Vibration Monitoring Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Process (Online, Portable), By Industry (Oil & Gas, Power Generation, Mining & Metals, Automotive, Aerospace), By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-552-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Vibration Monitoring Market Size & Trends

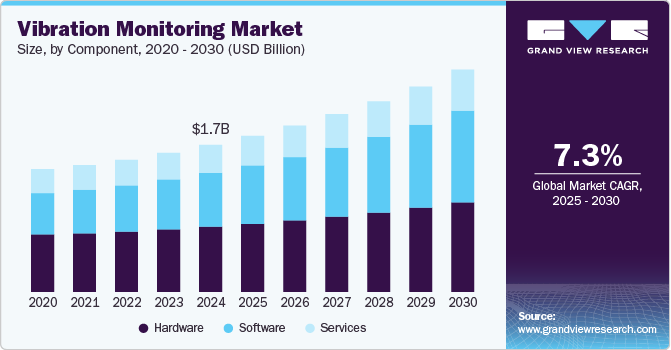

The global vibration monitoring market size was estimated at USD 1,702.2 million in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2030. This growth is primarily driven by the growing demand for predictive maintenance across various industrial sectors, including manufacturing, oil and gas, energy, and transportation. Organizations are increasingly focused on reducing unplanned downtime and lowering operational costs, leading to the implementation of vibration monitoring solutions that help identify equipment faults at an early stage. In addition, the shift away from traditional maintenance methods towards condition-based monitoring is fueled by the need to maximize machinery lifespan and enhance workplace safety. Regulatory pressures to ensure operational safety in high-risk industries are also encouraging companies to invest in efficient asset health monitoring systems.

A significant trend in the global market is the integration of wireless technologies and IoT sensors within vibration monitoring systems. These advancements enable real-time, remote monitoring of critical equipment and facilitate instantaneous data transmission for analysis. This capability is particularly vital for industries that manage dispersed assets or operate in hazardous conditions. The combination of wireless connectivity and cloud-based analytics allows organizations to reduce manual inspections, improve response times to equipment faults, and make more informed maintenance decisions through automated diagnostics and alerts.

Another emerging trend is the incorporation of machine learning and artificial intelligence (AI) into vibration monitoring. These technologies are being utilized by analytics platforms to provide capabilities for predictive fault detection and anomaly identification. Unlike traditional systems that rely solely on threshold-related alarms, AI models can detect subtle variations in vibration patterns that may indicate early stages of equipment degradation. This predictive capability helps organizations schedule maintenance effectively, prevent unnecessary shutdowns, and optimize repair tasks. AI-based systems are gaining traction in industries such as automotive, energy, and aerospace, where precision and uptime are critical.

Major players in the vibration monitoring industry are heavily investing in product development, partnerships, and acquisitions to expand their offerings. For example, FLIR Systems has introduced multi-sensor condition monitoring kits that combine vibration and thermal analysis, while Megger acquired Diagnostic Solutions Limited to enhance its condition monitoring services. KCF Technologies has partnered with SEAM Group to integrate asset monitoring with security services. These strategic moves reflect an industry-wide trend of companies striving to provide integrated solutions that combine hardware, software, and analytics to drive digital transformation in asset maintenance.

Component Insights

The hardware segment accounted for the largest market share of over 44% in 2024. This dominance is primarily due to the widespread use of physical sensing devices such as accelerometers, proximity probes, and velocity sensors, which are essential for gathering real-time vibration measurements. These devices play a crucial role in detecting machinery faults, such as imbalance or misalignment, before they lead to failure. Industries such as oil and gas, manufacturing, and power generation heavily rely on these hardware components to ensure equipment longevity and operational safety. As condition monitoring becomes increasingly standard practice, the demand for high-performance, durable hardware continues to grow steadily.

Meanwhile, the software segment is expected to experience the fastest growth in the vibration monitoring industry during the forecast period. The rising demand for predictive analytics, cloud integration, and centralized monitoring platforms is driving this trend. Vibration monitoring software enables users to analyze complex datasets, generate actionable insights, and automate maintenance decisions. With a heightened focus on Industry 4.0 and digital transformation, businesses are investing in smart platforms that integrate with enterprise systems, offering real-time dashboards, anomaly detection, and maintenance scheduling. This shift from manual to data-driven maintenance practices is fueling the adoption of more advanced vibration monitoring software across various industries.

Industry Insights

The oil and gas industry dominated the vibration monitoring market in 2024, primarily due to its reliance on rotating machinery such as pumps, turbines, and compressors. Continuous operation of this equipment is essential for maintaining production efficiency and ensuring safety. Vibration monitoring plays a critical role in early failure detection, which helps minimize downtime and reduce repair costs. Given the harsh operating environments and stringent safety regulations in this sector, deploying vibration monitoring systems is a high priority. The increasing focus on asset integrity and process reliability ensures that the oil and gas industry remains the largest and most advanced market for vibration monitoring technology.

