of nearly 39% in 2024. This is attributable to the region being the corporate hub and also an early adopter of new technology.

b. Some key players operating in the virtual events market include Microsoft Corporation; Cisco Systems, Inc.; ALE International; Cvent Inc.; VFairs; EventX Limited; George P. Johnson; and Alive Events.

b. Key factors that are driving the virtual events market growth include its cost-effectiveness, ease of connectivity, and growing popularity of Unified Communication as a Service (UCaaS) among corporations, education institutes, and various other organizations across industries.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2. Executive Summary

2.1. Virtual Events Market Snapshot

2.2. Virtual Events Market- Segment Snapshot (1/2)

2.3. Virtual Events Market- Segment Snapshot (2/2)

2.4. Virtual Events Market- Competitive Landscape Snapshot

Chapter 3. Virtual events market - Industry Outlook

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Industry Challenges

3.3.4. Industry Opportunities

3.4. Industry Analysis Tools

3.4.1. Porter’s five forces analysis

3.4.2. Macroeconomic analysis

3.5. Technology Trends

Chapter 4. Virtual Events Market: Event Type Estimates & Trend Analysis

4.1. Event Type Movement Analysis & Market Share, 2024 & 2030

4.2. Virtual Events Market Estimates & Forecast, By Type (USD Billion)

4.2.1. Internal

4.2.1.1. Internal Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.2.2. External

4.2.2.1. External Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.2.3. Extended

4.2.3.1. Extended Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Virtual Events Market: Component Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Virtual Events Market: Establishment Size Movement Analysis, 2024 & 2030 (USD Billion)

5.3. Platform

5.3.1. Platform Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.3.2. Web-based

5.3.2.1. Web-based Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.3.3. XR

5.3.3.1. XR Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Services

5.4.1. Services Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4.2. Communication

5.4.2.1. Communication Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4.3. Recruitment

5.4.3.1. Recruitment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4.4. Sales & Marketing

5.4.4.1. Sales & Marketing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4.5. Training

5.4.5.1. Training Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Virtual Events Market: Establishment Size Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Virtual Events Market: Establishment Size Movement Analysis, 2024 & 2030 (USD Billion)

6.3. SMB’s

6.3.1. SMB’s Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Large Institutions

6.4.1. Large Institutions Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Virtual Events Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Virtual Events Market: End Use Movement Analysis, 2024 & 2030 (USD Billion)

7.3. Educational Institutions

7.3.1. Educational Institutions Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Corporate

7.4.1. Corporate Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Government

7.5.1. Government Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Others

7.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Virtual Events Market: Application Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Virtual Events Market: Application Movement Analysis, 2024 & 2030 (USD Billion)

8.3. Conferences and Conventions

8.3.1. Conferences and Conventions Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Exhibitions & Trade Shows

8.4.1. Exhibitions & Trade Shows Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Seminars and Workshops

8.5.1. Seminars and Workshops Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. Corporate Meetings and Training

8.6.1. Corporate Meetings and Training Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.7. Others

8.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Virtual Events Market: Industry Vertical Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. Virtual Events Market: Industry Vertical Movement Analysis, 2024 & 2030 (USD Billion)

9.3. Banking, Financial Services, and Insurance (BFSI)

9.3.1. Banking, Financial Services and Insurance (BFSI) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4. Consumer Electronics

9.4.1. Consumer Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5. Healthcare

9.5.1. Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6. IT

9.6.1. IT Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.7. Manufacturing

9.7.1. Manufacturing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.8. Media & Entertainment

9.8.1. Media & Entertainment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.9. Telecom

9.9.1. Telecom Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.10. Others

9.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 10. Virtual Events Market: Use Case Estimates & Trend Analysis

10.1. Segment Dashboard

10.2. Virtual Events Market: Use Case Movement Analysis, 2024 & 2030 (USD Billion)

10.3. Everyday Events

10.3.1. Everyday Events Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4. Large-scale Events

10.4.1. Large-scale Events Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 11. Virtual Events Market: Regional Estimates & Trend Analysis

