Video Streaming Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-Premises), By Streaming (Live Streaming), By Platform, By Monetization Model, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-475-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Video Streaming Software Market Trends

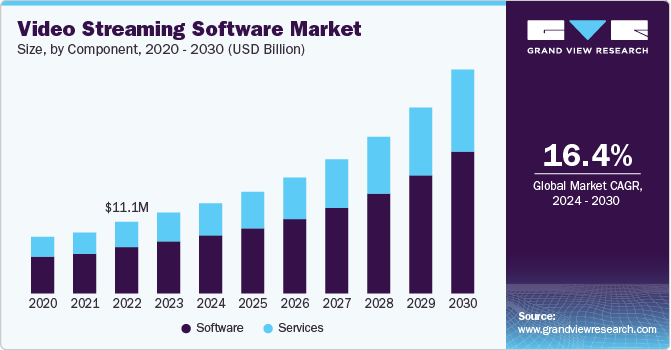

The global video streaming software market size was estimated at USD 12.52 billion in 2023 and is expected to grow at a CAGR of 16.4% from 2024 to 2030. Rising demand for on-demand content is a primary driver for the market growth, with consumers increasingly favoring video-on-demand (VoD) services that offer convenience and flexibility. The proliferation of smart devices and enhanced internet infrastructure, particularly the global rollout of 5G, has revolutionized the streaming experience, enabling faster, smoother, and more accessible streaming across devices.

Live streaming is also gaining popularity in sectors like gaming, sports, and e-commerce, where real-time interaction with audiences is crucial. Moreover, the rise of e-learning platforms and telehealth services has significantly increased the use of video streaming in education and healthcare. In the enterprise sector, businesses are adopting video solutions for internal communications, webinars, and corporate training. The ongoing integration of AI and machine learning into video analytics and content recommendation systems further enhances user experience, driving user engagement. Additionally, the adoption of cloud-based solutions that offer scalability and flexibility has made video streaming accessible to businesses of all sizes. These factors collectively support the continued upward trajectory of the market.

The shift toward remote work, distance learning, and virtual engagement, accelerated by the COVID-19 pandemic, has further boosted demand. The market’s expansion is also supported by rising internet penetration, advancements in mobile technology, and the adoption of 4G/5G networks. As industries continue to digitize, the video streaming software market is poised for sustained growth, driven by technological innovation and expanding use cases.

Technological advancements, particularly in cloud computing, AI, and 5G, are set to revolutionize how content is streamed and consumed. Artificial intelligence will play an increasingly significant role in content personalization and video analytics, offering more tailored user experiences and driving engagement. The continued expansion of mobile streaming is another growth area, as more consumers access content on smartphones and tablets, fueled by the growing availability of high-speed internet in emerging markets.Additionally, the increasing focus on content security and rights management will drive innovation in video encryption and protection technologies in coming years. The ad-supported video-on-demand (AVOD) model is expected to grow, as more consumers opt for free, ad-supported content, particularly in emerging markets. Overall, the video streaming market is set to thrive, with demand from both consumers and businesses continuing to grow as video becomes a preferred medium for content delivery and communication across the globe.

Component Insights

The software segment accounted for the largest market share of over 64% in 2023. The increasing demand for Video-on-Demand (VoD) and Live Streaming Services is significantly driving the need for advanced software solutions. Consumers prefer instant access to content, whether through on-demand services like Netflix or live streaming platforms like Twitch and YouTube Live. This shift necessitates robust video management, transcoding, and distribution software to handle the ever-growing volume and variety of content. Video management software enables efficient organization and retrieval of content, while transcoding software ensures videos are delivered in multiple formats for different devices. Distribution software ensures seamless delivery to global audiences, optimizing content for various network conditions. As a result, these software solutions are essential for supporting the scalability and quality of modern video streaming services.

The services segment is expected to grow at a CAGR of 16.9% during the forecast period. The increased focus on customization and integration stems from businesses needing tailored video streaming solutions that align with their unique infrastructure. This demand drives growth in customization services, ensuring seamless integration of streaming software with existing systems, from content management to delivery. Additionally, managed services play a vital role by helping companies manage and maintain their video platforms without the need for extensive in-house IT resources. The surge in managed services is driven by organizations outsourcing their streaming infrastructure management to external providers, allowing them to focus on core business activities. This trend is particularly strong among businesses with limited technical expertise, as it reduces costs and ensures reliable, high-quality streaming operations.

