Video Game Market Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type (Online, Offline), By Region (Asia Pacific, North America, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-527-4

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global video game market size was estimated at USD 217.06 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2023 to 2030. The market's expansion is attributed to the ongoing trend of online gaming, the emergence of high bandwidth network connectivity, and the continuous demand for 3D games. In addition, an upsurge in the penetration of smartphones has made video games more accessible, portable, and social. This has further driven the industry growth with the emergence of technologically advanced and more powerful smartphones. The market players are also focusing on developing advanced gaming products and services to attract a larger customer base, which is positively influencing the overall industry.

The outlook of the market is being further enhanced by a steady growth in the number of video gamers year over year. The population growth, broadening demographics, increased accessibility, social interaction, and connectivity, and changing perceptions and cultural acceptance of gaming led to a significant rise in number of gamers. These factors have contributed to the mainstream popularity of video games as a form of entertainment, leading to a growing number of players worldwide. This, in turn, is expected to fuel the market demand over the forecast period.According to Newzoo, there are 3.22 billion gamers worldwide as of 2023. However, this number is expected to rise to 3.32 billion gamers worldwide by 2024.

The emergence of the 5G network further boosted the number of gamers around the globe. Major market players have taken profound steps in this direction to gain a competitive edge. In January 2022, AT&T announced to join forces with NVIDIA Corp. to deliver high-end 5G cloud gaming experiences. This initiative will enable users to play around 100 free-to-play titles and games they own on renowned PC game stores, such as Epic Games Store, Steam, Ubisoft Connect, Origin, GOG, etc. The realistic, state-of-the-art graphics built on NVIDIA RTX technology and advanced AI features will provide a virtual world experience to gamers.

Furthermore, esports has experienced rapid growth in recent years, becoming a mainstream form of entertainment. It is a booming industry where skilled video gamers play competitively. Esports tournaments and competitions attract massive online and offline audiences, with millions of viewers and fans worldwide. The esports industry does not only include traditional sports-related games, such as NBA2K and FIFA, but also games, such as Counter-Strike, League of Legends, and Dota. The most popular esports genres include multiplayer online battle arenas, real-time strategy, and first-person shooter games. The increasing popularity of esports has led to a surge in demand for high-quality, competitive games that provide an engaging and immersive experience for players and viewers alike.

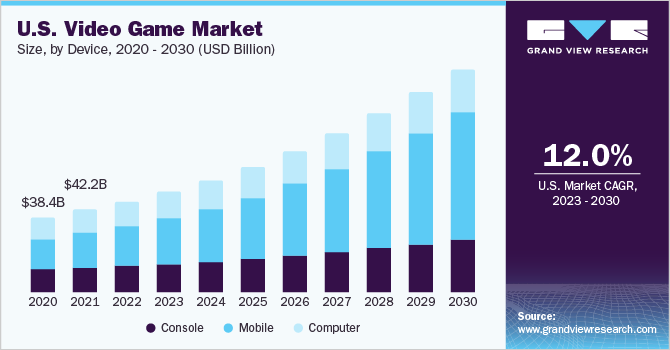

Device Insights

The mobile device segment held the largest revenue share of over 40.0% in 2022. The increased proliferation of smartphones along with rising internet penetration worldwide is creating vast opportunities for mobile gaming. In recent years, technological developments in terms of smartphone gaming hardware in addition to their convenience, accessibility, and availability of low-cost alternatives have boosted the popularity of mobile games among the population worldwide, compelling gamers to shift from consoles and pre-installed PC games to smartphone gaming. In addition, the popularity of mobile gaming among the young population is expected to offer lucrative opportunities for the mobile device segment. For instance, according to the 2023 data from Techpenny, the average age of mobile gamers is 36.3 years. In addition, 86% of Gen Z (born between 1997 and 2012) plays video games on their mobile devices.

The console device segment is expected to register a CAGR of over 10.0% from 2023 to 2030. Over the years, consoles manufacturers have continued to innovate and improve the hardware and software technology used in gaming consoles, resulting in more powerful, sophisticated, and immersive gaming experiences. The most significant technological advancement in gaming consoles has been the improvement in graphics technology; from 8-bit graphics in early consoles to 4K resolutions in current consoles, the graphics quality has improved drastically. This technological advancement in the console has boosted the growth of the global market. The development of AR and VR technologies has also significantly supported the market’s growth. VR headsets and AR technology have enabled gamers to experience more immersive and interactive gaming environments.

Type Insights

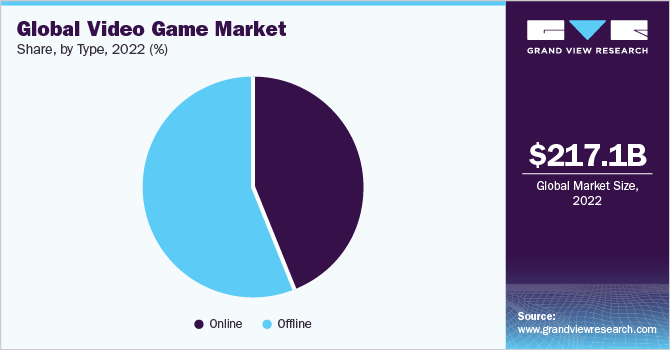

The online type segment accounted for the largest revenue share of around 44.0% in 2022. The growth of this segment is driven by a rise in internet penetration, growth of the online casual gaming sector, and increasing popularity of massively multiplayer online (MMO) and Free2Play (F2P) games. Technological trends like augmented reality (AR), virtual reality (VR), and mixed reality (MR) are also contributing to the growth of the market. Moreover, the popularity of esports events and multiplayer gaming contributes to the online gaming segment growth.

