Vials And Ampoules Market Size, Share & Trends Analysis Report By Material (Glass, Plastic), By End Use Industry (Pharmaceutical), By Product (Vials, Ampoules), By Size (Small), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-630-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2028

- Industry: Bulk Chemicals

Vials And Ampoules Market Size & Trends

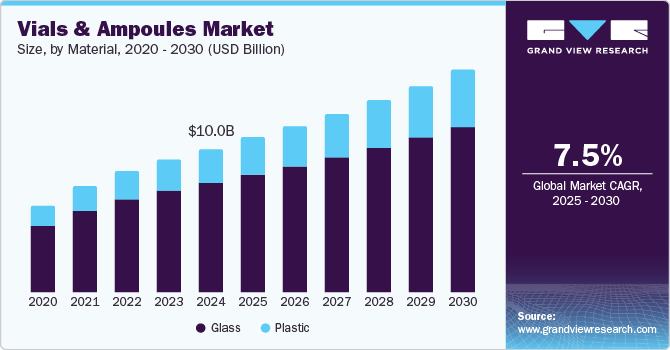

The global vials and ampoules market size was valued at USD 10.00 billion in 2024 and is expected to expand at a CAGR of 7.5% from 2025 to 2030. This growth is attributed to the rapid expansion of the pharmaceutical industry, which is fueled by increasing demand for biologics, vaccines, and parenteral packaging due to rising chronic diseases and a growing geriatric population. In addition, the shift towards using inert materials for drug packaging, particularly glass, ensures product integrity and safety. Furthermore, technological advancements and a surge in healthcare spending further support market expansion, with projections estimating significant growth in the coming years.

Vials and ampoules are specialized containers used for the storage and delivery of pharmaceuticals and biologics. The market for these packaging solutions is experiencing significant growth, driven by several key factors. One primary driver is the increasing global demand for pharmaceuticals and biologics, fueled by a rise in chronic diseases, an aging population, and the shift towards personalized medicine. As healthcare needs evolve, the necessity for effective packaging solutions such as vials and ampoules becomes paramount to ensure the safe storage and administration of these medical products.

Technological advancements are also playing a crucial role in this market's expansion. Innovations in materials, such as the development of advanced polymers and glass types, enhance the durability and functionality of vials and ampoules. New manufacturing techniques, including blow molding and injection molding, allow for more precise production while reducing costs. Furthermore, integrating technologies such as RFID enhances tracking capabilities throughout the supply chain, ensuring product safety and authenticity.

Moreover, in developing countries, the adoption of vials and ampoules is accelerating due to rising healthcare expenditures and increased awareness surrounding patient safety. As these nations invest in their healthcare systems to combat chronic diseases prevalent among their populations, the demand for reliable packaging solutions grows correspondingly. This trend reflects a broader commitment to improving healthcare quality and accessibility.

Material Insights

The glass segment dominated the global vials and ampoules industry and accounted for the largest revenue share of 76.4% in 2024, primarily driven by the material's inert properties, which prevent interactions with drug components, making it ideal for sterile formulations. In addition, increasing pharmaceutical expenditure and the expansion of the pharmaceutical industry, especially in emerging economies, further boost the demand for glass vials and ampoules. Furthermore, technological advancements are also improving glass vial manufacturing, promoting market growth.

The plastic segment is expected to grow at a CAGR of 8.6% over the forecast period, owing to its lightweight, durable, and shatterproof characteristics, making it a preferred choice for pharmaceutical applications. In addition, the increasing demand for single-use and pre-filled packaging solutions enhances safety and reduces contamination risks, particularly for biologic drugs and vaccines. Furthermore, advancements in plastic materials, such as cyclic olefin copolymers, improve stability under various storage conditions. Moreover, the rising focus on cost-effective packaging solutions further propels the adoption of plastic vials and ampoules across healthcare sectors.

