Veterinary Telehealth Market Size, Share & Trends Analysis Report By Type, By Animal type (Canine, Feline, Equine, Bovine, Swine, Others), Delivery Mode, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-329-7

- Number of Report Pages: 154

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Veterinary Telehealth Market Size & Trends

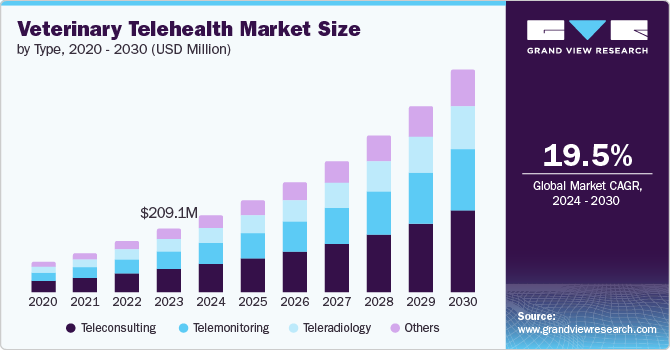

The global veterinary telehealth market size was valued at USD 306.72 million in 2024 and is projected to grow at a CAGR of 20.33% from 2025 to 2030. The increasing emphasis on veterinary telehealth and illness identification is responsible for the growing uptake of different types of telehealth like teleconsultation, teleradiology, telemonitoring, among others. In addition, some of the key factors propelling the market are the increasing occurrence of IoT & AI among pet parents and the incidence of chronic and zoonotic diseases in animals.

The market is being further stimulated by the rising prevalence of conditions like diabetes, kidney disorders, spinal disc problems, and blood pressure-related concerns among both companion as well as livestock animals. Pet obesity rates are rising as a result of ailments including osteoarthritis and joint disorders, which is driving up need for more effective treatments. For instance, according to May 2024 published survey by Association of Pet Obesity Prevalence (APOP), the U.S. has over 59% dogs and 61% cats that are either overweight or suffer from obesity in 2022. The 2022 survey further highlighted that diseases like obesity can prove to be fatal for the pet but yet there is a lack of awareness about such conditions among the pet owners.

Furthermore, disease outbreaks in livestock animals pose a serious socioeconomic risks due to the disruption they cause to local, regional, and global markets as well as the loss of output. For instance, a 2024 research study from National Library of Medicine (NLM) reveals that in Algeria, from 2014 - 2022 the overall prevalence of Foot-and-mouth Disease (FMD) was recorded at 34.5%. In some regions it was estimated to be as high as 91.6%, with cattle being the most affected animal species. The industry is growing due to these causes. Moreover, in April 2024, comprehensive cow milk testing revealed that 30% - 40% of the samples tested positive for H5N1 or Bird Flu. This highlights the widespread nature of the disease in the country’s cows.

Additionally, the number of cattle worldwide has been rising rapidly. Both developed and emerging economies are seeing an increase in the demand for animal products. This has increased worries about cattle health. According to the National Beefwire, as of January 2024, there are more than 94.26 million cattle globally. India currently holds the highest population of over 307.5 million bovine population, accounting for 33% of world’s inventory.

All these factors, including growing animal population and increasing disease prevalence are rising the demand of swift yet effective and convenient treatment options. Animal owners, as well as veterinarians, are seeking means to treat as many animals as possible to ensure high penetration of at least the basic healthcare. Telehealth as a whole provides a versatile option to tackle these issues as due to its remote accessibility, long-distance communications between the veterinarian and the animal owner make it possible to decide on proper diagnostic and treatment schedules for the animals. This mode of healthcare eliminates the need for both the veterinarian and the animal to be physically present for examination/consultation and effectively provides advantages like reduction in waiting time, reduction in cost, and increase in examined/treated patient volume.

Furthermore, another crucial driving factor for the market is the growing regulatory purview to ensure maintenance of a quality standard in telehealth delivery. Authorities across the globe are making regulatory modifications to ensure that the penetration of telehealth increases while maintaining a standard of quality. For example, in May 2024, National Parks Board’s Animal and Veterinary Service (AVS) along with the Singapore Veterinary Association (SVA) developed guidelines for veterinarians regarding effective and safe use of telehealth in the veterinary practice. Furthermore, in July 2024, Florida state in the U.S. passed a “Providing Equity in Telehealth Services (PETS) Act”, under which the veterinarians in the state can prescribe medications, diagnose as well as treat patients remotely by virtual means.