11.1. Virtual Events Market by Region, 2024 & 2030

11.2. North America

11.2.1. North America Virtual Events Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

11.2.2. U.S.

11.2.2.1. U.S. Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.2.3. Canada

11.2.3.1. Canada Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.2.4. Mexico

11.2.4.1. Mexico Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3. Europe

11.3.1. Europe Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.2. UK

11.3.2.1. UK Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.3. Germany

11.3.3.1. Germany Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.4. France

11.3.4.1. France Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.5. Italy

11.3.5.1. Italy Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4. Asia Pacific

11.4.1. Asia Pacific Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.2. China

11.4.2.1. China Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.3. Japan

11.4.3.1. Japan Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.4. India

11.4.4.1. India Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.5. South Korea

11.4.5.1. South Korea Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.6. Australia

11.4.6.1. Australia Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.5. Latin America

11.5.1. Latin America Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.5.2. Brazil

11.5.2.1. Brazil Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6. Middle East and Africa

11.6.1. Middle East and Africa Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.2. UAE

11.6.2.1. UAE Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.3. Saudi Arabia

11.6.3.1. Saudi Arabia Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.4. South Africa

11.6.4.1. South Africa Virtual Events Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 12. Virtual events market - Competitive Landscape

12.1. Company Categorization

12.2. Company Market Positioning

12.3. Company Heat Map Analysis

12.4. Company Profiles/Listing

12.4.1. Vosmos

12.4.1.1. Participant’s Overview

12.4.1.2. Financial Performance

12.4.1.3. Product Benchmarking

12.4.1.4. Recent Developments

12.4.2. Hubilo

12.4.2.1. Participant’s Overview

12.4.2.2. Financial Performance

12.4.2.3. Product Benchmarking

12.4.2.4. Recent Developments

12.4.3. 6Connex

12.4.3.1. Participant’s Overview

12.4.3.2. Financial Performance

12.4.3.3. Product Benchmarking

12.4.3.4. Recent Developments

12.4.4. ALIVE

12.4.4.1. Participant’s Overview

12.4.4.2. Financial Performance

12.4.4.3. Product Benchmarking

12.4.4.4. Recent Developments

12.4.5. Avaya LLC

12.4.5.1. Participant’s Overview

12.4.5.2. Financial Performance

12.4.5.3. Product Benchmarking

12.4.5.4. Recent Developments

12.4.6. ALE International

12.4.6.1. Participant’s Overview

12.4.6.2. Financial Performance

12.4.6.3. Product Benchmarking

12.4.6.4. Recent Developments

12.4.7. NTT Limited

12.4.7.1. Participant’s Overview

12.4.7.2. Financial Performance

12.4.7.3. Product Benchmarking

12.4.7.4. Recent Developments

12.4.8. Cisco Systems Inc.

12.4.8.1. Participant’s Overview

12.4.8.2. Financial Performance

12.4.8.3. Product Benchmarking

12.4.8.4. Recent Developments

12.4.9. Cvent Inc.

12.4.9.1. Participant’s Overview

12.4.9.2. Financial Performance

12.4.9.3. Product Benchmarking

12.4.9.4. Recent Developments

12.4.10. EventX Limited

12.4.10.1. Participant’s Overview

12.4.10.2. Financial Performance

12.4.10.3. Product Benchmarking

12.4.10.4. Recent Developments

12.4.11. George P.Johnson

12.4.11.1. Participant’s Overview

12.4.11.2. Financial Performance

12.4.11.3. Product Benchmarking

12.4.11.4. Recent Developments

12.4.12. GES

12.4.12.1. Participant’s Overview

12.4.12.2. Financial Performance

12.4.12.3. Product Benchmarking

12.4.12.4. Recent Developments

12.4.13. Kestone

12.4.13.1. Participant’s Overview

12.4.13.2. Financial Performance

12.4.13.3. Product Benchmarking

12.4.13.4. Recent Developments

12.4.14. Martiz Holdings Inc.

12.4.14.1. Participant’s Overview

12.4.14.2. Financial Performance

12.4.14.3. Product Benchmarking

12.4.14.4. Recent Developments

12.4.15. Microsoft Corporation

12.4.15.1. Participant’s Overview

12.4.15.2. Financial Performance

12.4.15.3. Product Benchmarking

12.4.15.4. Recent Developments

12.4.16. Pathable

12.4.16.1. Participant’s Overview

12.4.16.2. Financial Performance

12.4.16.3. Product Benchmarking