End Use Industry Insights

The pharmaceutical segment led the market with the highest revenue share of 81.2% in 2024, driven by the increasing demand for vaccines, biologics, and parenteral drugs. Factors such as a rising geriatric population and the increasing prevalence of chronic diseases necessitate advanced packaging solutions to maintain drug integrity and safety. Furthermore, the expansion of pharmaceutical production in emerging economies and the rise in healthcare spending globally contribute to the increased need for vials and ampoules

The food and beverage segment is expected to grow at a CAGR of 9.6% from 2025 to 2030, owing to the increasing demand for convenient and safe packaging solutions for liquid products. Furthermore, the rise in consumer preference for ready-to-drink beverages and the need for portion-controlled packaging enhance the demand for vials and ampoules. Moreover, stringent regulations regarding food safety and quality assurance necessitate reliable packaging materials that preserve product integrity.

Product Insights

The ampoules held the dominant position in the global vials and ampoules industry and held the largest revenue share of 75.3% in 2024. This growth is attributed to the rising demand for inert packaging materials, particularly in sterile formulations within the expanding pharmaceutical industry. Ampoules' single-dose design ensures sterility and reduces contamination risks, driving their adoption in clinical and home settings. In addition, increased healthcare spending and infrastructure development, especially in the Asia Pacific region, contribute to market expansion. Furthermore, the growing popularity of K-beauty skincare routines and veterinary applications also boost ampoule demand.

The vials are expected to grow at the fastest CAGRO of 8.3% over the forecast period, driven by the growing demand for safe and efficient packaging solutions in the pharmaceutical industry. Vials are essential for storing injectable, vaccines, and biologics, ensuring product stability and sterility. In addition, the rise in chronic diseases and the need for advanced drug delivery systems are driving this demand. Furthermore, innovations in vial technology, such as the development of break-resistant designs and eco-friendly materials, enhance their appeal and functionality, further contributing to market expansion.

Size Insights

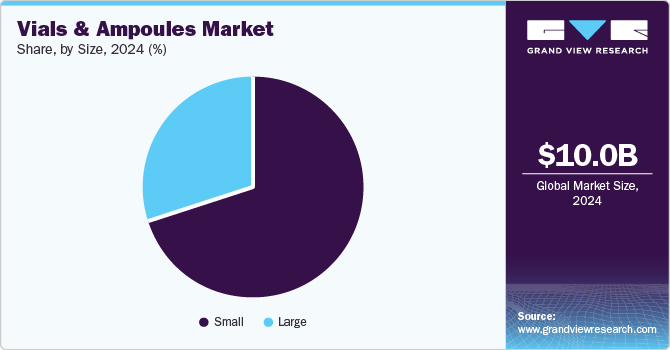

The growth of the small-sized vials and ampoules dominated the market and accounted for the largest revenue share in 2024, primarily driven by the increasing demand for vaccines and biologics, particularly in the pharmaceutical industry. These smaller containers are ideal for single-dose applications, ensuring sterility and reducing contamination risks. Furthermore, the rise in chronic diseases necessitating injectable medications contributes significantly to the popularity of small-sized vials and ampoules.

The large-sized vials and ampoules are expected to grow at a CAGR of 6.6% from 2025 to 2030, owing to the increasing use of larger containers for parenteral solutions, particularly in the cosmetic and food industries. These larger packaging options cater to bulk applications, enhancing convenience for manufacturers and consumers alike. In addition, the rising demand for multi-dose formulations in pharmaceuticals also supports this segment's growth. Furthermore, advancements in packaging technology that improve the safety and efficacy of large vials and ampoules contribute to their expanding market presence.

