- Home

- »

- Animal Health

- »

-

Veterinary Stereotactic Radiosurgery System Market Report, 2030GVR Report cover

![Veterinary Stereotactic Radiosurgery System Market Size, Share & Trends Report]()

Veterinary Stereotactic Radiosurgery System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gamma Knife, LINAC, PBRT/ Flash-RT, CyberKnife), By End-use (Hospitals & Clinics, Academic & Research Institutions), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-131-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

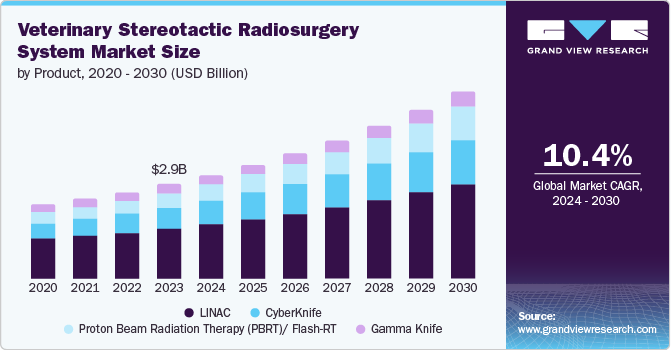

The global veterinary stereotactic radiosurgery system market size was estimated at USD 3.26 billion in 2024 and is expected to expand at a CAGR of 10.14% from 2025 to 2030. Key growth drivers include increasing usage of stereotactic radiosurgery systems (SRS) for the improvement of pets, increasing pet population across the globe, increasing government regulations for the better treatment of pets, advancement in technology, and advancement in non-invasive treatments. Additionally, the global veterinary stereotactic radiosurgery market is expanding as advanced radiotherapy technologies, such as Varian's TrueBeam, Edge, and VitalBeam systems, are increasingly adopted by veterinary hospitals worldwide.

The technological advancements are propelling the market's growth by offering precise and non-invasive cancer treatments for pets. Innovations such as real-time tumor tracking and AI-driven systems enhance treatment accuracy and safety, making radiosurgery a more viable option for veterinary care. This technological progress is increasing the adoption of advanced treatment methods in veterinary medicine. For instance, In September 2024, BluePearl Veterinary Hospital in Malvern, Pennsylvania, is the first in the world to use CyberKnife technology for veterinary cancer treatment. This noninvasive radiation therapy precisely targets tumors with minimal impact on healthy tissue, reducing side effects and treatment time.

Similarly, in October 2023, a state-of-the-art Elekta Infinity linear accelerator was installed by CVS Group at Bristol Vet Specialists, enabling advanced image-guided radiation therapy for pets with cancer. It featured a multi-leaf collimator for precise radiation beam shaping and a six-degrees-of-freedom couch for optimal patient positioning. The equipment allowed the center to offer cutting-edge treatments such as stereotactic radiation therapy, delivering high doses of targeted radiation with exceptional precision over shorter treatment periods.

Revolution of Veterinary Stereotactic Radiosurgery in Pet Cancer Treatment

Veterinary Stereotactic Radiosurgery is transforming cancer treatment for pets by offering highly precise, non-invasive radiation therapy. Unlike traditional radiotherapy, which requires multiple sessions over several weeks, SRS delivers concentrated radiation in one to three treatments, reducing the overall duration and side effects. This technique is particularly effective for treating localized, non-metastatic tumors in pets, offering improved tumor control and better quality of life.

Advantages of SRS in Pet Oncology

-

Precision and Accuracy: SRS uses advanced imaging and computer-guided systems to target tumors with sub-millimeter accuracy. This reduces radiation exposure to surrounding healthy tissues, minimizing side effects.

-

Fewer Sessions, Faster Recovery: Traditional radiotherapy typically involves 15-20 sessions, whereas SRS can be completed in 1-3 treatments. This reduces the need for repeated anesthesia, lowering the risk for older or fragile pets.

-

Improved Outcomes with Fewer Side Effects: SRS reduces common side effects like skin irritation, fatigue, and inflammation. Pets undergoing SRS often experience fewer complications and faster recovery times.

