- Home

- »

- Digital Media

- »

-

Video Streaming Market Size & Share, Industry Report, 2030GVR Report cover

![Video Streaming Market Size, Share & Trends Report]()

Video Streaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Solution, By Platform, By Service Industry, By Revenue Model (Advertising, Subscription), ByDeployment (Cloud, On-Premises), By User, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-629-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Streaming Market Summary

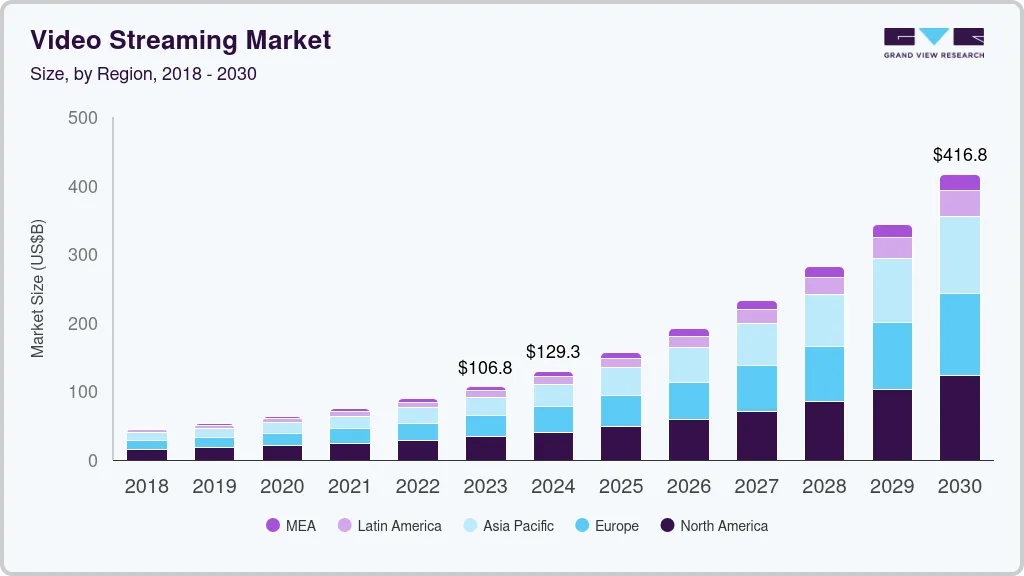

The global video streaming market size was estimated at USD 129.26 billion in 2024 and is projected to reach USD 416.8 billion by 2030, growing at a CAGR of 21.5% from 2025 to 2030. As streaming markets expand, platforms are placing greater emphasis on addressing the varied preferences of regional audiences.

Key Market Trends & Insights

- North America video streaming industry accounted for the largest revenue share globally in 2024, with a 31.3% share.

- By type, the live video streaming segment accounted for the largest revenue share in 2024.

- By solution, the over-the-top segment held the largest revenue share in 2024.

- By platform, smartphones and tablets have emerged as the dominant devices in the market.

Market Size & Forecast

- 2024 Market Size: USD 129.26 Billion

- 2030 Projected Market Size: USD 416.8 Billion

- CAGR (2025-2030): 21.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Customizing content to meet local cultural and language needs is becoming increasingly essential for success. Platforms are expanding their content libraries beyond traditional genres to attract a larger audience. A variety of content types, including live events, niche genres, and exclusive shows, helps meet the evolving interests of users. Streaming services are increasingly partnering with local businesses and global brands to enhance their reach and improve content types. These collaborations enable platforms to provide a mix of local and global content, expanding their audience base. For instance, in March 2024, Reliance Industries Limited, a diverse conglomerate in petrochemicals, telecom, retail, and energy in India, collaborated with The Walt Disney Company to merge their Indian TV and streaming assets, creating a powerful entity valued at $8.5 billion. This collaboration combines Disney+ Hotstar and JioCinema, bringing together an extensive content library, including 30,000 Disney assets, and exclusive sports content, strengthening its position in the highly competitive Indian streaming space.

There will be an increased focus on optimizing user experience through advancements in video quality, including HDR processing, low-latency audio/video, and artificial intelligence (AI) technologies. These innovations will drive streaming platforms to continually improve the viewing experience for consumers continually. Companies are also investing heavily in advanced technologies to create seamless, high-quality content experiences. As competition intensifies, platforms are looking for new ways to integrate these technologies and stay ahead of the market. For instance, in October 2024, Amlogic, a U.S.-based semiconductor company, strengthened its collaboration with Netflix to enhance the integration of Netflix services into global ecosystems. This collaboration focuses on cost-effective, faster-to-market set-top box solutions and improving user experiences through advancements in audio, video, and AI technologies.

