Vibration Sensor Market Size, Share & Trends Analysis Report By Type (Accelerometers, Velocity Sensor, Displacement Sensor), By Technology, By Material, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-738-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Vibration Sensor Market Size & Trends

The global vibration sensor market size was valued at 5.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% over the forecast period from 2023 to 2030. The benefits offered by vibration sensors, including low cost, simple installation, and good response at high frequencies, are expected to drive market growth. The high vibration levels of robotic machinery in high-end industrial applications are expected to create a demand for accelerometers. Accelerometers can control the damage caused to critical materials during high-speed operations, such as milling and cutting. The rising demand for Micro-Electromechanical System (MEMS)-based vibration sensors across various industries, such as automobile and aerospace & defense, is driving the market growth.

In response to the rising demand, vendors are launching enhanced MEMS-based sensors to strengthen their market position. For instance, in May 2021, STMicroelectronics announced the launch of the next-generation MEMS three-axis linear accelerometer, AIS2IH. This accelerometer can enhance temperature stability, resolution, and mechanical robustness in automotive applications, such as telematics infotainment. The growing integration of enhanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT) in vibration sensors, creates market growth opportunities. As a result, several vibration sensor providers are embedding AI end-use in their products.

For instance, in September 2021, Reality Analytics Inc. announced it would partner with Fujitsu Component Ltd. to bring Fujitsu Component Ltd.’s contactless vibration sensor to industrial and manufacturing applications. The former company is expected to demonstrate AI-enabled contactless vibrating sensing based on Doppler radar through this partnership. Researchers globally are focusing on bringing enhancements to accelerometers. For instance, in March 2021, the National Institute of End-use (NIST) researchers developed a new type of accelerometer based on optomechanical and laser principles. This sensor consists of a pair of silicon chips and could find use in spacecraft and aircraft, self-driving cars, tablets, and smartphones.

In addition, it could also be used in navigation systems where GPS is unavailable, such as satellites and submarines. The Inertial Measurement Unit (IMU) has been increasingly used in autonomous cars in recent years, creating a new opportunity for market growth. The IMU consists of a gyroscope and accelerometer and can measure the angular rate and gravity of an object to which it is attached. The IMU is used in automotive vehicles across applications, such as Advanced Driver-assistance Systems (ADAS), electronic stability control, and lane-keeping assistance. The rising demand for autonomous vehicles across countries, such as the U.S., the U.K., and Germany, due to government efforts will also drive market growth.

Moreover, oxwing to the lockdowns implemented amid the COVID-19 pandemic, several market vendors minimized their staff, which had a significant impact on the market's supply chain. Increased restrictions due to the pandemic and disruptions caused in transportation, such as reduced availability of air transport, port closures, and border controls, limited the capacity of vibration sensor manufacturers to meet customer demand. This had an adverse impact on the operations and finances of businesses. The impact of the COVID-19 pandemic on industries and sectors, such as automotive, oil & gas, and aerospace & defense, is also likely to affect market growth.

Vibration sensors have many applications in fracking operations in oil & gas refineries. As a result, the closure of several oil and gas refineries during the pandemic is expected to impact market growth negatively. However, the increased use of robotics to automate the process of drawing blood for COVID-19 detection has helped reduce the risk of infection for medical personnel. Vibration sensors enable these robots to monitor the intravascular blood pressure of patients. Some manufacturers have taken drastic steps to reduce the overall impact of the COVID-19 pandemic on their supply chains.

For instance, FUTEK Advanced Sensor End-use, Inc. has minimized the shortage of raw material risk by implementing vertical integration and utilizing domestic suppliers whenever possible. Such initiatives are likely to impact market growth positively. However, there remains concern over delivering vibration sensors to international and domestic customers.

