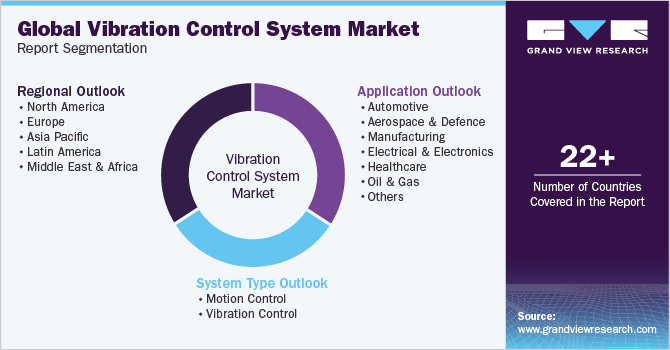

Vibration Control System Market Size, Share & Trends Analysis Report By System Type, By Application (Automotive, Aerospace & Defense, Manufacturing, Electrical & Electronics Healthcare, Oil & Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-196-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2024 - 2030

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Vibration Control System Market Trends

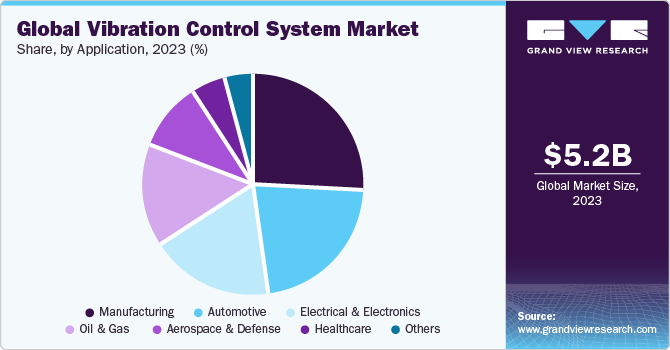

The global vibration control system market size was estimated at USD 5,182.0 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. The market is witnessing increased global demand due to the rising focus on mechanical balancing and stability in automobiles and industrial machinery. Vibration control systems (VCS) are isolation systems that effectively address incoming vibrations. These systems control vibrations in stationary and moving machines, reducing friction and other disruptive factors. Also, these systems safeguard machine parts' operation, heat generation, wear & tear, loss of energy, and cracks & breakage, among others. They are used in various industries such as automotive, aero & defense, electrical & electronics, oil & gas, and healthcare.

The rapidly growing automotive and aviation industries are expected to drive market growth over the forecast period. The rapid development of next-generation vibration control systems for aircraft to reduce vibration is a primary factor driving the market growth. Also, anti-vibration systems, such as mounting & bushing, reduce quivers in the automotive industry. These systems help in increasing vehicle efficiency as well as the life span of the components. VCSs were initially designed for use in automotive and electrical equipment. These systems are now used in aerospace & defense, oil & gas, and mining & quarrying, among others.

Furthermore, vibration monitoring systems are gaining ground in the healthcare sector as well pharmaceutical companies are using them to mitigate the impacts of trembles and quivers on sensitive equipment, such as DNA sequencing microarrays and Magnetic Resonance Imaging (MRIs), in healthcare and scientific institutions. On the other hand, factors, such as strict industry regulations, high costs of systems, and component reliability issues, are anticipated to hinder market growth over the coming years.

The strict regulations and policies set by the U.S. defense and airline authorities are compelling manufacturers of VCS to upgrade their design. Also, in recent years, anti-vibration control systems are being used in the aerospace & defense industry to maintain the reliability of various components, such as sensors, actuators, and controllers that needed to be improved, thus inhibiting the market's growth. However, the rising demand for smart, self-controlling, and adaptive VCS, along with technological development, such as Active Noise and Vibration Control systems (ANVC) and web-based continuous machine condition monitoring in aircraft, is an opportunity for market growth over the coming years.

Market Concentration & Characteristics

The vibration control system market is marked by its diverse applications across industries, including manufacturing, automotive, aerospace, and healthcare. This market encompasses a wide range of products such as isolators, dampers, absorbers, and controllers, each designed to address specific vibration control needs. The end-users of these systems vary widely, from large industrial enterprises to small businesses, contributing to the market's fragmentation.