Deployment Insights

The cloud segment held a market share of over 74% in 2023 and is expected to dominate the market by 2030. Cost efficiency is a major advantage of cloud-based video streaming, as it removes the need for businesses to invest in costly on-premise Video Management Software and infrastructure. By using a pay-as-you-go model, companies can scale their streaming services based on demand, making it more affordable, particularly for smaller enterprises that might not have the resources for large upfront investments. Additionally, global accessibility is enhanced through the use of content delivery networks (CDNs), which enable smooth and efficient delivery of video content worldwide. CDNs reduce latency by distributing content from servers closer to the viewer, ensuring high-quality streaming experiences across various regions. This combination of cost savings and worldwide reach makes cloud streaming an attractive option for businesses.

The on-premises segment is expected to grow at a CAGR of 16.1% over the forecast period.On-premises video streaming solutions offer businesses enhanced customization and control, allowing them to tailor their streaming infrastructure to specific requirements. This flexibility enables companies to optimize performance, strengthen security, and seamlessly integrate the system with existing internal networks. On-premises deployments provide a higher degree of control over the streaming environment, which is crucial for organizations with unique operational needs. Additionally, on-premises solutions offer superior reliability and performance, as they rely on dedicated local resources that ensure stable, high-quality streaming even during peak traffic. This makes them ideal for industries where continuous, uninterrupted service is critical, as any downtime or performance issues could lead to significant operational and financial losses.

Streaming Insights

The Video on Demand (VoD) segment held a market share of over 65% in 2023 and is expected to dominate the market by 2030. The growth of subscription models has significantly contributed to the expansion of the video on demand (VOD) segment. Subscription-based VOD services (SVOD) offer consumers easy access to extensive content libraries for a monthly fee, eliminating the need for pay-per-view costs. Platforms like Netflix, Hulu, and Disney+ have capitalized on this model by providing a wide variety of movies, series, and original programming, catering to diverse viewer preferences. This convenience and affordability attract subscribers, fostering user loyalty and increasing viewership. Additionally, the subscription model allows for predictable revenue streams for providers, enabling them to invest in new content and technologies. As a result, the rise of SVOD services has become a driving force in the growth of the VOD market.

The live streaming segment is expected to grow at a CAGR of 16.9% over the forecast period.The rise of social media platforms such as Facebook, Instagram, and TikTok has significantly influenced the growth of live streaming by integrating real-time broadcasting features that empower users to connect with their audiences instantly. This trend boosts the demand for live streaming software that seamlessly integrates with these platforms, enhancing audience reach and engagement. Additionally, the increased adoption of e-sports and gaming has propelled live streaming into the mainstream. Platforms like Twitch and YouTube Gaming offer dedicated spaces for gamers to broadcast their gameplay live, attracting millions of viewers and fostering a vibrant community. This phenomenon has created a substantial market for live streaming solutions, driving innovation and investment in technologies that support interactive and engaging experiences.

Platform Insights

The mobile-based segment held a market share of over 64% in 2023 and is expected to dominate the market by 2030.The increasing smartphone penetration globally has positioned mobile devices as the primary platform for consuming video content. With millions of users accessing streaming services on their phones, the demand for mobile-based streaming solutions has surged, making it essential for providers to optimize their offerings for mobile use. Additionally, the on-the-go viewing capability of mobile devices enhances user flexibility, allowing individuals to watch content anytime and anywhere, whether commuting, traveling, or during breaks. This convenience not only enriches the viewing experience but also drives the need for high-quality mobile streaming solutions that cater to varying internet speeds and screen sizes. As a result, businesses are increasingly focused on developing robust mobile streaming applications to meet this growing demand.

The Web-based segment is expected to grow at a CAGR of 15.7% over the forecast period.Cross-platform compatibility is a significant driver for the growth of web-based video streaming solutions. These platforms can operate seamlessly across various operating systems and devices, including desktops, laptops, tablets, and smartphones. This versatility broadens the potential audience by ensuring that users can access content regardless of their device choice, enhancing convenience and user experience. Viewers are more likely to engage with services that offer flexibility in how and where they consume content. Additionally, this compatibility minimizes barriers for content creators, enabling them to reach diverse audiences without needing to develop multiple versions of their applications. As a result, the appeal of web-based streaming continues to grow, positioning it as a preferred choice for both viewers and creators.

Monetization Model Insights

The subscription-based segment held a market share of over 54% in 2023 and is expected to dominate the market by 2030.Consumer preference for on-demand content has significantly influenced the growth of Subscription-Based Video on Demand (SVOD) services. Viewers increasingly seek control over their viewing experiences, desiring the ability to access a vast array of content at their convenience. SVOD platforms cater to this demand by allowing users to watch what they want, when they want, which greatly enhances user satisfaction. Additionally, the availability of family sharing options in many SVOD services further amplifies their appeal. These family plans enable multiple users to share a single subscription, providing an economical solution for households. This feature not only increases the overall value proposition of the service but also encourages families to subscribe and enjoy content together, driving higher subscription rates.