On the other hand, the automotive segment is projected to be the fastest-growing market for vibration monitoring throughout the forecast period. Driven by automation in assembly lines and the adoption of smart manufacturing strategies, these systems are becoming key tools for quality control and predictive maintenance in automobile factories. They help identify mechanical failures in assembly lines and robotic equipment, thereby maximizing production efficiency and reducing defects. With the rise in electric vehicle (EV) production and overall global automotive output, manufacturers are increasingly emphasizing real-time equipment analysis. This trend is expected to significantly boost the use of vibration monitoring solutions in the automotive sector.

Process Insights

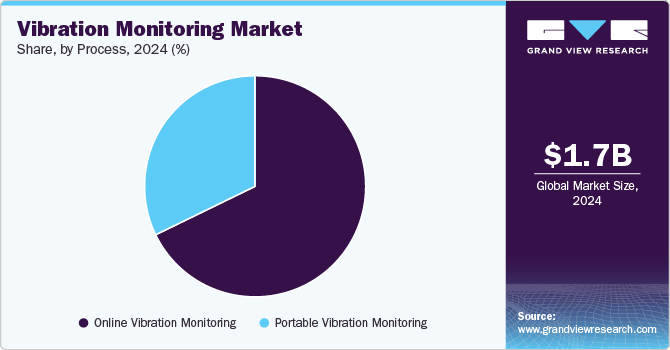

The portable vibration monitoring segment accounted for a significant share of the vibration monitoring industry in 2024. These systems are favored for their ease of use, affordability, and versatility, especially in environments where real-time monitoring is not feasible. Maintenance companies utilize portable or mobile devices to collect vibration data at regular intervals, enabling them to detect early signs of equipment wear. Portable systems are commonly employed by small and medium-sized businesses, as well as in remote installations. Their ability to deliver quick diagnostics without the need for permanent infrastructure makes them a reliable choice for maintenance teams across various industrial settings.

The online vibration monitoring segment is projected to experience the highest growth rate during the forecast period. These systems offer continuous, real-time monitoring of valuable machinery, which facilitates early detection of mechanical failures and helps prevent unexpected downtime. Online monitoring is particularly beneficial for high-risk, high-cost industries such as oil and gas, power, and heavy manufacturing, where equipment reliability is crucial. The integration of these systems with automated control systems and analytics platforms enhances their overall value. As companies shift towards predictive maintenance and adopt smart factory initiatives, the demand for online vibration monitoring technology is expected to grow significantly.

Regional Insights

The North America vibration monitoring market accounted for the largest revenue share of over 33% in 2024. This dominance is largely due to the early adoption of condition-monitoring practices and a robust industrial base. The oil and gas, power generation, and manufacturing sectors in the U.S. and Canada have extensively implemented vibration monitoring solutions to maintain operational efficiency and reduce unplanned downtime. The presence of major companies such as Honeywell, Emerson Electric Co., and Analog Devices Inc. further bolsters the availability of both hardware and software solutions in the region. Additionally, stringent regulatory requirements concerning equipment reliability and worker safety continue to drive investment in asset monitoring technology.

U.S. Vibration Monitoring Market Trends

The U.S. vibration monitoring market is shaped by strong demand for predictive maintenance in critical industries such as oil & gas, aerospace, energy, and manufacturing. Companies are increasingly adopting condition-based monitoring to reduce unplanned downtime and improve asset reliability. Integration of IoT-enabled sensors and wireless systems is becoming more common, allowing remote monitoring of equipment across large facilities. The U.S. also sees high adoption of analytics and AI-driven platforms for advanced diagnostics. Regulatory emphasis on workplace safety and asset reliability is pushing firms to invest in monitoring solutions while domestic players continue expanding offerings through product innovation and partnerships.

Europe Vibration Monitoring Market Trends

The vibration monitoring industry in Europe is undergoing tremendous growth owing to the industrial strength of the region and the greater focus on predictive maintenance practices. Manufacturing, power generation, and transportation industries are implementing sophisticated vibration monitoring systems to improve equipment reliability and operational effectiveness. The combined use of IoT and wireless technology is making it possible to acquire real-time data and analyze them, thus driving proactive maintenance methods. Moreover, strict regulatory requirements for workplace safety and environmental issues are making industries spend on advanced monitoring technologies to comply and minimize operational risks.

UK vibration monitoring is fueled by the increasing implementation of Industry 4.0 practices and the requirement for asset reliability in the manufacturing and energy sectors. The emphasis on predictive maintenance has seen the growing adoption of vibration monitoring systems that pick up early warning signals of machinery failure, reducing downtime and maintenance expenses. The UK's interest in technological advancement and digitalization facilitates the uptake of leading-edge sensors and data analysis in monitoring solutions, consistent with the larger movement towards smart manufacturing and operational effectiveness.

