Vinyl Ester Market Size, Share & Trends Analysis Report By Type, (Bisphenol-A, Novolac, Brominated Fire Retardant), By Application (Pipes & Tanks, Marine, Wind Energy, FGD & Precipitators), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-345-4

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Vinyl Ester Market Size & Trends

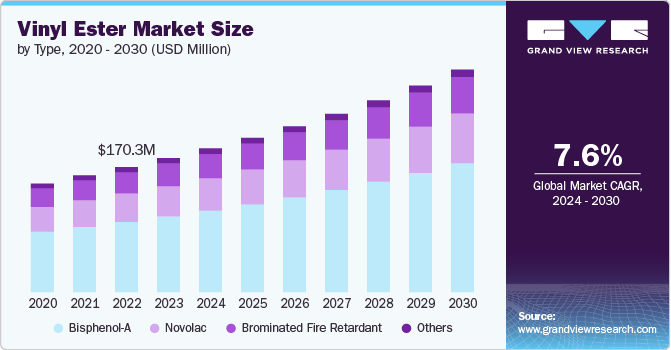

The global vinyl ester market size was estimated at USD 1.22 billion in 2023 and is projected to grow at a CAGR of 6.42% from 2024 to 2030. The demand for this product is being driven by an increase in the installation of flue gas desulfurization (FGD) systems due to growing environmental concerns and stricter regulations on hazardous emissions.

Vinyl esters are known for their exceptional chemical resistance and are often used as a reliable choice for lining the interior of a Flue Gas Desulfurization System. Moreover, the product demand is substantially propelled by the escalating construction activities, particularly in developing economies, for applications such as pipes, tanks, bridges, and building materials.

Vinyl ester resin is produced by esterifying an epoxy resin with monocarboxylic acid, then dissolving the resulting product in a solvent such as styrene. It is used in various industries and offers increased strength, corrosion resistance, low viscosity, and water absorption resistance.

The marine industry is anticipated to experience significant growth, particularly in ship and boat construction and repair. Approximately 80% of the volume of international trade in goods is transported by sea, with an even higher percentage for most developing countries. Containerization has revolutionized global cargo shipping, bringing about substantial improvements in efficiency. Despite the economic crisis, there is potential for the maritime industry's continued expansion. This resin is often considered an excellent choice in boat construction due to its exceptional durability and long-term performance, thereby boosting its consumption in the ever-growing marine industry.

In addition, the vinyl ester market is benefitting from increased investments in infrastructure. Nonetheless, the market faces challenges from cheaper substitutes and their easy availability. However, the surge in wind turbine installations globally, as well as the expanding product usage in mass transit vehicles and railways, presents opportunities for growth in the global vinyl ester market. The product offers enhanced fatigue resistance and greater overall toughness, contributing to extended durability and reduced weight.

The chemical and petrochemical industries often rely on vinyl ester for its corrosion-resistant properties in storage tanks, pipelines, and processing equipment. As these industries expand to meet the growing demand for chemicals and petroleum products, the demand for vinyl ester resins also increases.

Type Insights

Bisphenol-A (BPA) type dominated the market with a revenue share of 54.49% in 2023 owing to its growing usage in various chemical applications and FGD processes due to its corrosion resistance. In the marine industry, these resins are commonly used for barrier coats, gel coats, and in the main composite body of ships. They demonstrate good mechanical and chemical resistance properties and are also cost-effective. Also, BPA epoxy resin is employed in boat construction, repairs, and coatings because of its resistance to water and chemicals.

Novolac resins are known for their exceptional chemical resistance, high thermal durability, and strong mechanical properties, even at elevated temperatures. They are often favored in applications that necessitate a high resistance to solvents and chemicals, as well as the retention of strength and toughness in elevated temperature environments. These resins are commonly utilized in the fabrication of pipes and tanks using methods such as filament winding and hand lay-up.

Brominated vinyl ester resins (Br-VERs) are cost-effective, high-performance materials widely used in composites for specialized applications, such as naval vessel hull construction. They offer mechanical strength and are suitable for various production methods. In addition, they are resistant to chemicals and are flame retardant, making them ideal for applications like engine insulation, boiler units, chemical storage tanks, pipelines, and yachts.

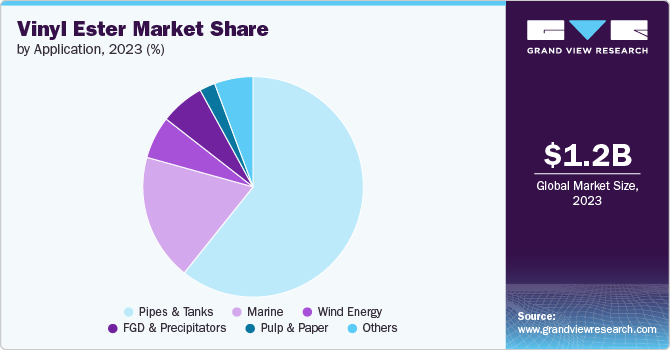

Application Insights

Pipes & tanks application segment dominated the market with a revenue share of 61.45% in 2023 owing to its excellent chemical resistance, making it a popular choice for manufacturing storage tanks, pipes, and other equipment exposed to harsh chemicals. There is a consistent demand for durable and corrosion-resistant pipes and tanks in construction, water management, and chemical processing. Vinyl ester is predominantly used in underground applications such as wastewater and oil & gas pipelines due to its superior performance. The focus on sustainability has opened doors for bio-based alternatives and recycled content in pipes and tanks applications. Advancements in joining techniques and smart monitoring systems present growth opportunities.