The Ad-Supported (AVOD) segment is expected to grow at a CAGR of 16.8% over the forecast period.Cost-effective access is a crucial growth factor for Ad-Supported Video on Demand (AVOD) services, as they provide users with free access to a diverse range of content. This accessibility is particularly appealing to individuals who are unwilling or unable to pay for subscription services, enabling AVOD platforms to rapidly attract a large user base. Additionally, the increased advertising spend by businesses further fuels the growth of the AVOD segment. As companies increasingly recognize the effectiveness of digital advertising, especially in video formats, they are allocating more substantial budgets to AVOD platforms. This trend not only enhances the revenue potential for content providers but also ensures that users can continue enjoying free content while advertisers benefit from reaching targeted audiences.

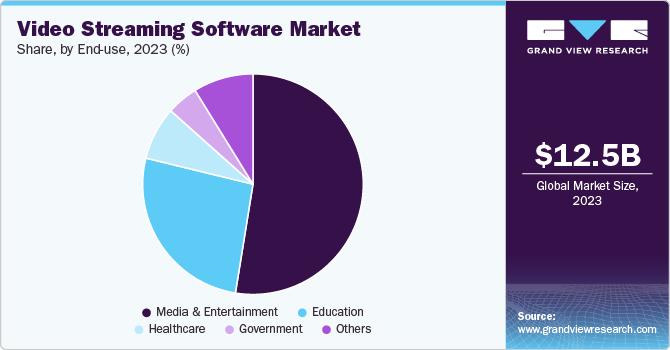

End-use Insights

The media & entertainment segment accounted for the largest market share of over 52% in 2023. The shift to digital consumption is fundamentally transforming the media landscape, as consumers increasingly move away from traditional cable and satellite TV in favor of digital streaming platforms. This trend reflects a growing preference for on-demand viewing options, which drive the adoption of video streaming solutions within the media and entertainment sector. Concurrently, the expansion of global reach is becoming a focal point for media and entertainment companies aiming to grow their audience base. By localizing content and tailoring offerings to meet diverse cultural preferences, these companies can tap into new revenue streams in international markets. This dual approach not only enhances viewer engagement but also allows organizations to establish a more robust and sustainable subscriber base worldwide.

The education segment is expected to grow at a CAGR of 17.0% over the forecast period. The increasing demand for online learning has significantly accelerated the adoption of video streaming solutions within educational institutions. As remote and hybrid learning models become more prevalent, schools and universities are utilizing video streaming software to deliver courses, lectures, and tutorials, thereby making education accessible to a broader audience. Additionally, the enhanced engagement through multimedia content offered by these platforms plays a crucial role in improving the learning experience. Educators can integrate videos, animations, and interactive quizzes into their lessons, creating a dynamic environment that fosters student participation. This approach not only makes learning more effective but also enjoyable, as students can engage with the material in diverse ways, leading to better retention of knowledge and overall academic performance.

Regional Insights

The North America region held the largest market share of over 34% in the video streaming software market in 2023.The rising adoption of e-learning platforms has significantly impacted the video streaming software market in North America. The surge in demand for online education and remote learning solutions, especially during recent global events, has prompted educational institutions to utilize video streaming software for course delivery. This shift not only facilitates flexible learning but also contributes to the overall growth of the market in the education sector. Additionally, the region's strong advertising market plays a crucial role in driving this growth. Businesses increasingly recognize the effectiveness of video advertising on streaming platforms, leading to a notable rise in advertising expenditure. This increased investment not only enhances the revenue potential for service providers but also encourages further innovation and development of video streaming software solutions.

U.S. Video Streaming Software Market Trends

The video streaming software market in the U.S. is growing significantly at a CAGR of 15.7% from 2024 to 2030. The high internet penetration and broadband access in the U.S. significantly contribute to the growth of the market. With one of the highest rates of internet connectivity globally, coupled with widespread availability of high-speed broadband, consumers can enjoy seamless streaming experiences. This robust infrastructure facilitates easy access to a vast array of video content, enabling users to engage with streaming platforms without interruptions, thereby driving demand and increasing consumption of video streaming services.

