- Home

- »

- Electronic Security

- »

-

Video Analytics Market Size & Share, Industry Report, 2030GVR Report cover

![Video Analytics Market Size, Share & Trends Report]()

Video Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Software, Services), By Deployment (Cloud, On-premise), By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-303-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Analytics Market Summary

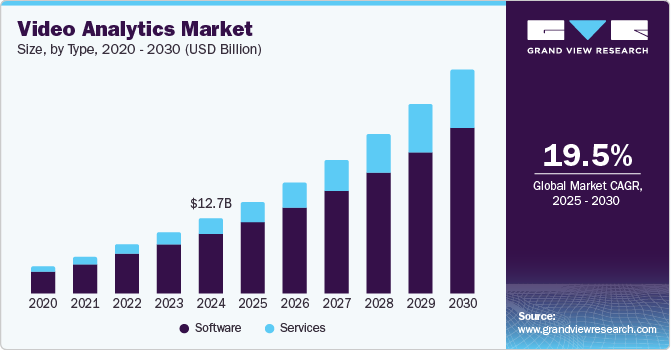

The global video analytics market size was estimated at USD 12.71 billion in 2024 and is projected to reach USD 37.84 billion by 2030, growing at a CAGR of 19.5% from 2025 to 2030. This growth can be attributed to the rising need for enhanced surveillance systems, the proliferation of smart city initiatives, and the integration of artificial intelligence (AI) in video analytics solutions.

Key Market Trends & Insights

- North America dominated the global video analytics market in 2024 with the largest revenue share of 33.2%.

- The U.S. video analytics market dominated North America in 2024.

- By type, the software segment in the video analytics industry accounted for the largest revenue share of 79.3% in 2024.

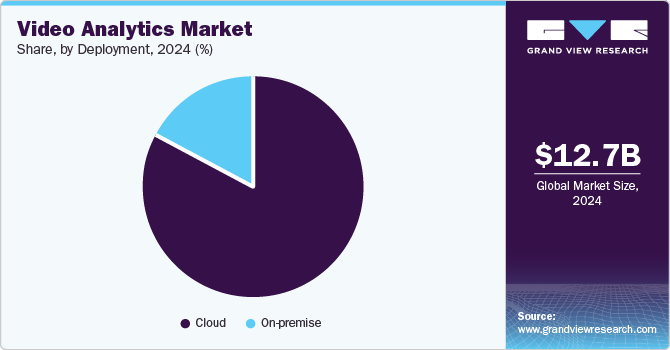

- By deployment, the cloud segment dominated the video analytics industry with the largest revenue share in 2024.

- By application, the facial recognition segment dominated the video analytics industry with the largest revenue share in 2024

Market Size & Forecast

- 2024 Market Size: USD 12.71 Billion

- 2030 Projected Market Size: USD 37.84 Billion

- CAGR (2025-2030): 19.5%

- North America: Largest market in 2024

The increasing concern for safety and security across various sectors has further driven the video analytics industry. Organizations are increasingly adopting video analytics to monitor real-time activities, detect anomalies, and ensure compliance with safety regulations. For instance, retail businesses utilize video analytics to analyze customer behavior, optimize store layouts, and reduce theft by identifying suspicious activities. This application not only enhances security but also contributes to improving customer experience and operational efficiency.

Moreover, the rapid development of smart cities is significantly boosting the demand for the video analytics industry. Governments are investing heavily in infrastructure, incorporating advanced surveillance systems to enhance public safety and streamline urban management. For instance, cities are deploying intelligent traffic management systems that utilize video analytics to monitor traffic flow, reduce congestion, and improve emergency response times. This technology integration enhances urban living and generates substantial data that can be analyzed for future urban planning.

Furthermore, the growing adoption of cloud-based solutions is facilitating the scalability and accessibility of video analytics technologies. Businesses leverage cloud platforms to store vast amounts of video data securely while utilizing advanced analytics tools without heavy upfront investments in hardware. This trend is particularly beneficial for small and medium-sized enterprises (SMEs) that may have previously found such technologies cost-prohibitive. As a result, the video analytics market is set to flourish as more organizations recognize its potential to transform operations and enhance security measures.

Type Insights

The software segment in the video analytics industry accounted for the largest revenue share of 79.3% in 2024 due to increasing demand for advanced security solutions across various sectors, which necessitates sophisticated software capable of real-time video processing and analysis. For instance, retail chains are implementing video analytics software to monitor customer behavior and optimize store layouts, enabling them to enhance customer experience and reduce losses from theft. In addition, the integration of artificial intelligence (AI) into video analytics software has further propelled its adoption, as AI enhances the accuracy of data interpretation and anomaly detection. This capability allows organizations to derive actionable insights from vast amounts of video data, making it an essential tool for decision-making processes.