Moreover, in Australia, as per July 2024 reports, the New South Wales (NSW) Parliamentary Inquiry Committee is actively investigating the adoption of telehealth as an alternative option to combat the veterinarian shortage in the state.

The growing regulatory purview, which establishes clear guidelines and standards for telehealth delivery and increases the adoption and penetration of telehealth services, is proving to be beneficial for the growth of the market. Continuous regulatory upgradation and purview ensures that quality standards are maintained as well as updated periodically for benefit of the end-users, which in turn develops trust among pet owners and veterinarians, leading to increased adoption and demand for telehealth services. This regulatory support is also encouraging investment and innovation.

Developing & under-developed nations in the Americas, the Middle East, and Africa are comparatively slower to adopt veterinary care that is both affordable and state-of-the-art. Whether designed for human or animal monitoring environments, large-scale telehealth systems share implementation challenges such as interstate licensing, cost-effectiveness, biocompatibility, industry momentum, ethical concerns, diagnostic feasibility, usability, and anonymity.

In developing nations like India, more broadband connectivity is needed, especially for remote and rural regions, to enable access to numerous bandwidth-intensive telehealth apps. When technology first starts out, it needs assistance and consideration. The only entity with the authority to support the growth and survival of that nation is its government. Although the internet is a great medium for sharing information across distant workstations, security issues might arise with it. Thus, it is important to find solutions to the issues of preventing unauthorized access to information exchanged between computers.

Moreover, there is variation in the state-level licensing regulations intended to control the conduct of interstate telehealth. Furthermore, since no high-tech advancement can alter anything when the end users do not want to change, patients and livestock owners lack confidence in the results of e-medicine. One psychological hurdle is that certain veterinarians, livestock owners, and paraveterinary professionals may find it uncomfortable to be on television or in a video. These elements contribute to the low uptake of telehealth in developing nations.

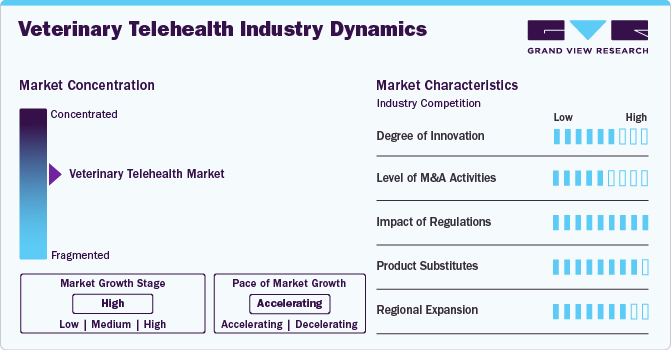

Market Concentration & Characteristics

The degree of innovation in this market is estimated be moderate owing to advancements such as emergence of novel care delivery platforms as well as industry players focusing on increasing accessibility of telehealth to animals for various ailments. Furthermore, established veterinary software players are now entering this space to expand their innovative product portfolio and dominance using their high market penetration.

The industry is experiencing moderate level of M&A activities. Leading manufacturers are focusing on acquiring financial funding through funding rounds with an aim to expand into the market through the means of product portfolio and regional expansion. For instance, in June 2024, Swedish company, FirstVet, in a Series C funding round, acquired over Euro 20 million (USD 22.11 million) to expand their existing veterinary telehealth services.

Impact of regulation is estimated to be high in this industry. In the recent times, especially post-pandemic, the adoption has skyrocketed, increasing the need for structured regulatory oversight. Authorities from various countries across the world are actively involved in formulating regulatory guidelines for veterinary telehealth.

The industry has high-level of product substitutes. Apart from some dominant telehealth providers like AirVet, whiskerDocs Llc., TeleVet, FirstVet, and Chewy inc.; each country has its own providers, fragmenting the market. Furthermore, many governments are also participating in providing telehealth services for animals in their country, increasing the number of substitutes even more.