12.4.16.4. Recent Developments

12.4.17. uBivent GmbH

12.4.17.1. Participant’s Overview

12.4.17.2. Financial Performance

12.4.17.3. Product Benchmarking

12.4.17.4. Recent Developments

12.4.18. Veritas Events

12.4.18.1. Participant’s Overview

12.4.18.2. Financial Performance

12.4.18.3. Product Benchmarking

12.4.18.4. Recent Developments

12.4.19. vFairs

12.4.19.1. Participant’s Overview

12.4.19.2. Financial Performance

12.4.19.3. Product Benchmarking

12.4.19.4. Recent Developments

12.4.20. Zoom Video Communications, Inc.

12.4.20.1. Participant’s Overview

12.4.20.2. Financial Performance

12.4.20.3. Product Benchmarking

12.4.20.4. Recent Developments

List of Tables

Table 1 Global virtual events market size estimates & forecasts, 2018 - 2030 (USD Billion)

Table 2 Global virtual events market, by region, 2018 - 2030 (USD Billion)

Table 3 Global virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 4 Global virtual events market, by component, 2018 - 2030 (USD Billion)

Table 5 Global virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 6 Global virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 7 Global virtual events market, by application, 2018 - 2030 (USD Billion)

Table 8 Global virtual events market, by Industry Vertical, 2018 - 2030 (USD Billion)

Table 9 Global virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 10 Internal virtual events market, by region, 2018 - 2030 (USD Billion)

Table 11 External Virtual Events market, by region, 2018 - 2030 (USD Billion)

Table 12 Extended virtual events market, by region, 2018 - 2030 (USD Billion)

Table 13 Platform virtual events market, by region, 2018 - 2030 (USD Billion)

Table 14 Web-based virtual events market, by region, 2018 - 2030 (USD Billion)

Table 15 XR virtual events market, by region, 2018 - 2030 (USD Billion)

Table 16 Services virtual events market, by region, 2018 - 2030 (USD Billion)

Table 17 Communication virtual events market, by region, 2018 - 2030 (USD Billion)

Table 18 Recruitment virtual events market, by region, 2018 - 2030 (USD Billion)

Table 19 Sales & Marketing virtual events market, by region, 2018 - 2030 (USD Billion)

Table 20 Training virtual events market, by region, 2018 - 2030 (USD Billion)

Table 21 SMB’s virtual events market, by region, 2018 - 2030 (USD Billion)

Table 22 Large Institutions virtual events market, by region, 2018 - 2030 (USD Billion)

Table 23 Educational Institutions virtual events market, by region, 2018 - 2030 (USD Billion)

Table 24 Corporate virtual events market, by region, 2018 - 2030 (USD Billion)

Table 25 Government virtual events market, by region, 2018 - 2030 (USD Billion)

Table 26 Others virtual events market, by region, 2018 - 2030 (USD Billion)

Table 27 Conferences and conventions virtual events market, by region, 2018 - 2030 (USD Billion)

Table 28 Exhibitions & trade shows virtual events market, by region, 2018 - 2030 (USD Billion)

Table 29 Seminars and workshops virtual events market, by region, 2018 - 2030 (USD Billion)

Table 30 Corporate meetings and training virtual events market, by region, 2018 - 2030 (USD Billion)

Table 31 Others virtual events market, by region, 2018 - 2030 (USD Billion)

Table 32 Banking, Financial Services, and Insurance (BFSI) virtual events market, by region, 2018 - 2030 (USD Billion)

Table 33 Consumer electronics virtual events market, by region, 2018 - 2030 (USD Billion)

Table 34 Healthcare virtual events market, by region, 2018 - 2030 (USD Billion)

Table 35 IT virtual events market, by region, 2018 - 2030 (USD Billion)

Table 36 Manufacturing virtual events market, by region, 2018 - 2030 (USD Billion)

Table 37 Media & entertainment virtual events market, by region, 2018 - 2030 (USD Billion)

Table 38 Telecom virtual events market, by region, 2018 - 2030 (USD Billion)

Table 39 Others virtual events market, by region, 2018 - 2030 (USD Billion)

Table 40 Everyday events virtual events market, by region, 2018 - 2030 (USD Billion)

Table 41 Large-scale events virtual events market, by region, 2018 - 2030 (USD Billion)

Table 42 North America virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 43 North America virtual events market, by component, 2018 - 2030 (USD Billion)

Table 44 North America virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 45 North America virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 46 North America virtual events market, by application, 2018 - 2030 (USD Billion)

