Video Surveillance And VSaaS Market Summary

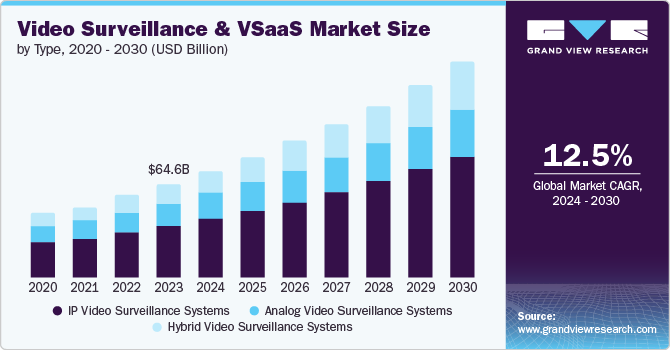

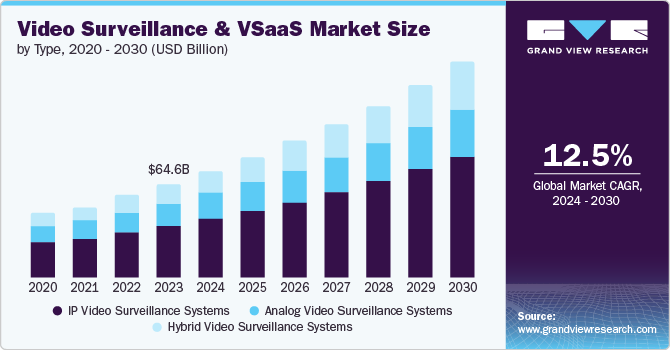

The global video surveillance and VSaaS market size was estimated at USD 64.61 billion in 2023 and is projected to reach USD 148.68 billion by 2030, growing at a CAGR of 12.5% from 2024 to 2030. The increasing security concerns in industries such as healthcare, transportation, retail, and other industries and rapid urbanization leading to the building of infrastructure, which requires advanced security solutions, are significant drivers contributing to the growth of video surveillance and the VSaaS market.

Key Market Trends & Insights

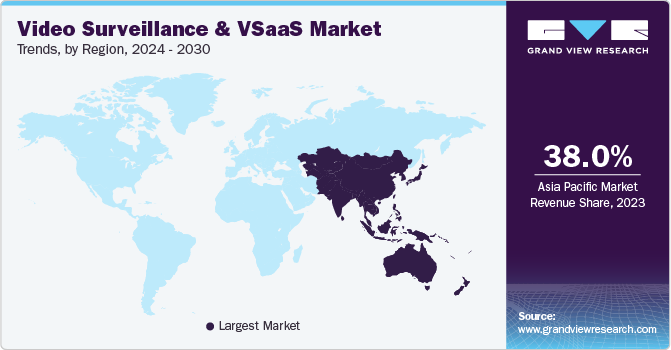

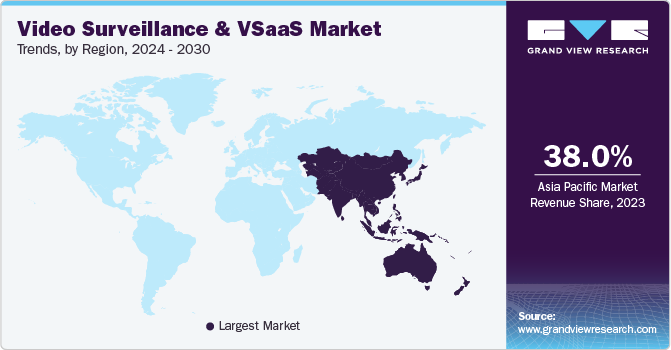

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The video surveillance and VSaaS market in the China accounted for a considerable share in 2023.