Technological advancements are instrumental in shaping the vibration control system market, with ongoing innovations such as the integration of smart sensors, adaptive control algorithms, and IoT capabilities significantly enhancing operational efficiency. The continual refinement of system capabilities, incorporating intelligent sensors for real-time data analysis, and the implementation of adaptive control algorithms demonstrate the commitment to delivering adaptable solutions. Furthermore, the integration of IoT capabilities facilitates seamless connectivity and remote monitoring, enhancing operational convenience. This continuous evolution highlights the industry's dedication to innovation, ensuring that vibration control solutions remain at the forefront of technological developments to address diverse business needs.

Key players in the vibration control system market are strategically expanding their global presence through targeted partnerships and collaborations. This strategic approach enhances market influence, allowing firms to remain competitive in this dynamic industry. The market's growth is driven by the escalating emphasis on operational efficiency spurred by the ascent of smart manufacturing practices. Industries relying on precise vibration control, such as manufacturing, automotive, and aerospace, are witnessing expansion, presenting lucrative opportunities for market players to deliver solutions that elevate overall product quality.

System Type Insights

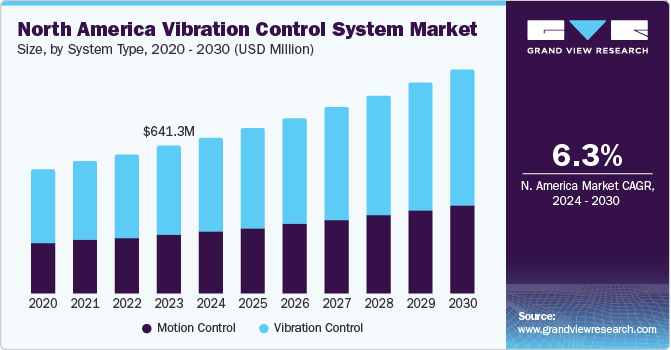

The vibration control systems (VCS) segment is expected to register the fastest CAGR of over 6.7% during the forecast period. The growth is attributed to the rising demand for tremble and quiver controls in various oil & gas and power plant industries. These mechanisms use multiple anti-vibration devices such as washers, absorbers, bushes, mounts, springs, hangers, and dampers to isolate the effects of tremble and shock in power plants. The vibration control segment is bifurcated into various sub-segments, including isolating pads and isolators.

VCS with motion control type is anticipated to account for a considerable industry share by 2030. This growth is ascribed to the growing automotive and aerospace sectors. Motion control systems are used in fixed-wing aircraft that help to the reduction of quiver and tremble in the helicopter fuselage generated by the main rotor. Besides, the increasing need for passenger comfort and convenience in aircraft is also expected to spur segment growth over the years.

Application Insights

In 2023, the manufacturing segment accounted for 25.55% of the global revenue share. The electrical & electronics vertical is expected to open significant growth opportunities for all players involved in the value chain on the back of increasing industrial machinery manufacturing globally. The vibration control mechanisms in the electronics industry consist of control electronics, vibration sensors, and actuators, which create a feedback loop in the mechanism and protect structures and equipment from impact forces.

The anti-vibration components for industrial applications include cylindrical buffers, bushes, cylindrical mounts, level mounts, and sandwich mounts. These components provide measuring equipment, passive quiver isolation on electronic instruments, and test cells. Other than electronic & electrical applications, these mechanisms are used in multiple verticals, such as mining & quarrying and food manufacturing. Vibration control systems used in the automotive industry are anticipated to grow considerably over the forecast period.

Vibration control systems help in increasing the efficiency of vehicles. By minimizing vibrations and reducing friction, these systems contribute to the optimal functioning of vehicle parts, resulting in improved fuel efficiency and reduced wear and tear. The adoption of vibration control systems in the automotive industry continues to grow as manufacturers strive to enhance vehicle performance, comfort, and compliance with regulations. These systems are vital in reducing vibrations, improving efficiency, extending component longevity, reducing noise, and advancing technological capabilities in the automotive sector.