The industry is experiencing moderate-high impact of regional expansion. Service providers across the globe are attempting to spread their dominance by entering untapped markets. For instance, in May 2024, Animal HealthLink along with Veterinarians Without Borders North America introduced a new program specifically customized for remote communities in the Northwest & Nunavut territories of Canada. This program will prove to be beneficial because these territories currently have only two veterinary practices.

Type Insights

The teleconsulting segment held the highest market share of 36.36% in 2024. Veterinarians have been using teleconsulting to get guidance and insights on animal care from veterinary experts via telehealth systems. Teleconsultation, thus, enhances treatment by offering suitable medical advice for sick animals. Teleconsultation also reduces ancillary costs and saves money on traveling. Furthermore, professional advice can be followed right away, saving time that might otherwise be lost on lengthy waits.

Teleradiology segment is anticipated to grow at the highest CAGR over the forecast period owing to the growing adoption of veterinary teleradiology in timely diagnosis of ailments. Furthermore, due to the growing need for prompt diagnosis and remote veterinary care, veterinarians can diagnose patients more quickly and accurately by using veterinary teleradiology, which enables remote analysis of images. As a result, the market is projected to maintain its upward trajectory, with a compelling a long-term outlook.

Animal type Insights

By animal type, canine segment held the highest market share in 2024. Dogs have a larger share than other animals because of rising costs for veterinary care, particularly in wealthy nations. For example, a November 2023 survey from the global pet business revealed that Italian households spend between USD 820 and USD 1,261 year on pet care; in 2023, nearly 29% of pet owners chose pet insurance, up from 20.4% in 2022. As a result, rising healthcare spending fosters market expansion. Growing consumer knowledge of telehealth's availability and advantages has led to an increase in its usage. Another element driving the expansion of the industry is owners' general concerns about the general health and hygiene of their pets.

Feline segment is anticipated to grow at the highest CAGR of 21.16% over the forecast period. This can be owed to the fact that adoption of cats over dogs as pets is rising in regions with high telehealth adoption like Europe. Furthermore, growing prevalence of infectious diseases among cats is also one of the high impact-rendering drivers for segment growth. Other prevalent conditions in felines such as chronic kidney disease, hyperthyroidism, endocrine diseases, and diabetes have raised clinical urgency to adopt veterinary telehealth, acting as high-impact rendering drivers for segment growth.

End Use Insights

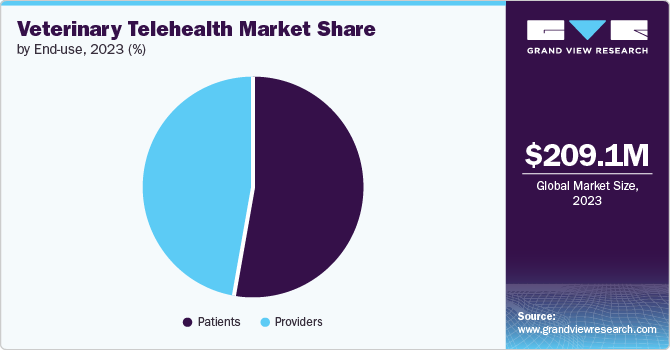

Patients segment led the market in 2024 in terms of share and is anticipated to grow with the highest CAGR over the forecast period. Given that pet owners are the main users of telehealth services for their animals, this segment is anticipated to hold the largest market share over the forecast period as well. Pet owners are more likely to use telehealth services than veterinarians due to the need for quick and easy access to medical treatment as well as growing consumer awareness of these services. The veterinary telehealth market's emphasis on initiative-taking pet care, remote monitoring, and user-friendly apps and online platforms further emphasizes the importance of this technology for patients.

Platforms for veterinary telemedicine give clinicians the means to perform remote consultations, diagnostics, and follow-up care. Through virtual visits, veterinarians may effectively communicate with pet owners, exchange medical records, and go over treatment options. These systems facilitate communication between veterinarians and their clients by incorporating features like file sharing, messaging, and teleconferencing. The capacity to provide teletriage services also helps providers because it allows them to judge the urgency of instances and give prompt advice. Veterinarians are further assisted in making educated decisions for their patients by accessing real-time data and analytics.