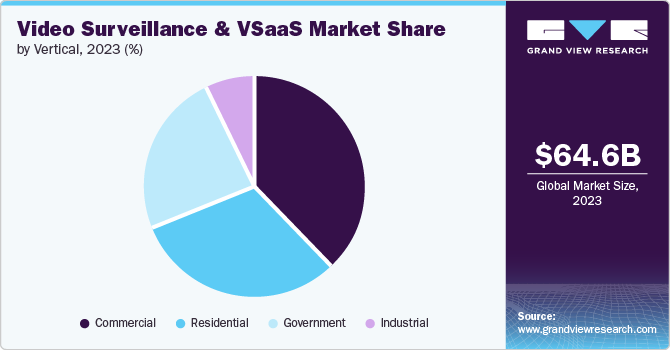

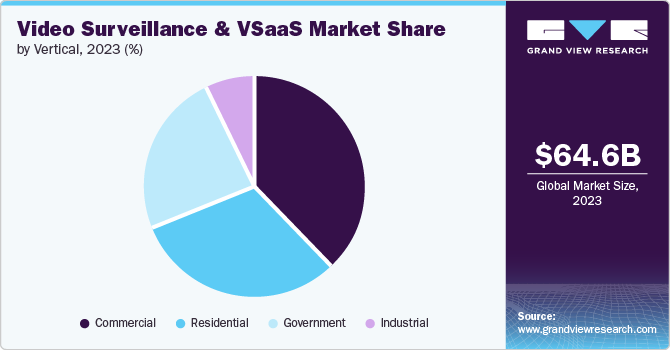

- In terms of vertical insights, the commercial segment accounted for the largest market share in 2023.

- In terms of type, the IP video surveillance systems segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 64.61 Billion

- 2030 Projected Market Size: USD 148.68 Billion

- CAGR (2024-2030): 12.5%

- Asia Pacific: Largest market in 2023

The scalability offered by video surveillance-as-a-service to organizations allows them to scale up or down surveillance systems easily. Remote accessibility, cloud-based VSaaS provides remote access to surveillance footage, improving monitoring. Analytics & AI-based VSaaS solutions benefit from integrating analytics and AI, such as facial recognition, object detection, and others.

VSaaS is one of the fastest-growing verticals in the video surveillance market. Technology is advancing rapidly, security threats are increasing, and the demand for cost-effective, scalable video surveillance solutions is rising. Key trends boosting the market growth include Cloud VSaaS, one of the fastest-growing cloud-based software-as-a-service (SaaS) solutions. This is largely due to cloud-based solutions' scalability benefits, remote access capabilities, and low infrastructure costs. Cloud-based software as a service provider offers end-to-end solutions that are easy to deploy and implement for businesses of all sizes.

Type Insights

The IP video surveillance systems segment accounted for the largest revenue share in 2023. Customers' requirements for superior image quality, higher scalability, and flexibility drive the demand for IP video surveillance systems. IP cameras provide more apparent video footage in high definition compared to traditional analog systems, improving evidence collection and identification.

The hybrid video surveillance systems segment is anticipated to register the fastest CAGR over the forecast period. Hybrid systems combine traditional analog cameras with modern IP technology. This enables organizations to utilize their current infrastructure while upgrading digital capabilities. The increasing use of wireless and spy cameras in hybrid systems enhances covert surveillance services and flexibility, driving market growth.

Vertical Insights

The commercial segment accounted for the largest market share in 2023 due to increasing theft, unauthorized access, vandalism, and employee misconduct, and security risk in retail stores, banks, corporations, & other industries. Video surveillance serves as a preventive measure and aids in the examination of incidents. These factors are creating a strong demand for video surveillance solutions within the commercial segment.

The industrial segment is anticipated to register the fastest CAGR over the forecast period. The emergence of Industry 4.0 is promoting the merging of video surveillance with other automation systems to foster security and provide a broader operational overview.

Regional Insights

North America video surveillance and VSaaS market was identified as a lucrative region in 2023. The early adoption of new technologies, rising security concerns, and the presence of major market players in this region are driving the market growth. Various video surveillance and VSaaS firms are based in North America leading to innovative research and development in the video surveillance market.

U.S. Video Surveillance and VSaaS Market Trends

The U.S. video surveillance and VSaaS market has significantly grown during the forecast period. The massive investment by the government in security infrastructure, including video surveillance systems for public spaces and critical infrastructure, is one of the key drivers attributing to the market growth. Moreover, governmental grants or incentives also contribute to expanding the market for security solutions. The commercial sector, including retail, banking, and hospitality, increasingly adopts video surveillance for loss prevention, fraud detection, and customer safety.

