Veterinary Sterilization Container Market Size, Share & Trends Analysis Report By Product (Sterilization Containers, Accessories), By Type, By Material, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-462-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

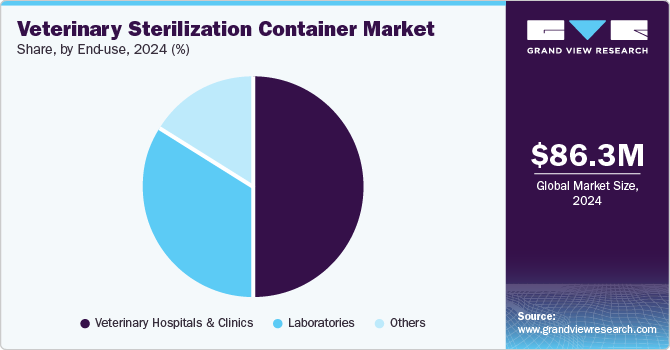

The global veterinary sterilization container market size was valued at USD 86.34 million in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2030. Key factors driving the veterinary sterilization containers market include the rising incidence of hospital-acquired infections (HAIs), the need for effective infection control, and increasing demand for durable, reusable containers. Regulatory requirements for improved hygiene standards and the growing prevalence of multidrug-resistant pathogens further boost the adoption of sterilization containers. Their ability to reduce contamination risks, enhance sterilization efficiency, and meet environmental sustainability goals also contributes to market growth.

Furthermore, according to a review published in veterinary microbiology, multidrug-resistant infections in veterinary settings are a significant concern, with over 80% of U.S. veterinary teaching hospitals reporting nosocomial infection outbreaks. Common infections include surgical site infections, wound infections, and catheter-associated urinary tract infections. Key pathogens such as methicillin-resistant staphylococci, extended-spectrum beta-lactamase-producing E. coli, and multidrug-resistant Salmonella are responsible for these infections. These infections not only affect animals but also pose risks to human health through zoonotic transmission. Effective infection control in veterinary clinics, including the use of advanced sterilization technologies, is crucial to mitigate these risks. This drives the demand for veterinary sterilization containers, which enhance infection control by ensuring the effective sterilization of medical instruments and reducing the spread of resistant pathogens.

Innovations such as the SteriCUBE system and EverGreen Containers, which offer more efficient, environmentally friendly, and cost-effective sterilization solutions, are enhancing market growth. These technologies improve workflow efficiency and reduce waste compared to traditional methods.

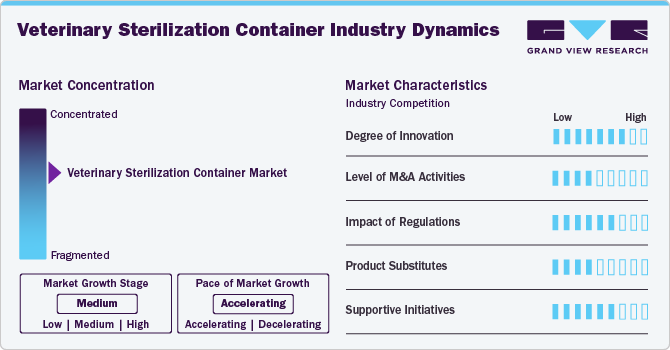

Market Concentration & Characteristics

The veterinary sterilization container market exhibits moderate industry concentration, with a few key players dominating the sector. Major companies, such as B. Braun SE (B. Braun Vet Care GmbH) and Vimian Group AB (Movora), lead the market by offering advanced sterilization technologies and innovative products. These industry leaders are focused on expanding their market share through technological advancements and strategic acquisitions. However, the market also includes a range of smaller and emerging firms offering niche products and specialized solutions, contributing to a competitive landscape with opportunities for new entrants and innovation.