Table 47 North America virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 48 North America virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 49 U.S. virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 50 U.S. virtual events market, by component, 2018 - 2030 (USD Billion)

Table 51 U.S. virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 52 U.S. virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 53 U.S. virtual events market, by application, 2018 - 2030 (USD Billion)

Table 54 U.S. virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 55 U.S. virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 56 Canada virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 57 Canada virtual events market, by component, 2018 - 2030 (USD Billion)

Table 58 Canada virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 59 Canada virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 60 Canada virtual events market, by application, 2018 - 2030 (USD Billion)

Table 61 Canada virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 62 Canada virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 63 Mexico virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 64 Mexico virtual events market, by component, 2018 - 2030 (USD Billion)

Table 65 Mexico virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 66 Mexico virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 67 Mexico virtual events market, by application, 2018 - 2030 (USD Billion)

Table 68 Mexico virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 69 Mexico virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 70 Europe virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 71 Europe virtual events market, by component, 2018 - 2030 (USD Billion)

Table 72 Europe virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 73 Europe virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 74 Europe virtual events market, by application, 2018 - 2030 (USD Billion)

Table 75 Europe virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 76 Europe virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 77 UK virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 78 UK virtual events market, by component, 2018 - 2030 (USD Billion)

Table 79 UK virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 80 UK virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 81 UK virtual events market, by application, 2018 - 2030 (USD Billion)

Table 82 UK virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 83 UK virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 84 Germany virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 85 Germany virtual events market, by component, 2018 - 2030 (USD Billion)

Table 86 Germany virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 87 Germany virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 88 Germany virtual events market, by application, 2018 - 2030 (USD Billion)

Table 89 Germany virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 90 Germany virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 91 France virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 92 France virtual events market, by component, 2018 - 2030 (USD Billion)

Table 93 France virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 94 France virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 95 France virtual events market, by application, 2018 - 2030 (USD Billion)

Table 96 France virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 97 France virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 98 Italy virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 99 Italy virtual events market, by component, 2018 - 2030 (USD Billion)

Table 100 Italy virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 101 Italy virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 102 Italy virtual events market, by application, 2018 - 2030 (USD Billion)

Table 103 Italy virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 104 Italy virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 105 Asia-Pacific virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 106 Asia-Pacific virtual events market, by component, 2018 - 2030 (USD Billion)

Table 107 Asia-Pacific virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 108 Asia-Pacific virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 109 Asia-Pacific virtual events market, by application, 2018 - 2030 (USD Billion)

Table 110 Asia-Pacific virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 111 Asia-Pacific virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 112 China virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 113 China virtual events market, by component, 2018 - 2030 (USD Billion)

Table 114 China virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 115 China virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 116 China virtual events market, by application, 2018 - 2030 (USD Billion)

Table 117 China virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 118 China virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 119 Japan virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 120 Japan virtual events market, by component, 2018 - 2030 (USD Billion)

Table 121 Japan virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 122 Japan virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 123 Japan virtual events market, by application, 2018 - 2030 (USD Billion)

Table 124 Japan virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 125 Japan virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 126 India virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 127 India virtual events market, by component, 2018 - 2030 (USD Billion)

Table 128 India virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 129 India virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 130 India virtual events market, by application, 2018 - 2030 (USD Billion)

Table 131 India virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 132 India virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 133 South Korea virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 134 South Korea virtual events market, by component, 2018 - 2030 (USD Billion)

Table 135 South Korea virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 136 South Korea virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 137 South Korea virtual events market, by application, 2018 - 2030 (USD Billion)

Table 138 South Korea virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 139 South Korea virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 140 Australia virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 141 Australia virtual events market, by component, 2018 - 2030 (USD Billion)

Table 142 Australia virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 143 Australia virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 144 Australia virtual events market, by application, 2018 - 2030 (USD Billion)

Table 145 Australia virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 146 Australia virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 147 Latin America virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 148 Latin America virtual events market, by component, 2018 - 2030 (USD Billion)

Table 149 Latin America virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 150 Latin America virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 151 Latin America virtual events market, by application, 2018 - 2030 (USD Billion)