The services segment is expected to grow at the highest CAGR of 23.9% over the forecast period due to increasing demand for implementation, maintenance, and support services. As organizations adopt complex video analytics systems, they require specialized services to ensure these technologies are effectively integrated and utilized to their full potential. This growing reliance on expert services helps organizations maximize their return on investment and allows them to stay current with the latest advancements in video analytics technology. In addition, as businesses recognize the importance of continuous improvement in their analytics capabilities, the demand for dedicated service offerings is expected to rise, driving further growth in this segment.

Deployment Insights

The cloud segment dominated the video analytics industry in 2024 due to its numerous advantages over traditional on-premises systems, such as cloud solutions' scalability, allowing organizations to easily adjust their storage and processing capabilities as their needs evolve. For instance, a growing retail chain can seamlessly add more cameras and storage without requiring extensive hardware investments or complicated installations, enabling rapid expansion. In addition, cloud-based systems provide cost-efficiency through subscription-based pricing models, reducing upfront costs and maintenance burdens. This flexibility is particularly attractive for businesses that may not have the resources to manage IT infrastructure. Furthermore, enhanced data security measures in cloud environments ensure that sensitive video data is protected with advanced encryption and regular updates, making it a preferred choice for organizations prioritizing security and operational efficiency.

The on-premise segment is expected to grow at a significant CAGR over the forecast period due to the increasing need for enhanced data security and control over sensitive information. Organizations in banking, healthcare, and government sectors often handle critical data that necessitates stringent security measures, making on-premise solutions more appealing. For instance, a financial institution may prefer an on-premise deployment to ensure that all video surveillance data remains within its secure network, thereby minimizing the risk of data breaches associated with cloud solutions. In addition, on-premise systems allow for greater customization and integration with existing infrastructure, enabling organizations to tailor their video analytics capabilities to specific operational requirements.

Application Insights

The facial recognition segment dominated the video analytics industry in 2024 due to its widespread adoption across various sectors for enhanced security and operational efficiency and increasing demand for advanced surveillance systems that can accurately identify individuals in real time, which is critical for access control and law enforcement applications. For instance, airports utilize facial recognition technology to streamline passenger identification processes, improving security while minimizing wait times. This technological advancement allows organizations to process vast amounts of video data quickly, enabling proactive security measures and personalized customer experiences. As businesses and governments increasingly recognize the benefits of facial recognition for safety and efficiency, its market share within video analytics continues to grow rapidly.

The license plate recognition segment is expected to grow at the highest CAGR over the forecast period due to increasing investments in traffic management and law enforcement technologies and the rising need for efficient vehicle identification systems to enhance public safety and streamline traffic flow. Many cities are implementing LPR systems to automatically monitor and manage parking spaces, reducing congestion and improving compliance with parking regulations. In addition, LPR technology plays a crucial role in combating vehicle theft and enhancing security measures, as it allows law enforcement agencies to identify stolen vehicles on the road quickly.

Vertical Insights

The smart cities segment dominated the video analytics industry in 2024 due to the increasing integration of advanced technologies to improve urban living conditions and the growing emphasis on public safety and efficient resource management within urban areas. In addition, these systems facilitate real-time surveillance to identify and respond to criminal activities swiftly, contributing to overall community safety. The rise of IoT devices within smart city frameworks also enhances the effectiveness of video analytics by providing vast amounts of data that can be analyzed for actionable insights.

The government segment is expected to grow at the highest CAGR over the forecast period due to heightened investments in public safety and smart city initiatives. Governments are increasingly adopting video analytics solutions to enhance security, manage traffic, and improve emergency response capabilities. For instance, cities are implementing video analytics to monitor large public events, allowing law enforcement agencies to detect potential threats and manage crowds effectively. In addition, the ability of video analytics systems to analyze vast amounts of unstructured data in real time enables government agencies to make informed decisions that enhance operational efficiency and citizen safety.

Regional Insights

North America dominated the global video analytics market in 2024 with the largest revenue share of 33.2% due to the rapid adoption of advanced surveillance technologies and a strong focus on public safety. The presence of numerous leading technology companies in the region has fostered innovation and investment in video analytics solutions. For instance, cities such as New York are increasingly implementing video analytics for real-time monitoring of urban environments, enabling law enforcement to respond swiftly to incidents. In addition, the heightened security concerns following various global events have compelled governments and organizations to enhance their surveillance capabilities. The integration of artificial intelligence and machine learning into video analytics systems further drives market growth by improving accuracy and efficiency in data processing.

U.S. Video Analytics Market Trends

The U.S. video analytics market dominated North America in 2024, driven by technological advancements, increasing security concerns, and rapid integration of artificial intelligence and machine learning into video analytics systems, enhancing their ability to process and analyze vast amounts of data in real time. Cities such as Chicago have implemented advanced video analytics to monitor public spaces, improving incident response times and overall public safety. In addition, the presence of major technology companies, such as IBM and Cisco, fosters innovation and provides robust solutions tailored to various sectors, including retail and transportation.