Regional Insights

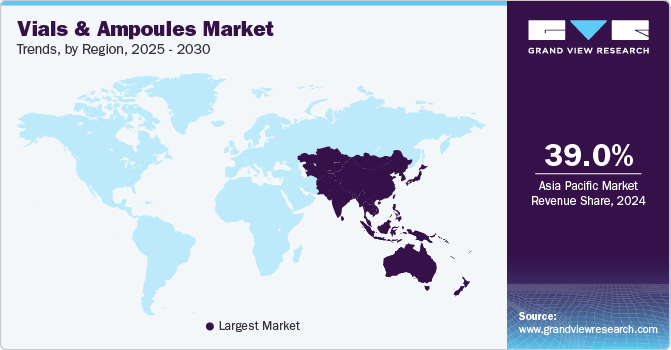

The Asia Pacific vials and ampoules market dominated the global market and accounted for the largest revenue share of 39.0% in 2024. This growth is attributed to an increasing demand for pharmaceuticals and biologics. Rapid urbanization and a growing population are contributing to rising healthcare needs. Furthermore, government initiatives aimed at improving healthcare infrastructure and accessibility are fostering investments in pharmaceutical packaging. Moreover, the prevalence of chronic diseases is also on the rise, prompting healthcare providers to seek reliable packaging solutions that ensure patient safety and effective drug delivery.

China Vials And Ampoules Market Trends

The vials and ampoules market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its status as a leading pharmaceutical producer. The government's commitment to enhancing healthcare services, coupled with rising domestic demand for innovative drugs, is driving this growth. Furthermore, increased investments in biotechnology and research initiatives are encouraging manufacturers to adopt advanced packaging solutions. Moreover, the focus on regulatory compliance and patient safety is pushing for high-quality vials and ampoules that meet stringent industry standards, thereby enhancing market dynamics.

Middle East & Africa Vials And Ampoules Market Trends

The Middle East and Africa vials and ampoules market is expected to grow at a CAGR of 8.4% over the forecast period, owing to rising healthcare investments from both governments and private sectors. In addition, efforts to improve healthcare access and quality are leading to a greater demand for reliable pharmaceutical packaging solutions. Furthermore, growing awareness of counterfeit drugs has created a push for secure packaging options that ensure product integrity.

North America Vials And Ampoules Market Trends

The vials and ampoules market in North America is expected to grow significantly over the forecast period, primarily due to the presence of numerous biopharmaceutical companies engaged in extensive research and development. In addition, the increasing focus on biologics and personalized medicine is driving demand for advanced packaging solutions that ensure product stability and safety. Furthermore, stringent regulatory requirements regarding pharmaceutical packaging compel manufacturers to innovate continuously, leading to enhanced product offerings. Moreover, the growing emphasis on patient-centric approaches further shapes market dynamics in this region.

The U.S. vials and ampoules market dominate the North American market and held the largest revenue share in 2024, driven by strict regulatory standards that prioritize patient safety and product integrity. Furthermore, the robust pharmaceutical industry is characterized by continuous innovation, which increases the need for high-quality packaging solutions. Moreover, the rising focus on biologics and advanced drug delivery systems drives demand for specialized vials and ampoules designed to meet specific requirements. This combination of factors positions the U.S. market as a key player in the global landscape.

Europe Vials And Ampoules Market Trends

The growth of the vials and ampoules market in Europe is projected to be driven by ongoing research initiatives in pharmaceuticals and biologics. A strong emphasis on innovation within the healthcare sector encourages manufacturers to develop advanced packaging solutions that comply with rigorous regulatory standards. Furthermore, increasing healthcare expenditures across various European nations contribute to heightened demand for reliable drug delivery systems. Moreover, the focus on patient safety further drives the need for high-quality vials and ampoules, positioning Europe as a significant contributor to global market trends.

Key Vials And Ampoules Company Insights

Key companies in the global vials and ampoules industry include Schott AG, Gerresheimer AG, SGD SA, and others. These companies are employing numerous strategies to enhance their viable edge. These include investing in research and development to innovate packaging solutions, expanding distribution networks, and forming strategic partnerships or alliances. Furthermore, companies are focusing on mergers and acquisitions to strengthen market presence and leverage technological advancements.