Asia Pacific Video Surveillance and VSaaS Market Trends

Asia Pacific video surveillance and VSaaS market dominated the global Video Surveillance and VSaaS market in 2023. Rapid urbanization in this region is resulting in the emergence of cities and the development of infrastructure. This expansion requires strong security measures to protect public areas, essential facilities, and companies. Additionally, rising crime rates and security risks in the retail, manufacturing, and transportation industries drive the need for video surveillance solutions. In March 2024, Transline Technologies Limited collaborated with RailTel Corporation of India Ltd and Telecommunications Consultants India Limited (TCIL) to integrate its Integrated Control and Command Center (ICCC) in Indian railway as a part of the video surveillance system project.

The video surveillance and VSaaS market in the China accounted for considerable share in 2023. The imposition of various policies by the government is making it mandatory for customers to incorporate them in their settings.

Key Video Surveillance And VSaaS Company Insights

Some of the key companies in the video surveillance and VSaaS market include Robert Bosch GmbH, Motorola Solutions, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Axis Communications AB., TKH GROUP, and others. Businesses in the video surveillance and VSaaS sectors are focusing on creating new components and expanding their distribution networks. Strategic partnerships are also utilized to expand business operations.

-

Hangzhou Hikvision Digital Technology Co., Ltd. offers a wide variety of physical security products, including video security, access control, and alarm systems. It offers AI-powered integrated security solutions to aid end-users in safety management and business intelligence with new applications and opportunities.

Key Video Surveillance And VSaaS Companies:

The following are the leading companies in the video surveillance and VSaaS market. These companies collectively hold the largest market share and dictate industry trends.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd

- Robert Bosch GmbH

- Axis Communications AB.

- Motorola Solutions, Inc.

- Zhejiang Uniview Technologies Co.,Ltd.

- Tiandy Technologies Co., Ltd.

- TKH GROUP

- Hanwha Vision Co., Ltd.

- THE INFINOVA GROUP.

Recent Developments

-

In July 2024, Arcules and Milestone Systems announced that they would merge, and the deal is anticipated to be finalized by the end of 2024. The deal will unite them in video surveillance as a service (VSaaS), video management software (VMS), and video analytics, thereby offerinf comprehensive video technology solutions.

-

In June 2024, Hanwha Vision Co., Ltd. launched two new high-performance AI PTZ Plus cameras, namely the XNP-C9310R and XNP-C7310R. These cameras use AI technology to quickly zoom and focus, allowing for better awareness of situations and faster response. It ensures cybersecurity, high resolutions offered by the cameras, and easy installation.

-

In October 2023, Milestone Systems announced the upcoming launch of Camera to Cloud Milestone Kite VSaaS software. The new option is projected to offer cost efficiency and simplicity to customers.

Video Surveillance and VSaaS Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 73.40 billion

|

|

Revenue forecast in 2030

|

USD 148.68 billion

|

|

Growth Rate

|

CAGR of 12.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Revenue in USD billion/million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, vertical, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Germany; China; Japan; India; South Korea; Australia; Brazil; South Arabia; UAE; South Africa

|

|

Key companies profiled

|

Hangzhou Hikvision Digital Technology Co., Ltd.; Dahua Technology Co., Ltd; Robert Bosch GmbH; Axis Communications AB.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co.,Ltd.; Tiandy Technologies Co., Ltd. ; TKH GROUP; Hanwha Vision Co., Ltd.; THE INFINOVA GROUP

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

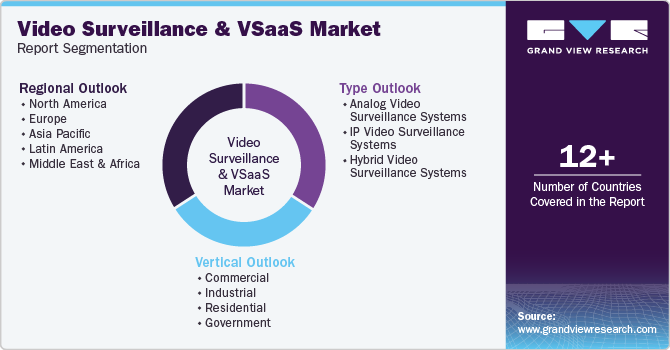

Global Video Surveillance And VSaaS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video surveillance and VSaaS market report based on type, vertical and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog Video Surveillance Systems

-

IP Video Surveillance Systems

-

Hybrid Video Surveillance Systems

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Government

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)