- Home

- »

- Biotechnology

- »

-

Viral Inactivation Market Size, Share & Growth Report, 2030GVR Report cover

![Viral Inactivation Market Size, Share & Trends Report]()

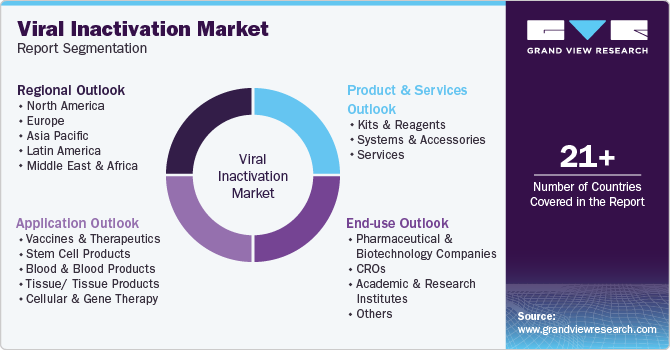

Viral Inactivation Market Size, Share & Trends Analysis Report By Products & Services (Kits & Reagents), By Application (Vaccines & Therapeutics), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-998-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Viral Inactivation Market Size & Trends

The global viral inactivation market size was valued at USD 653.5 million in 2023 and is projected to grow at a CAGR of 11.4%from 2024 to 2030. The rise in the number of pharmaceutical and biotechnological companies, rise in drug launches and approvals, increasing funding and investments for R&D, and the increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders leading to the increase in healthcare expenditure are the driving factors propelling the growth of the market.

The development of novel therapeutics against SARS-CoV2 during the outbreak of the COVID-19 pandemic has led many biopharmaceutical companies to study viral inactivation procedures and their market. Recent developments have helped this market grow positively to quite an extent, such as viral inactivation procedures, which irradiation rays can also perform. For instance, according to a research report published in 2023 by Springer Nature Limited, irradiation rays help in inactivating virions through ionizing and non-ionizing effects. These rays destroy the genome by the action of radicals on viral nucleic acids, causing less damage to the protein membrane.

In addition, according to a report published by the PDA Journal of Pharmaceutical Science and Technology, in 2024, the use of detergents or low pH was employed in downstream biologics processing to inactivate enveloped viruses. In addition, other procedures such as media supplement treatments, virus filtration, and high-temperature, short-time processing have been widely used for viral inactivation procedures. For instance, according to a study by the Institute of Virology, Slovakia, in 2023, an approach to combat infectious diseases was performed by using heat inactivation (high temperature). It was found that 99.8% of SARS-CoV2 were killed by a single Ni foam-based filter pass-through, which was heated up to 200 degrees Celsius.

Product & Services Insights

Kits & reagents dominated the market and accounted for a share of 57.3% in 2023. This is attributed to the rise in biopharmaceutical and biotechnological companies worldwide. The increasing development activities of companies and product launches have positively impacted the market. For instance, in 2023, Croda Pharma launched Virodex TXR-1 and TXR-2 for effective viral inactivation. The increase in R&D investments has led to drug development, which is driving growth in the market.

Services segment is expected to register the fastest CAGR over the forecast period. This growth can be attributed to the ease of management and services offered by various service-providing companies, thereby helping the segment growth of this market. Contract Research Organizations offer quality standards and safety guidelines by providing virus inactivation procedures and planning further steps in the drug development process.

Application Insights

Vaccines and therapeutics accounted for the largest market revenue share of 32.8% in 2023. It can be attributed to the rising investments in R&D applications such as gene therapy and stem cell research, contributing significantly to market growth. The increasing incidences of cancer and other chronic diseases have increased demand for inactivated vaccines, which is further expected to help market growth. Researchers and scientists have developed various procedures for viral activation. For instance, according to a research report published in Frontiers in 2023, chemical reagents such as TNA-Cifer Reagent E help in the effective inactivation of the virus while preserving RNA for sensitive PCR testing. This also helps in the safe handling of samples and transport without the need for biosafety facilities.

Stem cell products segment is expected to register the fastest CAGR over the forecast period. Stem cell products are at high risk of contamination, so intense requirement for viral inactivation is required. Stem cell research has also been increasing in developed and developing countries with the help of government support. Stem cell research has progressed a lot within a shorter time period and has contributed to treating various diseases, thereby driving market growth. For instance, according to the information published by the Ministry of Health and Family Welfare in February 2022, the Department of Biotechnology (DBT), India, invested USD 8.79 million in stem cell research and other potential therapeutic applications in the past three years.

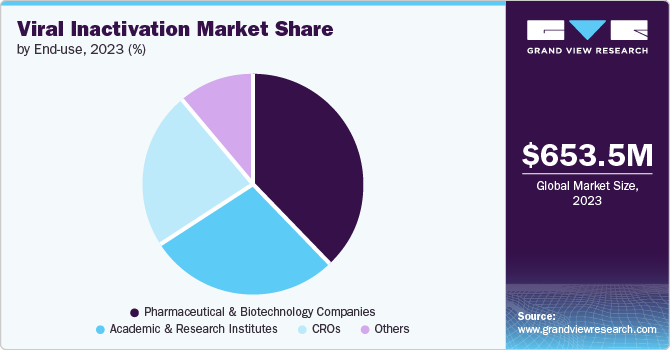

End-use Insights

Pharmaceutical and biotechnology companies accounted for the largest market revenue share of 38.3% in 2023. It can be attributed to the growth of pharmaceutical and biopharmaceutical companies, which has helped in the investment to find alternative therapies, thereby increasing the number of new drugs. These companies use bioreactors and various techniques such as solvent detergent, low pH, and other methods to ensure the safety of the product. For instance, in March 2022, Thermo Fisher Scientific Inc., a global company operating in life science research, developed and introduced a viral inactivation Medium formula, InhibiSURE. The new formula is expected to help in the collection and inactivation of the SARS-CoV-2 virus and RNA stabilizing at ambient temperature for use in in-vitro diagnostic testing procedures.