Case Studies and Examples

- Case 1: Brisbane Veterinary Specialist Centre (BVSC), Australia

BVSC uses Varian TrueBeam with volumetric modulated arc therapy (VMAT) and SRS to treat a variety of cancers. For example, a 9-year-old Labrador with a sinonasal tumor was treated with three consecutive SRS sessions. The targeted radiation reduced the tumor size by 70%, significantly improving the dog’s breathing and overall comfort. The pet returned to normal activities within two weeks, with no significant side effects.

- Case 2: Animal General Hospital, Japan

Using Varian Edge, the team in Kawaguchi City treated a 12-year-old cat diagnosed with a spinal tumor. The cat underwent two SRS sessions, resulting in a marked reduction in pain and tumor regression. The non-invasive treatment provided substantial symptom relief, with the cat regaining mobility and showing improved quality of life.

- Case 3: Riddell-Swan Veterinary Center, Scotland

At RSVC, Varian VitalBeam was used to treat a 10-year-old Golden Retriever with a brain tumor. The hospital performed stereotactic body radiotherapy (SBRT), completing the entire treatment in three sessions. Post-treatment MRI scans revealed significant tumor shrinkage, with no neurological side effects. The dog’s seizure frequency reduced drastically, and it returned to a normal, active lifestyle.

Future of SRS in Veterinary Oncology

The adoption of SRS is expanding globally, with more veterinary hospitals investing in advanced radiotherapy systems. Hospitals in Hong Kong, Australia, and the UK are upgrading to Varian Halcyon and TrueBeam systems, offering faster, more precise treatment with fewer side effects. As veterinary medicine continues to evolve, SRS is set to become the gold standard for treating localized pet cancers. Its non-invasive nature, rapid recovery, and improved quality of life make it a promising option for pets and a beacon of hope for pet owners seeking advanced cancer care.

Market Concentration & Characteristics

The veterinary stereotactic radiosurgery system market is witnessing moderate to high innovation, driven by advancements in image-guided radiotherapy (IGRT), robotic-assisted precision delivery, and adaptive radiation therapy. For example, systems like Varian’s Edge Radiosurgery System and Accuray’s CyberKnife offer sub-millimeter accuracy, enhancing treatment outcomes for pet tumors. Emerging technologies include AI-powered treatment planning and real-time motion tracking, improving precision and reducing side effects.

The veterinary stereotactic radiosurgery system market has seen low to moderate M&A activity, primarily driven by strategic acquisitions to expand oncology capabilities. For example, Varian Medical Systems’ acquisition by Siemens Healthineers (2020) indirectly impacts veterinary applications by advancing radiation oncology technologies. Additionally, partnerships like Accuray’s collaborations with veterinary clinics help integrate human-grade SRS into animal care, fostering market growth.

The veterinary stereotactic radiosurgery system market is moderately to highly impacted by regulatory frameworks, especially concerning radiation safety standards and device approvals. For instance, in the U.S., the FDA’s Center for Veterinary Medicine (CVM) oversees device safety, while the Nuclear Regulatory Commission (NRC) regulates radioactive material usage. In the EU, compliance with CE marking and Euratom radiation protection standards is mandatory, influencing market entry and product adoption.

The product substitutes include conventional radiotherapy, chemotherapy, and surgical tumor removal. For instance, linear accelerators (LINAC) and intensity-modulated radiotherapy (IMRT) offer alternative radiation treatments, though with less precision. Additionally, targeted drug therapies and immunotherapy are emerging as non-invasive substitutes for managing veterinary cancers.

The market experiences moderate to high end user concentration, primarily driven by specialty veterinary oncology centers, referral hospitals, and large veterinary clinics. Key players include Colorado State University Veterinary Teaching Hospital and The Animal Medical Center (AMC) in New York, which utilize advanced SRS systems for treating complex pet tumors. Adoption is lower in smaller clinics due to the high cost and technical expertise required.