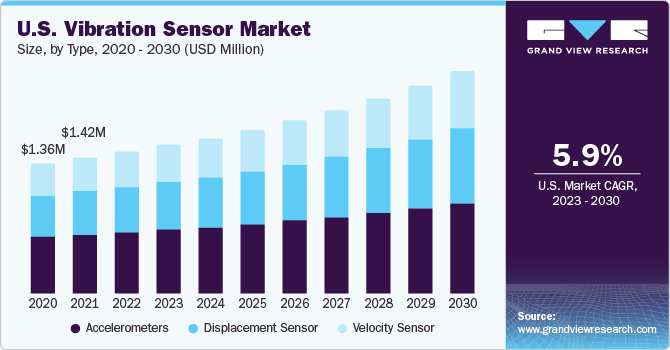

Type Insights

The type segment is categorized into accelerometers, velocity sensor, and displacement sensor. The accelerometers held the largest market share of 44.2% in 2022. This high share is attributed to the increasing adoption of accelerometers in the automotive, consumer electronics, and manufacturing industries. Furthermore, several companies in the market, including Hansford Sensors and Robert Bosch LLC, are focusing on developing tri-axial accelerometers, driving the segment's growth. For instance, in October 2021, Endevco, a measurement sensor solutions provider, announced the launch of Model 7298A, a triaxial variable capacitance accelerometer. This accelerometer is designed to provide global accuracy and high thermal stability for measuring low-frequency accelerations in automobile and aerospace environments.

The displacement sensor is projected to register the fastest CAGR of 8.1% over the forecast period. The demand for displacement sensors is high across industries where robustness, precision, and cost competitiveness are important. The increasing adoption of displacement sensors for detecting defects in stacked Printed Circuit Boards (PCBs) and the positioning of electronic components on PCBs is one of the major factors driving the segment growth. Moreover, elevators use displacement sensors to synchronize the opening of elevator car doors with the level of building floors, further boosting segment growth.

Technology Insights

The piezoresistive segment dominated the market with the highest revenue share of 24.1% in 2022. The benefits offered by piezoresistive vibration sensors, such as fixed sensitivity and cheaper electronics and cabling needs, are expected to drive the segment's growth. Piezoresistive accelerometers, such as anti-lock braking systems, airbags, and traction control systems, are widely used in automobile safety applications. Moreover, compared to variable capacitance and optical sensors, piezoresistive accelerometers are more suitable for measuring static and dynamic accelerations. The segment's growth is also fueled by the increased adoption of piezoresistive sensors for monitoring intravascular blood pressure.

On the other hand, the tri-axial sensors segment is expected to grow at a fastest CAGR of 8.8% over the forecast period. The capability of a tri-axial sensor to provide a quick and accurate phase analysis is expected to drive its demand across industries. Furthermore, rising adoption in automotive gearboxes for the identification of gear mesh faults bodes well for the growth of this segment. Moreover, manufacturers, such as HILLCREST LABS and Micro-Epsilon, emphasize the development of 9-axis IMUs, which is expected to drive the tri-axial segment.

End-use Insights

The automobile segment dominated the market with the highest revenue share of 27.0% in 2022. The increased product usage in vehicles to detect mechanical vibrations, such as knocking from the engine body, is anticipated to drive the segment growth. Furthermore, in recent years, there has been an increase in the adoption of vibration sensors for the non-destructive testing of automobiles. Vibration sensors measure the vibrations of rotating parts in an automobile engine. A global rise in automobile accidents caused by engine failure has encouraged many governments to establish stringent automotive safety regulations. These regulations mandate the use of vibration sensors that monitor the condition of engines.

The aerospace & defense segment is expected to witness the fastest growth of CAGR of 8.4% over the forecast period. Accelerometers are used in the aerospace industry for applications such as inertial navigation, industrial measurement, and guidance and control. Vibration sensors are also used for monitoring turbine engine failures, as they are a primary cause of mechanical failures that increase maintenance costs in the aerospace industry. As a result, companies in the aerospace & defense sector are increasingly adopting Prognostic and Health Management (PHM) systems for the prevention of mechanical failures and reduction in maintenance costs. As vibration is the most common health monitoring parameter in the aerospace engine industry, the development of PHM systems is likely to impact market growth directly.