In marine industry, vinyl ester resin is highly preferred due to its superior resistance to moisture absorption, hydrolytic attack, and cracking in hard-worked hull and deck structures. It is substantially used in the marine industry for shipbuilding, boat manufacturing, and offshore structures due to its excellent resistance to water, chemicals, and harsh environmental conditions. With the growth of the marine industry, there is an increasing product demand for composites for hulls, decks, and other components.

Vinyl ester resins have been widely utilized in flue gas desulfurization (FGD) processes due to their cost-effectiveness and dependable performance as an alternative to metals. They are employed to withstand the highly corrosive environment of the FGD process, and serve various essential functions within this process, including use in limestone slurry pipes and stack liners.

Regional Insights

The demand for vinyl ester in North America is growing due to its use in construction, chemical processing plants, and the marine (yacht) industry. There is also increasing interest in bio-based and recycled content vinyl ester alternatives, aligning with sustainability goals. Additionally, ongoing research and development is opening new market opportunities in the region.

U.S Vinyl Ester Market Trends

The U.S. recreational boating industry, coupled with increasing disposable income and growing interest in marine tourism, continues to attract many participants in leisure activities like yachting, water sports, etc. This, in turn, is likely to spur the usage of vinyl ester resin to modify and repair boat hulls.

Asia Pacific Vinyl Ester Market Trends

The Asia Pacific region is experiencing significant growth due to substantial demand from major sectors. These industries encompass marine, water and wastewater treatment, chemical, wind, pharmaceutical, food processing, and transportation, primarily for applications involving pipes, tanks, wind turbines, and ship manufacturing.

The vinyl ester market in China is expected to witness significant growth owing to surging investments in infrastructure projects like high-speed rail and water treatment plants. This expansion is creating demand for corrosion-resistant materials like vinyl ester. Government initiatives to promote wind energy are also opening up opportunities for vinyl ester in turbine components.

Europe Vinyl Ester Market Trends

Investments in aging infrastructure drive demand for durable vinyl ester solutions in Europe. Wind energy and renewable fuels require weather-resistant vinyl ester components, thereby spurring regional growth. Leading boat and tank manufacturers boost domestic demand.

Key Vinyl Ester Company Insights

Some of the key players operating in the market include AOC, Bkdj Polymers India, DIC CORPORATION, INEOS, Interplastic Corporation, Poliya, Polynt, Scott Bader Company Ltd, SHOWA DENKO K.K, Sino Polymer Co. Ltd, and Swancor among others.

-

INEOS Group is a global manufacturer of petrochemicals, specialty chemicals, and oil products. The company operates 194 sites across 29 countries, with an annual revenue of $65 billion and over 26,000 employees. INEOS Composites produces and sells various grades of unsaturated polyester and vinyl ester resins.

-

Poliya is a well-regarded supplier of specialized composite resins. The company is primarily involved in the research, design, development, manufacturing, and integration of polymer systems.

Key Vinyl Ester Companies:

The following are the leading companies in the vinyl ester market. These companies collectively hold the largest market share and dictate industry trends.

- AOC

- Bkdj Polymers India

- DIC CORPORATION

- INEOS

- Interplastic Corporation

- Poliya

- Polynt

- Scott Bader Company Ltd

- SHOWA DENKO K.K

- Sino Polymer Co. Ltd

- Swancor

Recent Developments

-

In July 2020, Showa Denko opened new plants in Shanghai to produce vinyl ester resin and synthetic resin emulsion to expand their resin business in China.

Vinyl Ester Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.30 billion |

|

Revenue forecast in 2030 |

USD 1.89 billion |

|

Growth rate |

CAGR of 6.42% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; Russia; China; India; Japan; South Korea; Thailand; Indonesia; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

AOC; Bkdj Polymers India; DIC CORPORATION; INEOS; Interplastic Corporation; Poliya; Polynt; Scott Bader Company Ltd; SHOWA DENKO K.K; Sino Polymer Co. Ltd; Swancor |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vinyl Ester Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vinyl ester market report based on type, form, application & region:

-

Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Bisphenol-A

-

Novolac

-

Brominated Fire Retardant

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Pipes & Tanks

-

Marine

-

Wind Energy

-

FGD & Precipitators

-

Pulp & Paper

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vinyl ester market size was estimated at USD 1.22 billion in 2023 and is expected to reach USD 1.30 billion in 2024.

b. The global vinyl ester market is expected to grow at a compound annual growth rate of 6.42% from 2024 to 2030 to reach USD 1.89 billion by 2030.

b. Asia Pacific dominated the vinyl ester market with a share of 44.4% in 2023. This is attributable to substantial demand from major sectors such as marine, water & wastewater treatment, chemical, wind, food processing, etc. primarily for applications involving pipes, tanks, wind turbines, and ship manufacturing.

b. Some key players operating in the vinyl ester market include AOC, Bkdj Polymers India, DIC CORPORATION, INEOS, Interplastic Corporation, Poliya, Polynt, Scott Bader Company Ltd, SHOWA DENKO K.K, Sino Polymer Co. Ltd, and Swancor.

b. Key factors that are driving the market growth include an increase in the installation of flue gas desulfurization (FGD) systems due to growing environmental concerns and stricter regulations on hazardous emissions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."