Product Insights

The LINAC (linear accelerator) systems segment dominated the market and accounted for a share of 53.10% in 2024. The adoption of linear accelerators is driven by increased pet ownership, rising healthcare spending, and advancements in veterinary oncology, making these technologies more effective and precise. Growing awareness among pet owners and expanding specialized veterinary centers also contribute to the demand for advanced treatment options such as linear accelerators. For instance, in October 2023, Washington State University installed a linear accelerator at its veterinary teaching hospital, offering advanced radiation therapy to treat cancers in animals, such as mast cell tumors and soft tissue sarcomas.

The proton beam radiation therapy (PBRT)/ Flash-RT is expected to grow at the fastest CAGR of 10.24% over the forecast period. The factors such as the development of magnetic resonance imaging (MRI) linear accelerators, treatment planning software, proton therapy, advancement in radiotherapy treatment and heavy investments which are being made by the governments and companies has been responsible for the growth of the market.

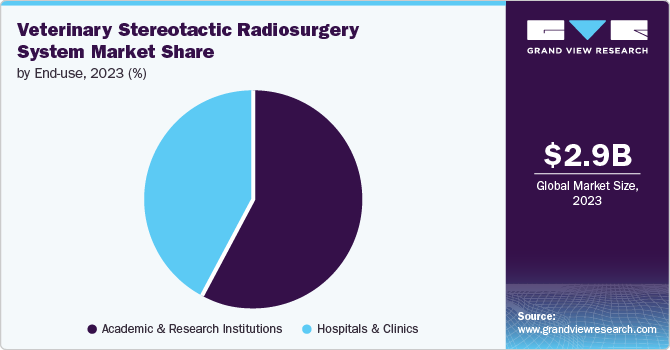

End-use Insights

Based on end-use, academic and research institution segment dominated the market and accounted for a share of 57.91% in 2024. The dominance can be attributed to increasing research and development capacities, clinical trials, wide-spreading educational programs, investments, developing property, and building trust in these institutions. In addition, partnerships and collaboration between academic centers and private practices have enhanced the offerings and propelled the market. For instance, cancer is a major health concern for pets, with around 6 million dogs and nearly 6 million cats diagnosed annually in the U.S. Petco Love and in May 2024, Blue Buffalo contributed USD 100,000 to Morris Animal Foundation's Stop Cancer Forever campaign, supporting the Foundation's efforts to advance scientific research to save animals.

The hospitals and clinics segment is expected to grow at the fastest CAGR of 10.18% over the forecast period. This growth can be attributed to factors such as improved healthcare infrastructure and facilities, increased skilled professionals, established patient trust, the presence of wide networks, increasing technological advancements, and the availability of nearby patients. In addition, clinics' cost-effective treatments further help propel the market.

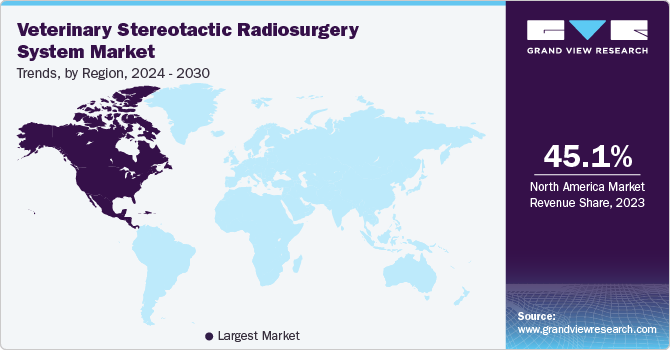

Regional Insights

North America veterinary stereotactic radiosurgery system market dominated the market in 2024. This dominance can be attributed to factors such as the increasing number of pets in the region, the presence of major players, an increase in the research and studies for the treatment of pets, increasing heavy investments by the government, and private players for the improvement of the pets has helped in the market growth.

U.S. Veterinary Stereotactic Radiosurgery System Market Trends

U.S. veterinary stereotactic radiosurgery system market dominated the North America market with a share of 83.3% in 2024 due to the increasing trend towards pet adaptation and increasing awareness among people about advanced treatment procedures, the availability of traces of pesticides and fertilizers, which has led to the increase of cases of cancer in animals, and technological advancements in equipment and software.