Asia Pacific Video Streaming Software Trends

The video streaming software market in Asia Pacific is growing significantly at a CAGR of 17.5% from 2024 to 2030. Rapid internet adoption in the Asia Pacific region has significantly boosted video streaming engagement. With the rise of smartphone usage and affordable data plans, more consumers can access video streaming platforms, enhancing their viewing experiences. This increased accessibility is pivotal in driving the demand for diverse content and streaming services. Additionally, rising disposable income in emerging economies further fuels this growth. As individuals have more disposable income, they tend to spend more on entertainment and subscription services. This trend encourages a larger segment of the population to subscribe to streaming platforms, expanding the market and increasing competition among service providers to offer compelling content and features.

Europe Video Streaming Software Trends

The video streaming software market in Europe is growing significantly at a CAGR of 16.3% from 2024 to 2030. The shift from traditional media to streaming services across Europe reflects a significant change in consumer behavior. Many viewers are opting to move away from cable and satellite television due to the desire for on-demand content and the flexibility it offers. Streaming platforms provide users with the ability to watch what they want, when they want, without being tied to rigid broadcasting schedules. This convenience and control over viewing choices drive the growing popularity of streaming services, reshaping the media landscape.

Key Video Streaming Software Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Brightcove has launched the Brightcove AI Suite, integrating advanced AI solutions into its video cloud platform to enhance content creation, engagement, and revenue. This suite includes tools like the AI Content Multiplier and AI Universal Translator, aimed at automating and optimizing video production. Collaborating with major tech partners like AWS and Google, Brightcove focuses on improving customer efficiency and content monetization while ensuring secure data handling.

-

In July 2023, Kaltura enhanced its cloud TV and streaming platform to better serve TV operators and media customers. The upgrades, utilizing cross-device react-native technology, enable a more innovative user experience and the introduction of personalized product add-ons. These developments aim to improve user engagement and revenue generation.

-

In April 2023, Akamai Technologies launched new cloud computing capabilities for streaming video, enhancing its platform for better live and on-demand content delivery. These advancements focus on optimizing video performance, scalability, and security, particularly for sports and entertainment applications. With integrated tools and analytics, content providers can now offer viewers high-quality experiences while efficiently managing resources. This announcement was made at the 2023 NAB Show.

Key Video Streaming Software Companies:

The following are the leading companies in the video streaming software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- Kaltura, Brightcove Inc.

- Vimeo

- Haivision

- Edgio

- Panopto

- Wowza Media Systems

- Dacast

- Akamai Technologies.

Video Streaming Software Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.96 billion |

|

Revenue forecast in 2030 |

USD 34.67 billion |

|

Growth rate |

CAGR of 16.4%from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, streaming, platform, monetization model, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

IBM Corporation; Microsoft Corporation; Kaltura; Brightcove Inc.; Vimeo; Haivision; Edgio; Panopto; Wowza Media Systems; Dacast; Akamai Technologies. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Video Streaming Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global video streaming software market report based on component, deployment, streaming, platform, monetization model, end-use and region:

-

Component Outlook (Revenue; USD Billion; 2018 - 2030)

-

Software

-

Video Management Software

-

Transcoding & Processing Software

-

Video Delivery & Distribution Software

-

Video Analytics Software

-

Others

-

-

Services

-

Consulting Services

-

Support & Maintenance Services

-

Managed Services

-

Integration and Deployment Services

-

-

-

Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Streaming Outlook (Revenue; USD Billion; 2018 - 2030)

-

Live Streaming

-

Video on Demand (VoD)

-

-

Platform Outlook (Revenue; USD Billion; 2018 - 2030)

-

Web-based

-

Mobile-based

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

Media & Entertainment

-

Education

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global video streaming software market size was estimated at USD 12.52 billion in 2023 and is expected to reach USD 13.96 billion in 2024.

b. The global video streaming software market is expected to grow at a compound annual growth rate of 16.4% from 2024 to 2030 to reach USD 34.67 billion by 2030.

b. The North America region held the largest market share of over 34% in the video streaming software market in 2023. The rising adoption of e-learning platforms has significantly impacted the video streaming software market in North America.

b. Some key players operating in the video streaming software market include IBM Corporation; Microsoft Corporation; Kaltura; Brightcove Inc.; Vimeo; Haivision; Edgio; Panopto; Wowza Media Systems; Dacast; Akamai Technologies.

b. Rising demand for on-demand content is a primary driver for the market growth, with consumers increasingly favoring video-on-demand (VoD) services that offer convenience and flexibility. The proliferation of smart devices and enhanced internet infrastructure, particularly the global rollout of 5G, has revolutionized the streaming experience, enabling faster, smoother, and more accessible streaming across devices.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."