Video Intercom Devices Market Size, Share & Trends Analysis Report By Access Control (Password, Wireless), By Device Type (Door Entry Systems, Handheld Devices), By End Use, By System, By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-968-5

- Number of Report Pages: 183

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Video Intercom Devices Market Size & Trends

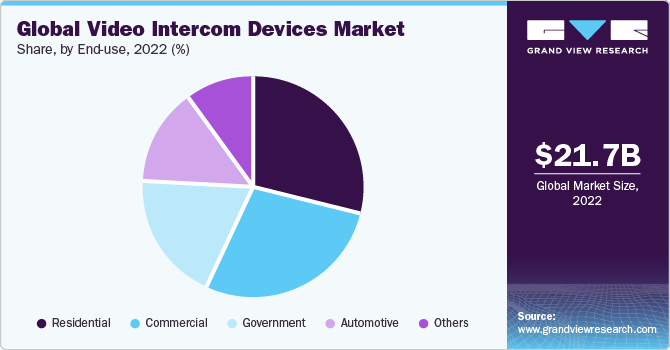

The global video intercom devices market size was valued at USD 21.70 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. Increasing demand for these devices in the security and surveillance sector is expected to propel the market growth over the forecast period. Video intercom equipment is widely installed as audiovisual communication systems at the entry-exit points of offices, societies, and buildings.

These appliances transmit a visitor's audio and visual information to the loudspeakers, telephones, walkie-talkies, etc., which the user accesses. Rapid urbanization in various economies is expected to create lucrative growth opportunities for the market participants. Increased building automation is driving the adoption of video intercom appliances in residential and commercial buildings.

Moreover, the growing popularity of smart homes is expected to create lucrative opportunities for the market. In addition, various government initiatives toward developing smart cities are expected to drive market growth further. The introduction of advanced security audiovisual systems that provide a higher level of security to residential buildings and offices is also contributing to the market growth.

On the other hand, high initial investments and maintenance costs incurred by the audiovisual appliances are expected to hinder market growth. Furthermore, the signals from the appliances, such as audio and visual communication systems, are interrupted due to the overlapping of frequencies. It is also expected to act as a challenge to the market's growth.

End-use Insights

The residential segment held the largest revenue share of 29.1% in 2022. The products are widely used in residential buildings as they protect against intruders. The instrument features IP video intercom terminals and monitor stations integrated with CCTV and access control systems. These equipment have been customized for private housing, estates, and apartments to ensure maximum security and safety.

The automotive segment is expected to expand at the fastest CAGR of 14.5% over the forecast period. Video intercom tools are widely used in the automotive industry, allowing users to communicate conveniently with door stations. These systems include various features, such as a built-in IP camera, compatible IP touchscreen, audiovisual communication systems, and discrete speaker & microphone. An increasing number of deployments of audiovisual functionality in automobile manufacturing is expected to drive the segment over the forecast period.

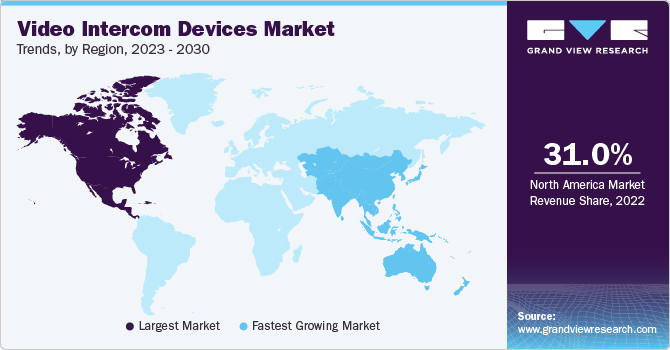

Regional Insights

North America dominated the video intercom devices market and accounted for the largest revenue share of 31.0% in 2022. It is expected to retain its leading position throughout the forecast years due to smart city initiatives in economies like the U.S. and Canada. Introducing initiatives, such as smart buildings and smart transportation, is also expected to create growth opportunities for the regional market. Rapid growth of the residential and commercial sector in the region is further expected to fuel the market over the forecast period.

Asia Pacific is expected to expand at the fastest CAGR of 14.4% during the forecast period. Increasing disposable income levels in developing countries like India and China are expected to boost the regional market. Also, the rising number of crimes, an increase in awareness pertaining to video intercom systems, and growing demand across numerous industry verticals are the key factors fueling the market growth in the region.

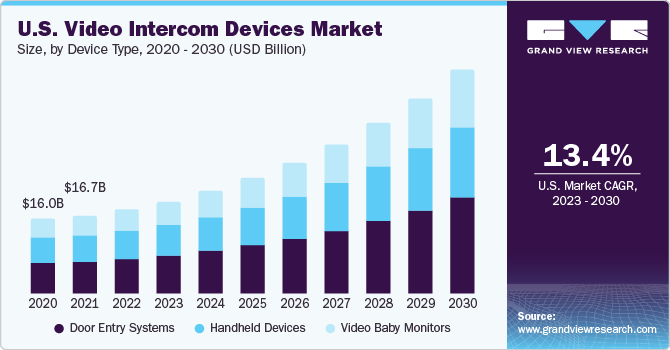

Device Type Insights

The door entry systems segment accounted for the largest revenue share of 41.9% in 2022 and is expected to expand at the fastest CAGR of 14.0% during the forecast period. These systems offer enhanced audio and visual quality and include various functions, such as keyless access control, audiovisual function, and flexible operating options, for connecting to IP networks. The handheld devices segment is also expected to witness significant growth over the forecast period as these devices are widely used in hotels, restaurants, service centers, retail stores, etc. Handheld systems allow easy and clear communication between hotel rooms and home. Moreover, they feature digital sounds and noise-canceling microphones to avoid overlapping frequencies, which is expected to create growth opportunities for the segment.