Europe Veterinary Stereotactic Radiosurgery System Market Trends

Europe veterinary stereotactic radiosurgery system market was identified as a lucrative region in 2024. The rising incidence of cancer in pets, especially in dogs and cats, drives demand for advanced treatments such as veterinary stereotactic radiosurgery systems (SRS). SRS provides a non-invasive, less stressful option for treating various cancers in animals, offering improved precision and effectiveness. For instance, in April 2024, Antech Diagnostics, Inc., a company specializing in veterinary diagnostics, launched the Nu.Q Canine Cancer Test in Europe. This screening tool was designed for dog breeds at high risk of cancer and senior dogs, enabling veterinarians and pet owners to make knowledgeable choices concerning treating common canine cancers.

The UK veterinary stereotactic radiosurgery system market is set to witness lucrative growth due to the rising pet ownership, increasing prevalence of pet cancer, and growing demand for advanced, minimally invasive treatments. Technological advancements and expansion of veterinary care centers in UK is also contribute to market growth. For instance, in June 2024, Bristol Vet Specialists (BVS) opened a £13.5m (USD 17.48 million) state-of-the-art veterinary referral hospital, the largest in South West England and South Wales. Equipped with cutting-edge technology, including a stereotactic linear accelerator for advanced cancer treatment in pets, the 30,000 sq. ft. facility offers multidisciplinary care by over 100 highly skilled veterinary professionals.

Germany veterinary stereotactic radiosurgery system market held a substantial market share in 2024 owing to a high rate of pet ownership, particularly of dogs and cats, leading to increased demand for advanced veterinary care. Germany's emphasis on research and development in veterinary medicine promotes the adoption of cutting-edge, non-invasive technologies such as SRS. Pet owners' growing awareness and willingness to invest in sophisticated treatments, combined with the rising incidence of pet cancers, further fuel the demand for these precise treatment options.

Asia Pacific Veterinary Stereotactic Radiosurgery System Market Trends

The Asia Pacific veterinary stereotactic radiosurgery system market is expected to grow at the fastest CAGR of 11.9% over the forecast period. Factors such as the presence of countries such as China, India, Japan, and others, the increasing trends towards pet adoption, and pet owners' awareness about their pets' health and wellness have largely influenced the market's growth. In addition, the increasing disposable income has further propelled the market's growth in the region. For instance, in December 2023, in the efforts to protect the region from emerging infectious diseases (EIDs), Southeast Asia made a significant advancement with the first meeting of the ASEAN Coordinating Centre for Animal Health and Zoonoses (ACCAHZ) Governing Board.

The veterinary stereotactic radiosurgery system market in Japan is expected to grow rapidly in the coming years due to the increasing trends amongst the younger generations, such as the young generation and millennials. In addition, the increasing adoption of advanced technology influenced the market growth. For instance, an online survey conducted by the Pet Food Association from September to October 2023 received valid responses from about 50,000 individuals aged 20 to 79. The survey revealed 6,844,000 pet dogs (a decrease of 209,000 from 2022) and 9,069,000 pet cats (an increase of 232,000 from the previous year), totaling 15,913,000 pets-up by 23,000 from 2022.

China veterinary stereotactic radiosurgery system market held a substantial market share in 2024 owing to the increasing number of clinics and diagnostic centers, which made treatments easy to obtain, and the availability of advanced technology in clinics and hospitals, which led to market growth.

Latin America Veterinary Stereotactic Radiosurgery System Market Trends

The Latin America veterinary stereotactic radiosurgery system market is experiencing gradual growth, driven by increasing pet cancer cases and rising demand for advanced oncology treatments. Countries like Brazil is leading in adoption, with larger veterinary hospitals investing in radiotherapy technology. However, high equipment costs and limited specialized facilities hinder widespread adoption.

The Brazil veterinary stereotactic radiosurgery system market is growing steadily, driven by a rising incidence of pet cancer and increasing demand for advanced oncology treatments. Leading veterinary hospitals in São Paulo and Rio de Janeiro are investing in image-guided SRS systems. However, high equipment costs and a shortage of specialized radiotherapy centers limit market expansion.