The academic and research institutes segment is expected to register the fastest CAGR during the forecast period. These institutes help in conducting fundamental research by studying the mechanisms, developing various viral inactivation techniques and collaborating with biopharmaceutical and biotechnological companies to translate research findings into practical applications for enhancing the safety of biological products. This is expected to help this segment grow positively in this market.

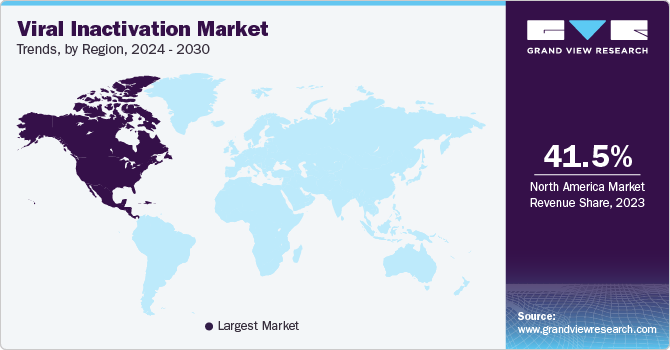

Regional Insights

North America viral inactivation market dominated in 2023 and accounted for the market share of 41.5%. This growth can be attributed to the advanced infrastructure, presence of major pharmaceutical and biotechnological companies, significant R&D investments, and healthcare expenditure by the government and companies. For instance, in May 2024, the University of Alberta researchers received federal research grants of nearly USD 100 million to find and develop diagnostic tests, vaccines, and treatments against a wide range of threats.

U.S. Viral Inactivation Market Trends

The U.S. viral inactivation market dominated the global market with a share of 36.2% in 2023. The growth can be attributed to the increasing R&D facilities and government initiatives. The high prevalence of various diseases and their requirement for treatment facilities has also surged market growth in the country. The U.S. viral clearance testing service providers have helped in upgrading of capabilities and infrastructure. The increase in funding has also driven the market growth.

Europe Viral Inactivation Market Trends

Europe viral inactivation market registered significant growth in 2023. Europe’s well-developed infrastructure and healthcare facilities, and scope of R&D have driven the market to grow. The German Center for Infection Research (DZIF) studies on eco-immunological factors associated with viral infections, which can inform the development of better viral inactivation methods. Various partnerships have proved to be a major source of market growth in Germany. The University of Technology Sydney has collaborated with German partners on using irradiation to inactivate viruses by damaging their genome and disrupting viral proteins.

Asia Pacific Viral Inactivation Market Trends

Asia Pacific's viral inactivation market is anticipated to witness significant growth in the viral inactivation market owing to the significant increase in investments, technological advancements, and research across the region. The Department of Biotechnology (DBT) and the Ministry of Science and Technology of India are supporting various R&D projects. Researchers at the Indian Institute of Technology (IIT) Guwahati are conducting fundamental research to understand the mechanisms of viral inactivation. Their labs focus on studying immune responses to viral infections that can inform the development of better inactivation methods. The continuous efforts made by the government and various initiatives have also helped in driving the market growth.

Key Viral Inactivation Company Insights

Some of the key companies in the viral inactivation include Charles River Laboratories, Inc., Clean Cells, Cytiva (Danaher Corporation), Merck KGaA. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Charles River Laboratories, Inc. is a U.S. based company engaged in the discovery, development, and safe manufacturing of new drug therapies to meet drug development demand. The company offers comprehensive viral inactivation testing programs to ensure that medical devices are free of potential viruses and harmful pathogens.

-

Merck KGaA is an American multinational pharmaceutical company that offers a range of products for viral inactivation, including reagents, kits, and systems. It has also collaborated with pharmaceutical, biotechnology, and academic institutions on advancing viral inactivation research and technologies.

Key Viral Inactivation Companies:

The following are the leading companies in the viral inactivation market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories, Inc.

- Clean Cells

- Cytiva (Danaher Corporation)

- Merck KGaA

- Mettler Toledo

- Parker Hannifin Corp

- Rad Source Technologies Inc

- Sartorius AG

- Texcell SA

- Vironova AB

Recent Developments

-

In June 2023, Texcell SA announced the launch of a testing facility in North America. This step is expected to help the company in enhancing the viral safety and clearance procedures of medical devices and biotherapeutics.

-

In May 2021, Charles River Laboratories announced its plans to acquire Rockville’s Vigene Biosciences, which is engaged in providing viral vector-based gene delivery solutions. The acquisition is expected to help the company in enhancing its gene therapy capabilities.

-

In September 2020, Merck KGaA announced the expansion of its biosafety testing laboratory services in Singapore. It is expected to enable customers to conduct viral clearance studies and ensure the safety & quality of various biological drugs during clinical development.

Viral Inactivation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 718.8 million

Revenue forecast in 2030

USD 1,371.6 million

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa, Kuwait.

Key companies profiled

Charles River Laboratories, Inc., Clean Cells, Cytiva (Danaher Corporation), Merck KGaA, Mettler Toledo, Parker Hannifin Corp, Rad Source Technologies Inc, Sartorius AG, Texcell SA, Vironova AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Viral Inactivation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global viral inactivation market report based on product & services, application, end-use, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits and Reagents

-

Systems & Accessories

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines and Therapeutics

-

Stem Cell Products

-

Blood and Blood Products

-

Tissue/ Tissue Products

-

Cellular and Gene Therapy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

CROs

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."