Virtual Client Computing Software Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (Hosted, On-premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-715-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

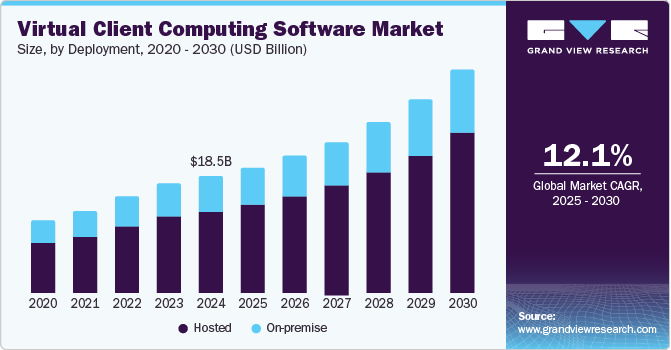

The global virtual client computing software market size was valued at USD 18.50 billion in 2024 and is projected to grow at a CAGR of 12.1% from 2025 to 2030. An increasing demand for an agile workforce is influencing strong market growth, the growing need to enhance user productivity, improvements in information security, and the requirement for simplified IT management across enterprises. Furthermore, constant data theft and loss risks have encouraged the adoption of virtual client computing solutions, as they offer centralized management, better data protection, and reduced risk by keeping sensitive data off local devices.

Virtual client computing (VCC), also known as client virtualization or endpoint virtualization, is a model that provides desktop virtualization tools to address limitations presented by the traditional distributed desktop environment. It offers the ability to deploy and manage virtual desktops that users can access from any device, anywhere, and run applications remotely without requiring installation on local devices. Through the implementation of these solutions, desktop management can be achieved from a centralized location. For instance, organizations may require employees to restart their laptops spanning a few weeks to apply a major update, add a new desktop configuration, or download new software. Virtual desktops ensure no such downtime, as users cannot access their desktops until they establish a connection with the virtual desktop host, causing updates or software modifications to happen during downtime.

The VCC software separates every system component that facilitates easy movement of user applications, data, or the complete workplace into the data center from the operator's machine. IT departments can manage client devices effectively, securely, and cost-efficiently, driving this model's appeal. They utilize the client system's local processor to run CPU-intensive and rich multimedia applications to offer better user experience. The rapidly expanding mobile workforce has highlighted the need to have seamless data access that can be easily realized by client virtualization software. Users with access to such software types can access their virtual desktops and data securely from distant locations. Furthermore, this model offers benefits such as improved employee accessibility, increased organizational productivity, and lessening the workload on IT administrators to manage systems.

Component Insights

The solution segment accounted for a dominant revenue share of 67.8% in the global market in 2024. Virtual client computing solutions are critical in modern IT infrastructure, enabling businesses to optimize their desktop and application management. These solutions leverage virtualization technologies to centralize the management of desktops and applications, delivering them securely to end-users, regardless of their location or devices. The major solutions offered include terminal service, virtual desktop infrastructure (VDI), and virtual user session (VUS), among others. The Virtual Desktop Infrastructure (VDI) sub-segment accounted for a leading revenue share in 2024, owing to the consistently rising demand for workplace productivity and flexibility benefits for IT personnel. VDI performs a crucial function in resolving various security-based issues, thus maintaining the network's safety from cyberattacks.

Meanwhile, the service segment is expected to expand at the fastest CAGR from 2025 to 2030. Using services such as integration & deployment, support & maintenance, and training & consulting has become crucial for organizations to extract maximum value from client virtualization software and improve efficiency across business processes. The training and consulting service segment accounted for a leading revenue share in the global market in 2024, aided by the extensive deployment of client virtualization software across large and small enterprises. As organizations increasingly implement virtualization solutions to support remote work and improve IT efficiency, there is an urgent need for training personnel to effectively utilize these technologies. Client virtualization solutions are generally complex to deploy and manage. Organizations thus seek consulting services to ensure a smooth transition and effective integration with existing systems.