AI is increasingly being utilized to enhance user experiences in video streaming. One significant application is improving recommendations, as AI algorithms analyze viewers' habits and preferences to suggest content that aligns with their interests. This personalization helps keep users engaged and encourages longer viewing sessions. AI is also transforming content creation by automating tasks such as video editing, which streamlines the production process. Moreover, AI can enhance video quality by adjusting elements such as lighting, color grading, and noise reduction. These AI-driven innovations enable platforms to deliver more polished and tailored content to viewers. AI contributes to a more customized and elevated viewing experience for consumers.

In the education sector, videos are increasingly being used in webinars and courses to enhance teaching and learning processes. Visual recordings significantly impact students' ability to retain information, making video an effective educational tool. As a result, schools, universities, and colleges are creating multimedia content and delivering it through video presentations. Factors such as easy access to educational video content, the growing demand for mobile devices, and the increasing availability of the internet are driving the adoption of live video streaming services for educational purposes. These trends are making educational resources more accessible and engaging, improving the overall learning experience.

Type Insights

The live video streaming segment accounted for the largest revenue share in 2024, with around 62.5% market share. This dominance highlights the growing demand for real-time content across various industries, including entertainment, sports, gaming, and business events. The widespread use of mobile devices, faster internet speeds, and the increasing popularity of social media platforms have significantly contributed to this trend. Moreover, live streaming offers unique opportunities for audience engagement, creating interactive experiences that drive consumer interest and brand loyalty. As more businesses and content creators adopt live video streaming, the segment is expected to maintain its leading position and continue expanding.

Non-linear video streaming is experiencing significant growth in the market. This model allows users to access content on demand, providing more flexibility compared to traditional linear television. With the increasing adoption of streaming platforms such as Netflix and Amazon Prime Video, viewers can watch their favorite shows, movies, and documentaries at their convenience, without being restricted to scheduled broadcasts. The rise of personalized content recommendations, powered by AI, further enhances the appeal of non-linear streaming by tailored viewing experiences. As internet connectivity improves and mobile devices become more ubiquitous, the demand for non-linear video streaming is expected to continue rising, shaping the future of content consumption.

Solution Insights

The Over-the-Top (OTT) segment held the largest revenue share in 2024. This dominance is attributed to the growing popularity of platforms such as Netflix, Amazon Prime Video, and Disney+ across global markets. Increasing internet penetration and smartphone usage have made OTT content more accessible to a wider audience. Consumers prefer the flexibility and variety offered by OTT services over traditional cable TV. As demand for on-demand and personalized content rises, the OTT segment is expected to maintain strong growth momentum in the coming years.

The Internet Protocol TV (IPTV) segment benefits the market. It delivers television content over internet platforms, with better quality and flexibility compared to traditional broadcasting methods. IPTV is gaining popularity among telecom and internet service providers as part of bundled service types. Its appeal lies in features such as time-shifted media and video on demand, which enhance user convenience. As broadband infrastructure continues to improve, the IPTV segment is expected to expand further, especially in developing regions.

Platform Insights

Smartphones and tablets have emerged as the dominant devices in the market, primarily due to their portability, user-friendly interfaces, and the increasing availability of high-speed mobile internet. These devices allow users to stream content on the go, making them an ideal choice for younger demographics and busy professionals who prefer flexible viewing options. The continuous improvement in screen resolution, battery life, and processing power has further enhanced the streaming experience on mobile platforms. Moreover, the integration of advanced features such as offline downloads, adaptive streaming, and personalized content recommendations has significantly boosted user engagement on mobile devices.

Smart TVs are witnessing rapid growth in the market, driven by consumer demand for high-quality home entertainment systems that integrate streaming platforms directly into the television interface. These devices eliminate the need for external hardware such as streaming sticks or set-top boxes, providing a more streamlined and immersive viewing experience for users. With features such as 4K resolution, HDR support, voice control, and AI-driven content recommendations, Smart TVs are transforming the traditional living room setup into a modern digital hub. As internet penetration increases and the cost of Smart TVs continues to decline, more households are adopting them as the primary medium for consuming streaming content.

Service Industry Insights

The training & support segment held the largest revenue share in 2024. The training & support segment has dominated due to the increasing demand for customer assistance and knowledge transfer. As streaming platforms and services grow in complexity, robust training and support become essential to help users and businesses effectively utilize these technologies. This service ensures that clients, whether they are content creators, distributors, or viewers, understand how to make the most out of the streaming experience. Furthermore, providing ongoing support helps address technical issues promptly, reducing user frustration and enhancing satisfaction.