-

Schott AG produces a diverse range of products, including vials and ampoules made from Type I borosilicate glass, which ensures superior chemical resistance and stability for pharmaceutical applications. The company operates primarily in the pharmaceutical packaging segment, focusing on providing reliable solutions that meet stringent regulatory standards and enhance drug safety during storage and delivery.

-

Gerresheimer AG manufactures a wide array of products, including glass and plastic vials, ampoules, and prefillable syringes designed to meet the needs of the pharmaceutical and biotech industries. The company operates within the healthcare packaging segment, emphasizing innovation and quality to ensure that its products comply with rigorous industry standards while facilitating safe and effective drug delivery.

Key Vials And Ampoules Companies:

The following are the leading companies in the vials and ampoules market. These companies collectively hold the largest market share and dictate industry trends.

- Schott AG

- Gerresheimer AG

- SGD SA

- Nuova Ompi SRL (Stevanato Group)

- NIPRO Corporation

- Piramida d.o.o.

- APL Solutions Pvt. Ltd

- Crestani srl

- Pacific Vials Manufacturing Inc.

- Borosil

Recent Developments

-

In September 2024, Gerresheimer, SCHOTT Pharma, and Stevanato Group have formed a strategic partnerhsip to support the implementation of ready-to-use (RTU) cartridges and vials in the pharmaceutical industry. This alliance is called "Alliance for RTU", aims to share expertise on sterile primary packaging of high-quality, specifically focusing on RTU configurations over traditional bulk packaging. By adopting RTU setups, pharmaceutical companies can reduce operational risks and improve efficiency. The alliance seeks to create an open platform to educate manufacturers on the benefits of RTU processes, helping them evaluate investments for transformation to effective filling systems, ensuring safer medication delivery in vials and ampoules.

-

In February 2024, Nipro launched its D2F (Direct to Fill) glass vials, utilizing Stevanato Group's EZ-Fill technology. These ready-to-use vials aim to enhance efficiency and safety in pharmaceutical manufacturing. The D2F vials and ampoules offer a streamlined process, reducing the need for washing, depyrogenation, and sterilization. This innovative approach minimizes particulate contamination risks, ensuring higher quality. Nipro's adoption of EZ-Fill technology underscores its commitment to providing advanced solutions for the pharmaceutical industry, optimizing vial processing and improving the overall safety and reliability of injectable drug products.

-

In January 2024, SCHOTT Pharma introduced EVERIC freeze vials, designed specifically for mRNA and gene therapies requiring deep-cold storage down to -80°C. These new glass vials and ampoules aim to protect sensitive medications from infectious diseases, cancer, and central nervous system disorders. The vials feature a strength-optimized geometry to minimize breakage risks during deep-cold storage. Rigorous testing confirms that these vials maintain container closure integrity, crucial for drug stability and efficacy. Manufactured in Germany, the EVERIC freeze vials are available in 2-30 mL sizes and can be supplied ready-to-use, offering pharmaceutical companies a reliable solution for deep-cold storage needs.

Vials And Ampoules Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.77 billion |

|

Revenue forecast in 2030 |

USD 15.45 billion |

|

Growth rate |

CAGR of 7.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, end use industry, product, size, region. |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa. |

|

Country scope |

U.S., Canada, Mexico, Switzerland, Germany, France, Italy, UK, China, Japan, India, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, and South Africa. |

|

Key companies profiled |

Schott AG; Gerresheimer AG; SGD SA; Nuova Ompi SRL (Stevanato Group); NIPRO Corporation; Piramida d.o.o.; APL Solutions Pvt. Ltd; Crestani srl; Pacific Vials Manufacturing Inc.; Borosil |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vials And Ampoules Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global vials and ampoules market report based on material, end use industry, product, size, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

-

End Use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Chemical

-

Personal Care & Cosmetics

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vials

-

Ampoules

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Large

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Switzerland

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."