The veterinary sterilization container market is witnessing a high degree of innovation, particularly in the design of reusable, airtight containers with advanced filtration systems. Innovative features includes tamper-proof locks and sterilization indicators, increase user confidence in maintaining long-term sterility. As veterinary practices adopt these cutting-edge technologies, the demand for advanced sterilization containers rises, driving market growth and setting new industry standards for infection control.

The veterinary sterilization container market is experiencing moderate M&A activity as companies acquire innovative and eco-friendly sterilization solutions to expand their portfolios and market presence. These acquisitions focus on reducing biohazardous waste, enhancing efficiency, and meeting the rising demand for safe and effective sterilization, aligning with sustainability and improved infection control standards in veterinary healthcare. For instance, in April 2024, HealthpointCapital acquired a majority stake in SteriCUBE, an FDA-cleared sterilization platform that replaces disposable "blue wraps" with a reusable filtered metal container, enabling simultaneous sterilization of multiple instrument trays. The system reduces biohazardous waste, enhances efficiency, and improves safety, aligning with market trends toward sustainable, cost-effective, and advanced sterilization solutions in the veterinary sector.

Regulations significantly impact the veterinary sterilization container market by ensuring product safety, efficacy, and compliance with sterilization standards. Strict regulatory guidelines from agencies like the FDA and the European Medicines Agency (EMA) mandate that sterilization containers meet rigorous standards for sterility, material use, and environmental safety. These regulations drive innovation, as manufacturers must develop advanced, compliant products while maintaining cost-effectiveness. Non-compliance can lead to product recalls, delays in market approval, and potential financial losses, making regulatory adherence crucial for market success.

The product substitutes include disposable blue wraps, which have traditionally been used for instrument sterilization but are less sustainable and prone to perforation. Other alternatives are chemical sterilization methods and reusable textile wraps. While these substitutes can offer lower initial costs or specific use-case advantages, they often fall short in terms of durability, efficiency, and environmental impact compared to advanced sterilization containers like SteriCUBE, which provide enhanced safety, reduced waste, and improved workflow efficiency.

Strategic initiatives by key players to raise awareness about hospital-associated infections (HAIs) are driving growth in the veterinary sterilization container market. Companies are introducing educational programs, campaigns, and certifications to promote sterilization best practices and infection control. For example, in February 2023, Virox Technologies and NAVTA launched the Infection Prevention Leader Certificate Program, offering RACE-approved courses on disinfection and sterilization, equipping veterinary professionals with tools to reduce HAIs and improve workplace safety. These efforts are fostering the adoption of advanced sterilization containers and contributing to market expansion.

Product Insights

By product, sterilization containers segment dominated market with a share of 62.2% in 2024 and is expected to grow at fastest CAGR of 6.2% during forecast period due to their higher efficiency in maintaining sterility, compliance with stringent infection control regulations, and durability for repeated use. Unlike single-use alternatives, sterilization containers are designed for multiple uses, which contributes to cost savings and reduces environmental waste. Their durable construction ensures long-term performance, making them a more economical and sustainable option.

Also, veterinary practices are increasingly required to adhere to stringent infection control regulations. Sterilization containers meet these regulatory standards by providing reliable and consistent sterilization, thus making them a preferred choice in compliance with hygiene protocols.

Material Insights

Based on material, aluminium segment dominated market in 2024 with a market share of 51.0%. Aluminum-based containers are widely used due to their durability, excellent heat conductivity, and resistance to corrosion. Their robust construction ensures reliable protection and effective sterilization of instruments while being reusable and cost-effective compared to disposable alternatives.

Whereas other material segment is expected to be fastest-growing segment with the highest CAGR of 6.9% over the forecast period. Other materials such as polycarbonate and high-grade plastic composites are expected to gaining popularity in the market. These materials are valued for their lightweight nature, resistance to chemical corrosion, and cost-effectiveness. They offer an alternative to traditional metals, providing effective sterilization and durability while being easier to handle and maintain.