Delivery Mode Insights

By delivery mode, cloud/app-based segment held the highest market share in 2024 and is estimated to grow with the highest CAGR over the forecast period. This delivery mode offers scalability, flexibility, and accessibility, allowing veterinary practices and animal owners to easily have remote access to the patient and the patient data, & also collaborate with other veterinarians and animals across locations. Moreover, this mode offers lower upfront costs, reduces IT burden, and automatic updates provided by cloud-based platforms appeal to veterinary professionals and animals owners seeking efficient and cost-effective solutions.

Due to the widespread use of cell phones and the internet, quick communication, in-the-moment consultations, and remote pet health monitoring are made possible. This improves the overall user experience and makes it more appealing than conventional on-premise delivery methods.

Regional Insights

North America veterinary telehealth market held the largest share of 42.80% of the global market in 2024, The region is expected to experience record growth as a result of several factors, such as the rise in the number of pets, the prevalence of chronic illnesses, and the amount of money spent on pet insurance. Major market participants and a well-established healthcare infrastructure are other variables. The covered pet population in the United States increased by 28.3% in 2021 over 2020, according to the North American Pet Health Insurance Association (NAPHIA) Organization's 2022 report. Cat population growth of 37% and dog insurance growth of 26.5%, respectively, drove this increase. As per the same source, there was a 22.7% rise in the count of insured pets in Canada between 2020 and 2021.

U.S. Veterinary Telehealth Market Trends

Growth of U.S. veterinary telehealth market is attributed to various factors such as the presence of key players in the region and high investment in animal health care expenditure. Besides, technological advancements and high disposable income are some of the factors expected to fuel the market for veterinary telehealth over the forecast period. Furthermore, the market is also dominating globally owing to the increasing regulatory purview like the recently passed parliamentary bill - Providing Equity in Telehealth Services (PETS) Act for enabling veterinarians in Florida, U.S. to treat, diagnose and prescribe medications to animals by the means of remote consultation and monitoring.

Europe Veterinary Telehealth Market Trends

The veterinary telehealth market in Europe is driven by the high penetration of EHR systems for veterinary care, which are powered by AI and ML. This systems help enhanced data management and result in accurate decision-making. Furthermore, other factors that are driving the regional market are growing prevalence of zoonotic diseases, and rising consumption of livestock products. In addition, recent software developments by leading players, such as veterinarian engagement software with real-time output, high accuracy, & accessibility of data, further contribute to market growth. The shifting trend for new technology-based telehealth software systems contribute to the increasing demand for veterinary telehealth in this region.

The veterinary telehealth market in UK is driven by emergence of startups developing telemedicine platforms specifically designed for veterinary use. This leads to rise in options for the animal owners as well as veterinary healthcare settings to choose the best platform for their needs. Furthermore, to encourage adoption of telehealth among veterinarians, the authorities in the country are providing benefits. Earlier, for a veterinarian in UK to prescribe a medicine, a physical examination was mandatory. Irrespective of whether that patient has undergone a teleconsultation or not, veterinarians were not permitted to prescribe medications on teleconsultations. But, in January 2023, the authorities removed this rule and have hence allowed prescription over teleconsultations without the need for physical examination.

A 2023 research study that was published in the Frontiers of Veterinary Sciences indicates the growing need for remote veterinary consultations, particularly among urban pet owners, is driving the industry in Germany. The outcomes of the study illustrate that there exists a need for additional types of care in rural areas owing to the shortage of veterinarians. It also shows that the market has been growing as a result of advances in digital technology and pet owners' increasing acceptance of telemedicine. Its findings regarding the advantages and viability of telehealth in veterinary care will likely drive a substantial growth in the country’s industry over the forecast years.

France is showing a promising boost due to the fact that the government regulations are in support of adoption of telehealth in veterinary practice. The authorities officially authorized the French veterinarians to adopt telehealth into their practice post the pandemic.

Asia Pacific Veterinary Telehealth Market Trends

Asia Pacific is anticipated to witness significant growth in the veterinary telehealth market. First, the demand for veterinary services is expanding due to an increase in pet ownership and a growing understanding of the value of animal healthcare. Furthermore, the growing middle class in the area is more inclined to spend money on innovative pet healthcare options because they have more spare income.