Regional Insights

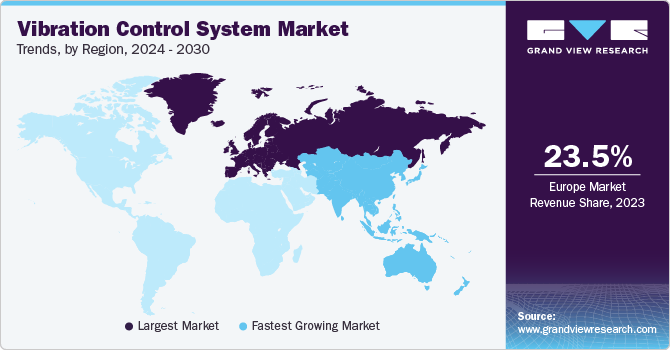

Europe accounted for the largest market share of 23.49% in 2023. Asia Pacific is expected to emerge as the fastest-growing region with a CAGR of 8.2% over the forecast period. The growth can be attributed to rapid industrialization in Japan, China, and India. Moreover, key manufacturers are from China because of the low capital cost required in the country and developments in technology in the market. Moreover, Latin America is expected to grow considerably over the forecast period owing to continuous technological upgrades in the VCS. Brazil is considerably contributing to the market growth owing to the rapid development in the oil & gas, textile, automotive, and machinery & equipment sectors.

North America held a market share of more than 20% in 2023 of the global revenue. The growth is attributed to the growing demand for healthcare, aviation, and defense anti-vibration systems in the U.S. and Canada. In the current market scenario, the U.S. dominates the regional market. Large-scale adoption of these mechanisms can be seen in the U.S. electronics & electrical, automotive, and food manufacturing sectors. Being early adopters of vibration control technology, North America is home to many vibration-controlling manufacturers and solution providers.

U.S. Vibration Control Market

The vibration control market in U.S. is growing due to the rising awareness about the benefits of vibration control systems, such as improved safety, increased productivity, and reduced maintenance costs, especially in the manufacturing, oil & gas, and aerospace industries.

U.K. Vibration Control Market

The vibration control market in the U.K. accounted for a revenue share of 25.81% in the European market. The growth can be attributed to the expansion of manufacturing and construction sectors to enhance equipment performance and safety.

France Vibration Control Market

The vibration control market in France accounted for a revenue share of 14.28% in the European market. The revenue share can be attributed to the Increasing focus on environmental sustainability and growth in infrastructure development projects such as transportation and energy.

Germany Vibration Control Market

The vibration control market in Germanya ccounted for a revenue share of more than 22%. The revenue share can be attributed to the strong industrial base and technological advancements in automotive and machinery sectors stimulating the need for vibration control systems to improve product quality and longevity.

China Vibration Control Market

The vibration control market in China accounted for a revenue share of more than 40% in the Asia Pacific market. The revenue share can be attributed to the rapid urbanization and construction activities leading to a surge in demand for vibration control solutions to mitigate the impact of structural vibrations on buildings and infrastructure.

India Vibration Control Market

The vibration control market in India accounted for a revenue share of more than 12% in the Asia Pacific market. The revenue share can be attributed to the rising investments in renewable energy projects creating opportunities for vibration control applications in wind turbines and solar panel installations.

Japan Vibration Control Market

The growth of the vibration control market in Japan can be attributed to the high prevalence of earthquake-prone regions necessitating the adoption of advanced vibration control technologies in buildings, bridges, and critical infrastructure for seismic resilience.

Kingdom of Saudi Arabia (KSA) vibration control market

The growth of the vibration control market in KSA can be attributed to accelerated infrastructure development initiatives such as smart cities and transportation networks driving the demand for vibration control systems to meet stringent performance and safety standards.

Key Vibration Control Systems Company Insights

Some of the key vibration control system vendors operating in the market include HUTCHINSON, and PARKER HANNIFIN CORP.

-

HUTCHINSON designs and manufactures smart solutions such as vibration control, body sealing systems, precision sealing systems, belt drive systems, fluid management systems, and sealing technologies for automotive & trucks, aerospace, defense, rail, and energy, among other industries.