Type Insights

Based on type, perforated held the largest share of 69.0% in 2024 and is estimated to grow at the highest CAGR of 5.9% over the forecast period. Perforated containers are preferred due to their superior efficiency in the sterilization process. Perforated containers allow steam and other sterilizing agents to reach all surfaces of the instruments more effectively, ensuring thorough disinfection. This design reduces the risk of infection and contamination, enhances the effectiveness of sterilization, and supports better airflow and drying, making them the preferred choice in animal hospitals.

Non-perforated containers, on the other hand, do not have these openings and rely on external sterilization methods. They often provide better protection against contamination during storage and transport, as they create a sealed environment. However, they may not be suitable for all sterilization methods and might require additional processing steps to ensure complete sterilization.

End Use Insights

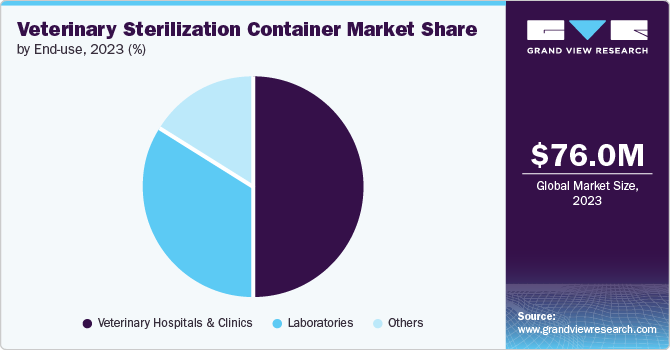

Based on end use, veterinary hospitals & clinics segment held the largest share of 50.3% in 2024 due to their high volume of surgical procedures and the need for stringent infection control practices. These facilities frequently use sterilization containers to maintain a sterile environment for surgical instruments, reducing the risk of hospital-acquired infections and ensuring the safety of both patients and staff. The continuous demand for effective sterilization solutions in these settings drives the significant market share of this segment.

On other hand, laboratories segment is expected to grow at highest CAGR of 6.8% during forecast period. Veterinary laboratories are rapidly adopting veterinary sterilization containers due to the increasing need for stringent infection control and contamination prevention in diagnostic and research settings. These containers help ensure the sterilization of equipment and samples, which is crucial for accurate test results and reliable research outcomes. The rise in sophisticated diagnostic procedures and a heightened focus on maintaining a sterile environment to prevent cross-contamination are key factors driving this adoption.

Regional Insights

North America veterinary sterilization container market held the highest revenue share of 45.47% in 2024, driven by rise in multidrug-resistant (MDR) pathogens and hospital-acquired infections (HAIs) and need for sterilization container. According to the article published in International Journal of Veterinary Sciences and Animal Husbandry in 2023, a study conducted in North American veterinary teaching hospitals found that 82% reported at least one HAI outbreak over a five-year period, necessitating restricted patient admissions or temporary closures in 58% of cases.

U.S. Veterinary Sterilization Container Market Trends

The veterinary sterilization container market in the U.S. is expected to grow at a significant pace over the forecast period. The rise in veterinary hospitalizations, driven by higher pet ownership and more complex surgical procedures, has increased the need for effective decontamination solutions. The prevalence of MDR pathogens such as methicillin-resistant Staphylococcus aureus (MRSA) and extended-spectrum beta-lactamase (ESBL)-producing bacteria is rising. These pathogens are a major concern in veterinary settings, necessitating enhanced sterilization protocols. For instance, a study in the U.S. found that over 40% of bacterial infections in veterinary hospitals were caused by MDR pathogens, highlighting the urgent need for effective sterilization solutions. Hospital-acquired infections in veterinary hospitals have also been increasing. According to the Centers for Disease Control and Prevention (CDC), about 10% of infections in veterinary hospitals are classified as HAIs. These infections are often linked to inadequate disinfection practices, prompting a greater focus on advanced sterilization containers.

Additionally, stricter regulations and compliance requirements regarding sterilization practices have also fueled market growth. The U.S. Food and Drug Administration (FDA) and other regulatory bodies have enforced higher standards for sterilization, prompting veterinary facilities to invest in upgraded containers to meet these standards.