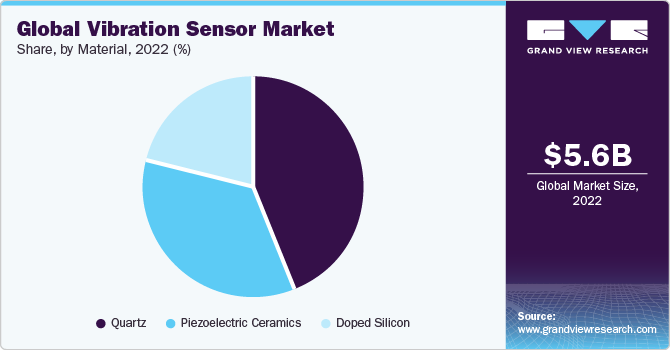

Material Insights

The quartz segment dominated the market with the highest revenue share of 43.7% in 2022. The benefits offered by quartz-based vibration sensors, such as high precision, low threshold, simple structure, and low power consumption, are expected to drive segment growth. However, using quartz force sensors is impractical in weighing applications as the measurement signal generated by a quartz sensor decays over time, making long-term, static force measurements not feasible. Nevertheless, these sensors offer many advantages and unique characteristics, making them an ideal choice for many dynamic force measurement requirements.

The doped silicon segment is expected to witness the fastest growth of CAGR of 7.9% over the forecast period. The market for doped silicon is experiencing growth due to its increasing applications and demand in various industries. Doped silicon, which involves introducing specific impurities into silicon to alter its electrical properties, has been extensively used in electronics, semiconductors, solar cells, and other technologies. As these industries continue to advance and expand, the demand for doped silicon has risen, driving its market growth.

Moreover, the piezoelectric ceramics segment is anticipated to grow significantly over the forecast period. A rise in the use of piezoelectric ceramics in applications such as automotive and energy harvesting is expected to drive segment growth. They are also used in dynamic wheel balancing machines, where a signal is generated in the sensor for every imbalance in the wheel. Furthermore, in recent years, there has been an increase in the adoption of piezoelectric ceramic-based vibration sensors in electric musical instruments, driving the segment growth. In addition, due to the higher sensitivity of piezoelectric ceramic-based accelerometers, they can be assembled with a smaller mass than quartz, making them much lighter.

Regional Insights

North America dominated the market with the largest revenue share of 37.3% in 2022. This is attributed to the increased adoption of vibration sensors in the region’s well-established automotive sector. Furthermore, the region consists of some of the largest railway networks in the world, with companies such as the Canadian National Railway, Kansas City Southern Railway, and Norfolk Southern Railway. As a result, product demand in applications, such as rail asset management, drives market growth. Moreover, a rise in product demand for consumer electronics applications is estimated to support regional market growth.

The Asia Pacific is expected to grow at the fastest CAGR of 8.6% during the forecast period. Growing automation across several regional industries creates the need for advanced vibration sensors. Furthermore, low labor costs encourage global manufacturers to expand their production bases in India, China, and South Korea. This is expected to drive the regional manufacturing sector’s product demand. Furthermore, countries like China and Japan are regarded as the manufacturing and assembling hubs for consumer electronics manufacturers, such as Samsung and Sony Corporation. Vibration sensors are used in applications such as orientation detection and free-fall sensing in consumer electronics.

Key Companies & Market Share Insights

Various players in the market are focusing on their R&D activities to develop new products. The R&D activities of Analog Devices, Inc. enabled it to launch the accelerometer ADXL372, which is designed for the long-term monitoring of the physical condition of machines. Some other strategies market players adopt are mergers, acquisitions, and partnerships. For instance, TE Connectivity, Ltd. has partnered with Mouser Electronics, Inc., under which Mouser Electronics, Inc. distributes TE Connectivity, Ltd.’s vibration sensors across Europe.

Product innovation and heavy R&D investments are the major strategies leading players in market use. For instance, Analog Devices Inc.’s R&D expenses accounted for USD 1,296.1 million, USD 1,050.5 million, and USD 1,130.3 million in FY 2021, FY 2020, and FY 2019, respectively. The company uses the investments to enhance its product offering and market position.

Key Vibration Sensor Companies:

- Baumer

- Bosch Sensortec GmbH

- TE Connectivity

- NATIONAL INSTRUMENTS CORP

- Honeywell International Inc.

- SAFRAN

- Hansford Sensors

- DYTRAN INSTRUMENTS INCORPORATED

- Analog Devices, Inc.