Managed services have become highly beneficial in the market. They provide businesses with the ability to offload their IT operations to specialized providers. This enables streaming companies to focus on their core services, such as content delivery, while experts handle backend infrastructure, security, and maintenance. Managed services enhance operational efficiency, ensuring that platforms run smoothly with minimal downtime. Moreover, these services offer scalability, allowing businesses to adapt to growing user bases or fluctuating demand without compromising performance or quality.

Revenue Model Insights

The subscription segment dominated the market in 2024, holding the largest revenue share. This growth can be attributed to the increasing preference for ad-free, premium content and exclusive types available through subscription-based models. As more consumers seek tailored experiences, subscription services have become a popular choice for accessing high-quality content across multiple devices. The availability of various subscription tiers also caters to diverse customer preferences, further driving the segment’s growth. Moreover, streaming platforms are consistently expanding their content libraries, making subscriptions even more attractive to users worldwide.

The rental model in the market offers a flexible and cost-effective alternative to subscription-based services. It allows consumers to pay for content on a per-view or per-title basis, which appeals to those who do not want to commit to ongoing subscription fees. This model is particularly attractive for users who are interested in accessing specific movies or shows without paying for an entire subscription. Moreover, the rental model provides a broader range of content options, including new releases and niche films that might not be available through subscription services. As a result, rental services cater to a diverse audience, providing convenience and affordability while meeting the demand for on-demand access to premium content.

Deployment Insights

The cloud segment held the largest revenue share in 2024, due to its scalability, flexibility, and cost-efficiency. With cloud technology, streaming platforms can deliver high-quality content to a global audience without the need for extensive infrastructure investments. This allows content providers to manage vast amounts of data and traffic seamlessly, improving the user experience. Cloud services also enable faster content delivery through content delivery platforms (CDNs), reducing latency and buffering times. The cloud’s ability to scale and handle spikes in demand is crucial as the streaming market continues to grow. As more platforms adopt cloud-based solutions, the segment's dominance is expected to further strengthen in the coming years.

The on-premises segment in the market offers benefits in terms of complete control over infrastructure, allowing companies to customize and manage their content delivery and storage systems according to their specific needs. This model ensures higher security and data privacy, as content is stored within the company's facilities, reducing the risks associated with third-party providers. On-premises solutions are particularly advantageous for organizations with strict regulatory requirements or those dealing with sensitive content, as they can implement tailored security measures. Moreover, these systems offer greater reliability and consistent performance, especially for large-scale operations with high traffic demands.

User Insights

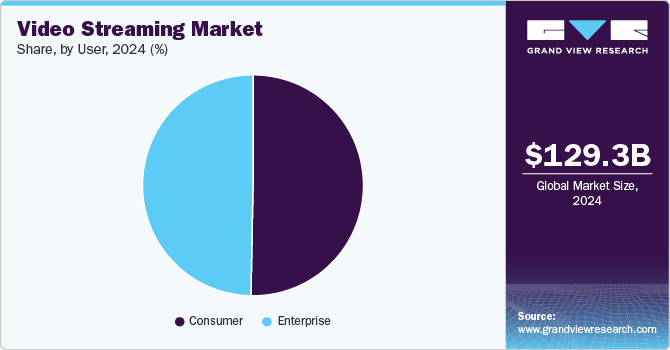

The consumer segment held the largest revenue share in 2024, driven by the increasing popularity of video-on-demand and live streaming services in the media and entertainment industry. The segment is expected to continue growing due to the convenience and flexibility of accessing video content remotely. The rise in the use of connected devices, particularly smartphones, has further boosted the segment's expansion. Mobile subscriptions and the growing availability of high-speed internet also contribute to the segment's growth. As more consumers embrace digital entertainment, the consumer segment will maintain its dominance in the market.

The enterprise segment is experiencing significant growth in the market as businesses increasingly adopt video content for communication and marketing purposes. Companies are utilizing video streaming for webinars, training sessions, product demonstrations, and internal communications, recognizing its effectiveness in reaching larger audiences. The rise of remote work and the demand for virtual meetings have further accelerated the need for video streaming solutions in enterprises. Moreover, the growing use of video analytics to track engagement and improve content delivery has driven the segment's growth.

Regional Insights

North America video streaming industry accounted for the largest revenue share globally in 2024, with a 31.3% share. This was majorly owing to the rapid growth of cloud-based streaming services. Streaming giants such as Netflix, Disney+, and Amazon Prime Video compete fiercely for subscribers in the North American market with original content and diverse libraries.