MEA Veterinary Stereotactic Radiosurgery System Market Trends

The Middle East and Africa (MEA) veterinary stereotactic radiosurgery system market is in its nascent stage, with limited adoption due to the high cost of equipment and a lack of specialized veterinary oncology centers. However, growing pet ownership in countries like the UAE and South Africa is driving demand for advanced cancer treatments, leading gradual market growth.

The South Africa veterinary stereotactic radiosurgery system market is nascent but expanding, driven by a growing demand for advanced cancer treatments in pets. Leading veterinary centers in Johannesburg and Cape Town, such as the Onderstepoort Veterinary Academic Hospital, are beginning to adopt radiotherapy technologies. However, high equipment costs and a limited number of specialized facilities hinder widespread adoption.

Key Veterinary Stereotactic Radiosurgery System Company Insights

Major players operating in the market are involved in various strategies such as distribution agreements, mergers & acquisitions, and expansions. Most crucially, they exhibit a very high degree of innovation in product research & development to improve their market penetration.

Key Veterinary Stereotactic Radiosurgery System Companies:

The following are the leading companies in the veterinary stereotactic radiosurgery system market. These companies collectively hold the largest market share and dictate industry trends.

- Elekta

- Accuracy Incorporated

- Varian Medical Systems, Inc.

- ALCEN

- Xstrahl

Recent Developments

-

In September 2024, LSU Vet Med acquired a Varian Trilogy linear accelerator, offering advanced stereotactic radiotherapy and IMRT with RapidArc technology. This enhances cancer treatment precision, reduces side effects, and shortens patient sedation time, highlighting the expanding adoption of stereotactic radiosurgery systems in veterinary oncology.

-

In June 2024, Bristol Vet Specialists (BVS) opened a £13.5m (USD 17.44 Mn) state-of-the-art veterinary hospital, featuring one of England's only stereotactic linear accelerators for pets. This cutting-edge technology offers advanced, high-precision cancer treatment with fewer sessions, reduced side effects, and improved outcomes, highlighting the growing demand for veterinary stereotactic radiosurgery systems.

-

In February 2024, Varian Medical Systems, Inc. announced that its TrueBeam and Edge radiotherapy systems with the HyperSight imaging solution received 510(k) clearance from the U.S. Food and Drug Administration (FDA).

-

In October 2023, Thrive Pet Healthcare launched Thrive Pet Healthcare Specialists in Hoffman Estates, expanding its network to over 380 locations across 37 U.S. states. This facility offers round-the-clock emergency care for pets with critical or life-threatening conditions and provides specialty services by appointment.

Veterinary Stereotactic Radiosurgery System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.58 billion

Revenue forecast in 2030

USD 5.81 billion

Growth Rate

CAGR of 10.14% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, End-use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Elekta; Accuracy Incorporated; Varian Medical Systems, Inc.; ALCEN; Xstrahl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Stereotactic Radiosurgery System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary stereotactic radiosurgery system market report on the basis of product, end-use and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Gamma Knife

-

LINAC

-

Proton Beam Radiation Therapy (PBRT)/ Flash-RT

-

CyberKnife

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals & Clinics

-

Academic & Research Institutions

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. North America dominated the veterinary stereotactic radiosurgery system market with a share of 44.82% in 2024. This is attributable to the increasing number of cancer incidences in the pet population, rising pet companionship along with the surge in the willingness to spend on their pets, and government initiatives for SRT treatment.

b. Some key players operating in the veterinary stereotactic radiosurgery system market include Elekta, Accuracy Incorporated, Varian Medical Systems, Inc., ALCEN, and Xstrahl etc.

b. Key factors that are driving the market growth include increasing usage of stereotactic radiosurgery systems (SRS) for the improvement of pets, increasing pet population across the globe, increasing government regulations for the better treatment of pets, advancement in technology, and advancement in non-invasive treatments.

b. The global veterinary stereotactic radiosurgery system market size was estimated at USD 3.26 billion in 2024 and is expected to reach USD 3.58 billion in 2025.

b. The global veterinary stereotactic radiosurgery system market is expected to grow at a compound annual growth rate of 10.14% from 2025 to 2030 to reach USD 5.81 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.