For instance, FIFA 22, launched by Electronic Arts Inc., experienced 9.1 million players, 7.6 million team squads, and 460 matches played by gamers within the first month of launch. The offline segment is expected to record a considerable growth rate of nearly 10.0% from 2023 to 2030. The market for offline video games has witnessed substantial growth in recent years, establishing a significant presence within the broader video game industry. Such games offer unique gameplay experiences that set them apart from their online counterparts.

Offline games often prioritize immersive narratives, intricate puzzles, and captivating worlds that can be explored at the player’s preferred pace. Offline gaming does not require an internet connection and there is no pressure to compete against other players. These factors have contributed to the popularity of offline gaming. For example, the growth and success of offline video games can be exemplified by notable titles, such as The Witcher 3: Wild Hunt and The Legend of Zelda: Breath of the Wild. These games have received critical acclaim and achieved commercial success, underscoring the market potential of offline gaming.

Regional Insights

North America captured the revenue share of around 24.0% of the market in 2022. According to the Entertainment Software Association, over 65% of Americans play video games, with around 212.6 million players per week. This includes 26% of players aged less than 18 years, while 25% are over the age of 45 years. This popularity of video games in the region fuels the market's growth. In addition, the strong presence of major video game makers and technology giants, such as Amazon Web Services, Inc., Apple Inc., Google LLC, Microsoft Corp., and NVIDIA Corp., in the region contributes to its growth. These companies are focusing on business expansion activities, including new product launches, strategic alliances, and expanding their presence.

Asia Pacific captured a substantial revenue share of over 48.0% in 2022 and is expected to exhibit a CAGR of around 14.0% from 2023 to 2030. The high popularity of gaming in countries, such as China, Japan, and South Korea, coupled with the deployment of multiple strategies by Chinese developers to attract gamers, contributed to the region’s growth. For instance, Tencent Holdings Ltd. has utilized the potential of its social messaging platform WeChat, an application with over 1 billion active users across China, to promote the games and swiftly connect players to other gamers. The company is headquartered in China and is well known for its organic growth strategies. In February 2022, Tencent Holdings Ltd. acquired 1C Entertainment and acquired the majority of stakes in Inflexion Games as part of the company's growth strategy.

Key Companies & Market Share Insights

The key market players are focusing on developing innovative gaming solutions to attract a large customer base and gain a competitive edge in the industry. Also, there is a significant trend of developing more interactive games and incorporating of AR and VR in gaming. For instance, in June 2023, Electronics Art Inc. launched Super Mega Baseball 4 latest addition to the highly acclaimed Super Mega Baseball series. Super Mega Baseball 4 introduces an upgrade in terms of presentation, marking the most substantial improvement in the franchise’s history. Some of the prominent players in the global video game market are:

-

Activision Blizzard

-

Apple Inc.

-

Disney

-

Electronic Arts Inc.

-

Lucid Games

-

Microsoft Corp.

-

Nintendo

-

Rovio Entertainment Corporation

-

Sony Interactive Entertainment Inc.

-

Tencent Holdings Ltd.

Video Game Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 242.39 billion |

|

Revenue forecast in 2030 |

USD 583.69 billion |

|

Growth rate |

CAGR of 13.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

August 2023 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, type, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Germany; UK; China; Japan; South Korea; Brazil;Egypt; Jordan; Saudi Arabia; UAE |

|

Key companies profiled |

Activision Blizzard; Apple Inc.; Disney; Electronic Arts Inc.; Lucid Games; Microsoft; Nintendo; Rovio Entertainment Corp.; Sony Interactive Entertainment Inc.; Tencent Holdings Ltd. |

|

Pricing and purchase options |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Video Game Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video game market report on the basis of device, type, and region:

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Console

-

Mobile

-

Computer

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Latin America

-

Mexico

-

Middle East & Africa (MEA)

-

Egypt

-

Jordan

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global video game market size was estimated at USD 217.06 billion in 2022 and is expected to reach USD 242.39 billion in 2023.

b. The global video game market is expected to grow at a compound annual growth rate of 13.4% from 2023 to 2030 to reach USD 583.69 billion by 2030.

b. The Asia Pacific dominated the video game market with a share of more than 48 % in 2022. This is attributable to the ever-increasing smartphone penetration and the growing demand for entertainment in China.

b. Some key players operating in the video game market include Microsoft Corporation, Nintendo Co., Ltd., Rovio Entertainment Corporation, NVIDIA Corporation, Valve Corporation., PlayJam Ltd., Bluestack Systems, Inc., and Sony Corporation.

b. Key factors that are driving the video game market growth include the growing penetration of internet services coupled with the easy availability and access of games on the internet across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."