The growing number of livestock is another important factor propelling the expansion of veterinary telemedicine in the Asia-Pacific area. Efficient and easily available veterinary care is crucial as agriculture and animal farming employ a sizable section of the population. For farmers and livestock owners in remote or rural regions, these platforms can offer simple and affordable remote consultations, disease monitoring, and advice on livestock management. The Asia-Pacific region is positioned as a significant development area for the veterinary telehealth market because to the constructive collaboration between the increasing demand for livestock management solutions and the growing demand for pet healthcare.

India is set to witness the fastest growth of over 26.53% over the forecast period. The constant support from government in promoting telehealth adoption is the main driver of the market. Authorities like NITI Aayog and Pashudhan Praharee are promoting telehealth by introducing structured guidelines to ensure best practices in the industry. Furthermore, in 2022, NITI Aayog launched their own telemedicine platform for the large livestock population in the country. In addition, in July 2023, it also suggested to assign a unique user ID to registered veterinary practitioners (RVP) and animal keepers under the advisory guidelines and framework for livestock telemedicine in India.

Another crucial factor driving the market, is the fact that global leaders in veterinary products are foraying their way into the veterinary telehealth industry and making India the ground for their initial market launch. For instance, in June 2023, Cargill, a food, agricultural solutions, and industrial products, among others giant, entered the global veterinary telehealth market by launching ZooniVet, veterinary telehealth platform in India.

High pet adoption as well as the fact that China among the world’s top cattle producers is boosting the penetration of telehealth among the pet owners and cattle owners in the country. Furthermore, another factor that can prove to be lucrative for the market growth opportunity in the country is shortage of veterinarians. As per recent study from February 2024, around 10,000 veterinarians graduate each year from China, however, only around 10% of them stay in the veterinary practice field. On the contrary, the demand for veterinary care is on a rise in the country, with around 22% of households owning a pet in 2023; a sharp rise from only 13% in 2019. Implementation of telehealth can help in reducing this supply-demand gap, boosting the market in China.

Latin America Veterinary Telehealth Market Trends

Latin American market is estimated to grow due to multiple factors like the increasing number of household pets, high demand for livestock products, and an increasing number of clinics in the region are likely to boost the market over the forecast period. Furthermore, the most crucial driver in the market is the regions dominance in livestock production. The region is among the leading meat producers in the globe and hence, a thorough healthcare infrastructure is the need of the hour for ensuring that the met-producing animals stay healthy to avoid any disruption in the production.

The Brazilian government has been taking steps to regulate and promote the use of telemedicine in the country, which has contributed to the rising demand for veterinary telehealth services. Other factors driving the demand for veterinary telehealth in Brazil include the rising pet ownership rate, the expansion of the e-commerce market, the expanding availability of smartphones and internet access, and the need for convenient and accessible pet healthcare services, especially since the COVID-19 pandemic.

MEA Veterinary Telehealth Market Trends

MEA market is estimated to present a lucrative growth over the forecast period owing the increasing penetration of veterinary telehealth services into untapped geographies of the region. For instance, U.S.- based provider, VetNow, in July 2024, launched their veterinary telehealth services into the country of Kenya.

The Saudi Arabian veterinary telehealth market is estimated to present a lucrative growth over the forecast period owing emerging startup culture in the country focused on veterinary care. The country runs a startup accelerator program known as TAQADAM Startup Accelerator in partnership with Abdullah University of Science and Technology (KAUST) and Saudi British Bank. One of the most successful startups in this program is VetWork, launched in 2019, apart from telehealth services, provides services such aspet grooming, training, walking, sitting as well as e-commerce of pet products like food and other accessories.

Key Veterinary Telehealth Company Insights

Some of the key players operating in the market include Chewy Inc., AirVet, FirstVet, TeleVet, WhiskerDocs Llc. etc. The industry is currently evolving at a rapid rate owing to increase in adoption and popularity of telehealth. Market players are collaborating with other veterinary industry players to present a unique product proposition to the customers as well as focusing on expanding into newer and untapped geographies across the globes. Government participation in the form of regulatory guidelines as well as product launches across the world is further helping in increasing the adoption of telehealth among the veterinary community.