-

PARKER HANNIFIN CORP is engaged in the manufacturing of motion and control technologies and systems. The critical solutions offered by the company include fluid power systems, electromechanical controls, and associated components. These solutions are utilized in a wide range of industries and applications, such as food production machinery, alternative energy, life sciences and medical, oil & gas, power generation, industrial machinery, agriculture, construction machinery, marine, mining, chemical and refining, telecommunications, aerospace, industrial and commercial refrigeration, and transportation.

Sumitomo Riko Company Limited, and Trelleborg AB are some of the emerging RAN intelligent controller vendors.

-

Sumitomo Riko Company Limited produces rubber and various synthetic resin products. Through its subsidiaries in twenty-four countries, the company holds a significant share of automotive anti-vibration products. The company caters to industries such as automotive, infrastructure, housing environment, electronics, and healthcare. It operates through two business segments, namely automotive products and general industrial products. The automotive product segment supplies anti-vibration rubber, interior equipment, hoses, sound reducing materials, and products for fuel seal products cell vehicles to domestic and foreign customers.

-

Trelleborg AB offers engineered polymer solutions that damp, seal, and protect critical applications. The company operates through three business areas, namely Trelleborg Sealing Solutions, Trelleborg Industrial Solutions, and Group Activities.

Key Vibration Control System Companies:

The following are the leading companies in the vibration control system market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these vibration control system companies are analyzed to map the supply network.

- ContiTech Deutschland GmbH

- Resistoflex

- HUTCHINSON

- ELESA S.p.A.

- Fabreeka

- Sentek Dynamics Incorporated

- VICODA GmbH

- Isolation Technology Inc.

- Trelleborg AB

- Kinetics Noise Control, Inc

Recent Developments

-

In November 2022, Sumitomo Riko Company Limited entered into a joint-development contract to shift to a circular economy for rubber, resin, and urethane waste with LanzaTech NZ, Inc., a U.S.-based carbon capture and transformation company. The agreement aimed to facilitate the transition to a circular economy for waste rubber, resin, and urethane, and involved the development of new technologies. Through this collaboration, both companies aimed to contribute to the creation of a sustainable society that is characterized by carbon neutrality and circularity.

-

In March 2021, Hutchinson partnered with va-Q-tec, a provider of Vacuum Insulation Panels (VIPs), to create cutting-edge insulation solutions for the automotive and aerospace industries. By leveraging each other's technologies, the two companies aimed to deliver superior thermal and fire management capabilities to the mobility market.

Vibration Control System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5,182.0 million |

|

Revenue forecast in 2030 |

USD 7,933.9 million |

|

Growth Rate |

CAGR of 6.3% from 2024 to 2030 |

|

Actual Data |

2017 - 2030 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

System type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Russia; China; India; Japan; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

Resistoflex; ContiTech Deutschland GmbH; Fabreeka; HUTCHINSON; Sentek Dynamics Incorporated.; Isolation Technology Inc.; VICODA GmbH; ELESA S.p.A.; Trelleborg AB; Kinetics Noise Control, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vibration Control System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global vibration control system market report based on system type, application, and region:

-

System Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Motion Control

-

Springs

-

Hangers

-

Washers & Bushes

-

Mounts

-

-

Vibration Control

-

Isolating Pads

-

Isolators

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Manufacturing

-

Electrical & Electronics

-

Healthcare

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vibration control system market size was estimated at USD 4.91 billion in 2022 and is expected to reach USD 5.18 billion in 2023.

b. The global vibration control system market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 7.93 billion by 2030.

b. Europe dominated the vibration control system market with a share of 23.34% in 2022. This is attributable to the growing demand for healthcare, aviation, and defense anti-vibration systems in U.K and Germany.

b. Some key players operating in the vibration control system market include ContiTech AG; Lord Corporation; Resistoflex (P) Ltd.; HUTCHINSON; Fabreeka; Sentek Dynamics Inc.; VICODA GmbH; Isolation Technology Inc.; Trelleborg AB; and Kinetics Noise Control, Inc.

b. Key factors that are driving the vibration control system market growth include growing emphasis on the mechanical stability and balancing of industrial machinery and automobiles, growing automotive as well as the aviation industry, rising demand for self-controlling smart & adaptive VCS, along with technological developments, such as web-based continuous machine condition monitoring and Active Noise and Vibration Control (ANVC) systems in aircraft.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."