Middle East and Africa Video Analytics Market Trends

The Middle East and Africa video analytics market is expected to grow at the highest CAGR over the forecast period primarily due to increasing security concerns and the rapid urbanization in the region. Governments and organizations invest heavily in advanced surveillance technologies to enhance public safety and effectively manage growing populations. For instance, cities such as Dubai are implementing sophisticated video analytics systems to monitor traffic patterns and ensure public safety during large events. In addition, the rising adoption of smart city initiatives, which integrate various technologies for improved urban management, is driving demand for video analytics solutions. The need for real-time data analysis to address security threats and optimize city services further propels market growth.

The Saudi Arabia video analytics market dominated the Middle East and Africa in 2024 with the largest revenue share, driven by significant investments in security infrastructure and smart city initiatives and the government's commitment to enhancing public safety through advanced surveillance technologies, which are essential for monitoring urban environments and managing crime rates. For instance, the Saudi government has been investing heavily in projects aligned with Saudi Vision 2030, which aims to develop smart cities such as NEOM that incorporate sophisticated video analytics systems for real-time monitoring and data analysis.

Europe Video Analytics Market Trends

Europe Video analytics market is expected to grow significantly over the forecast period, due to the increasing adoption of advanced surveillance technologies and a heightened focus on public safety. The rapid development of communication networks, which facilitates the deployment of Internet Protocol (IP)-based security systems that enhance monitoring capabilities, has further propelled the growth. For instance, in the United Kingdom, law enforcement agencies are utilizing video analytics for automatic number plate recognition (ANPR) to improve traffic management and enforce regulations. In addition, the rising demand for smart city initiatives across Europe is pushing municipalities to implement video analytics solutions that optimize urban infrastructure and enhance citizen safety.

Key Video Analytics Company Insights

Some key players in the Video analytics market are Avigilon Corporation (Motorola Solutions, Inc.), Claro Enterprise Solutions, IBM Corporation, Irisity AB, and others. These companies in the video analytics market employ various strategies to maintain a competitive edge, including the integration of artificial intelligence and machine learning technologies to enhance their product offerings. They focus on developing advanced solutions that provide real-time insights and improve security measures across multiple sectors, such as retail, transportation, and public safety.

-

Avigilon Corporation, a subsidiary of Motorola Solutions, specializes in advanced security solutions that integrate cutting-edge video analytics technology to enhance surveillance capabilities. The company focuses on developing innovative products that utilize artificial intelligence for features such as facial recognition and motion detection, allowing organizations to monitor environments effectively and respond to incidents in real-time.

-

Honeywell International Inc. provides integrated security solutions that leverage video analytics to improve safety and operational efficiency across various sectors. The company develops advanced video surveillance systems with intelligent analytics features, enabling users to detect anomalies, track movements, and proactively manage incidents.

Key Video Analytics Companies:

The following are the leading companies in the video analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Avigilon Corporation (Motorola Solutions, Inc.)

- Canon Inc.

- Cisco Systems, Inc.

- Claro Enterprise Solutions

- Honeywell International Inc.

- Huawei Technologies Co Ltd.

- IBM Corporation

- Irisity AB

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

Recent Developments

-

In March 2023, Motorola Solutions unveiled its new Avigilon Security Suite, which integrates the Alta Cloud and Unity on-premise solutions to enhance security operations. This suite is designed to provide organizations with advanced video surveillance capabilities, allowing for seamless management of security footage and real-time monitoring. The integration aims to improve situational awareness and response times while offering scalable options tailored to various operational needs.

-

In May 2023, Claro Enterprise Solutions announced the launch of its AI Video Analytics solution, developed in partnership with Iveda, to enhance security in public spaces like schools. The solution offers advance threat detection capabilities, including identifying weapons and unauthorized access, and can integrate with existing surveillance systems. This initiative aims to provide a cost-effective security measure amidst rising safety concerns in educational and public environments.

Video Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.51 billion

Revenue forecast in 2030

USD 37.84 billion

Growth rate

CAGR of 19.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Avigilon Corporation (Motorola Solutions, Inc.); Canon Inc.; Cisco Systems, Inc.; Claro Enterprise Solutions; Honeywell International Inc.; Huawei Technologies Co Ltd.; IBM Corporation; Irisity AB; Qualcomm Technologies, Inc.; Robert Bosch GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Video analytics market report based on type, deployment, application, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Crowd Management

-

Facial Recognition

-

Intrusion Detection

-

License Plate Recognition

-

Motion Detection

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Smart Cities

-

Critical Infrastructure

-

Education

-

Government

-

Retail

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.