Key Veterinary Telehealth Companies:

The following are the leading companies in the veterinary telehealth market. These companies collectively hold the largest market share and dictate industry trends.

- AirVet

- Vetlive

- GuardianVets

- PetCoach

- whiskerDocs Llc.

- Vetster

- TeleVet

- Pets at Home Group Plc

- Activ4Pets

- VitusVet

- FirstVet

- Petriage

- BabelBark

- Chewy inc.

- VetCT

- VetRad

View a comprehensive list of companies in the veterinary telehealth market

Recent Developments

-

In October 2024, Dial A Vet acquired SpeakToAVet.com to strengthen its market presence and provide affordable pet-health services across the world. This strategic move will lead to significant market expansion of the company in the telehealth sector.

-

In August 2024, Vetster received “Pet App of the Year” award for the third consecutive year. This app is regarded as the fastest growing pet telehealth platform in recent times.

-

In July 2024, Ontario-based Canadian telemedicine company, VetSon expanded their existing veterinary telehealth platform by adding novel animal care options to its existing platform.

-

In May 2024, Walmart collaborated with Pawp to provide round-the-clock telehealth services for pets with unlimited access to leading veterinary experts.

-

In April 2024, Colorado State in U.S. enacted two bills that will impact the veterinary profession, one of which expands the scope of practice for veterinary technicians, and the other of which clarifies the rules for veterinary telemedicine

-

In March 2024, Nestle Purina Petcare partnered with Petzey to provide on-demand telehealth services to pet owners in U.S.

-

On 30 August 2023, Vetster announced a new feature integrating the seamless transfer of a pet’s medical records to the client’s home clinic or veterinarian. All requests for records transfer are client-driven in order to preserve their control over their pet’s information, but - as always- user still have the option to download their Vetster records at any time.

-

On 4 May 2023, PetHub, Inc., launched its Wellness Tools powered by VetInsight. It provides subscribers with a suite of innovative features including 24/7 veterinary telehealth services, a comprehensive AI symptom checker, and a virtual food and treat finder that provides custom recommendations for pets.

-

On April 2023, Australian veterinarian launched Dog+ a subscription-based telehealth platform for dogs.

Veterinary Telehealth Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2025 |

USD 365.20 million |

|

The revenue forecast in 2030 |

USD 921.40 million |

|

Growth rate |

CAGR of 20.33% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Animal Type, Delivery Mode, End Use, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait |

|

Key companies profiled |

AirVet, Vetlive, GuardianVets, PetCoach, whiskerDocs Llc., Vetster, TeleVet, Pets at Home Group Plc, Activ4Pets, VitusVet, FirstVet, Petriage, BabelBark, Chewy inc., VetCT, VetRad |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Veterinary Telehealth Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary telehealth market report based on type, animal type, delivery mode, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Teleradiology

-

Teleconsulting

-

Telemonitoring

-

Others (telepathology, storage & forward, teletriage, tele-training, etc.)

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

Bovine

-

Swine

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud/App-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Patients

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary telehealth market was estimated at USD 306.72 million in 2024 and is expected to reach USD 365.20 million by 2025.

b. The global veterinary telehealth market is expected to grow at a compound annual growth rate of 20.33% from 2025 to 2030 to reach USD 921.40 million by 2030.

b. North America held the largest share of 42.80% of the global market in 2024, The region is expected to experience record growth as a result of several factors, such as the rise in the number of pets, the prevalence of chronic illnesses, and the amount of money spent on pet insurance.

b. Some key players operating in the veterinary telehealth market include AirVet, Vetlive, GuardianVets, PetCoach, whiskerDocs Llc., Vetster, TeleVet, Activ4Pets, VitusVet, FirstVet, Petriage, BabelBark, Chewy inc., VetCT, VetRad, etc.

b. Key factors driving the veterinary telehealth market growth include the rising population of livestock as well as pets, rising prevalence of diseases and disease outbreaks, technological advancements, growing regulatory purview, etc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."