Table 152 Latin America virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 153 Latin America virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 154 Brazil virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 155 Brazil virtual events market, by component, 2018 - 2030 (USD Billion)

Table 156 Brazil virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 157 Brazil virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 158 Brazil virtual events market, by application, 2018 - 2030 (USD Billion)

Table 159 Brazil virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 160 Brazil virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 161 Middle East & Africa virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 162 Middle East & Africa virtual events market, by component, 2018 - 2030 (USD Billion)

Table 163 Middle East & Africa virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 164 Middle East & Africa virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 165 Middle East & Africa virtual events market, by application, 2018 - 2030 (USD Billion)

Table 166 Middle East & Africa virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 167 Middle East & Africa virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 168 South Africa virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 169 South Africa virtual events market, by component, 2018 - 2030 (USD Billion)

Table 170 South Africa virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 171 South Africa virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 172 South Africa virtual events market, by application, 2018 - 2030 (USD Billion)

Table 173 South Africa virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 174 South Africa virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 175 Saudi Arabia virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 176 Saudi Arabia virtual events market, by component, 2018 - 2030 (USD Billion)

Table 177 Saudi Arabia virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 178 Saudi Arabia virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 179 Saudi Arabia virtual events market, by application, 2018 - 2030 (USD Billion)

Table 180 Saudi Arabia virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 181 Saudi Arabia virtual events market, by use case, 2018 - 2030 (USD Billion)

Table 182 UAE virtual events market, by event type, 2018 - 2030 (USD Billion)

Table 183 UAE virtual events market, by component, 2018 - 2030 (USD Billion)

Table 184 UAE virtual events market, by establishment size, 2018 - 2030 (USD Billion)

Table 185 UAE virtual events market, by end use, 2018 - 2030 (USD Billion)

Table 186 UAE virtual events market, by application, 2018 - 2030 (USD Billion)

Table 187 UAE virtual events market, by industry vertical, 2018 - 2030 (USD Billion)

Table 188 UAE virtual events market, by use case, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Virtual events market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Virtual events market snapshot

Fig. 7 Virtual events market segment snapshot

Fig. 8 Virtual events market competitive landscape snapshot

Fig. 9 Market research process

Fig. 10 Market driver relevance analysis (current & future impact)

Fig. 11 Market restraint relevance analysis (current & future impact)

Fig. 12 Virtual events market, by event type, key takeaways

Fig. 13 Virtual events market, by event type, market share, 2024 & 2030

Fig. 14 Internal market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 15 External market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 16 Extended market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 17 Virtual events market, by component, key takeaways

Fig. 18 Virtual events market, by component, market share, 2024 & 2030

Fig. 19 Platform market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 20 Web-based market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 21 XR market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 22 Services market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Communication market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 24 Recruitment market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 25 Sales & marketing market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 26 Training solution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Virtual events market, by establishment size, key takeaways

Fig. 28 Virtual events market, by establishment size, market share, 2024 & 2030

Fig. 29 SMB’s market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Large Institutions market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 31 Virtual events market, by end use, key takeaways

Fig. 32 Virtual events market, by end use, market share, 2024 & 2030

Fig. 33 Educational institutions market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 34 Corporate market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 35 Government market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 36 Others banking & finance market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 37 Virtual events market, by application, key takeaways

Fig. 38 Virtual events market, by application, market share, 2024 & 2030

Fig. 39 Conferences and conventions market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 40 Exhibitions & trade shows market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 41 Seminars and workshops market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 42 Corporate meetings and training market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 43 Others market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 44 Virtual events market, by Industry Vertical, key takeaways

Fig. 45 Virtual events market, by Industry Vertical, market share, 2024 & 2030

Fig. 46 Banking, financial services, and insurance (BFSI) market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Consumer electronics market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Healthcare market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 49 IT market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Manufacturing market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 51 Media & entertainment market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 52 Telecom market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Others market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Virtual events market, by use case, key takeaways

Fig. 55 Virtual events market, by use case, market share, 2024 & 2030

Fig. 56 Everyday events market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Large-scale events market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 58 North America virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 59 U.S. Virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 60 Canada virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 61 Mexico virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 62 Europe virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 63 UK virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 64 Germany virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 65 France virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 66 Italy virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 67 Asia-Pacific virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 68 China virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 69 Japan virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 70 South Korea virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 71 Australia virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 72 India virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 73 Latin America virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 74 Brazil virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 75 Mexico virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 76 MEA virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 77 South Africa virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 78 Saudi Arabia virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 79 UAE virtual events market estimates & forecast, 2018 - 2030 (USD Billion)