Germany vibration monitoring market is supported by its robust industrial base, especially in automotive manufacturing, aerospace, and machinery production. Precision engineering and quality concerns drive the demand for sophisticated vibration monitoring systems to provide machinery reliability and performance. The spread of predictive maintenance strategies is enhanced by Germany's emphasis on Industry 4.0 initiatives, encouraging the use of smart sensors and real-time data analytics to improve asset optimization and minimize unplanned downtime.

Asia Pacific Vibration Monitoring Market Trends

Asia Pacific vibration monitoring market is witnessing strong growth due to high industrialization and the growing application of predictive maintenance practices across various industries, including manufacturing, energy, and mining. The incorporation of new-age technologies such as the Internet of Things (IoT) and artificial intelligence (AI) has strengthened vibration monitoring systems with real-time data acquisition and analytics capabilities. This technological innovation enables industries to be able to fix equipment problems before they happen, which can minimize downtime and maintenance expenses. The concentration of the region towards maximizing operational efficiency and machinery safety further drives the demand for such monitoring solutions.

The vibration monitoring industry in China is growing rapidly, driven by the nation's focus on industrial productivity and safety. Adoption of predictive maintenance technologies is growing, prompted by the desire to reduce downtime and improve productivity. The government of China's drive to enhance smart manufacturing and Industry 4.0 practices is also propelling the use of advanced vibration monitoring solutions in the industrial segment.

India vibration monitoring market is expected to witness significant growth with an estimated compound annual growth rate (CAGR) of 10.1% during 2024-2030. This growth is driven by India's growing industrial sector and improving awareness regarding the predictive benefits of maintenance. Indian industries are adopting vibration monitoring systems at an accelerated pace to identify equipment faults at an early stage, thus avoiding unnecessary downtime and increasing equipment life. Its efforts toward industrial modernization and the use of smart technologies also add to the growth of the market.

Middle East & Africa Vibration Monitoring Market Trends

The vibration monitoring industry in Middle East & Africa region is witnessing growing demand owing to the increasing focus on operational efficiency and equipment reliability in industries such as oil & gas, mining, power generation, and manufacturing. As most countries are investing in industrial infrastructure and digital transformation, predictive maintenance solutions are becoming popular as a cost-saving and risk-mitigation option. The requirement for lower downtime and higher standards of safety is also compelling industries to switch to higher-level condition monitoring instruments, such as wireless and real-time vibration monitoring technologies. Government-backed programs for industrial modernization are also affecting adoption levels.

The UAE vibration monitoring market is growing rapidly, driven by technological development and a forward-looking strategy towards industrial automation. The country's strong emphasis on smart industry practices, particularly in oil & gas, energy, and manufacturing, has provided a suitable scenario for the implementation of predictive maintenance systems. Large-scale infrastructure developments and the need to increase asset reliability have promoted vibration sensor usage and monitoring software. With increasing interest in Industry 4.0 and a digitally interconnected ecosystem, UAE-based businesses are increasingly adopting vibration monitoring into their operational processes for real-time equipment diagnostics and maintenance planning.

Key Vibration Monitoring Company Insights

Some of the key players operating in the market are Honeywell International Inc., Emerson Electric Co., and SKF, among others.

-

Honeywell International Inc. provides industrial sensing and automation solutions comprising vibration monitoring equipment utilized across industries such as manufacturing, power generation, aerospace, and process industries. The portfolio of the company comprises a range of wired and wireless vibration sensors, data acquisition systems, and software platforms to support predictive maintenance and minimize equipment failure. Honeywell's solutions are typically integrated into larger industrial automation systems to facilitate continuous monitoring of key assets.

-

Emerson Electric Co. offers an extensive portfolio of condition monitoring and predictive diagnostics technologies under its AMS product suite. Its vibration monitoring solutions are applied to evaluate the health of rotating equipment in industries including oil & gas, power, water treatment, and chemical processing. Emerson's solutions encompass portable analyzers, online vibration monitoring systems, and cloud-enabled diagnostic tools. They are generally employed to detect mechanical imbalances, misalignments, and bearing wear prior to production losses.

-

SKF offers a wide range of machine condition monitoring products, from handheld vibration analyzers to permanent sensors and fully integrated online systems. The company focuses on enabling customers to optimize machine uptime and reduce unplanned maintenance costs. SKF's condition monitoring solutions are widely used in pulp & paper, mining, and marine industries, where asset reliability is of the essence. Its cloud-based analytics services further allow users to interpret vibration data with minimal in-house expertise.

Schaeffler AG, Analog Devices Inc., and ALS are some of the emerging market participants in the Vibration Monitoring Market.