Deployment Insights

The hosted segment accounted for the highest revenue share in the market in 2024 and is expected to further advance at the fastest CAGR in the coming years. The accelerated growth in mobile device usage and positive advances in information sharing technologies have driven the adoption of hosted solutions. Organizations that operate on several sites prefer to work on the same database, making them ideal customers for hosted application servers. It is more convenient to deploy hosted applications when compared to conventional software, as they do not require any upfront installation and have lesser integration needs. Also, organizations can easily scale resources up or down based on demand, adding or removing virtual desktops and applications as needed without significant infrastructure investment. Hosted applications are managed by service providers and regularly updated, patched with the most recent stable version, and provided with reliable customer and technical support.

The on-premise segment is expected to witness substantial growth from 2025 to 2030 in the virtual client computing software market, as this mode allows software customization according to the client's processes. Larger enterprises still prefer on-premise solutions as they need to adhere to various regulations, particularly in sectors such as finance and healthcare. Companies can implement security measures, ensuring compliance with internal policies and regulatory requirements, including firewalls, access controls, and encryption. The lack of Internet requirements means that on-premise deployment can optimize performance by reducing latency since data does not need to travel over the Internet. This proves to be particularly beneficial for resource-intensive applications. Additionally, organizations can keep sensitive data within their geographical boundaries, which is crucial for compliance with certain data protection regulations.

Enterprise Size Insights

The large enterprise segment accounted for the highest revenue share of the overall market in 2024, as these organizations focus on decreasing their high Capital Expenditure (CAPEX) and Operating Expenditure (OPEX). Large enterprises possess expansive in-house IT resources and substantial financial capabilities, making them a leading deployer of advanced application management strategies. Moreover, they generate substantial volumes of data that require efficient management and security. These organizations also can easily scale their virtual environments to accommodate changing workforce needs, seasonal fluctuations, or project-based demands. The demand for optimum resource allocation and strategic decision-making among large corporations has driven the requirement for robust monitoring solutions and automation features, aiding segment growth.

The small and medium enterprises (SMEs) segment is expected to exhibit the fastest CAGR from 2025 to 2030. Rising awareness regarding the benefits of digitalization has compelled businesses to invest heavily in expanding and maintaining their processes and systems to remain ahead in a highly competitive market. Additionally, rapid advancements in cloud technology have enabled such businesses to adopt high-end solutions. The constant need to ensure reductions in operating expenses and simultaneously improve business efficiency are considered major drivers for VCC software demand among SMEs. It allows small businesses to quickly add or remove virtual desktops based on changing workforce or project requirements, enabling agile business operations.

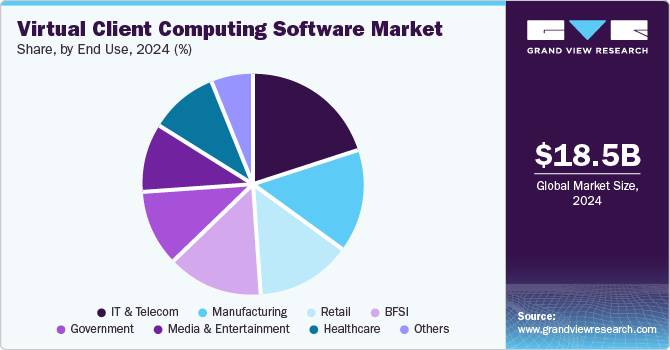

End Use Insights

The IT and telecom segment accounted for the leading revenue share of the global VCC software market in 2024. This sector has conventionally been an early adopter of digitalization trends. In recent years, IT & telecom companies have been constantly upgrading their legacy applications to enable seamless digital customer experiences. Furthermore, the extensive adoption of innovative technologies such as the Internet of Things (IoT) has aided substantial demand for client virtualization solutions. Telecom firms are migrating conventional applications to the cloud and newer technology platforms to effectively manage important customer data. The rapidly shifting focus from expensive systems to low-cost BYOD solutions is another factor that has ensured sustained market expansion.