Europe Veterinary Sterilization Container Market Trends

Europe veterinary sterilization container market is influenced by several trends, driven by increasing pet ownership and awareness of advanced veterinary care, advancements in veterinary sterilization technologies, and rising demand for effective infection control solutions. Similarly, increased canine & feline population and pet care expenditure is fueling market growth. For instance, the number of pet owners is increasing, with 166 million out of Europe's 352 million pets being owned by 50% of European households. Rising pet ownership across Europe leads to higher demand for veterinary services and advanced surgical tools, including sterilization containers. Pet owners and animal healthcare practices seek reliable solutions to ensure the health and safety of animals.

Additionally, Europe has stringent regulations and standards for infection control and hygiene in animal healthcare facilities. Compliance with these regulations necessitates the use of effective sterilization containers, driving market demand.

Germany veterinary sterilization container market held the largest share in Europe in 2024. Germany has a high rate of pet ownership as well as livestock population, leading to increased demand for veterinary services and advanced surgical tools. This surge in pet care drives the need for efficient disinfection solutions. For instance, according to the German Livestock, the country has the largest dairy cattle herd & the second-largest cattle population in the EU. Furthermore, according to the International Committee for Animal Recording (ICAR), 50% of German farms specialize in livestock. Similarly, according to a survey commissioned by Industrieverband Heimtierbedarf (IVH) e.V., 44% of all households in Germany have at least one domestic animal.

Asia Pacific Veterinary Sterilization Container Market Trends

The Asia Pacific veterinary sterilization container market is expanding rapidly, driven by factors such as increasing animal care standards and rising awareness about infection control. Furthermore, there is significant potential for growth in emerging markets within the Asia-Pacific region as small animal practices modernize and adopt advanced sterilization solutions. Opportunities are also arising from increased investments in veterinary infrastructure and expanding healthcare facilities.

Additionally, presence of leading companies like Narang Medical Ltd. is boosting market growth. Narang Medical Ltd. is known for its comprehensive range of veterinary sterilization containers and solutions, which cater to the growing demand for effective infection control in veterinary settings.

The veterinary sterilization container market in India is witnessing notable growth due to a surge in health problems in pets and the need for effective infection control and disinfection measures in veterinary practices. For instance, according to a report published by Times Internet in India, in June 2024, Veterinary clinics in Kolkata have reported a surge in pets, particularly dogs, experiencing health issues such as fur loss, allergies, stomach disorders, and haemoprotozoan infections (babesiosis, theileriosis, and anaplasmosis) due to fluctuating pre-monsoon weather. As clinics address these health challenges and implement stringent disinfection protocols to prevent and manage infections, the demand for veterinary sterilization containers is expected to increase.

Latin America Veterinary Sterilization Container Market Trends

The demand for Latin America veterinary sterilization containers is on the rise, driven by an increasing emphasis on hygiene and infection control in veterinary practices and the need for efficient decontamination solutions. In Brazil, the expanding veterinary care sector, combined with stricter regulatory requirements for higher sterilization standards, is further boosting this demand. As veterinary facilities aim to improve operational efficiency and ensure patient safety, the use of premium sterilization containers is projected to see continued growth.

The Brazil veterinary sterilization market is expanding significantly due to an increase in livestock population and outbreaks of hospital-acquired infections in animals. For instance, according to Agro Concept Management Ltd, Brazil had the second-largest cattle herd, accounting for 232 million heads. Moreover, the country is also the world's largest exporter of beef. As the livestock sector expands, the need for effective sterilization solutions to manage and prevent the spread of infections in veterinary settings grows.

Middle East & Africa Veterinary Sterilization Container Market Trends

The Middle East & Africa veterinary sterilization container market has notable growth potential driven by increasing investments in veterinary healthcare infrastructure, growing awareness of infection control, and rising pet ownership. However, regional economic disparities and varying levels of technology adoption may impact the growth rate.