The video baby monitors segment is expected to witness a significant CAGR of 13.7% during the forecast period due to its ability to provide parents with a sense of safety and security, coupled with its convenience and portability. With advanced features like two-way audio, night vision, and temperature monitoring, video baby monitors cater to the evolving needs of modern parents. Increasing awareness, affordability, and integration with other smart home devices have also played a role in driving the market's expansion. As parenting challenges continue to increase, video baby monitors offer a valuable solution by allowing parents to multitask while keeping a watchful eye on their little ones.

Access Control Insights

The password segment accounted for the largest revenue share of around 31.3% in 2022, owing to benefits such as high security, convenience, and easy access. Password access involves the encryption of data, which can be decrypted by entering the authorized fingerprint or keyword password.

The wireless access segment is estimated to register the fastest CAGR of 14.4% over the forecast period. Wireless access control servers are integrated with a virtual private cloud network, preventing unauthorized requests from accessing the internal network. These servers are widely used in surveillance, home automation, smart buildings, and safety & security sectors. Access control wireless audiovisual intercom system allows two-way communication with the visitor. These instruments offer various benefits, such as storing the images of visitors and high connectivity using Wi-Fi.

System Insights

The wired segment held the largest revenue share of 64.6% in 2022 owing to various benefits of these systems, such as ease of installation and convenient communication. Furthermore, wired appliances are easy to integrate with the existing systems.

The wireless segment is expected to expand at the fastest CAGR of 14.3% over the forecast period. Wireless devices are affordable and offer secure access control to users. Their features include motion detection with audiovisual surveillance, smart lock integration, audiovisual storage at zero additional cloud charges, and keyless entry using a built-in touchscreen keypad. Wireless video intercom systems offer system expansion, easy operation, and flexible layouts.

Technology Insights

The IP based segment held the largest revenue share of 63.9% in 2022 and is expected to expand at the fastest CAGR of 13.9% during the forecast period, due to their wide usage and advancements in terms of technologies and features. These appliances offer various benefits, such as easy installation, low initial investment, and low infrastructure costs. Network video recorders, SIP phones, and CCTV cameras are IP-based video intercom devices. These systems provide high video quality regardless of the number of receiving devices, driving the segment growth. Analog equipment is not suitable for duplex communication. Visual signal and data network signal disruption is a challenge to the segment growth.

The analog segment is expected to expand at a significant CAGR during the forecast period due to high reliability, simplicity, integration capabilities, and cost-effectiveness. Analog video intercoms can withstand power outages and network issues, whereas digital systems might fail.

Key Companies & Market Share Insights

The companies operating in the market focus on strategic partnerships and acquisitions to boost their market shares. Furthermore, companies are also investing in research and development activities, new product development, and product portfolio expansion to offer cost-effective and reliable video intercom devices. For instance, in April 2023, Aiphone Corporation, a global manufacturer of intercoms and security communication solutions, launched its IX Series kit. The IX Series kit is a preprogrammed and preassembled box set with a preprogrammed video intercom system ready to install.

Key Video Intercom Devices Companies:

- Aiphone Corporation

- Alpha Communications

- Comelit Group S.p.A.

- Dahua Technology USA Inc.

- Godrej.com

- Honeywell International Inc.

- Legrand

- Panasonic Holdings Corporation

- SAMSUNG

- Siedle

- 2N TELEKOMUNIKACE a.s.

Recent Developments

-

In June 2023, 2N announced that it became the first company to integrate adaptive Face Zooming into its video intercom. Adaptive Face Zooming improves security by making it easier for business owners and users to identify visitors in their facility.

-

In January 2023, Dahua Technologies Co., Ltd. announced the launch of EACH series - a 2-wire hybrid video intercom system for villas. The new EACH series redefines extensibility and accessibility, convenience, and HD video in the 2-Wire video intercom system.

Video Intercom Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 23.86 billion |

|

Revenue forecast in 2030 |

USD 58.30 billion |

|

Growth rate |

CAGR of 13.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device type, access control, system, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Aiphone Corporation.; Alpha Communications; Comelit Group S.p.A.; Dahua Technology USA Inc.; Godrej.com; Honeywell International Inc.; Legrand; Panasonic Holdings Corporation; SAMSUNG; Siedle; 2N TELEKOMUNIKACE a.s. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Video Intercom Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global video intercom devices market report based on device type, access control, system, technology, end-use, and region.

-

Device Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Door Entry Systems

-

Handheld Devices

-

Video Baby Monitors

-

-

Access Control Outlook (Revenue, USD Million, 2017 - 2030)

-

Fingerprint Readers

-

Password Access

-

Proximity Cards

-

Wireless Access

-

-

System Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Analog

-

IP-based

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Commercial

-

Government

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global video intercom devices market size was valued at USD 21.70 billion in 2022 and is expected to reach USD 23.86 billion in 2023.

b. The global video intercom devices market is expected to witness a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 58.30 billion by 2030.

b. North America dominated the video intercom devices market with a share of 30.1% in 2022. This is attributable to the introduction of initiatives such as smart buildings and smart transportation.

b. Some of the key players operating in the video intercom devices market include Aiphone Co., Ltd.; Alpha Communications; Comelit Group S.P.A.; Dahua Technology Co., Ltd.; Godrej.Com; Honeywell International Inc.; Legrand; Panasonic Corporation; Samsung; and Siedle & Sohne OHG.

b. Key factors driving the video intercom devices market growth include increasing demand for these devices in the security and surveillance sector and rising government initiatives toward the development of smart cities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."