The healthcare segment is anticipated to advance at the fastest CAGR from 2025 to 2030. VCC solutions enable healthcare professionals to access electronic health records (EHRs) and other critical patient information from anywhere, facilitating telemedicine and remote consultations. Also, the need to comply with stringent regulations such as HIPAA in the U.S. to maintain the privacy and security of patient data has driven the use of these tools, as they ensure centralized data management and enhanced security measures, reducing the risk of data breaches. The telehealth space has witnessed strong growth in recent years as it provides convenience for both the patient and healthcare professionals, making VCC essential for providing healthcare solutions remotely and ensuring that practitioners can connect with patients without compromising data security.

Regional Insights

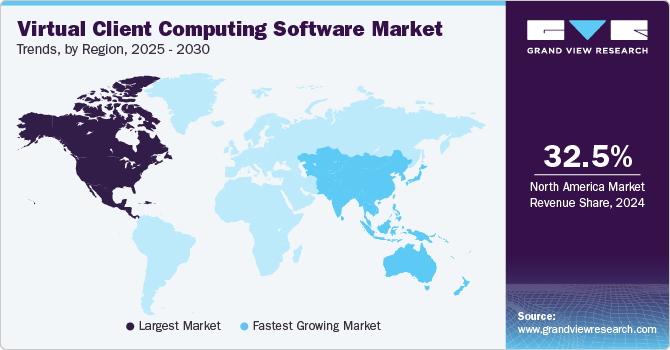

North America accounted for the largest revenue share of 32.5% in the global market in 2024, aided by the extensive adoption of cloud technology in the region and growing popularity of BYOD trends. Furthermore, the well-established IT sector and constant technological advancements in major verticals such as BFSI, healthcare, and telecom have provided growth avenues to software providers. Virtual client computing software requires the presence of highly flexible and active IT support, which can be found extensively in regional economies. The presence of major market players in the U.S. and Canada and intensifying competition to offer reliable and secure solutions is expected to strongly contribute to the regional market advancement.

U.S. Virtual Client Computing Software Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024 and is expected to maintain its position in the coming years. The shift to remote and hybrid work has accelerated the adoption of VCC solutions, allowing employees to securely access corporate resources from various locations and devices. A research report published to highlight the demand for remote and hybrid work models found that 29% of employees in the country operated in a hybrid setting. Moreover, enterprises across the country have acknowledged the role of VCC in enabling businesses to extend the lifespan of existing hardware by allowing less powerful devices to run virtual desktops, reducing capital expenditures and IT costs. Companies such as VMware, Citrix, and Microsoft have well-established operations in the country, aiding businesses in profiting from their customizable offerings in this industry.

Europe Virtual Client Computing Software Market Trends

Europe accounted for a notable revenue share in the global market in 2024 on account of the growing requirement to comply with regulations, particularly in industries such as healthcare and BFSI, along with the extensive support for BYOD policies. With increasing risk of cyber threats, organizations in Europe are prioritizing secure access to applications and data. VCC solutions help mitigate risks by keeping sensitive information on secure servers rather than local devices. Moreover, the growing adoption of cloud technologies in European economies is driving significant demand for VCC solutions that can seamlessly integrate with cloud applications and services, thus building a cohesive IT ecosystem. European businesses are also increasingly focusing on digital transformation, with VCC being considered a vital aspect for modernizing IT infrastructure and improving operational efficiency.

Asia Pacific Virtual Client Computing Software Market Trends

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period, on account of the increasing digitalization in emerging economies and accelerated adoption of VCC solutions across BPOs and data centers. Recognizing the high potential of this region, several global enterprises have established their manufacturing facilities in economies such as India and China. This has resulted in extensive foreign investments in innovative and cutting-edge technologies. The rapid emergence of cloud computing and data virtualization has driven meaningful developments in major regional verticals such as BFSI, healthcare, IT, and telecom in recent years. Furthermore, the extensive presence of small- and medium-sized businesses is projected to positively shape industry growth in this region, as client virtualization tools offer advantages such as cost efficiency, scalability, improved security, simplified IT management, and business continuity to these enterprises.