-

Schaeffler AG offers vibration-based monitoring solutions as part of its industrial automation and mechatronics solutions. Its products and services include smart bearings with in-built sensors, condition monitoring units, and remote diagnostics digital platforms. They are generally applied in automotive manufacturing, machine tools, and wind energy applications. Schaeffler facilitates both real-time machine diagnosis and long-term performance analysis for preventive and corrective maintenance.

-

Analog Devices Inc. creates high-accuracy MEMS vibration sensors for industrial condition monitoring applications. The sensors are the center of third-party monitoring systems. They are intended to provide accurate amplitude and frequency data for the early detection of faults such as bearing wear, imbalance, and resonance. Analog Devices aims to manufacture low-noise, high-reliability components that can be utilized in challenging environments such as heavy manufacturing, aerospace, and transportation.

-

ALS offers testing, inspection, and condition monitoring services, such as vibration analysis, to industrial customers globally. Its services include on-site data gathering, remote diagnostics, and reporting to assist asset performance management strategies. ALS operates across a broad range of industries, such as energy, mining, manufacturing, and infrastructure, with its vibration monitoring work frequently integrated with thermal imaging, oil analysis, and electrical diagnostics.

Key Vibration Monitoring Companies:

The following are the leading companies in the vibration monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc

- Emerson Electric Co.

- SKF

- Schaeffler AG

- Analog Device Inc.

- ALS

- Teledyne FLIR LLC

- Parker Hannifin Corp

- Rockwell Automation

- Baker Hughes Company

Recent Developments

-

In April 2024, SEAM Group and KCF Technologies formed a strategic alliance to leverage their respective strengths in industrial safety and vibration monitoring. The partnership is aimed at merging KCF's sophisticated machine health monitoring solutions with SEAM's asset reliability and safety services. The partnership is expected to assist industrial customers in achieving maximum uptime, minimizing risk, and reducing maintenance expenses by providing a more holistic predictive maintenance solution across industries such as energy, manufacturing, and heavy industry.

-

In April of 2024, FLIR Systems introduced the SV88 and SV89 Vibration and Temperature Monitoring Solution Kits, intended to provide in-depth intelligence on equipment condition. These small, durable, wireless sensors allow for real-time monitoring of industrial equipment, enabling users to see trends and spot potential failure modes before they occur. Providing support for protocols such as Wi-Fi and MQTT, the kits are well-suited for use in new as well as existing industrial settings, advancing predictive maintenance strategies and reducing unplanned downtime.

-

In March 2024, Megger Group acquired Diagnostic Solutions Limited (DSL), a UK company that provides solutions related to vibration monitoring and analysis of rotating equipment. The purchase broadens Megger's product range by incorporating DSL's condition monitoring equipment into its portfolio. This acquisition strengthens Megger's capability to meet customers in industries such as power generation, water, and industrial automation with a more comprehensive range of asset health and diagnostics solutions.

-

During February 2024, RDI Technologies launched IRIS Edge as a new offering that utilizes edge computing and motion amplification for real-time delivery of vibration information. IRIS Edge is implemented for plug-and-play use with no need to attach sensors to the equipment physically. AI-enhanced trend monitoring and fault visualization in real-time are among its features, all of which allow maintenance staff to identify faults earlier, ensure safety, and minimize failures across manufacturing facilities and critical infrastructure.

Vibration Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.81 billion |

|

Revenue forecast in 2030 |

USD 2.57 billion |

|

Growth rate |

CAGR of 7.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, process, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E. |

|

Key companies profiled |

Honeywell International Inc.; Emerson Electric Co.; SKF; Schaeffler AG; Analog Devices; Inc.; ALS; Teledyne FLIR LLC; Parker Hannifin Corp; Rockwell Automation; Baker Hughes Company |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vibration Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vibration monitoring market report based on component, process, industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Vibration Monitoring

-

Portable Vibration Monitoring

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Power Generation

-

Mining & Metals

-

Chemicals

-

Automotive

-

Aerospace

-

Food & Beverages

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vibration monitoring market size was estimated at USD 1,702.2 million in 2024 and is expected to reach USD 1.81 billion in 2025.

b. The global vibration monitoring market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 2.57 billion by 2030.

b. The North America vibration monitoring market accounted for more than 33% revenue share in 2024. This dominance is driven by the strong presence of industries such as manufacturing, oil & gas, and power generation. The region benefits from early adoption of advanced technologies like IIoT-based monitoring systems and has a robust regulatory framework supporting predictive maintenance.

b. The key players in the vibration monitoring market include Honeywell International Inc, Emerson Electric Co., SKF, Schaeffler AG, Analog Devices, Inc., ALS, Teledyne FLIR LLC, Parker Hannifin Corp, Rockwell Automation, Baker Hughes Company, among others.

b. Key factors that are driving market growth include rising demand for predictive maintenance, adoption of IIoT technologies, and stricter equipment safety regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."