The veterinary sterilization container market in South Africa is growing slowly due to a lack of awareness and adoption of advanced decontamination technologies, along with budget constraints in many veterinary practices, contributing to the slow growth. Additionally, the relatively small size of the market and lower investment in veterinary infrastructure and infection control compared to other regions further restrain revenue potential.

Key Veterinary Sterilization Container Company Insights

The market is competitive with key players striving to innovate and capture market share. Companies like Movora are leading this trend with new product launches such as advanced disinfection systems that enhance efficiency and safety. Additionally, companies are focusing on improving product features, expanding their portfolios, and establishing strategic partnerships to gain a competitive edge.

Key Veterinary Sterilization Container Companies:

The following are the leading companies in the veterinary sterilization container market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE (B. Braun Vet Care GmbH)

- Vimian Group AB (Movora)

- Fine Science Tools, Inc.

- Changzhou XC Medico Technology Co., Ltd.

- Erbrich Instrumente GmbH

- Jewel Precision

- Narang Medical Limited.

- Integra LifeSciences Holdings Corporation

- SPiTZ Vet Care

- Aysam Orthopaedics & Medical Devices

Recent Developments

-

In May 2024, Movora launched EverGreen Filtered Sterilization Containers with cost-effective and sustainable solutions for veterinary practices. These containers feature a rigid design with airtight seals and reusable or replaceable filters, maintaining sterility for up to six months. They enhance practice efficiency by eliminating the need for blue wrap, improving autoclave efficacy, and providing secure, long-term storage for surgical instruments and medical equipment.

-

In April 2024, HealthpointCapital acquired a majority stake in SteriCUBE Holdings, Inc., known for its innovative SteriCUBE Multiple Tray Sterilization (MTS) System. The system reduces waste, cuts costs, and enhances workflow in hospitals, with significant implications for the sterilization of surgical instruments.

Veterinary Sterilization Container Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 90.35 million |

|

Revenue Forecast in 2030 |

USD 119.53 million |

|

Growth rate |

CAGR of 5.8% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, material, type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait. |

|

Key companies profiled |

B. Braun SE (B. Braun Vet Care GmbH), Vimian Group AB (Movora), Fine Science Tools, Inc., Changzhou XC Medico Technology Co., Ltd., Erbrich Instrumente GmbH, Jewel Precision, Narang Medical Limited., Integra LifeSciences Holdings Corporation, SPiTZ Vet Care, Aysam Orthopaedics & Medical Devices |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Sterilization Container Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary sterilization container market report based on product, material, type, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Sterilization Containers

-

Accessories

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Stainless Steel

-

Aluminium

-

Other Material

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Perforated

-

Non-Perforated

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary sterilization container market size was estimated at USD 76.00 million in 2023 and is expected to reach USD 79.24 million in 2024.

b. The global veterinary sterilization container market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 109.70 million by 2030.

b. North America dominated the veterinary sterilization container market with a share of 45.73% in 2023. This is attributable to rising animal healthcare awareness coupled with an increase in multidrug-resistant (MDR) pathogens and hospital-acquired infections (HAIs) in veterinary facilities, which is significantly driving the demand for veterinary sterilization containers.

b. Some key players operating in the veterinary sterilization container market include B. Braun SE (B. Braun Vet Care GmbH), Vimian Group AB (Movora), Fine Science Tools, Inc., Changzhou XC Medico Technology Co., Ltd., Erbrich Instrumente GmbH, Jewel Precision, Narang Medical Limited., Integra LifeSciences Holdings Corporation, SPiTZ Vet Care, Aysam Orthopaedics & Medical Devices.

b. Key factors that are driving the market growth include the rising incidence of hospital-acquired infections (HAIs), the need for effective infection control, and increasing demand for durable, reusable containers. Regulatory requirements for improved hygiene standards and the growing prevalence of multidrug-resistant pathogens further boost the adoption of sterilization containers. Their ability to reduce contamination risks, enhance sterilization efficiency, and meet environmental sustainability goals also contributes to market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."