Fig. 80 Strategic framework

Market Segmentation

- Virtual Events Type Outlook (Revenue, USD Billion, 2018-2030)

- Internal

- External

- Extended

- Virtual Events Component Outlook (Revenue, USD Billion, 2018-2030)

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Virtual Events Establishment Size Outlook (Revenue, USD Billion, 2018-2030)

- SMB’s

- Large Institutions

- Virtual Events End Use Outlook (Revenue, USD Billion, 2018-2030)

- Educational Institutions

- Corporate

- Government

- Others

- Virtual Events Application Outlook (Revenue, USD Billion, 2018-2030)

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Virtual Events Industry Vertical Outlook (Revenue, USD Billion, 2018-2030)

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Virtual Events Use Case Outlook (Revenue, USD Billion, 2018-2030)

- Everyday Events

- Large-scale Events

- Virtual Events Regional Outlook (Revenue, USD Billion, 2018-2030)

- North America

- North America Virtual Events Market, by Event Type

- Internal

- External

- Extended

- North America Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- North America Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- North America Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- North America Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- North America Virtual Events Industry Vertical Outlook (Revenue, USD Billion, 2018-2030)

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- North America Virtual Events Use Case Outlook (Revenue, USD Billion, 2018-2030)

- Everyday events

- Large scale events

- U.S.

- U.S. Virtual Events Market, by Event Type

- Internal

- External

- Extended

- U.S. Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- U.S. Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- U.S. Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- U.S. Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- U.S. Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- U.S. Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- U.S. Virtual Events Market, by Event Type

- Canada

- Canada Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Canada Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Canada Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Canada Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Canada Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Canada Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Canada Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- Canada Virtual Events Market, by Event Type

- Mexico

- Mexico Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Mexico Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Mexico Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Mexico Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Mexico Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Mexico Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Canada Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- Mexico Virtual Events Market, by Event Type

- North America Virtual Events Market, by Event Type

- Europe

- Europe Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Europe Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Europe Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Europe Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Europe Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Europe Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Europe Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- UK

- UK Virtual Events Market, by Event Type

- Internal

- External

- Extended

- UK Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- UK Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- UK Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- UK Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- UK Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- UK Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- UK Virtual Events Market, by Event Type

- Germany

- Germany Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Germany Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Germany Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Germany Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Germany Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Germany Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Germany Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- Germany Virtual Events Market, by Event Type

- France

- France Virtual Events Market, by Event Type

- Internal

- External

- Extended

- France Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- France Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- France Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- France Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- France Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- France Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- France Virtual Events Market, by Event Type

- Italy

- Italy Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Italy Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Italy Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Italy Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Italy Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Italy Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Italy Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- Italy Virtual Events Market, by Event Type

- Europe Virtual Events Market, by Event Type

- Asia Pacific

- Asia Pacific Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Asia Pacific Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Asia Pacific Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Asia Pacific Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Asia Pacific Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- Asia Pacific Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- Asia Pacific Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- China

- China Virtual Events Market, by Event Type

- Internal

- External

- Extended

- China Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- China Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- China Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- China Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- China Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- China Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- China Virtual Events Market, by Event Type

- India

- India Virtual Events Market, by Event Type

- Internal

- External

- Extended

- India Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- India Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- India Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- India Virtual Events Market, by Application

- Conferences and Conventions

- Exhibitions & Trade Shows

- Seminars and Workshops

- Corporate Meetings and Training

- Others

- India Virtual Events Market, by Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Electronics

- Healthcare

- IT

- Manufacturing

- Media & Entertainment

- Telecom

- Others

- India Virtual Events Market, by Use Case

- Everyday events

- Large scale events

- India Virtual Events Market, by Event Type

- Japan

- Japan Virtual Events Market, by Event Type

- Internal

- External

- Extended

- Japan Virtual Events Market, by Component

- Platform

- Web-based

- XR

- Services

- Communication

- Recruitment

- Sales & Marketing

- Training

- Platform

- Japan Virtual Events Market, by Establishment Size

- SMB’s

- Large Institutions

- Japan Virtual Events Market, by End Use

- Educational Institutions

- Corporate

- Government

- Others

- Japan Virtual Events Market, by Application