U.S. Video Streaming Market Trends

The video streaming industry in the U.S. is evolving rapidly, with niche platforms rising, mobile viewing dominating, and ad-supported models gaining traction. As traditional giants push to keep up, this dynamic shift in the U.S. market presents both opportunities and challenges. Niche platforms cater to specific audiences with hyper-focused content, creating loyal communities and fostering engagement. Mobile viewing, meanwhile, demands seamless user experiences and bite-sized content, prompting platforms to adapt their types.

Europe Video Streaming Market Trends

The European video streaming industry anticipates robust growth, driven by its large and engaged online audience. Increasing disposable income and diverse content types, including locally produced originals, further fuel this expansion. Technological advancements, such as the widespread adoption of smartphones, enhance accessibility and convenience further.

Asia Pacific Video Streaming Market Trends

The Asia Pacific video streaming industry is witnessing rapid growth in the market due to increasing internet penetration and the widespread use of smartphones. Rising demand for localized content and multilingual programming is attracting a diverse audience across the region. The surge in digital transformation and affordable data plans is boosting user engagement on streaming platforms. Moreover, strong investments by global and regional players are enhancing content libraries and user experiences.

Key Video Streaming Company Insights

Some of the key companies in the global video streaming industry include Apple Inc., Cisco Systems, Inc., Google LLC, Kaltura, Inc., Netflix, Inc., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Cisco Systems, Inc. has been enhancing video streaming infrastructure through its advanced platforming and cloud solutions. It provides scalable video delivery systems for enterprises and service providers, ensuring smooth content distribution. Cisco’s innovations in edge computing and content delivery platforms (CDNs) help reduce latency and improve video quality. The company is also investing in AI and analytics to optimize streaming performance and user experience.

-

Google LLC contributes to the video streaming industry through YouTube, which provides both on-demand and live content. It focuses on enhancing user experience using AI-based content recommendations and real-time moderation tools. Google Cloud supports video platforms with solutions for processing, encoding, and delivering content. The company is also exploring immersive formats such as virtual reality (VR) and 360-degree videos to expand streaming capabilities.

Key Video Streaming Companies:

The following are the leading companies in the video streaming market. These companies collectively hold the largest market share and dictate industry trends. :

- Akamai Technologies

- Amazon Web Services, Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- Kaltura, Inc.

- Netflix, Inc.

- International Business Machine Corporation (IBM Cloud Video)

- Wowza Media Systems, LLC

- Hulu, LLC

Recent Developments

-

In March 2023, Brightcove, Inc., a U.S.-based internet company, announced integrations with Instagram, Shopify, and Salesforce Sales Cloud to their video cloud platform. This integration aims to enable companies to reach, capture, and activate audiences with interactive, immersive, and live and on-demand video content.

-

In March 2023, IBM Watson Media, an American virtual events platform company, announced some event registration features integrated into IBM Enterprise Video Streaming. This enterprise video streaming registration form feature aims to enable customers to manage events more efficiently

Video Streaming Market Report Scope

Report Attribute

Details

Market Service Industry value in 2025

USD 157.11 billion

Revenue forecast in 2030

USD 416.8 billion

Growth rate

CAGR of 21.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Type, solution, platform, service industry, revenue model, deployment, user, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Akamai Technologies; Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Streaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video streaming market based on type, solution, platform, service industry, revenue model, deployment, user, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Live Video Streaming

-

Non-Linear Video Streaming

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internet Protocol TV

-

Over-the-Top (OTT)

-

Pay-TV

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise

-

Corporate Communications

-

Knowledge Sharing & Collaborations

-

Marketing & Client Engagement

-

Training & Development

-

-

Consumer

-

Real-Time Entertainment

-

Web Browsing & Advertising

-

Gaming

-

Social Networking

-

E-Learning

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the video streaming market growth include extensive growth of online video streaming and the rising demand for on-demand streaming and the growing demand for high-speed internet connectivity.

b. The global video streaming market size was estimated at USD 129.26 billion in 2024 and is expected to reach USD 157.11 billion in 2025.

b. The global video streaming market is expected to grow at a compound annual growth rate of 21.5% from 2025 to 2030 to reach USD 416.84 billion by 2030.

b. North America dominated the video streaming market with a share of 31.3% in 2024. This is attributable to the increasing use of mobiles and tablets, rapid technological advancements, and the popularity of online streaming.

b. Some key players operating in the video streaming market include Akamai Technologies; Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google; Kaltura, Inc.; Netflix, Inc; Wowza Media Systems, LLC; AT&T Intellectual Property; and Hulu.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.