- ASC GmbH

Recent Developments

-

In March 2023, DYTRAN INSTRUMENTS INCORPORATED and ENMO Sound & Vibration Technology joined forces through a partnership encompassing Belgium, the Netherlands, and Luxembourg. This significant collaboration marks a strategic milestone for both entities as they navigate the dynamic realm of testing and measurement. By uniting their expertise, ENMO and Dytran aim to foster the advancement of their respective enterprises while collectively contributing to the progress of technology in this field.

-

In February 2023, IMI Sensors, a division of PCB Piezotronics Inc., launched the Model 655A91, a budget-friendly 4-20 mA velocity transmitter. The Model 655A91 has a 4-pin M12 connector, simplifying its integration into pre-existing industrial monitoring setups. Thanks to its built-in piezoelectric component, this model offers enhanced precision and broader frequency response, spanning from 3.5 to 2 kHz.

-

In January 2023, NSXe Co. Ltd., a Japanese firm specializing in mechanical equipment installation and maintenance solutions, launched its latest innovation, the "conanair" Wi-Fi vibration sensor, to the U.S. market. This advanced sensor, designed to detect bearing damage, offers a significantly more cost-effective solution than previous options.

-

In January 2023, HARMAN International, a subsidiary of SAMSUNG specializing in automotive technology, focusing on crafting consumer experiences of automotive grade, has unveiled its Sound and Vibration Sensor and External Microphone products. These cutting-edge offerings are designed to elevate the auditory experience both within and outside the vehicle. Introducing these novel products opens the door to various applications to enrich safety and user interaction, encompassing tasks such as identifying emergency vehicle sirens, capturing spoken directives from drivers or traffic personnel, and detecting instances like glass breakage or vehicular collisions.

-

In March 2022, SAMSUNG launched its latest addition to the Galaxy A-series lineup, the Galaxy A53 5G smartphone. Powering this device is an octa-core processor, ensuring robust performance. The smartphone boasts a 120 Hz refresh rate on its 6.50-inch touchscreen display, which offers a sharp resolution of 1080 x 2400 pixels, equating to a pixel density of 407 pixels per inch.

Vibration Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5.97 billion |

|

Revenue forecast 2030 |

USD 9.78 billion |

|

Growth rate |

CAGR of 7.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, material, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Baumer; Bosch Sensortec GmbH; TE Connectivity; NATIONAL INSTRUMENTS CORP; Honeywell International Inc.; SAFRAN; Hansford Sensors; DYTRAN INSTRUMENTS INCORPORATED; Analog Devices, Inc.; ASC GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vibration Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vibration sensor marketbased on type, technology, material, end-use, and region:

-

Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Accelerometers

-

Velocity Sensor

-

Displacement Sensor

-

-

Technology Outlook (Revenue in USD Million, 2017 - 2030)

-

Piezoresistive

-

Strain Gauge

-

Variable Capacitance

-

Hand Probe

-

Optical Sensor

-

Tri-Axial Sensors

-

Others

-

-

Material Outlook (Revenue in USD Million, 2017 - 2030)

-

Doped Silicon

-

Piezoelectric Ceramics

-

Quartz

-

-

End-use Outlook (Revenue in USD Million, 2017 - 2030)

-

Automobile

-

Consumer Electronics

-

Healthcare

-

Aerospace & Defense

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vibration sensor market size was estimated at USD 5.63 billion in 2022 and is expected to reach USD 5.97 billion in 2023

b. The global vibration sensor market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 9.78 billion by 2030

b. North America dominated the vibration sensor market with a share of 37.29% in 2022. This is attributable to the increased adoption of these vibration sensors in the region’s aerospace & defense sector.

b. Some key players operating in the vibration sensor market include Advanced Sensors Calibration GmbH, Inc.; Analog Devices, Inc.; Dytran Instruments, Inc.; Honeywell International, Inc.; Robert Bosch GmbH; Hansford Sensors Ltd.; Colibrys Ltd.; National Instruments Corporation; TE Connectivity Ltd.; and FUTEK Advanced Sensor Technology Inc.

b. Key factors that are driving the vibration sensor market growth include the increasing need for machine condition monitoring and maintenance and rising adoption in industrial IoT (IIoT).

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."