Japan accounted for the largest revenue share in the regional market in 2024 and is expected to maintain a significant contribution to the market in the coming years. The well-established IT and telecom industry in the economy, coupled with the presence of several notable technological leaders, has driven the adoption of client virtualization software among businesses. Small businesses in Japan have witnessed steady growth in recent years and are increasingly incorporating cloud-based solutions, enabling them to transform their business by adopting virtual client computing solutions.

Key Virtual Client Computing Software Company Insights

Some key companies involved in the virtual client computing software market include Microsoft, Amazon Web Services, and Parallels, among others.

-

Amazon Web Services (AWS) is a subsidiary of Amazon that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments across the globe. The company mainly offers compute services, storage services, database services, machine learning and AI solutions, and developer tools such as AWS CodeCommit and AWS CodeDeploy. Amazon provides client virtualization solutions primarily through its Amazon WorkSpaces and Amazon AppStream 2.0 services. Amazon WorkSpaces is a managed, secure Desktop-as-a-Service (DaaS) solution that allows users to access their desktop environments from anywhere using various devices, including PCs, Macs, and tablets. Meanwhile, Amazon AppStream 2.0 is a fully managed application streaming service that enables clients to access desktop applications from anywhere without installing software on local devices.

-

Parallels is a software organization specializing in virtualization and automation solutions that enable businesses and individuals to enhance productivity and streamline IT processes. Its key products include Parallels Desktop, a popular virtualization software for Mac users to run Windows and other operating systems alongside macOS without rebooting. Parallels Remote Application Server (RAS) is another major solution for delivering virtual applications and desktops to any device, enabling remote access and improving workforce flexibility. The company provides both on-premise and hybrid solutions (Parallels RAS and Parallels Secure Workspace) and cloud-based products (Parallels DaaS and Parallels Browser Isolation). The company caters to several major industries, including IT, healthcare, education, finance, and others.

Key Virtual Client Computing Software Companies:

The following are the leading companies in the virtual client computing software market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Broadcom (VMware)

- Cloud Software Group, Inc.

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Nutanix

- Hitachi, Ltd.

- Parallels International GmbH

Recent Developments

-

In March 2024, Parallels launched its secure web access service' Parallels Browser Isolation', designed to mitigate the increasing threat of data breaches and cyberattacks in organizations. The new offering has integrated the company's desktop, cloud, and legacy workspace solutions. It presents a holistic approach to accessing applications, desktops, and data across any device, platform, or location. Key features include a highly secure environment, endpoint protection, availability of real-time insights, fast setup, and predictable pricing.

-

In August 2023, VMware announced advanced AI integrations to its Anywhere Workspace platform, part of the VMware Cross-Cloud service portfolio. The platform integrates virtual desktop infrastructure and apps, digital employee experience (DEX), unified endpoint management (UEM), and security, enabling a secure and seamless workspace on any location or device. VMware also announced an agreement with Intel through the cloud-native integration of the former's Workspace ONE with the Intel vPro chip. This allows secure and convenient management of work devices completely from the cloud without needing any additional infrastructure.

Virtual Client Computing Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 19.94 billion |

|

Revenue Forecast in 2030 |

USD 35.24 billion |

|

Growth Rate |

CAGR of 12.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, deployment, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Microsoft; Broadcom (VMware); Cloud Software Group, Inc.; Cisco Systems, Inc.; Amazon Web Services, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; Nutanix; Hitachi, Ltd.; Parallels International GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Virtual Client Computing Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual client computing software market report based on solution, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Terminal Service

-

VUS

-

VDI

-

Others

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."